Meilian New Materials’ Semiannual Report: Masterbatch and Cyanuric Chloride Under Pressure, Battery Separator Still in Loss

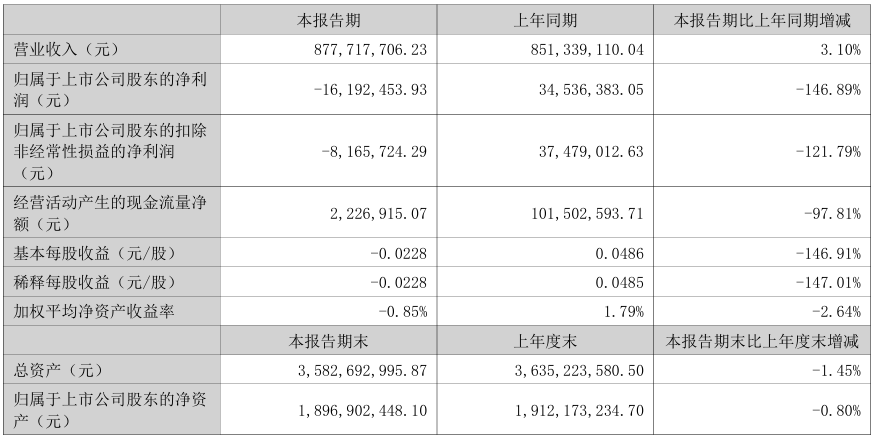

On August 26, 2025, Meilian New Materials released its semi-annual report. The report showed that the company's operating revenue for the first half of the year was 878 million yuan, an increase of 3.1% year-on-year. However, the net profit attributable to shareholders was -16 million yuan, a year-on-year decrease of 146.89%. During the reporting period, the company’s short-term loans amounted to 341 million yuan, an increase of 56 million yuan; long-term loans stood at 334 million yuan, a decrease of 34 million yuan. The total borrowings amounted to 675 million yuan, an increase of 22 million yuan over the half-year period.

The performance situation has indeed made many people concerned about Meilian New Materials break into a sweat. After all, in a fiercely competitive market environment, revenue growth but profit decline signifies considerable underlying issues.

Masterbatch segment: significant price reduction, shrinking profits

As one of Meilian New Materials' main products, masterbatch achieved an operating revenue of 340.3466 million yuan in the first half of the year, representing an 11.43% year-on-year increase. According to the sales data, the sales volume of masterbatch rose by 21.51% year-on-year. Although this significant growth in sales volume seems like good news, it is not necessarily so. The unit selling price decreased by 8.29% year-on-year, and although the unit cost also dropped by 5.91%, the overall gross margin was 11.94%, down 2.23 percentage points year-on-year.

Trichlorocyanuric Acid Segment: Gross Profit Margin Only 1%

The performance of the melamine cyanurate sector in the first half of the year was also less than satisfactory. While revenue declined, costs increased. Compared with the same period last year, the sales volume of melamine cyanurate products increased by 6.08% year-on-year, but the unit price decreased by 25.15% year-on-year. As a result, the gross profit margin was only 1.09%, down 23.41% year-on-year.

High-performance pigment and dye sector: outstanding performance

High-performance dyes exhibit outstanding performance, with a gross margin as high as 44.10%. This result reflects the essence behind it, which is "high profit potential," directly indicating that the product possesses strong "profit potential reserve" and "cost control capability."

According to available information, Huihong Technology, a subsidiary of Meilian New Materials, achieved an operating revenue of 44.4462 million yuan during the reporting period, representing a year-on-year increase of 10.07%, with sales revenue from EX electronic materials reaching 9.1162 million yuan. Huihong Technology possesses globally leading manufacturing technology for high-performance dyes and pigments. Its series of high-performance dyes and pigments—such as Orange 43, Red 15, Red 14, and their intermediates—feature excellent performance and enjoy a unique competitive advantage in the global market, currently constituting its main source of income. The masterbatch industry itself has limited profit margins and weaker R&D investment capabilities compared to upstream sectors, leading to a dilemma in “cost reduction and efficiency improvement” where there is the will but a lack of funds and technology. While such upstream technological barriers solidify the position within the industry chain and pose challenges to cost reduction and efficiency improvement in the masterbatch industry to some extent, they also compel the industry to actively explore breakthrough paths.

Battery separator sector: revenue improvement

The battery separator segment has seen some improvement in revenue, with a gross margin of -23.72%, representing a year-on-year increase of 112.52%, but it is still operating at a loss. It is understood that the low selling price of products from the subsidiary Anhui Meixin has been a key factor dragging down performance. During the reporting period, Anhui Meixin failed to contribute positive operating results to Meilian New Materials.

In the first half of 2025, Meilian New Materials exhibited a clear divergence in performance: the masterbatch and cyanuric chloride segments faced profit pressure, the battery separator segment had yet to escape losses, and only the high-performance pigments and dyes segment maintained high profitability due to its technical advantages.

For the masterbatch industry, Meilian New Material's semi-annual report is not only a reflection of a company's operations but also highlights the common challenges faced by the industry in its development. We hope to see companies within the industry find ways to overcome these difficulties and jointly promote more stable growth for the entire industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track