Medical Device Giant Restructures Again to Save Itself as Stock Plummets 67%

01

Recently (May 9, 2025), according to foreign media reports, the globally renowned diabetes medical device manufacturer Embecta will launch a new restructuring plan aimed at streamlining its organizational structure and optimizing resources.

It has not yet been disclosed whether this restructuring will lead to further layoffs. It is worth mentioning that this is the company's second restructuring action in the past six months.

Last November, the company announced a major decision: the official termination of its much-anticipated insulin patch pump project, withdrawal from the market, accompanied by restructuring and layoffs.

Embecta was spun off from the global top 10 medical device company BD in 2022, has over 100 years of insulin delivery experience, employs more than 2,000 people, and is one of the largest diabetes device companies in the world.

The production line that was suspended is precisely the Insulin Patch Pump, a disposable insulin delivery system that received FDA 510(k) clearance in September of last year.

The production line was once highly anticipated, and its CEO, Kurdikar, had previously positioned the insulin patch pump technology as the team's top strategic priority on multiple occasions.

The system is a disposable wearable patch pump equipped with Bluetooth wireless technology and a color touchscreen lock controller, capable of providing adjustable basal and mealtime insulin infusion for up to 72 hours based on individual user needs.

In addition, the system features a tubeless design with a built-in 300-unit insulin reservoir, making it especially suitable for type 2 diabetes patients who require higher daily insulin doses.

The termination work for the project has been basically completed.

Emberta reported that its profit for the quarter was $23.5 million. For the three months ended March 31, sales were $259 million, equivalent to earnings of $0.40 per share.

Embecta's sales decreased by 9.8%, and profits also declined by 18.7%.

Excluding one-time items, the earnings per share were 70 cents, 11 cents higher than Wall Street's expectations. However, the sales fell short of expectations, with experts forecasting revenue of $261.8 million.

Amidst restructuring news and mixed second-quarter results, Embecta's stock price fell over 8% in a single day.

02

Embecta's Two-Year Journey:

Embecta's history can be traced back to the 1920s, as the creator of groundbreaking products such as the world's first dedicated insulin syringe and the first disposable glass syringe, nearly monopolizing the insulin syringe market.

However, after a century of the passage of time, the glorious achievements of Embecta have been gradually replaced by slowing performance. In April 2022, Embecta officially separated from BD to operate as an independent publicly traded company.

After the spin-off, Embecta announced its focus on the GLP-1 market, viewing its disposable insulin delivery system under development as a hope to revive its prominence.

Last September, the product received FDA approval, marking a victory.

So, at this critical moment, why did Embecta fail to seize the opportunity, but instead hit the brakes, terminate projects, and undergo continuous restructuring?

Despite the ideal being very rich, the reality is quite stark. Ever since going public independently, Embecta's stock price has not performed well.

The company's closing stock price on May 9th was $11.97, a 67% decrease compared to the $36.64 price in November 2022.

To make matters worse, following the continued downturn, there were frequent rumors about the potential sale of the entire company.

Although the company's stock price received a short-term boost when the patch pump was approved by the FDA, it failed to achieve a significant turnaround, which also indirectly indicates that the market's bet on Embecta was not very optimistic.

Embecta also faces another severe reality challenge - its persistently high debt problem.

In fields with lower competitive barriers, players will inevitably face the awkward situation of being overtaken by latecomers and having their competitiveness weakened.

On the contrary, to establish a foothold in a high-barrier track, higher requirements are placed on the technological content of the product. This path is even more perilous, often requiring substantial financial support and a long period of commercialization validation, with product certification being just the beginning.

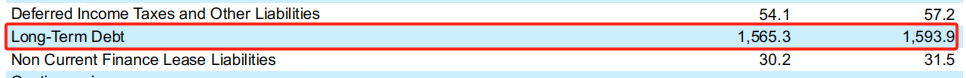

Currently, Embecta's finances are not very robust. According to its latest report for the 2024 fiscal year, the company's long-term debt amounts to $1.565 billion (approximately 11.35 billion yuan).

Embecta 2024 Financial Report

Embecta total liabilities Baidu Stock Market

Under the dual pressure of time and funding, coupled with the uncertainty of tariffs, Embecta inevitably finds itself "struggling to keep up," facing the difficult choice between ideals and reality. In this situation, Embecta has no choice but to continually restructure in order to gain strategic breathing room.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories