MDI Market in 60 Days: From Global Coordinated Price Hikes to Supply-Demand Reversal at the Start of the Year

On January 17, Wanhua Chemical's Ningbo Industrial Park's MDI Phase II (1 million tons/year) completed its two-month shutdown for maintenance and resumed normal production. The restart of this crucial production line in the global MDI supply chain signals the end of the MDI price rally that began in November.

Global coordinated price increases

Supply contraction triggers year-end rally.

From December 2025, when major global manufacturers jointly issued price increase letters, to January 2026, when prices saw a slight and continuous correction, MDI, a core raw material for polyurethane, experienced a rollercoaster ride within two months. Market attention has shifted from the sudden contraction on the supply side to the assessment of demand sustainability and new production capacity.

From late November to mid-December 2025, the global polyurethane market experienced a rare concentrated price increase, unseen in nearly three years. Major MDI producers, including BASF, Wanhua Chemical, Huntsman, and Dow Chemical, successively issued price adjustment notices within approximately three weeks, with increases generally ranging from $200-350 USD/ton, covering major global markets.

This round of price increases is driven by an unexpected tightening of the supply side. In November, Wanhua Chemical's Ningbo Industrial Park MDI Phase II (1 million tons/year) plant started its planned shutdown for maintenance. During the same period, overseas supply disruptions also occurred: BASF's 650,000 tons/year MDI plant in Antwerp, Belgium, was operating at low capacity due to upstream raw material issues; and a 400,000 tons/year plant in Saudi Arabia announced that it would undergo maintenance in January 2026.

Under the expectation of supply contraction, major producers have formed a price increase synergy.Buy Chemicals and PlasticsAccording to research institute data, as of mid-December, the domestic polymeric MDI market price rose to 15,050 yuan/ton, an increase of approximately 500 yuan/ton within the month.

Reversal of the supply-demand pattern

Maintenance completion and weak demand push prices down.

Entering January 2026, market drivers shifted. As maintenance units gradually resumed operation, expectations of increased supply strengthened, while downstream demand did not recover synchronously, leading to downward pressure on prices.

Supply-side recovery is evident. On January 17th, Wanhua Chemical announced that its Ningbo MDI Phase II plant has completed its maintenance and resumed normal production. This plant is one of the world's largest single-line MDI production facilities, and its resumption of production significantly increases market supply expectations. Currently, Wanhua Chemical's total MDI capacity is 3.8 million tons per year, ranking it first globally.

Demand-side support is insufficient. Downstream industries such as home appliances, automobiles, and construction are in their traditional off-peak production season, and end-customers generally have weak inventory replenishment intentions. A Longzhong Information report pointed out that from January 9th to 15th, the market price of polymeric MDI continued to decline slightly, with Shanghai sourced goods dropping to the 13800-13900 yuan/ton range. Although the prices of raw materials such as pure benzene and aniline have risen, cost support has not been effectively transmitted to the MDI segment.

The global MDI industry's medium-to-long-term capacity layout is more noteworthy than short-term price fluctuations. Leading companies are continuing to expand capacity to consolidate their market positions.

Wanhua Chemical's Fujian base revamp and capacity expansion project is expected to commence production in 2026, increasing the company's total MDI capacity to 4.5 million tons/year. Concurrently, another major Asian producer is also advancing its expansion plans. Kumho Mitsui Chemicals recently announced the expansion of its MDI plant at its Yeosu production base in South Korea, planning to add an annual capacity of 100,000 tons, with production commencing in May 2027. The base's capacity will then reach 710,000 tons/year.

High concentration industry marathon

Continue finding driving needs.

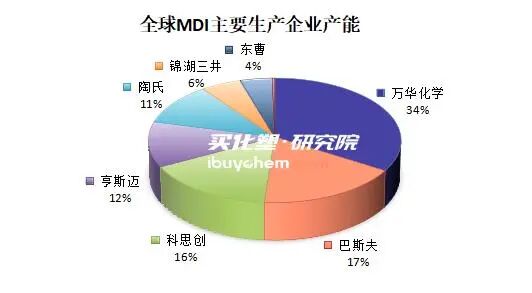

Currently, the global MDI market is characterized by a high degree of concentration. Five major enterprises—Wanhua Chemical, BASF, Covestro, Huntsman, and Dow—collectively account for 91% of global production capacity. This high level of concentration makes the industry extremely sensitive to changes on the supply side, granting leading companies significant pricing influence.

In the short term, the polymeric MDI market is expected to maintain a weak performance. As the Spring Festival approaches, some downstream enterprises may engage in pre-holiday stockpiling; however, the overall volume is expected to be limited, making it difficult to reverse the market's downward trend. The Buy-chem Research Institute pointed out that without clear bullish news to boost the market, the weak performance of the polymeric MDI market is likely to persist.

The situation in the pure MDI market is slightly different. Although prices have also shown a weakening trend recently, the tight supply pattern is unlikely to change in the short term due to ongoing maintenance at some major plants through January. Consequently, the room for further price declines is relatively limited.

Long-term demand drivers remain. Mitsui Chemicals, in explaining its expansion, noted that countries worldwide are promoting energy-efficient building renovations to combat climate change, anticipating a sustained 5% annual growth in MDI market demand. Additionally, MDI's applications are expanding in emerging fields such as automotive lightweighting and eco-friendly coatings.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories