MDI Giants Unite in Price Support! How Will the Market React to Tariff Escalations?

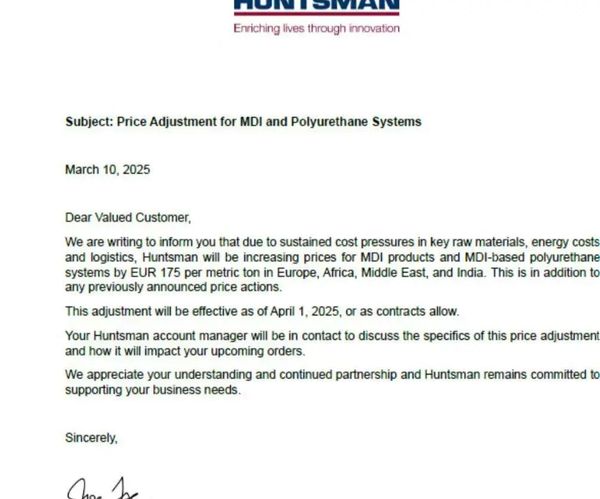

Recently, Huntsman Corporation announced that due to ongoing cost pressures from key raw materials, energy costs, and logistics, Huntsman will increase the price of MDI products and MDI-based polyurethane systems by 175 euros per ton in Europe, Africa, the Middle East, and India. This adjustment will take effect on April 1, 2025, or as permitted by contract.

Huntsman's current price adjustment is its second round of price increases following a 125 euros/ton increase on February 1st. Meanwhile, giants such as Wanhua Chemical, BorsodChem, Dow Chemical, BASF, and Kumho of South Korea have also密集上调MDI价格,涨幅在100-300美元/吨不等。在涨价的原因中,这些公司都提到了表示是由于物流、原材料和能源成本不断上涨。 densely raised MDI prices in the first quarter, with increases ranging from 100 to 300 US dollars per ton. In the reasons for the price hikes, these companies all mentioned that it was due to the continuous rise in logistics, raw materials, and energy costs.

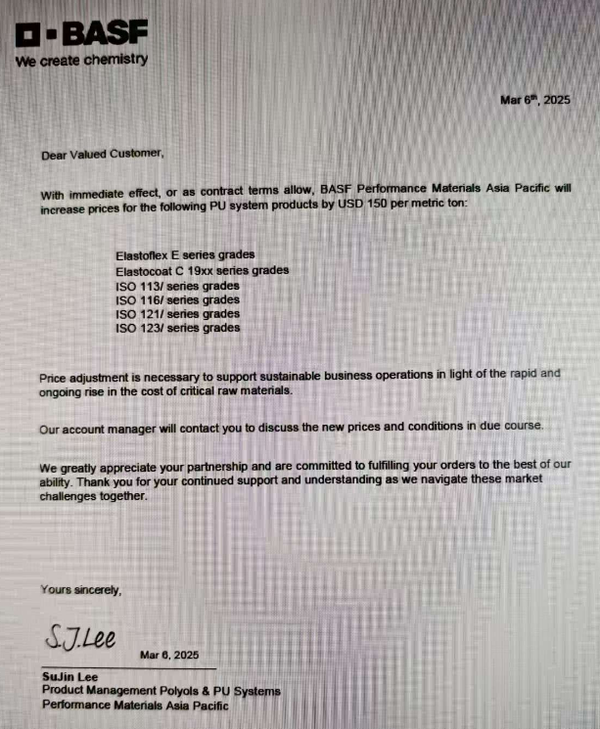

On March 6, BASF's Performance Materials division in the Asia Pacific region announced that, effective immediately or as permitted by contract terms, the prices of the following polyurethane system products will be increased by $150 per ton: Elastoflex E series grades, Elastocoat C 19xx series grades, ISO 113/ series grades, ISO 116/ series grades, ISO 121/ series grades, ISO 123/ series grades. The reason cited is the sustained and rapid increase in the price of key raw materials.

In addition, it is worth mentioning that in February, Dow and BASF formed an MDI fair trade alliance, requesting the U.S. Department of Commerce and the U.S. International Trade Commission to impose anti-dumping duties on MDI imported from China. In 2024, the U.S. tariff on polymeric MDI from China is 31.5%, and at the beginning of 2025, an additional 10% tariff will be imposed on goods exported from our country to the United States. Currently, the export of MDI from our country to the United States faces a high tariff of 41.5%.

Overall, the reasons for price increases given by various parties point to the rise in raw materials, energy, and logistics costs. Industry-leading companies are collectively adjusting prices to pass on cost pressures and maintain profit margins.

cost pressure

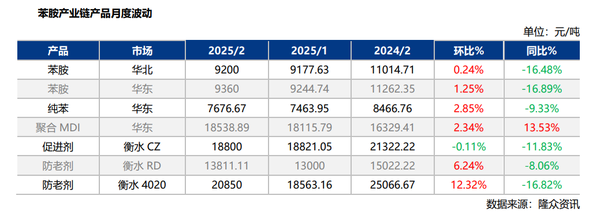

The upstream of the MDI industry chain includes raw materials such as aniline, formaldehyde, liquid chlorine, and carbon monoxide. Among these, the prices of basic chemical products like benzene and methanol are influenced by fluctuations in crude oil prices (with European and American crude oil futures rising to over 80 USD per barrel in early January), which have pushed up costs. The average price of pure benzene in February was 7676.67 CNY/ton, a month-on-month increase of 2.85%. According to Longzhong Information, the prices of key intermediate products in the aniline industry chain were generally higher in February compared to January, leading to an increase in MDI production costs.

supply tightness

In addition, recent停车检修of some MDI facilities in the Asian region has led to a tighter supply expectation, which is also one of the factors affecting this round of price increases in the industry. For example, TOSOH's 400,000 tons/year facility in Japan temporarily shut down on January 17 due to an incident and suspended quotations; KUMHO's 410,000 tons/year facility in South Korea plans to undergo maintenance for one month starting from early February (another 200,000 tons/year facility is operating normally); BASF's MDI facility in South Korea plans to undergo maintenance for about one month starting from February 9; Covestro's 70,000 tons/year facility in Japan will undergo a planned maintenance for one month starting in March.

high industry concentration

MDI supply is highly concentrated, making it easy for companies to form a united front in maintaining prices, which may further support the price maintenance logic and promote profit improvement. Major producers include Wanhua Chemical (3.5 million tons/year), BASF (2.07 million tons/year), Covestro (1.77 million tons/year), Huntsman (1.37 million tons/year), Dow (1.11 million tons/year), Mitsui Chemicals (610,000 tons/year), Tosoh Corporation (470,000 tons/year), and Iran's Karoon (40,000 tons/year). At the same time, inventories of some products are currently at low levels. Looking at a longer timeframe, there will be limited new global MDI capacity additions over the next three years, mainly including 600,000 tons from Wanhua in Ningbo (2025) and 200,000 tons from BASF in the US (2026).

downstream application demand

From the perspective of downstream application demand, changes in market demand are the underlying reason for this MDI price increase. In 2024, the recovery of the European construction industry is slow, and the growth in demand for automobiles and home appliances is limited, leading to lower-than-expected MDI consumption growth. In the Asia-Pacific region, especially in the Chinese market, the expansion of new energy and photovoltaic industries drives demand, but fierce price competition further squeezes manufacturers' profits.

The actual market situation, as seen from the latest prices by Longzhong Information, shows that since February, after a slight increase, the market price of polymeric MDI has shown a downward trend, with transactions remaining moderate. As shown in the figure below, the actual transaction and offer prices for domestic Shanghai goods (44V20, M20S, 5005) are 16,900-17,300 yuan/ton, the actual transaction prices for domestic goods (PM200) are 17,400-17,600 yuan/ton, and the offer prices for imported goods (MR200, M200) are 16,800-17,300 yuan/ton.

Aggregated MDI price trend chart (yuan/ton)

However, companies like Huntsman are trying to reverse this situation and maintain operational stability by raising prices. Therefore, some industry experts believe that price hikes are not only a transfer of costs but also a prediction of future demand recovery—it is expected that the global economy will see a moderate recovery in 2025, with MDI demand potentially growing by 5%-6%. Additionally, when releasing its 2024 financial report, Huntsman stated that it expects to see more positive signs in the MDI industry in 2025, especially in the North American and Chinese markets.

In addition, on January 5th of this year, the National Development and Reform Commission and the Ministry of Finance issued the "Notice on Expanding the Implementation of Large-Scale Equipment Renewal and Consumer Goods Trade-in Policies by 2025", proposing to increase support for the trade-in of home appliances, actively support the renewal of home decoration consumer goods, and improve the subsidy standards for car replacement and updating. With the help of these policies, it is expected that the prosperity of polymeric MDI will continue. This is because in the home appliance and automotive industries, MDI accounts for about 15%-20% of the cost of refrigerators and car interiors.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics