LYB Reports Q2 2025 Earnings with Revenue of $7.66 Billion

■ Net profit: USD 115 million; USD 202 million (excluding recognized projects)

■ Diluted earnings per share: $0.34 per share; $0.62 per share (excluding recognized items) ■ Earnings before interest, taxes, depreciation, and amortization (EBITDA): $606 million; $715 million (excluding recognized items)

■ Cash flow generated from operating activities: 351 million USD

■ Returned $536 million to shareholders through dividends and share repurchases

■ While executing the strategy, continue to address cyclical changes with operational and financial discipline.

Announced plans to sell part of European assets to further optimize the business portfolio.

Postpone the construction of the Flex-2 project to preserve capital during the downturn.

The cash improvement plan is progressing well, with an expected enhancement of $600 million annually by 2025, and further expansion in 2026 with an incremental target of $500 million.

LYB (LyondellBasell) released its financial report for the second quarter of 2025. Comparative data with the previous quarter and the same period in 2024 are shown in the table below:

2025 Q2 Performance

In the second quarter of 2025, LYB achieved a net profit of $115 million, or diluted earnings per share of $0.34. During the quarter, the company recognized after-tax identified items totaling $87 million, which impacted second quarter earnings per share by $0.28. These items included asset impairments, transaction costs, cash improvement initiatives, and discontinued operations. EBITDA for the second quarter of 2025 was $606 million, or $715 million excluding identified items.

In North America, LYB successfully completed the turnaround of its Channelview complex, thereby improving operational efficiency and driving sequential improvements in integrated polyethylene production and profits. Domestic demand for polyethylene and polypropylene has shown seasonal growth, mainly due to strong demand in consumer packaging, healthcare, construction, and infrastructure markets. The increase in polyethylene contract prices in June has provided strong support for third-quarter profitability. In Europe, lower feedstock costs have helped improve integrated polyethylene margins, while sales of polyolefins have also benefited from increased seasonal demand.

The profitability of the intermediate chemicals business improved, mainly due to the decline in benzene costs and price support resulting from industry shutdowns in the second quarter, which boosted styrene margins. The typical seasonal increase during the summer driving season was limited by falling crude oil prices, leading to lower margins for pure oxygenate products. In the second quarter, global markets began to adapt to trade fluctuations, providing a more stable operating environment for multiple product chains.

In the second quarter of 2025, LYB generated $351 million in cash from operating activities. The company continued to maintain a balanced capital allocation strategy, spending $539 million on capital expenditures and returning $536 million to shareholders through dividends and stock repurchases. By the end of the quarter, LYB held $1.7 billion in cash and cash equivalents and maintained $6.4 billion in available liquidity.

Strategic Highlights

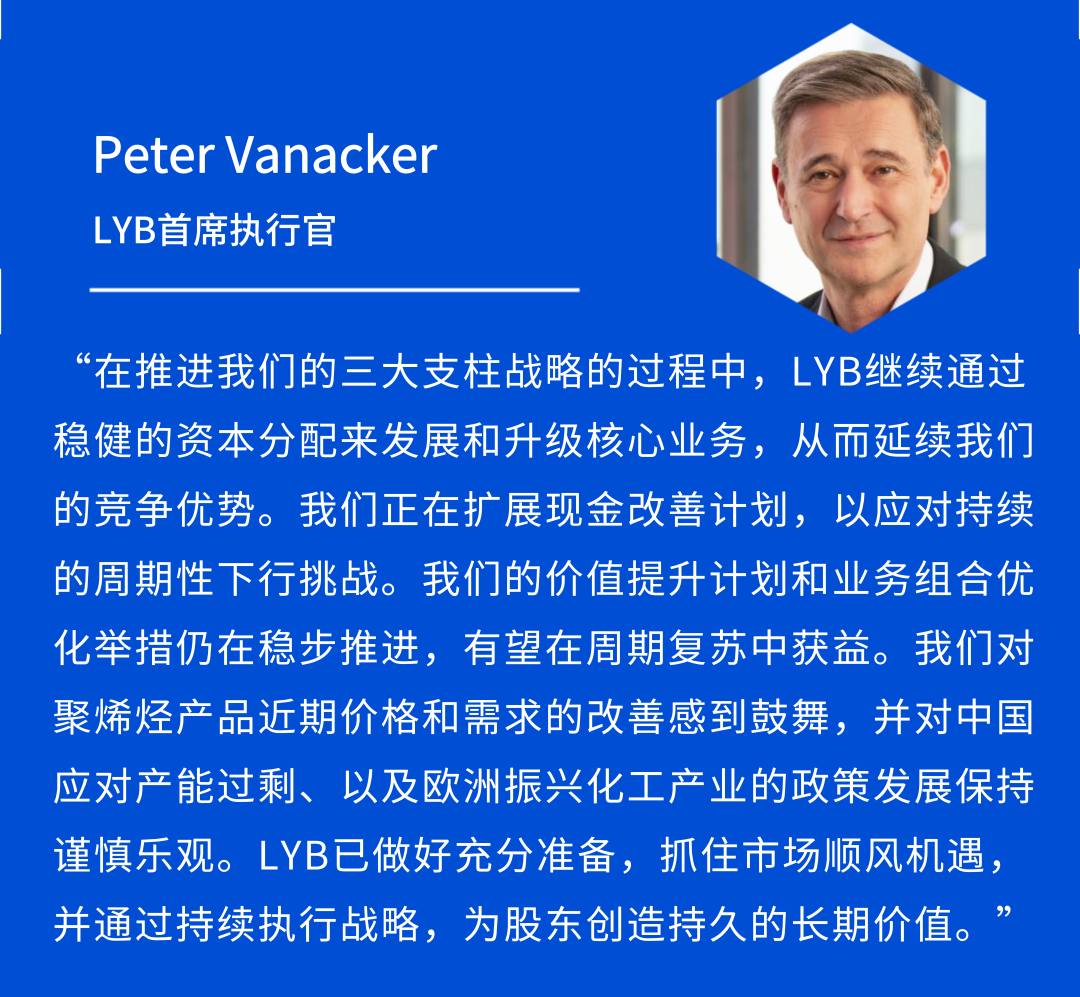

LYB continues to steadfastly implement its three-pillar strategy, reshaping its asset portfolio through decisive actions to enhance its ability to create long-term value. LYB plans to sell four European assets to reposition with a more cost-advantaged asset base, thereby better serving the global market. To better align investment levels with cash flow, LYB will postpone the construction of the Flex-2 project. The cash improvement program has been expanded, targeting at least $1.1 billion in cash improvements in 2025 and 2026 to protect the balance sheet and support shareholder returns. The company remains committed to maintaining balanced capital allocation to ensure safe and reliable operations, robust growth, and shareholder returns, while sustaining an investment-grade balance sheet.

In the third quarter, LYB expects integrated polyethylene margins in North America to improve, primarily due to a planned maintenance completed in April and price increases supported by strong domestic demand and export growth. In Europe, stable seasonal demand and favorable feedstock costs are expected to continue. The ongoing capacity optimization in the region is expected to help achieve a regional supply-demand balance. The margins for oxyfuel products are expected to remain low throughout the summer. LYB will continue to prudently assess potential risks and opportunities related to the evolving tariff policies and global trade flows.

To align with global demand and the company's maintenance schedule, LYB expects third-quarter operating rates for North American Olefins & Polyolefins (O&P) assets to be 85%, European O&P assets to be 75%, and Intermediates & Derivatives (I&D) assets to be 80%.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track