Lululemon's Top Rival Draws 7 Billion Yuan From Gen Z in One Year

Under the big tree of Lululemon, the new generation of "yoga symbols" is crazily attracting wealth.

Written by Ding Jie

Lululemon's "number one rival" has scored another victory.

A week ago, the sportswear brand Alo, which originated in Beverly Hills, Los Angeles, USA, opened its first store in Seoul, South Korea. Notably, this store marks a new stop in Alo's expansion in Asia, following locations in Saudi Arabia, Dubai, Thailand, Malaysia, and Indonesia. The store is situated in the affluent Gangnam district of Seoul, adjacent to the Hermès Maison.

On social media, a group of KOLs led by purchasing agents have posted the freshest "store visit logs." A girl wrote on Xiaohongshu: "It takes 2 hours to queue before entering." This queue time, comparable to waiting for a popular ride at Disneyland, also proves the brand's immense popularity.

From the perspective of North America, where store coverage is the widest, Alo's main competitor is Lululemon, the "number one seed player" in yoga apparel. As Lululemon becomes increasingly mainstream and its product designs lack innovation, emerging brands like Alo, with their eye-catching colors and fashionable designs, have become new favorites among consumers.

Differentiating itself from peers, Alo's brand growth model employs a strategy akin to "building KOLs" to develop the brand, targeting Gen Z and firmly controlling the initiative on social media. In a recent set of credit card data released by Earnest Analytics, Lululemon customers in 2024 spent $660 (approximately RMB 4,438) at Alo, surpassing their $600 (approximately RMB 4,307) spending at Lululemon for the first time, representing a 76.5% increase compared to six years ago.

"Super girls" are moving closer to becoming "IT girls." Data shows that Alo's annual revenue has reached $1 billion (approximately 7.1 billion RMB).

Compared to Lululemon, which has 151 stores in China, Alo's entry into the Chinese market has been noticeably slower. It has neither entered mainstream domestic e-commerce channels nor established physical stores. Instead, the market is dominated by hard-to-distinguish authentic and counterfeit resellers, as well as brand knockoffs claiming to be "original factory" products. Meanwhile, amidst the booming domestic sports market, can the "slow-heating" Alo still secure a spot among China's "new middle class"?

Contemporary enterprise

Following Lululemon, entering the "verified" market

The Wall Street Journal, in an article, mentioned the rise of Alo, calling it "a business story, a marketing story, a pandemic story, and a celebrity story, with a lot of serendipity involved."

Alo's entrepreneurial journey shows that its good fortune along the way is inseparable from the dividends of the times.

In 2007, when the predecessor Lululemon rang the bell on NASDAQ, Alo was born. At that time, Alo's two founders, Danny Harris and Marco DeGeorge, were running a brand known for its T-shirts, Bella+Canvas, in Los Angeles. Influenced by Lululemon's successful debut and market education, they decided to enter this validated market by launching a yoga pants category within Bella+Canvas, later renaming it Alo and establishing it as an independent yoga brand.

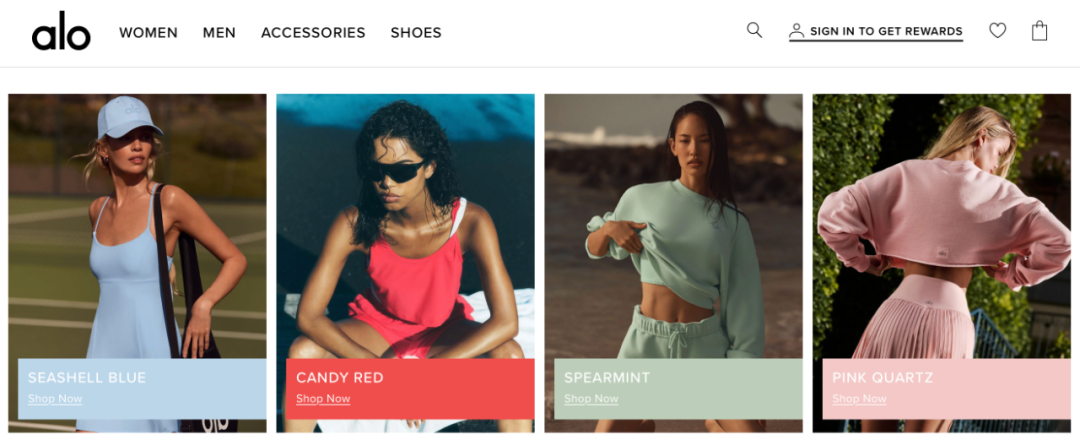

In the product line, sports bras and yoga pants are Alo's core categories. Unlike competitors who focus on fabric and technology narratives, Alo emphasizes design.

Among Alo’s best-selling products, various brightly colored yoga pants, tennis skirts, and sports vests are currently the most popular items. According to a Korean purchasing agent interviewed by Contemporary Enterprise, the search volume for “Alo Magic Pants” is very high on social media. The so-called “Magic Pants” refer to a pair of long pants with a logo on the waistband that make a “swishing” sound when walking. Because they are slimming and give off an energetic vibe when worn, they are one of the most frequently clicked items in her shop. Reportedly, the “Magic Pants” are priced at $151, approximately 1,088 RMB.

To some extent, Alo has transcended the realm of yoga and has become more of a lifestyle brand. In its apparel line, Alo has expanded to include categories such as shirts, sun-protective clothing, knit sweaters, and jackets. In terms of style, the brand incorporates a large number of trendy elements—for example, using colors like "neon bubblegum pink, shell blue, and mint green" to make yoga wear more fashionable. "These are products you can seamlessly transition from the yoga studio to a bar or red carpet," one user remarked.

It is reported that to maintain freshness, Alo releases a new color every two weeks, and some products are discontinued one year after their launch.

In 2020, Alo expanded into the beauty sector and launched the skincare brand Alo Glow System, which is centered around the concept of Clean Beauty. Recently, its official social media accounts have also been promoting its sun protection products.

After Alo emerged, some voices regarded it as a more affordable alternative to Lululemon. However, this is not the case. In terms of pricing, this new brand born in Beverly Hills positions itself as high-end. Taking yoga pants as an example, Alo's product prices range from 700 to 1400 yuan, and sports bras are generally priced between 300 and 1400 yuan. For some products, the pricing is even slightly higher than Lululemon's.

According to data from Earnest Analytics, in the 12 months ending April 22, 2024, the customer overlap rate between Alo and Lululemon was 63%, and about 4% of Lululemon customers purchased from Alo during the same period.

Moreover, to attract customers, over 80% of Alo's new store locations are within a 1-kilometer radius of Lululemon's stores. Alo is pursuing closely to claim the title of the "number one yoga brand."

Contemporary Enterprise

Target Generation Z, with an annual income of 1 billion USD.

It is difficult to visually distinguish the differences between Alo and Lululemon in core products such as yoga pants and sports bras. Both target a group of affluent, quality-conscious new middle-class women. However, in terms of marketing, Alo focuses on a younger demographic that pays more attention to fashion sense and social attributes.

Alo focuses more deeply on the younger Generation Z demographic in its audience strategy.

The age of Generation Z is approximately between 16 and 30 years old. These young people, who are active on the internet and social media, chase trends and are easily influenced by influencers. In "Marketing 5.0" by Philip Kotler, known as the "Father of Modern Marketing," it is written: "Generation Z and Generation Alpha (referring to children born after 2010) prefer brands that are 'eye-catching'."

Alo's most successful move was in its marketing strategy.

In fact, Alo initially gained popularity because American socialites and supermodels like Kendall Jenner, Hailey Bieber, and Bella Hadid were spotted by paparazzi wearing Alo clothing while out and about. Young girls' attention to and admiration for these "IT girls" (idols who gained fame by showcasing a healthy and fashionable lifestyle on social media) made Alo a new social favorite in fashion trends.

A large number of celebrities are spotted wearing Alo in public.

The influence of celebrities and supermodels has caused Alo's traffic to surge dramatically. Understanding the "science of traffic," Alo proactively set up a dedicated section on its official website, releasing quarterly photos of celebrities and supermodels wearing the brand and being street photographed. This approach conveys to consumers that the brand has become a part of the lives of the elite.

Even a LOGO of Alo or a bag can become a highlight on social media. Previously, there was a girl who posted a picture on Instagram of herself walking around the neighborhood with seven or eight Alo paper bags, resembling the Upper East Side girls in "Gossip Girl."

Going with the trend, Alo signed Kendall and Kim Kardashian from the Kardashian family, leveraging the influence of America's "top influencers" to amplify the brand. Following that, they successively signed Kim Jisoo from BLACKPINK and Jin from BTS, accelerating their expansion in the Asian market. It is reported that after Kim Jisoo was announced as their global ambassador, the celebrity-endorsed yoga pants sold out.

On the brand's official website, Alo has set up a dedicated product navigation for numerous celebrity "buyer show" photos, allowing users to directly click on the images to purchase the same styles, thereby converting the influence of these celebrities' traffic.

During the opening of a new store in Korea, Alo invited several Chinese celebrities and influencers, including Aespa's Ning Yizhuo and Yi Mengling. This is also seen as a signal that Alo intends to enter the Chinese market.

On the social media platforms that Alo excels at, they cultivate their presence with particular precision.

On Instagram, Alo has divided its presence into a series of matrix accounts: the official Alo account primarily showcases products and brand image; Aloyoga is dedicated to yoga-related content; Alomoves mainly shares yoga teaching knowledge through video content; Alowellness focuses more on lifestyle, emphasizing beauty and health knowledge; Alomen is dedicated to content for male users. Currently, these five accounts have over 8.62 million followers.

Leveraging powerful influencer marketing strategies, Alo is fully capturing the minds of young women who aspire to a refined lifestyle. "Contemporary Enterprise" has found that Alo does not emphasize the characteristics and advantages of a specific fabric in its product marketing. Clearly, unlike Lululemon, it does not follow a technology-driven route; instead, it excels at building "social currency," creating a psychological suggestion for users that "wearing Alo equals having a refined lifestyle."

Contemporary Enterprises

The Chinese market is progressing slowly, risking the loss of first-mover advantage.

Both Lululemon and the rising yoga apparel star Vuori regard the Chinese market as a crucial battleground and have been accelerating their store openings in China over the years. In comparison, Alo has clearly moved at a slower pace.

Previously, some media reported that Aurora Liu, former Vice President of Marketing at Arc'teryx, has joined Alo and is now serving as the head of its China market. Furthermore, it is reported that Alo will officially enter the Chinese market this year and open its first offline store in China. Currently, the company is selecting retail locations in major commercial areas such as Jing’an Kerry Centre and Plaza 66 in Shanghai.

Compared to Alo's aggressive expansion in its North American home market with an average of one new store opening per week, industry insiders analyze that Alo appears in only a few core commercial areas in Asia, with sparse stores, scattered marketing, and no established localized narrative.

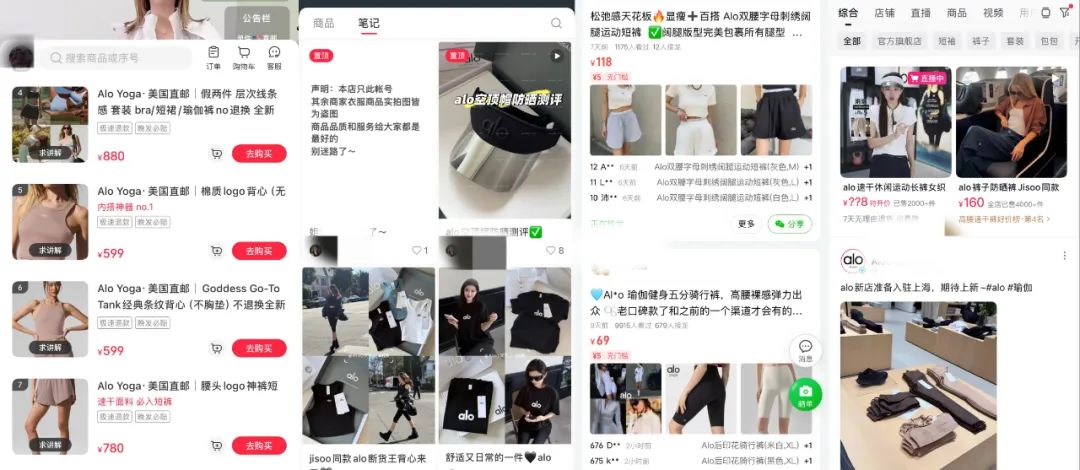

What is even more noteworthy is that while major brands are vigorously entering domestic e-commerce platforms, Alo still sells to the Chinese market solely through its global official website.

Although Alo has not yet entered the Chinese market, it has already gained a certain level of popularity domestically. This situation of "visible but unavailable for purchase" has also stimulated the purchasing desire of young consumers. Currently, not only has Alo become a new hot item in various purchasing agent groups, but numerous stores claiming to be "Alo" have also emerged online. Products labeled as "Alo same style" or "original" are selling well in group buying circles, with a mix of genuine and counterfeit items, including classic Alo embroidered shorts and other styles.

Online stores under the name "Alo" have emerged on major domestic e-commerce platforms.

"Fake Alo is helping real Alo expand its influence domestically," a netizen commented. On Xiaohongshu, topics related to "#Alo" have garnered over 140 million views, with new posts about it being published daily, which fully demonstrates the brand's momentum in the Chinese market.

Even after entering the Chinese market, Alo's progress will not be easy.

On the one hand, its core competitor Lululemon has separated the Mainland China market from its "international business" and disclosed financial data separately, which also marks the increased importance of the Chinese market to the company. By the end of the 2024 financial report, the number of Lululemon stores in China has reached 151, accounting for about 20% of its total number of stores. The latest news is that it is working hard to expand its presence in second- and third-tier cities in the country to further enhance its brand influence.

On the other hand, international competitors focusing on the “yoga” sector are also sharing Alo’s market. Recently, the China operations of Sweaty Betty, known as the “British Lululemon,” have been transferred to the e-commerce service provider Baozun, and Sweaty Betty will undoubtedly accelerate its expansion in the domestic market. At the same time, Vuori, often called the “male Lululemon,” is also rapidly expanding; since entering the Chinese market through its Tmall flagship store in 2022, Vuori has opened three stores in just two years and is prioritizing the Asian market for further development.

Meanwhile, in recent years, a large number of emerging yoga brands have sprung up in China, including MAIA ACTIVE, a domestic brand under Anta that designs yoga apparel specifically for Asian women. Zhao Guangxun, Vice President of Retail Business at Anta Group and President of MAIA ACTIVE, mentioned in a recent media interview that Alo has not yet entered China, but they will observe Alo’s performance in other Asian markets. MAIA focuses solely on Asian women and excels at analyzing the more detailed needs of Asian women, rather than simply shortening the length of pants like some Western brands do.

With numerous competitors, Alo’s path in China is destined to be far from smooth. However, Alo still offers consumers an imaginative space for an ideal lifestyle, driving a new aesthetic revolution. Yet amid the mixed reviews of its products, whether Alo’s product strength and R&D capabilities can sustain a long lifecycle remains uncertain. Discerning consumers will inevitably awaken from symbolic consumption, as the true vitality of a brand relies on more than just attractive filters and traffic.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track