Lens Technology 2025 Half-Year Report: Profit Achieves Double-Digit Growth, Emerging Sectors Like Robotics and AI Glasses Blossom Across Multiple Fronts

Thanks to the continued high prosperity of the consumer electronics industry and the business growth of core customers such as Apple and Xiaomi, Lens Technology has maintained a steady growth trend since last year.

On August 25, 2025, Lens Technology (300433.SZ) officially released its semi-annual performance report. The report shows that during the period, the company achieved operating revenue of 32.96 billion yuan, representing a year-on-year increase of 14.18%; net profit reached 1.194 billion yuan, a year-on-year growth of 35.53%. Under the guidance of its long-term development strategy, the company's main business achieved double-digit growth, with overall efficiency and profitability further improved.

As an important company within the Apple supply chain, Lens Technology has been continuously expanding its Apple-related business. Currently, its products cover multiple categories including iPhone, Apple Watch, Mac, and Apple Vision Pro. In addition to the smartphone business, the company has actively been developing emerging fields such as smart automobiles, AI glasses, and humanoid robots in recent years, gradually building a diversified growth pattern. For example, the company has cooperated with leading humanoid robot enterprises in both China and North America, and in January this year, it achieved mass delivery of the Lingxi X1 complete products to Zhiyuan Robotics. In February this year, Lens Technology reached a deep strategic cooperation with Rokid, providing them with components, modules, and complete machine assembly services, helping to reduce industry costs and promote market penetration of new product categories.

Looking ahead to the second half of 2025, with the arrival of the traditional peak season, Lens Technology's core consumer electronics business is expected to see a continued release of orders. In addition, the accelerated implementation of various new businesses and emerging sectors is projected to contribute more growth momentum to the company’s full-year performance.

The main business growth momentum is strong.

Lens Technology's main business can be divided into four categories: smartphones and computers, smart vehicles and cockpits, smart headsets and wearable devices, and other smart terminals.

Smartphones and computer products remain the main sources of revenue, with operating income reaching 27.185 billion yuan in the first half of this year, representing a year-on-year increase of 13.19%. The company continues to consolidate its market-leading position in appearance components, structural parts, and functional modules made of glass, ceramics, sapphire, and metal. It has completed the research and development and mass production preparation for several flagship smartphones of the year, and cooperated with leading customers to achieve large-scale mass production of metal middle frames for multiple high-end models. Both market share and profitability have significantly improved compared to the same period last year.

In addition to bar phones, the rise of foldable phones has also brought new value growth points to the upstream supply chain. The much-anticipated Apple foldable phone has recently made new progress and is expected to be released in the second half of 2026, marking a major upgrade for the iPhone product line. It is reported that this foldable iPhone may adopt a horizontal "book-style" design and is expected to apply UTG ultra-thin glass technology to achieve a "zero crease" visual experience.

Lansi Technology revealed in its investor relations activity record that, as a core supplier of ultra-thin flexible glass (UTG) globally, the company possesses significant advantages in UTG technology, patent layout, and mass production capabilities. It has been deeply involved in product development and mass production with multiple customers in Mainland China, North America, and South Korea. The company holds a leading market share in core components of foldable screens, including UTG, CPI, PET protective films, glass support plates, hinges, and titanium alloy middle frames. At the same time, as the core supplier of appearance and structural parts for a major North American client, Lansi is fully engaged in the entire process of product design, research and development, production, and iteration. The development and verification of new foldable screen products are progressing smoothly, and capacity planning and construction are advancing according to customer requirements, fully preparing for future large-scale mass production.

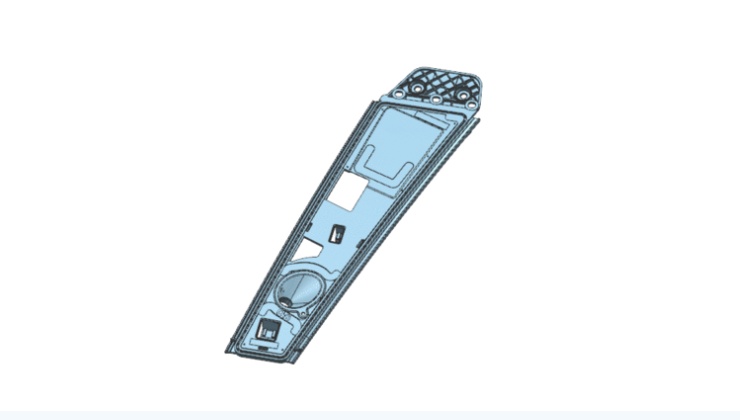

The intelligent vehicle and cockpit business is Lens Technology's second-largest business segment. In the first half of 2025, it achieved operating revenue of 3.165 billion yuan, representing a year-on-year growth of 16.45%. The company has established cooperation with more than 30 leading domestic and international automakers, including major North American clients, covering multiple mainstream intelligent driving platforms. Its products include central control screens, instrument panels, B-pillars, C-pillars, charging piles, and interior structural components. This business holds a 20.9% market share in the global intelligent vehicle interactive system comprehensive solutions market, ranking first in the industry.

Leveraging decades of technological expertise in the deep processing of electronic glass, Lens Technology continuously expands the boundaries of its automotive business. By fully utilizing its advantages in glass thinning, chemical strengthening, multi-layer coating, and high-precision processing, the company has developed automotive glass with functions such as lightweight, sound insulation, heat insulation, UV protection, and color-changing shading. These can be widely applied to car windows, windshields, and panoramic roofs.

The company stated that the ultra-thin laminated automotive glass has been established as a strategic-level innovative product, successfully integrated into the mass production system of new models by leading domestic automakers, and continues to deepen cooperation with global technology brands and traditional European and American automakers. It is about to enter the mass production phase. Related capacity construction has been initiated according to customer demand. Leveraging technological barriers and capacity synergy, this business is expected to become a new and sustainable growth point for the company.

Deploying Robots and AI Glasses to Create New Growth Engines

In recent years, companies in the Apple supply chain have been seeking cross-sector development, with Lens Technology actively venturing into high-growth areas such as AI glasses and robotics.

In the first half of this year, the company's smart headsets and smart wearables business achieved operating revenue of 1.647 billion yuan, a year-on-year increase of 14.74%. Lens Technology has developed a full-stack solution capability covering optical lenses, structural components, functional modules, and complete device assembly, with products including smart headsets, AI glasses, and smartwatches.

In the AI glasses/XR headset field, Lens Technology has collaborated with a major North American client for years of R&D, becoming the core supplier of exterior structural components for their first-generation smart headset. Additionally, it provides other leading North American AI glasses clients with functional modules such as light guide modules, microphone modules, and precision structural components.

In the domestic market, in February this year, Lens Technology and Rokid reached a cooperation agreement on complete device assembly, covering the entire production chain from frames, lenses, and functional modules to fully automated assembly. Previously, Rokid’s founder Zhu Mingming delivered a “script-free” speech while wearing AR glasses, which quickly attracted widespread market attention and further boosted the popularity of AR glasses.

Although the AI glasses industry still faces production capacity bottlenecks in areas such as light waveguide lenses and core modules, Lens Technology stated that with the gradual release of the company's related module and light waveguide lens capacity, industry constraints will be effectively alleviated. At the same time, as a core manufacturing platform in the industry, the company has established long-term cooperation with multiple leading customers and will ensure order delivery through strong vertical integration capabilities in the future, continuously bringing incremental growth to its smart wearable business.

Humanoid robots are another important strategic direction for Lens Technology. The company has developed the capability to research and develop core structural components, achieving mass production of key components such as six-dimensional force/moment sensors and planetary roller screws. In terms of appearance and interaction, Lens has also developed curved glass display and nano-microcrystalline glass technology to provide lightweight and high-strength appearance solutions for humanoid robots.

In terms of product delivery, the company successfully delivered complete machine products in bulk to Zhiyuan Robotics in January this year and was deeply involved in the production, assembly, and testing of core components such as the joint modules and DCU controllers for Lingxi X1. In addition, Lens Technology provides structural parts and complete machine assembly services—including head modules, joint modules, dexterous hands, and torso shells—for numerous domestic and international robotics companies. The company has secured shares in head modules and structural parts for a leading North American robotics client, while dexterous hands and some structural parts are currently in the sample delivery stage. As clients accelerate the finalization of new models and move towards large-scale mass production, the company's related products are expected to achieve bulk supply.

Lens Technology stated that its long-term goal in the robotics field is to build China's largest highly vertically integrated embodied intelligent hardware core manufacturing platform, continuously reduce the overall cost of humanoid robots, improve the efficiency of the industrial chain, and promote the industry towards standardization and scale development.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track