July Passenger Car Retail Sales Rankings: BYD and Tesla Plummet Year-Over-Year, Geely Galaxy and Xiaomi Skyrocket

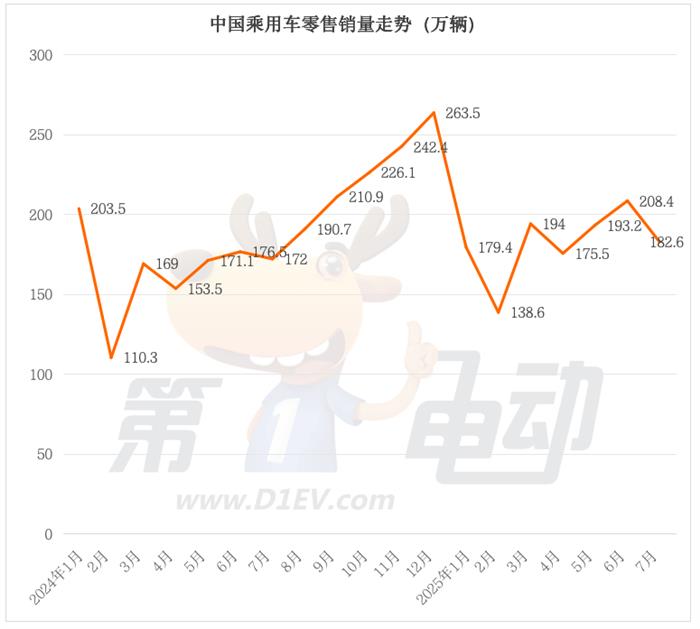

In July, the overall Chinese passenger car market showed a downward trend. According to data from the China Passenger Car Association, retail sales of passenger cars for the month reached 1.826 million units, a month-on-month decline of 12.4%. However, year-on-year growth was still maintained at 6.2%.

Among them, new energy vehicles performed particularly well, with retail sales reaching 987,000 units. Although there was a month-on-month decline of 11.2%, there was a year-on-year increase of 12%. The retail penetration rate of passenger vehicles has risen to 54%, an increase of 2.7 percentage points compared to the same period last year, further consolidating the mainstream position of new energy vehicles in the market.

Specifically, the internal structure of new energy vehicles has undergone significant changes. Retail sales of pure electric vehicles reached 607,000 units, a month-on-month decline of 8%, but a year-on-year increase of 24.6%. Retail sales of plug-in hybrid vehicles were 380,000 units, a month-on-month decline of 15.7%, and a year-on-year decrease of 3.6%. These figures reflect that the market share of pure electric vehicles is continuously rising.

At the brand level, significant market segmentation is evident. Among leading brands, BYD experienced a sharp decline due to a drop in sales of several popular models, with retail sales at 249,000 units—down 22% month-on-month and 17% year-on-year. Besides BYD, brands such as Tesla, BBA (BMW, Mercedes-Benz, Audi), Honda, and Li Auto all saw their sales decrease by more than 10% both month-on-month and year-on-year. Both traditional leading brands and some emerging players are facing considerable market pressure.

In stark contrast, the sales of Geely and Galaxy brands under the Geely system increased against the trend on a month-on-month basis, especially the Galaxy brand, which achieved a doubling surge year-on-year. Through the dual-brand synergy strategy of "Geely + Galaxy," the Geely system's monthly retail volume exceeded 160,000 units, not only approaching BYD but also surpassing Volkswagen, fully demonstrating the cluster-like explosive power of Chinese brands in the transition to new energy.

Emerging brands also performed impressively, with Leapmotor, Xiaomi, and XPeng all achieving month-on-month sales growth against the trend, and year-on-year sales more than doubling, making them key drivers of market growth.

▍ Xingyuan hits a new high, AITO M8 enters the top ten for the first time, Song PLUS drops by more than 33%.

Among the TOP 20 models, the month-on-month sales data shows a clear trend of polarization. Among them, six models—Xingyuan, Hongguang MINIEV, Sylphy, AITO M8, Xiaomi SU7, and Boyue L—achieved an increase in sales compared to the previous month, while the other 16 models experienced varying degrees of decline.

The standout performer is Xingyuan, with sales exceeding 44,000 units, a month-on-month increase of 8.3%. Not only did it set a new record high, but it also once again surpassed the Model Y, firmly holding the top spot on the Chinese passenger car sales chart. The performance of the Hongguang MINIEV is also impressive, with sales exceeding 27,000 units, a month-on-month increase of 4.7%. It successfully surpassed models like Qin L and Seagull, returning to the top five on the list, ranking fourth.

Sales of Xiaomi SU7 saw a steady increase, rising by 5% month-on-month, surpassing Seagull to rank seventh. AITO M8 performed exceptionally well, with sales once again exceeding 20,000 units, reaching 216,000 units, setting a new record high, and entering the top ten in sales rankings for the first time.

In the field of fuel vehicles, only the Sylphy and Boyue L achieved month-on-month sales increases. Sylphy's sales rose by 7.7% month-on-month, returning to the top five on the list; Boyue L's sales saw a significant month-on-month increase of 62%, re-entering the top 15 on the list. It is worth noting that Boyue L is currently conducting a price reduction promotion, with a maximum discount of 20,000 yuan, and the minimum starting price has dropped to 92,900 yuan.

In contrast to the aforementioned models with increased sales, there are 16 models whose sales have decreased to varying degrees month-on-month. Affected by the launch of numerous competing products, the sales of the Song PLUS plummeted by more than 33% month-on-month, causing its ranking to drop significantly to the 14th position. In addition to the Song PLUS, BYD's Qin L and Seagull also experienced a significant month-on-month decline of over 20% in sales, with the Seagull dropping out of the top five to ninth place. The Song PRO saw an even sharper decline of over 40% month-on-month, falling out of the TOP 20 list altogether.

Meanwhile, the sales of Tesla's models have also seen a significant decline. Model Y sales dropped by more than 31% month-on-month, falling to third place in the rankings; Model 3 sales decreased by over 40% month-on-month, dropping out of the top 50.

The sales decline of fuel vehicles is also not optimistic, with models such as Camry, Sagitar, Xingyue L, Magotan, Passat, and Tiguan L all experiencing a month-on-month sales drop of over 10%.

In terms of year-on-year growth, Xingyuan and AITO M8 have become the two new super "dark horses" in the TOP 20 vehicle rankings in 2025. In the new energy sector, almost all of BYD's best-selling models have suffered significant declines, with July sales of the Qin PLUS, Song PLUS, Seagull, and Qin L all dropping by more than 20% year-on-year. In contrast, sales of the Xiaomi SU7 and Wuling MINI EV surged by over 70% year-on-year.

In the fuel vehicle sector, sales of Passat and Lavida declined year-on-year, while the other eight models all saw increases. Among them, Boyue L's sales more than doubled, and sales of Tiguan L, Camry, and Magotan increased by over 30% year-on-year.

▍BYD and Tesla drop sharply, while Geely and Xiaomi rise against the trend.

In the TOP 20 brand list, BYD, Volkswagen, Honda, BMW, Tesla, Audi, and Li Auto all experienced a month-on-month sales decline of 10%. Moreover, Mercedes-Benz saw its sales plummet by over 40% month-on-month, dropping out of the TOP 20.

Due to a significant decline in the sales of several popular models, BYD's retail sales in July exceeded 249,000 units, a month-on-month decrease of over 21%, yet it still firmly holds the top spot in China's passenger car sales rankings.

Both Volkswagen and Toyota, which closely follow, experienced a month-on-month decline in sales. Among them, Volkswagen's sales dropped by more than 16% month-on-month, with popular models such as Lavida, Sagitar, Magotan, Passat, and Tiguan L all seeing a month-on-month decrease of over 10% in sales.

In particular, Tesla’s sales dropped by more than 33% month-on-month, falling to 14th place in the rankings. In today’s Chinese market, with the rise of domestic new energy brands, Tesla’s advantages are no longer obvious. Many domestic brands are continuously innovating in areas such as smart cockpits and vehicle networking, offering products with better cost performance.

In contrast, the brand that performed outstandingly on the list, Galaxy, achieved sales of 90,582 units in July, a month-on-month increase of 5.9% and a year-on-year growth of as much as 264.7%. As a new energy brand under Geely Automobile, Geely Galaxy has developed rapidly since its establishment in 2023. In 2024, sales reached 494,000 units, with several models such as the Galaxy E5 receiving enthusiastic market responses. In 2025, Galaxy Xingyuan continued to sell well, and the integration of Yizhen further enriched the product lineup.

In addition to Galaxy, the sales of Geely, Nissan, Leapmotor, XPeng, and Xiaomi all increased month-on-month. It is surprising that Nissan's sales managed to rise against the trend. Its main models—Sylphy, Teana, and Nissan N7—all achieved month-on-month sales growth against the trend.

In terms of year-on-year growth, BYD, Tesla, Honda, BMW, Audi, Li Auto, and Mercedes-Benz (which fell out of the top 20) all experienced a year-on-year sales decline of over 10%, with Li Auto and Mercedes-Benz seeing a particularly sharp drop of 40%. Meanwhile, Galaxy, Leapmotor, Xpeng, and Xiaomi achieved a year-on-year sales increase of over 100%, experiencing explosive growth.

Overall, China’s passenger car market is undergoing intense competition between emerging and established players, leading to a reshaping of the industry landscape. Behind this market reshuffling is a fundamental shift from “incremental competition” to “intensive cultivation of existing stock.” In the future, the ability to continuously innovate in smart experiences, whole-industry-chain efficiency, and user ecosystem development will be key factors determining the fate of each brand in this new round of competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track