July 2025 Top 30 SUV Sales and Complaint Volume Corresponding Review

According to the national automobile production and sales data provided by the China Passenger Car Association, the cumulative retail sales of the domestic SUV market in July 2025 were 901,000 units, down 13.4% month-on-month and up 6.3% year-on-year. During the same period, Car Quality Network received 7,933 valid complaints from car owners against SUVs, an increase of 39.1% month-on-month and 64.6% year-on-year. After excluding information from complainants who voluntarily withdrew their complaints, the ranking of the TOP30 SUV sales complaints for July 2025 is as follows:

Independent brands dominate the market as mid-size SUV sales surge and then decline.

In July, domestic SUV sales experienced a decline after peaking, dropping below one million units once again. Affected by the broader environment, most models on the sales chart saw varying degrees of month-on-month declines. Among them, Dongfeng Honda CR-V led the drop with a decline of 42.5% compared to June. Meanwhile, seven models on the chart experienced growth against the trend, with the Geely Galaxy E5, which has been on the market for just a year, leading the pack with a month-on-month increase of more than 1.4 times, rejoining the "10,000 units club" after three months.

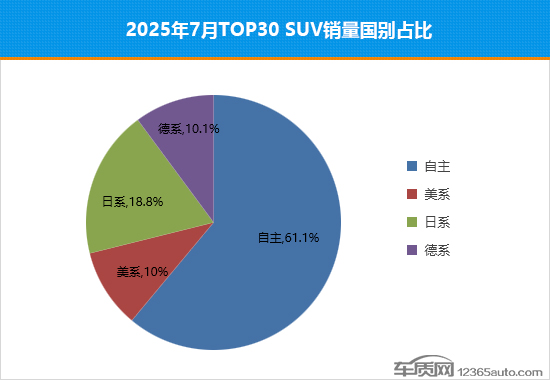

In July, the market share of domestic brands further expanded, increasing by 3.9 percentage points compared to June. In addition, Japanese brands performed well this month, with both the number of models on the list and their sales share increasing, the latter rising by 3.1 percentage points month-on-month.

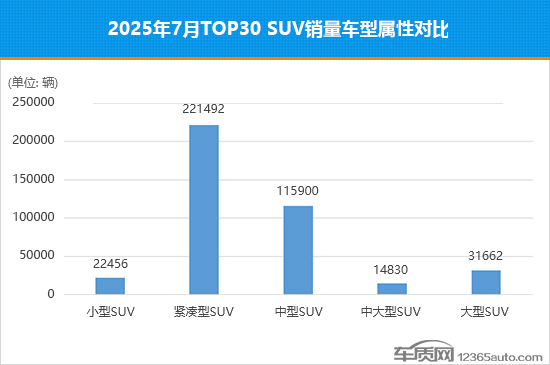

This month, compact SUV sales continued to maintain a significant lead but decreased by 8.3% compared to June. In addition, the sales of other vehicle types also declined to varying degrees month-on-month, with mid-size SUVs experiencing the largest drop, falling by 33.6% compared to the previous month. Sales of mid-to-large SUVs decreased by approximately 10% month-on-month, reaching the lowest point of the year.

The proportion of quality issues reaches a record high, with "steering system abnormal noise" becoming a growing complaint point.

Compared to the significant decline in overall sales, more than 60% of the models on the list saw an increase in complaint volumes month-on-month, with some models even experiencing a doubling in complaints. For example, the Li Auto L6 saw its complaints soar to over 100 in July, representing a month-on-month increase of more than 3.4 times. In contrast, 11 models experienced a month-on-month decrease in complaint volumes, with the Changan CS75 PLUS standing out by dropping 60.3%. Additionally, the complaint volumes for the BYD Song L DM-i and BYD Haishi 05 EV also showed a significant decline, falling 45.1% and 50% respectively compared to June, indicating a positive short-term reputation performance.

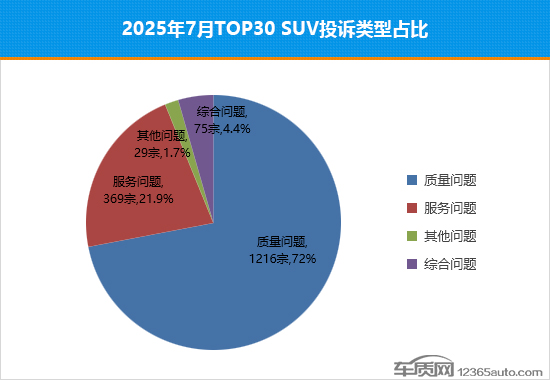

In July, the number of complaints due to quality issues increased by 41.2% compared to the previous month, with the proportion rising by 7.6 percentage points from June, setting a record high for the year. In terms of changes in complaint fault points, "audio-visual system faults" remained at the top, with the number of complaints increasing by more than 50%. Notably, "steering system noise" rose to the second place this month, with the number of complaints increasing nearly 3.9 times month-on-month, becoming a new point of complaint growth. On the other hand, service-related complaints were similar to last month in terms of volume, but their proportion fell by 6.1 percentage points. "System upgrade issues" became the focus of complaints, with the number of complaints increasing nearly fourfold month-on-month.

The complaint-to-sales ratio of 22 models performs better than the same class.

According to the statistical rules of the Car Quality Network's complaint-to-sales ratio, the number of complaints for a vehicle model includes all valid complaints for the month (including cases where the complaint was properly resolved and the complainant voluntarily requested withdrawal). Upon calculation, the average SUV complaint-to-sales ratio for July was 55.8 per 10,000 units, showing a significant increase compared to June, and the short-term trend indicates a sharp deterioration.

A total of 22 SUV models had a complaint-to-sales ratio lower than the average in July. Among them, four models saw a month-on-month decline in this ratio, with the Geely Galaxy E5 standing out as the most remarkable, showing notable short-term improvement.

Key Model Analysis

The reputation is not good, and the market performance of the Leapmotor C11 is unlikely to stabilize and recover in the short term.

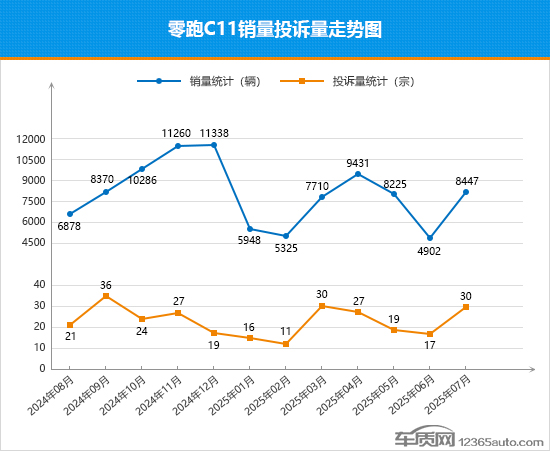

As a veteran member of the new power brands, the Leapmotor C11 has been on the market for over four years and has now become the sales pillar of the Leapmotor brand. However, after entering 2025, its market performance fell into a slump, with sales trends fluctuating significantly and repeatedly hitting rock bottom. In July, the Leapmotor C11 experienced a rebound from the bottom, with sales increasing by 72.3% month-on-month, but it still remains some distance from breaking the ten thousand mark. Unlike the sales trend, the monthly complaint trend for the Leapmotor C11 has been relatively stable, but recently there have been signs of deteriorating reputation, with complaints in July rising by 76.5% month-on-month, rebounding to a high level. According to data from the Car Quality Network, the complaint issues for the Leapmotor C11 are relatively scattered, with "power battery failure" and "charging failure" receiving more complaints. From the change in the complaint-to-sales ratio in July, the value has increased month-on-month, ranking in the middle to lower range among all listed models, with overall performance not as good as in June. In the short term, the market performance of the Leapmotor C11 may continue its fluctuating trend, and when it can stabilize and rebound remains uncertain.

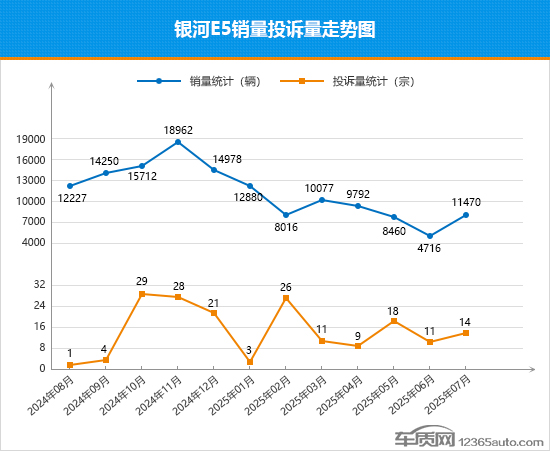

2. The complaint-to-sales ratio has improved significantly, marking a turning point in the market for the Galaxy E5.

The Galaxy E5, which has been on the market for just over a year, experienced a market turnaround in July, with sales surpassing 10,000 units again after three months, ending the previous downward trend of three consecutive months of decline. From the sales and complaint trends over the past year, it can be seen that after reaching a peak in November 2024, sales started to decline sharply, hitting a low in June. Unlike the sales trend, the monthly complaint trend for the Galaxy E5 has been volatile, but the number of complaints has remained relatively low in most months. Starting from the second quarter of this year, the monthly complaint trend has gradually stabilized, and the short-term reputation is commendable. From the change in the complaint-to-sales ratio of the Galaxy E5 this month, the figure has significantly decreased compared to June, with overall performance visibly better than in June. The rebound in July might be a turning point for the Galaxy E5, coinciding with the release of a new model in the same month, which has been upgraded in terms of range, safety, intelligence, and driving control, thus enhancing its market competitiveness. With this opportunity, the market performance of the Galaxy E5 is expected to continue to recover, ushering in a new stage of development.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track