July 2025 Top 30 Sedan Sales and Complaints Analysis

According to national automobile production and sales data provided by the China Passenger Car Association, cumulative retail sales in the domestic sedan market reached 836,000 units in July 2025, representing an 11.8% decrease from the previous month and a 6.1% increase year-on-year. During the same period, Car Quality Network (CheZhiWang) received 9,679 valid complaints from sedan owners, up 25.3% month-on-month and 25.1% year-on-year. After removing complaints voluntarily withdrawn by complainants, the rankings of the TOP30 sedan models by sales-related complaints for July 2025 are as follows:

The market share of independent brands expands, with compact car sales leading.

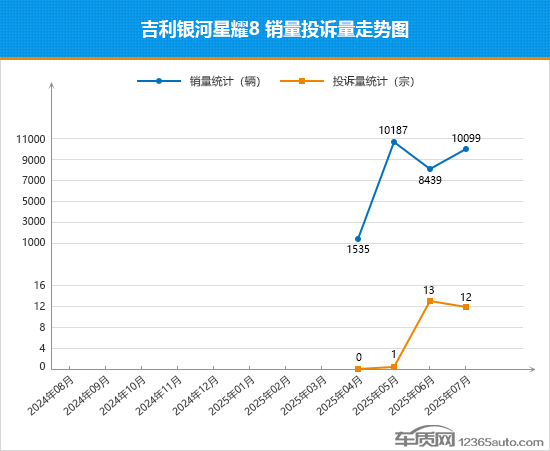

In July, the overall sedan market experienced a decline, affecting over 70% of the models on the list, which saw a month-on-month decrease in sales. Among them, the Tesla Model 3, ranking at the bottom, had the largest decline with a 40.8% drop compared to the previous month. Additionally, BYD Dolphin and FAW Audi A6L also saw significant decreases in sales, with declines of nearly 30% compared to June. On the other hand, among the "minority" of models with increased sales, the Geely Galaxy Xingyao 8, launched in the second quarter, performed remarkably well, with sales surpassing 10,000 units again, an increase of 19.7% from June.

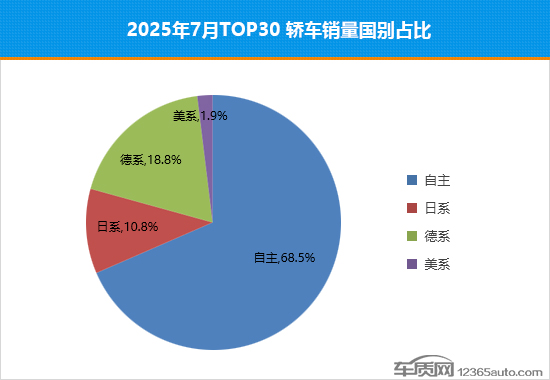

The sales share of domestic brands has significantly increased this month, rising by 11.8 percentage points compared to June. Among the top 10 in the TOP30 list, domestic brand models occupy 7 spots. In contrast, German brands performed poorly, with a reduced number of models on the list and weaker sales compared to last month, resulting in a substantial decline in their share.

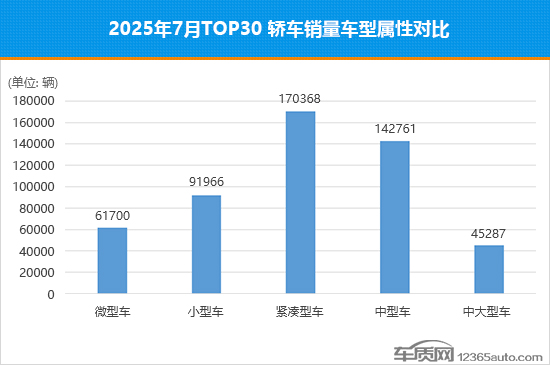

In July, sales of compact cars surpassed those of mid-sized cars, ranking first with a month-on-month increase of 6.5%. Similarly, microcars also saw a month-on-month growth, rising by 13% compared to June, reaching the second highest point of the year. In contrast, sales of large mid-sized cars showed a significant decline this month, with a month-on-month decrease of approximately 28%.

Service issue complaint volume rebounds as "system upgrade problems" make a comeback

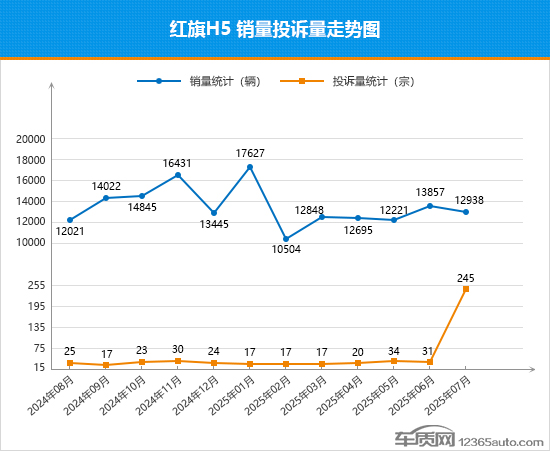

Unlike the changes in sales trends, half of the models on the list saw a month-on-month increase in the number of complaints. Among them, the number of complaints for the Hongqi H5 surged nearly sevenfold compared to June, making it the model with the highest number of complaints on the list. During the same period, complaints about the Hongguang MINIEV and Tesla Model 3 also saw significant increases, with the former rising by 1.8 times month-on-month. In contrast, due to a low base number of complaints, the Bestune Pony became the model with the largest month-on-month decrease in July, dropping by 77.8% compared to June. It is worth noting that some models under BYD, such as the BYD Dolphin and Seagull, saw a significant decrease in complaints this month, with declines of more than 30%, indicating a continued improvement in reputation.

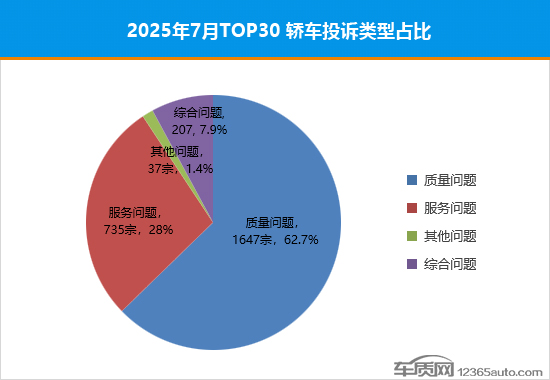

In terms of the proportion of complaint types in July, quality issues saw a slight decline, dropping by 1 percentage point compared to June and gradually stabilizing. This month, service-related issues surged, with the number of complaints increasing by 24.4% month-on-month. Looking at specific complaint issues, "system upgrade problems" became the biggest growth point, rising to the top position, mainly related to domestic brands such as the Hongqi H5. In addition, complaints about "unfulfilled sales promises" also saw a certain increase compared to the previous month.

The 2023 model's complaint-to-sales ratio performs better than the same class.

According to the statistical rules of complaint-to-sales ratio on the CheZhiWang website, the complaint volume for a car model includes all valid complaints for the month (including information where the complainant voluntarily applied to withdraw the complaint due to satisfactory resolution). According to statistics, the average complaint-to-sales ratio for sedans this month is 0.621%, showing a significant increase compared to June, and the overall performance is exhibiting a trend of accelerated regression.

Specifically, among the models on the list, a total of 23 models have a complaint-to-sales ratio lower than the average for sedans in July 2025, with most of them being new energy vehicles. It is worth mentioning that, among these 23 models, the ratio for 6 models has decreased compared to June, showing short-term improvement.

Key Model Analysis

1. Deterioration in Reputation: Hongqi H5's Market Performance Unlikely to Improve in the Short Term

According to the sales and complaint trends of the Hongqi H5 over the past year, its market performance has been lukewarm since entering 2025. Although it has maintained average monthly sales of over 10,000 units, there is still a certain gap compared to its peak period in 2024. In July, the Hongqi H5 unexpectedly suffered a major setback, with sales dropping by 6.6% month-on-month and the number of complaints surging by 6.9 times. Data from CheZhiWang shows that complaints about the Hongqi H5 mainly focus on “system upgrade issues.” Some owners reported that the in-car system of their Hongqi H5 has not been updated for a long time, resulting in system lag and black screens. In addition, the built-in map version is outdated, and navigation errors frequently occur; the system does not support smartphone connectivity, which seriously affects daily use. Since the manufacturer has not provided a reasonable solution to these issues, collective complaints from owners have ensued. As of the time of writing, the incident is still fermenting. Judging from the complaint-to-sales ratio in July, the figure has increased significantly compared to June, ranking at the bottom among all listed car models, with performance continuing to deteriorate. In the short term, the reputation of the Hongqi H5 is worsening, and its market performance may enter a downward trajectory, making it difficult to see significant improvement in the near future.

2. Demonstrating the potential to become a hit, the Geely Galaxy Star 8 still needs to focus on product reputation.

As a brand-new mid-to-large-sized car launched by Geely Galaxy, the Xingyao 8 achieved sales of over 10,000 units in its first month on the market, showing strong momentum. The reasons behind this are, on one hand, its spacious interior, rich seat functionalities, and the Flyme Auto intelligent cockpit system, which make daily driving more comfortable and convenient; on the other hand, powered by the Thor EM-P super hybrid system, the Xingyao 8 not only delivers ample power but also maintains low operating costs. Coupled with a top-spec model price of under 170,000 yuan, it offers competitiveness that surpasses its peers. However, alongside the encouraging sales figures, complaints about the Xingyao 8 have also emerged. Besides some service issues related to vehicle delivery, quality problems have also appeared, which sends a clear negative signal for a brand-new model and should alert the manufacturer. From the complaint-to-sales ratio perspective this month, the figure has noticeably increased compared to June but fortunately remains within a reasonable range, placing the overall performance at a mid-level among all models on the list. Judging from the current trend of sales and complaints, the Xingyao 8’s market performance is likely to achieve a breakthrough in the short term, but the existing reputation issues must not be ignored to avoid regretting it when problems become entrenched.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track