Jinpu Titanium Plans to Exit Titanium Dioxide Industry, Main Business to Shift to Rubber Products

On July 14, 2025, Jinpu Titanium Industry announced that it plans to acquire 100% of the equity of Nanjing Lide Oriental Rubber and Plastic Technology Co., Ltd. (hereinafter referred to as "Lide Oriental") through a major asset swap, issuance of shares, and cash payment, while also raising matching funds. This transaction marks Jinpu Titanium Industry's strategic exit from the titanium dioxide industry, with its main business changing to rubber products.

Current Status and Challenges of Titanium Dioxide Business

Since July 2013, Jinfeng Titanium Industry's main business has been the production and sales of titanium dioxide.

As one of the earliest domestic producers of titanium dioxide using the sulfuric acid method, its "Nannan" brand trademark is well-known nationwide, and its products are widely used in coatings, plastic pipes and profiles, masterbatches, and papermaking, among other fields.

However, in recent years, the industry has faced environmental pressure and overcapacity issues, coupled with weak demand in the titanium dioxide market, fluctuations in raw material prices, and high energy costs, leading to the company suffering losses for three consecutive years.

-

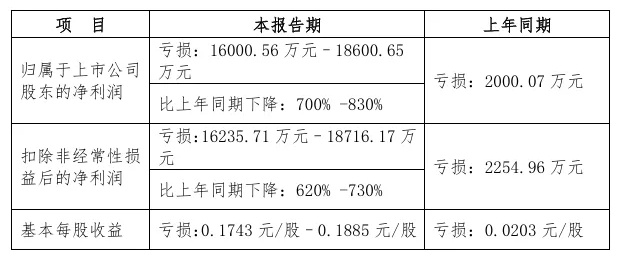

In the first half of 2025, the company expects to achieve a net loss attributable to shareholders of the listed company of 160 million to 186 million yuan, a year-on-year decline of 700% to 830%.

-

In 2024, the company's revenue was 2.133 billion yuan, a year-on-year decline of 5.86%; the net profit attributable to the parent company was a loss of 244 million yuan, a year-on-year decline of 39.81%.

(Kinpo Titanium Industry 2025 Half-Year Performance Forecast)

Attempts and Terminations in the New Energy Sector

In response to the difficulties in its main business, Jinfeng Titanium Industry once attempted to enter the new energy sector.

Relying on the production of iron(II) sulfate as a byproduct of titanium dioxide to prepare iron phosphate, forming a "titanium dioxide + lithium battery materials" dual-driven model.

However, in April 2025, the company announced that, after comprehensive consideration of the financial status of its wholly-owned subsidiary Nanjing Titanium Dioxide and the suspended status of the iron phosphate project, it decided to terminate the plan to jointly invest in the establishment of the joint venture company Gansu Jinlin Lithium Battery New Materials Co., Ltd. with Lanzhou Jinchuan Science and Technology Park Co., Ltd. and Gansu Nickel Capital Industry Investment Fund Partnership, completely withdrawing from the 200,000 tons/year iron phosphate project.

According to the announcement, Jinpu Titanium Industry plans to exchange part of the assets and all liabilities held by its subsidiaries Nanjing Titanium White, Xuzhou Titanium White, and Jinpu Supply Chain with the equivalent portion of the 91% equity stake in Lide Oriental held by Jinpu Dongyu.

At the same time, the company intends to issue shares and pay cash to Jinpu Dongyu and Hengyutaihe to purchase 100% equity of Lide Dongfang held by them and the difference in the disposed assets.

Lide Dongfang Business and Financial Overview

Lide East has a registered capital of 200 million yuan and was founded in 2011. Its history can be traced back to the 415 Factory of the Logistics Department of the East China Military Region, established in 1949, and has undergone multiple reorganizations and name changes since then. The company is now an important research and production base for automotive brake hoses in China and is the designated supplier of hydraulic brake hose assemblies for national major celebration parades.

Customer coverage:

In the automotive field, the customers include domestic brand manufacturers such as FAW, Dongfeng, SAIC, GAC, BYD, Changan, Great Wall, Geely, Chery, Silis, Leap Motor, Jiangling, JAC, and Xiaopeng, as well as joint venture brand customers like Nissan, Honda, Toyota, General Motors, and Ford.

Financial data:

-

In the first three quarters of 2024, Lide Dongfang's revenue was 810 million yuan, and the net profit was 85.5257 million yuan.

-

As of the end of the third quarter of 2024, Lide Dongfang's total assets amounted to 1.196 billion yuan, and net assets were 723 million yuan.

Actual controller relationship and strategic significance:

-

According to information from the Color Masterbatch Industry Network, the actual controller of Lid Oriental, Guo Yantong, is the second daughter of Guo Jindong, the actual controller of Jinpu Titanium Industry.

-

After the completion of this transaction, Lide Dongfang will become a wholly-owned subsidiary of Jinpu Titanium Industry. The company's main business will change to the rubber products industry, with primary products including rubber hoses, seals, shock absorbers, and other rubber products.

According to official data, in the first half of 2025, China's automobile production and sales both surpassed 15 million for the first time, reaching 15.621 million and 15.653 million units, respectively, with year-on-year growth of 12.5% and 11.4%.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track