Jing tai q2 net profit grows 12% year-on-year

According to a report from Gasgoo Auto News, U.S. automotive rearview mirror supplier Gentex Corp. recently released its first quarterly report since acquiring consumer and automotive electronics manufacturer VOXX International Corporation.

The image source: Jingtai

Acquiring VOXX is a strategic move.

On April 1st, Gentex officially completed the acquisition of VOXX. This acquisition proved highly effective: in the second quarter of this year, VOXX contributed $78.7 million in net sales to Gentex; the combined net sales of Gentex and VOXX amounted to $657.9 million, representing a 15% increase compared to the $572.9 million in the same period last year when VOXX's net sales were not included.

Excluding the contribution from VOXX, Gentex's core revenue for the second quarter this year reached $579 million, a slight year-on-year increase of 1%, while the light vehicle production in the company's main markets declined by approximately 2% year-on-year. During this period, light vehicle production in the Chinese market also slowed down. In April this year, Gentex suspended the production of rearview mirrors for Chinese automotive customers, citing tariff issues.

At the same time, Gentay announced that its consolidated operating profit for the second quarter of this year was $118.5 million, higher than the operating profit of $114.9 million in the same period last year (excluding VOXX); core operating profit (excluding VOXX) was $123.8 million, an increase of 8% year-on-year; consolidated net profit attributable to Gentay was $96 million, up 12% from $86 million in the same period last year (excluding VOXX).

Gentex CEO Steve Downing stated in a press release: "Given the impact of tariffs and counter-tariffs on the demand for our products, especially in the Chinese market, achieving such financial results is particularly noteworthy. In the second quarter of this year, Gentex's total sales in the Chinese market were approximately $33 million, while at the beginning of this year, we expected sales in the Chinese market for the second quarter to be between $50 million and $60 million."

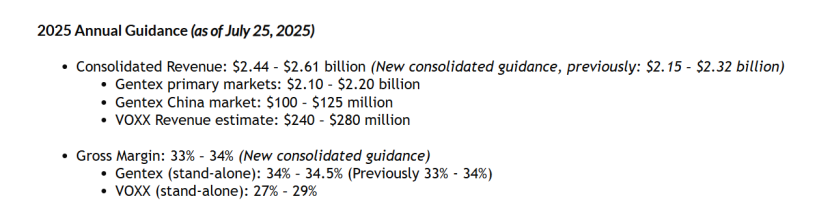

Based on the financial performance in the second quarter, Gentex currently expects its full-year 2025 consolidated revenue to reach $2.44 billion to $2.61 billion (previously expected to be $2.15 billion to $2.32 billion). Of this, revenue from Gentex's main markets will reach $2.10 billion to $2.20 billion, revenue in the Chinese market will reach $100 million to $125 million, and VOXX's revenue will reach $240 million to $280 million. The consolidated gross margin is expected to be 33% to 34%, with Gentex's standalone gross margin reaching 34% to 34.5% (previously expected to be "33% to 34%"), and VOXX's standalone gross margin reaching 27% to 29%.

Image source: Jingtai

After VOXX's sales declined, Gentex first announced its acquisition plan last December. Prior to the acquisition, Gentex already held nearly 32% of VOXX's shares, and Steve Downing was also a member of VOXX's board of directors at that time.

In its statement announcing the final agreement with VOXX, Gentai said: “The acquisition of VOXX is a strategic addition to Gentai’s product portfolio. VOXX’s revenue mainly comes from automotive OEM and aftermarket businesses as well as the consumer electronics industry.”

Notably, while other auto parts suppliers saw a decline in revenue in the second quarter of this year, Gentex successfully mitigated the impact of tariff uncertainties and the slowdown in electric vehicle production through this acquisition.

Steve Downing stated in the press release: "Despite facing revenue headwinds related to tariffs and a decline in sales in the Chinese market, the company is well-equipped to address these challenges through strong growth in full display mirrors (FDM) and other advanced features, along with additional revenue from the acquisition of VOXX."

Growth of the core product portfolio

The acquisition of VOXX is just the latest move by Gentex to expand its core product portfolio.

JingTai recently participated in the Series B financing of PhotoniCare Inc. in collaboration with Michigan Capital Network, with a total financing amount of $4.6 million. PhotoniCare is a company based in Illinois, USA, and it has developed an otoscope that can help diagnose and monitor middle ear infections. In 2024, JingTai also invested in Jolt Energy Storage Technologies, a company focused on low-cost energy storage technology.

Neil Boehm, Chief Operating Officer of JingTai, stated in a press release on April 1st: "The products, capabilities, and market expertise brought by VOXX complement our existing business lines."

In the 2025 global automotive parts suppliers top 100 list released by Automotive News, Gentex is ranked 91st, with sales to global car manufacturers of $2.3 billion in 2024.

Klaus Stricker, a partner and co-leader of the automotive practice at Bain & Company, told Automotive News that it is becoming an increasingly apparent trend for automotive parts suppliers to diversify into other business areas. "We believe that from our collaborations with some leading suppliers, we can observe a broader trend—they are actively exploring opportunities outside the automotive industry, particularly possibilities beyond the passenger car sector."

However, the automotive industry had already been cutting production before the recent tariff dilemma and the slowdown in electric vehicle demand. Therefore, it is almost logical for auto parts suppliers to seek to expand their business into other industries.

Klaus Stricker said, "In the past few decades, that is, before the COVID pandemic, the automotive industry was a global growth industry. Therefore, we saw its annual growth rate reach 2% or 3%, but now, this industry has suddenly come to a standstill or even begun to shrink."

Additionally, other Tier 1 automotive parts suppliers, such as LG Energy Solution, have adopted different strategies by applying existing products to new fields, such as the production of energy storage batteries.

Supplier Q2 FinancialsMixed performance

Overall, in the second quarter of this year, the performance of auto parts suppliers was mixed, with some suppliers being more impacted by tariff uncertainties and various market pressures than others.

Plante Moran is one of the largest audit, tax, consulting, and wealth management firms in the United States. Mark Barrot, the partner and head of automotive and mobility at Plante Moran, said in an interview with Automotive News, "The situation is indeed mixed. I believe that the suppliers who perform better often have a strong cost awareness and have genuinely considered what it takes to remain competitive in this market."

Underperforming suppliers have been affected by various factors, including tariff issues and decreased production, which are largely beyond their control. Mark Barrot said, "It's not that those poorly performing companies are doing the wrong things; they may just be in an environment that is not very favorable to them."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track