Insufficient Stock Demand Before the Holiday, ABS Post-Holiday Supply High Pressure on Prices Continues

9Starting from mid to late month, the domestic ABS market price has fluctuated and declined, with some manufacturers facing increased shipment pressure. They have offered low prices to agents, and some agents have resorted to selling off inventory at low prices, resulting in a market price drop.

1. Before the holiday, manufacturers maintain high production, and the demand for stocking up is insufficient.

In September, ABS prices in China fell across the board. Particularly in the first half of September, traders continued to lower prices to sell, resulting in very weak market transactions and average terminal demand. At the beginning of the month, petrochemical manufacturers reduced their ex-factory prices, leading to a cautious sentiment among traders who gradually lowered their prices to sell. In the second half of the month, some petrochemical plants focused on low-price sales, offloading bulk quantities, which put significant pressure on agents. The market continued to sell at lower prices, and there was insufficient demand for pre-holiday stockpiling, making it difficult for prices to rise.

In September, the industry's supply continued to remain high, with a clear state of oversupply, and prices mainly showed a fluctuating downward trend. In terms of market prices, domestic materials ranged from 8,800 to 9,400 yuan/ton, while composite materials ranged from 9,500 to 10,000 yuan/ton. Prices generally fell by 200-300 yuan/ton in September. The total production of the ABS industry in September is expected to be around 598,000 tons, a year-on-year decrease of 150,000 tons, a reduction of 2.45%. Although there was a decline month-on-month, it remains at a high level year-on-year. Towards the end of the month, some manufacturers increased their operating loads, reduced factory quotations, and the market sentiment was mostly bearish. Traders offered discounts to clear inventory, leading to a fluctuating decline in prices.

2. Post-HolidayABSThe industry's output remains high, and prices are expected to be more likely to fall than rise.

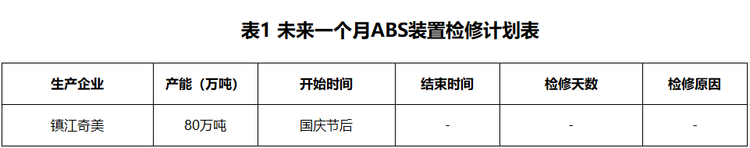

In October, only the Zhenjiang Chimei facility has a maintenance plan, and production is expected to drop to around 50%. Manufacturers such as Shandong Yulong, Haijiang, and Zhejiang Petrochemical all have plans to increase production, and the total domestic ABS output for October is expected to exceed 650,000 tons, potentially reaching a new high in supply. Manufacturers are likely to face significant inventory pressure, and further reductions in factory prices cannot be ruled out. On the raw material side, styrene is expected to operate weakly overall in October, and there remains significant supply pressure on butadiene and acrylonitrile. The cost support for ABS is generally limited, with bearish sentiment prevailing in the market. It is anticipated that after the holiday, manufacturers will face increased inventory pressure, and prices may fluctuate downward.

Content Source: Sumi Technology

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track