Impact of India Anti-Dumping Final Ruling on PVC

India's final anti-dumping ruling exceeds expectations.

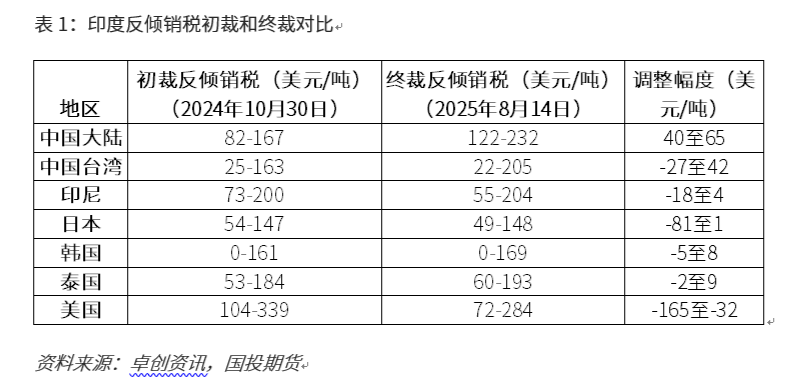

On March 26, 2024, the Indian Ministry of Commerce and Industry issued an announcement stating that, in response to applications from domestic companies Chemplast Cuddalore Vinyls Limited, DCM Shriram Limited, and DCW Limited, it had initiated an anti-dumping investigation on suspension-grade polyvinyl chloride (PVC) originating in or imported from mainland China, Indonesia, Japan, South Korea, Taiwan (China), Thailand, and the United States. On October 30, 2024, the Ministry issued a preliminary affirmative determination for the case. On August 14, 2025, the Ministry issued a final affirmative determination, recommending the continued imposition of anti-dumping duties on the products from the above countries and regions for a period of five years. There is a significant difference between the final and preliminary determinations: the anti-dumping duty imposed on China was significantly higher than expected, with an increase to USD 122-232/ton, representing the largest increment; the anti-dumping duty on the United States was significantly reduced, with a decrease of -165 to -32 USD/ton, bringing the U.S. duty down to USD 72-284/ton; the duties on Japan and Indonesia were also reduced; while the duties on Taiwan (China), South Korea, and Thailand fluctuated within a narrow range. It is expected that China’s exports of PVC to India will decrease substantially in the future.

2. India's PVC Import Situation

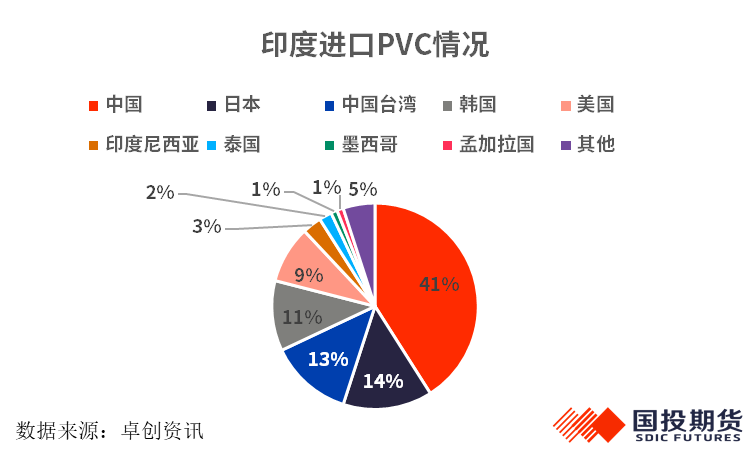

India is the world's largest importer of PVC, accounting for 16% of global imports. In India, PVC is mainly used to meet agricultural demand (such as irrigation pipes and water supply/drainage pipes), followed by applications in the construction industry (including profiles, films, and wires and cables). In terms of import sources, mainland China has consistently ranked first, with 41% of India's PVC imports coming from mainland China in 2024. Japan, Taiwan (China), South Korea, and the United States accounted for 14%, 13%, 11%, and 9% of imports, respectively.

Although India's anti-dumping duty on PVC has been announced, the specific implementation time has not yet been disclosed. The market expects that it may take about a month for the announcement. Pay attention to the subsequent specific execution time, as there might be a window period in between, creating opportunities for a rush in exports. If the policy is implemented, it is expected that the import structure of PVC in India will undergo significant changes. The import share from mainland China is expected to decrease, while the shares from Japan, Taiwan, South Korea, the United States, and Indonesia are expected to increase.

3. China's PVC Exports Seek New Directions

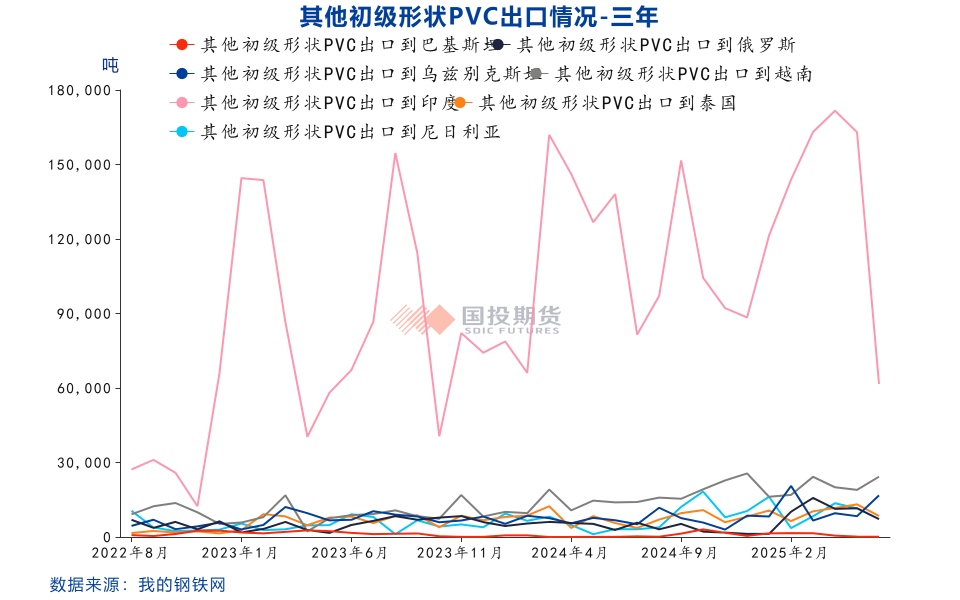

Due to India's BIS certification policy and anticipated anti-dumping tax policies, Indian importers stockpiled goods in advance during the policy window. This year, China's PVC export volume has performed remarkably, reaching 1.9597 million tons from January to June, a year-on-year increase of 50.7%. Currently, India remains the largest destination for China's PVC exports, accounting for about 50% of the total exports. However, the latest data for June shows a significant decline in India's import volume, dropping 62.19% month-on-month from May. Meanwhile, exports to Vietnam, the UAE, Uzbekistan, Thailand, and other regions have increased rapidly. On the one hand, India is experiencing the traditional monsoon off-season with seasonal decline; on the other hand, Chinese exporters are also exploring new export directions and actively adjusting their export structure.

In the future, after India's anti-dumping policy is implemented, it is expected that China will reduce its dependence on exports to India and instead increase exports to Southeast Asia and other regions. The structure of China's PVC exports will change, and in the long term, the impact of the anti-dumping policy on China's exports will be limited.

4. Summary

India’s final anti-dumping ruling exceeded expectations. China will reduce exports to India and instead increase exports to Southeast Asia and other regions. The overall impact of anti-dumping policies on China’s total exports is limited. Strategically, integrated chlor-alkali operations remain profitable in the short term, but cost support is not significant. Supply remains under high pressure, and social inventories continue to be elevated. It is expected that futures prices will fluctuate with a weak bias.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track