How Did the Two Major Toy Giants Perform in the First Half of the Year?

On July 23rd local time, Mattel and Hasbro respectively announced their performance for the second quarter and the first half of this year. Overall, the situation in the toy sector is not very optimistic.

Toys are selling less, but inventory has increased.

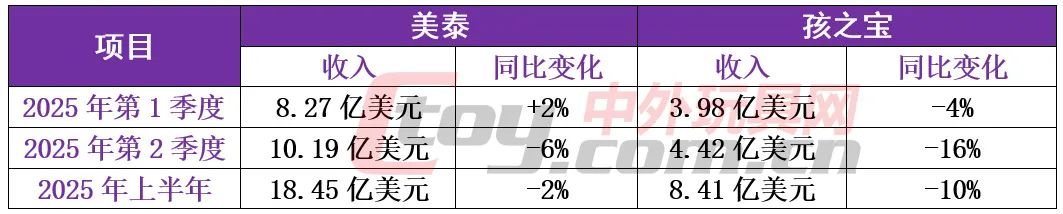

Let’s first take a look at the much-anticipated revenue figures (Note: Hasbro only reports data from its Consumer Products segment). Although overall toy market data from Circana shows year-on-year growth in the U.S. for the first half of this year, the performance figures of the two major American giants have both declined. Notably, Mattel shifted from growth in the first quarter to a downturn in the second quarter. See the table below for details:

Data source: Official performance news Table by: China Toy & Juvenile Products Association

Due to the impact of policy uncertainty, both companies have begun to increase their own inventories. Mattel's inventory value increased by 11.71% year-on-year, rising from $777 million in the same period last year to $868 million this year. Hasbro's inventory growth was even larger, reaching 17%, rising from $358 million in the same period last year to $417 million this year. Compared to last year's fourth-quarter Christmas season, the increase is as high as 52%. According to Hasbro's official disclosure, this is due to the resumption of orders and imports from China starting in May, but the old inventory rate remains at a historical low.

From the sales performance by region, the entire Americas segment, including the United States and Latin America, has seen a decline in sales. Both Europe and Asia regions experienced varying degrees of growth. Among them, the Asia region of both companies showed the largest increase across all major regions. Mattel and Hasbro's Asia regions grew by 14% and 5% respectively in the first half of this year. Hasbro's performance in Latin America was extremely weak, with revenue declines exceeding 20% in both the first and second quarters. Please refer to the table below for details.

Source of data: Official performance news Table prepared by: China Foreign Toys Network

Tariff policy impacts the full-year outlook.

What are the views of the two companies on the impact of tariffs?

Earlier, during the announcement of the first-quarter financial report, Hasbro's CEO stated that the company would incur a loss of $100-300 million this year due to tariffs. Even after reaching a new 20% tariff agreement between the U.S. and Vietnam (one of Hasbro's important production bases), the company would still lay off 3% of its workforce due to cost issues.

Despite initial pessimism, Hasbro's confidence in the company's full-year growth outlook has strengthened due to the digital gaming division and Wizards of the Coast achieving substantial growth for two consecutive quarters (increasing by 46% and 28%, respectively). As a result, the full-year performance forecast has been raised from slight growth to a mid-single-digit increase (approximately 4%-6%).

In contrast, Mattel's attitude is relatively cautiously optimistic: before taking effective mitigation measures, the estimated tariff risk loss this year is less than $100 million; all necessary price increase measures have been implemented to cope with U.S. tariffs, but about 40%-50% of U.S. products are still priced below $20. Due to this cautious attitude, the full-year performance forecast has been slightly lowered, from a sales growth of 2-3% for the whole year to an increase of 1-3%, but confidence in sales growth remains.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track