Halting the downward trend, japanese big three don't want to exit china

From shouting slogans to taking action, Toyota, Honda, and Nissan have once again widened the gap.

The internal competition in the Chinese automotive market has become one of the most important topics in recent years. On one hand, amidst this competition, domestic brands have achieved a breakthrough in market share through electrification and intelligence, increasing from 50% to around 70%.

On the other hand, the rapid changes in the market have made it difficult for traditional joint venture car companies to survive. From selling cars at a premium to cutting prices to stay alive, the harshness of the market is vividly evident. This is especially true for Japanese brands, which once dominated the mainstream market but are gradually losing their voice in the wave of new energy.

At the beginning of 2025, the market share of Japanese brands in the domestic market fell to 9.2%, dropping below 10% for the first time, which also sparked a survival instinct among Japanese joint ventures.

On February 25th, Toyota Motor announced the establishment of Lexus (Shanghai) New Energy Co., Ltd. in Shanghai, making it the second wholly foreign-owned car company after Tesla.

Subsequently, Honda, Nissan, and even Mazda have launched a new wave of new energy vehicle releases, demonstrating a determination to persevere until success is achieved.

After half a year has passed, looking back at the performance of Japanese cars, it turns out that the three companies that once advanced together have now parted ways and created a significant gap.

Burn one's boats.

From the July data, only brands that face market competition squarely have room for survival.

Toyota, in the context of overall shrinking sales for Japanese brands, achieved sales of 126,000 vehicles in China, marking a significant year-on-year increase of 6.8%, making it one of the few joint venture car companies to achieve positive growth.

In the crucial fuel vehicle market, Toyota continues to hold a dominant position, especially with the continuation of the "fixed price" policy. Toyota remains an undeniable presence in the fuel vehicle market, with monthly sales of 18,400 units for the RAV, 14,900 units for the Corolla, and 13,600 units for the Frontlander.

On the other hand, Toyota's efforts in the new energy vehicle sector have demonstrated the prowess of the world's largest automotive group to the domestic market. Besides the Lexus, which is still under construction, both FAW Toyota and GAC Toyota have introduced strong new energy products to tackle market competition.

In the first half of the year, GAC Toyota launched the all-electric SUV bZ3X, marking a breakthrough in Toyota's new energy vehicles. In July, 6,833 units were sold. Although it is still at the lower end compared to new domestic players, this sales figure is quite competitive among numerous joint venture brands.

Certainly, the success of the Baozhi 3X cannot be separated from the impact of its pricing. The entry-level version is priced at only 109,800 yuan, making it more affordable than similar Toyota fuel vehicles. The high-end intelligent driving version, equipped with lidar and Orin-X chips, is priced at only 159,800 yuan, making its pricing more competitive than that of domestic brands.

With an absolute price advantage, Toyota has achieved a dual effort in the domestic market with both fuel vehicles and new energy models. The rebound in sales also proves that there are no cars that can't be sold, only prices that make them hard to sell.

Nissan was the first to achieve a sales rebound after Toyota, selling 58,200 new cars in July, a significant year-on-year increase of 21.8%. Dongfeng Nissan contributed the majority of the sales, breaking the long-term decline curse with 53,500 units sold and a growth rate of 19.4%.

Certainly, the main sales force of Dongfeng Nissan still lies in fuel vehicles. As expected, the Sylphy once again clinched the title of best-selling joint venture sedan, with a monthly sales volume of 26,300 units, still maintaining a part of its former glory.

Certainly, such glory is also dwindling. When the terminal transaction price of the entry-level model starts with a 6, the sales only serve to prove its former brilliance.

However, Nissan has also demonstrated its determination to stay in the Chinese market with greater resolve, especially under the difficult circumstances faced by the headquarters. Dongfeng Nissan launched a counterattack in the market with the N7 priced at 119,900 yuan.

This pricing has shown the market a different Dongfeng Nissan, and even Toyota wouldn't dare to set prices as aggressively as Nissan.

Since its launch before the Shanghai Auto Show, the Nissan N7 has sold over 10,000 units. This surge in sales demonstrates that joint venture new energy vehicles can also penetrate the Chinese market, and that electrification and intelligence are not insurmountable technological barriers.

In contrast, Honda seems to have become the most disappointing Japanese brand, with sales in July reaching only 40,300 units, a year-on-year decline of 14.6%. Among them, GAC Honda saw a year-on-year decline of over 50%, making it the worst-performing joint venture brand in July.

Firstly, Honda has completely lost ground in the fuel vehicle market. Against the backdrop of continuously declining prices in this market, it has become very difficult for Honda to maintain its base in fuel vehicles. Both the CR-V and Accord have seen their sales drop below 10,000 units. In a situation where the redesigns are struggling to maintain competitiveness, Honda is forced to relinquish what was already an underperforming market.

On the other hand, Honda's electrification has still not broken away from its inherent perception compared to Toyota and Nissan. For example, Dongfeng Honda's annual flagship new energy model S7, apart from sales exceeding 100 units in the first month of launch, has been hovering in double digits in the remaining months. Moreover, it had to undergo a second price adjustment after the launch of its sister car by GAC Honda.

Certainly, the GAC Honda P7, which has a lower starting price, also failed to find the solution for new energy. On one hand, the hybrid model Accord PHEV, an oil-to-electric conversion, flopped with monthly sales of only a few hundred units. On the other hand, the highly regarded P7 also struggled to penetrate the new energy market, making Honda the slowest among Japanese brands in transitioning this year.

Trapped in fossil fuels, breaking through to new energy sources.

From the results, the six-month reforms of Japanese brands have been effective, especially Toyota and Nissan, which have maintained their sales base through a two-way price war.

From a market share of 9.2% at the beginning of the year to 9.8% in July, Japanese brands have become one of the few joint venture brands to maintain growth. In contrast, the entire market sees domestic brands still maintaining their growth momentum, with a market share close to 70% squeezing the survival space of joint ventures. All joint venture brands, except for Japanese ones, have experienced a decline.

Behind this is the operational space brought about by the long-term scale effect of Japanese brands. Although the prices of fuel vehicles from companies like Toyota and Nissan continue to decline, they are still able to maintain the most basic profit margins and profitability. This is due to the benefits brought by sales of hundreds of thousands, or even millions, of vehicles.

Economies of scale have always been the best solution for car manufacturers. As long as sales exceed a certain threshold, they can maintain a profit margin. This is especially true for Japanese gasoline vehicles, where the basic components like the engine, transmission, and chassis undergo very few major changes. This allows them to maximize the effects of economies of scale and continuously reduce production costs.

Even at current prices, popular models like the Corolla and Teana can still maintain basic profitability.

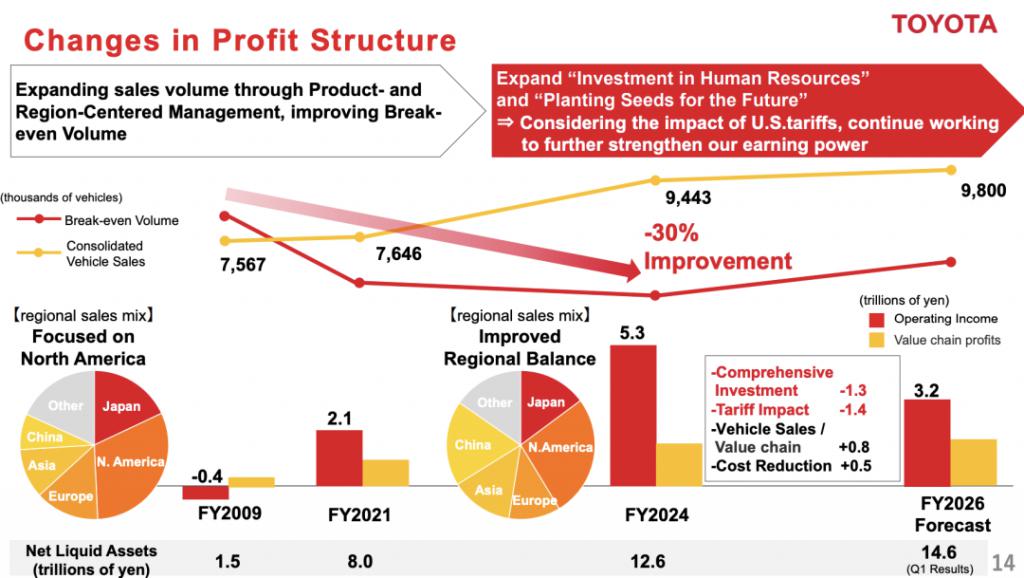

This strategy is not only implemented in China; Toyota is increasing production capacity globally to ensure profitability. According to the semi-annual financial report, Toyota achieved global sales of 4.92 million vehicles in the first half of 2025, a year-on-year increase of 6.8%, but profitability has significantly declined, with operating profit down by 10% and net profit attributable to the parent company down by 36.9%.

In response to declining profits, the only thing Toyota can do is increase production. After releasing the second-quarter sales figures, Toyota raised its annual sales target to 10 million vehicles, hoping to offset the profit decline through sales growth.

All of this is to maintain the fundamental base of the fuel vehicle market. From the current perspective, although Toyota's new energy vehicles have gained a foothold in the Chinese market, sales of just a few thousand units make it difficult for Toyota to sustain the costs of transitioning.

In the early stages of the development of new energy, it was all about burning money, and there are only a few car companies, both domestically and internationally, that have achieved profitability in new energy. Toyota is also unable to escape the reality of using profits from traditional fuel vehicles to subsidize its electric vehicle operations.

However, from Toyota's new energy strategic layout this year, it can be seen that as the world's largest automaker, Toyota still has the ability to make changes in a single market. This can be seen from the pricing of the bZ3X, as Toyota is relying on the Chinese new energy supply chain to achieve self-reform.

Under the "ONER&D" research and development system, you can see Momenta's intelligent driving assistance system, Huawei's HarmonyOS cockpit, and Hesai's LiDAR appearing in Toyota vehicles.

Toyota's boldness also reflects Honda's stubbornness. The day before the Dongfeng Honda S7 was launched, the GAC Trumpchi 3X was officially launched, showcasing its determination for reform with pricing lower than domestic brands. Meanwhile, the Dongfeng Honda S7 still chose a starting price of 259,900 yuan without any hesitation.

Until April, after the launch of the GAC Honda P7 at a price of 199,900 yuan, Dongfeng Honda only then reduced its prices. This reflects Honda's long-standing stubbornness and misjudgment of the new energy market.

The times have changed, and the premium capability of joint venture brands has long weakened. When the Cadillac CT5 is priced at only 206,900 yuan, what confidence does the lowest configuration of the Accord have to sell for 179,800 yuan?

Nissan, which is more aggressive than Toyota, clearly understands this principle. Currently, the sales of the Nissan N7 account for more than 10% of the total sales, proving that Nissan's new energy strategy has been successful. Moreover, Nissan is capitalizing on this success by quickly closing the gap with the planned release of the extended-range version of the N6 in the next few months.

It can only be said that the reform of Japanese automakers is still underway. Toyota has successfully "defended its position" with fuel vehicles, Nissan has "made a comeback" through electrification, while Honda has "fallen behind" due to delayed strategies.

In the wave of new energy vehicles dominated by domestic brands, localized R&D and agile pricing have become the core competencies for joint venture car companies to survive. In the next two years, whether the three Japanese car companies can build a complete new energy matrix will determine whether they can return to the mainstream track.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track