Great Wall Motors' Financial Prospects Mediocre in First Half, Several Positives in Second Half

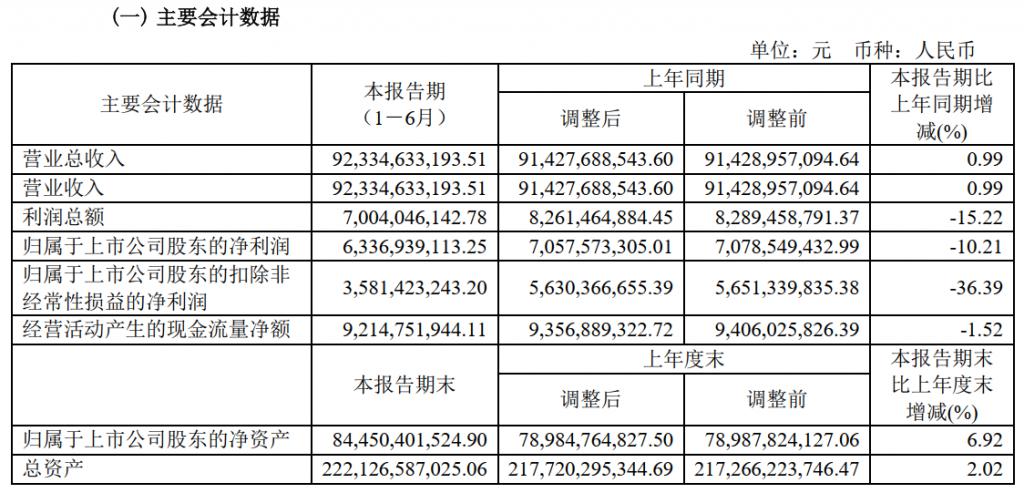

The latest financial report for the first half of 2025 released by Great Wall Motor shows that in the first half of 2025, the company achieved an operating income of 92.334 billion yuan, a year-on-year increase of 0.99%. The total profit was 7.004 billion yuan, down 15.22% year-on-year. The net profit attributable to shareholders of the listed company was 6.336 billion yuan, a year-on-year decrease of 10.21%. The net profit attributable to shareholders of the listed company, excluding non-recurring gains and losses, was 3.581 billion yuan, a year-on-year decrease of 36.39%.

Great Wall Motors explained that the company achieved year-on-year growth in sales volume and operating income due to the launch of a new product cycle. At the same time, the company accelerated the construction of new direct-to-user channel models and increased investment in the promotion of new models, new technologies, and brand enhancement. These increased investments led to fluctuations in net profit.

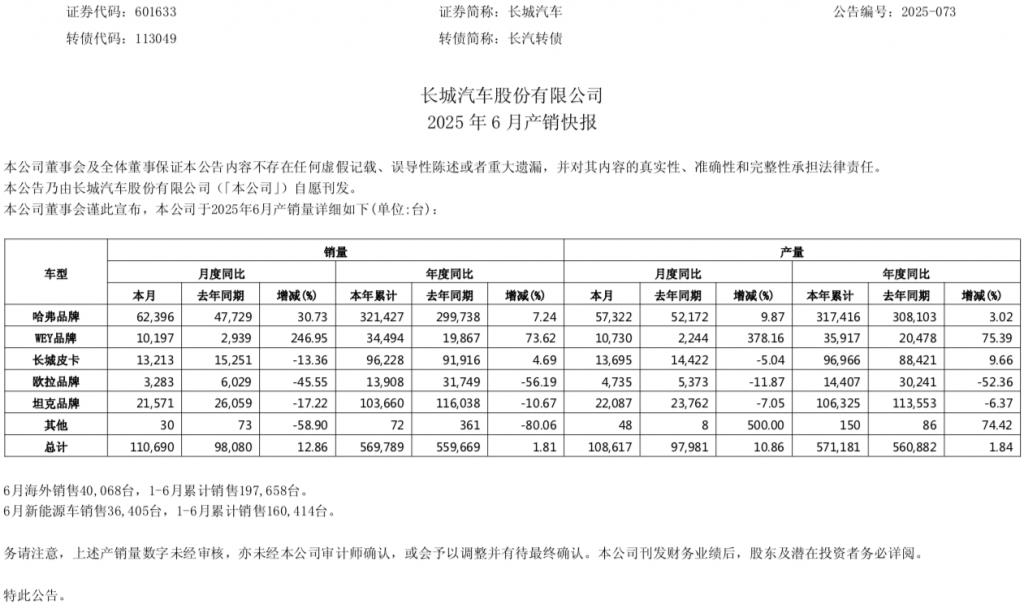

In the first half of the year, Great Wall Motor's sales reached 569,700 vehicles, an increase of 1.81% year-on-year. Among them, Haval brand's cumulative sales for the first half of the year were 321,400 vehicles, an increase of 7.24% year-on-year. WEY brand's cumulative sales for the first half of the year were 34,400 vehicles, an increase of 73.62% year-on-year. Tank brand's cumulative sales for the first half of the year were 116,000 vehicles, a decrease of 10.67% year-on-year. Ora brand's cumulative sales for the first half of the year were 31,700 vehicles, a decrease of 56.19% year-on-year. Great Wall Pickup's sales were 96,200 vehicles, an increase of 4.67% year-on-year.

From the sales data, among Great Wall Motor’s five brands in the first half of the year, only the Haval and WEY brands served as the main sales drivers, with cumulative sales exceeding 345,800 vehicles. The combined sales of these two brands accounted for over 60% of the total. In contrast, the Tank and ORA brands experienced declines in the face of increasing competition in the hybrid off-road segment. The Tank brand faced mounting market pressure, with sales dropping by 10.67% year-on-year to 103,660 units. The ORA brand, affected by product iteration and a limited product lineup, saw its sales halved, with cumulative sales of only 13,000 vehicles in the first half of the year. Great Wall’s pickup truck sales remained flat; considering the level of market competition, maintaining these figures is no easy feat and reflects the product’s competitive advantage and market recognition.

In the first half of this year, Great Wall Motor's selling expenses reached 5.036 billion yuan, an increase of 63.31% year-on-year. Regarding the main reasons for the increase in selling expenses, Great Wall Motor stated that during the reporting period, the company accelerated the construction of a new channel model that directly connects with users, and increased promotion for the launch of new models and new technologies as well as efforts to enhance its brand.

Great Wall Motor’s semi-annual report disclosed that in the first half of the year, the company’s marketing channel model mainly relied on “direct sales + dealership” dual channels and is comprehensively transitioning to an “all-touchpoint direct connection with users” model, accelerating the development of digital channels. The WEY brand has established over 360 retail centers, more than 50 delivery centers, and over 50 user service centers.

Great Wall Motors, as one of the largest SUV and pickup truck manufacturers in China, owns brands such as Haval, Wey, Tank, Great Wall Pickup, Ora, Great Wall Soul, and Great Wall Commercial Vehicles. Their powertrains include traditional combustion models, plug-in hybrids, and pure electric new energy vehicles. The product range mainly covers SUVs, sedans, pickup trucks, MPVs, motorcycles, heavy trucks, and the production and supply of major related auto parts.

In the second half of the year, Great Wall Motors will gradually enrich its range of new products. With the launch of new models such as the Haval Big Dog PLUS, the second-generation Haval Xiaolong MAX, the all-new Gaoshan, the all-new Lanshan, the all-new Tank 500, and the 2025 Ora Haomao, these upcoming new vehicles are expected to boost Great Wall Motors' market sales in the second half of the year.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track