Golden September Arrives, Industry Chain May Boost BOPP Demand Increase

Introduction:As of August 27, 2025, the weekly order days for BOPP samples in China decreased by 1.77% compared to the previous period. With the arrival of the peak season in September, the demand in downstream industries such as packaging and printing is expected to steadily increase, which in turn may boost BOPP consumption and lead to an anticipated increase in orders for film companies.

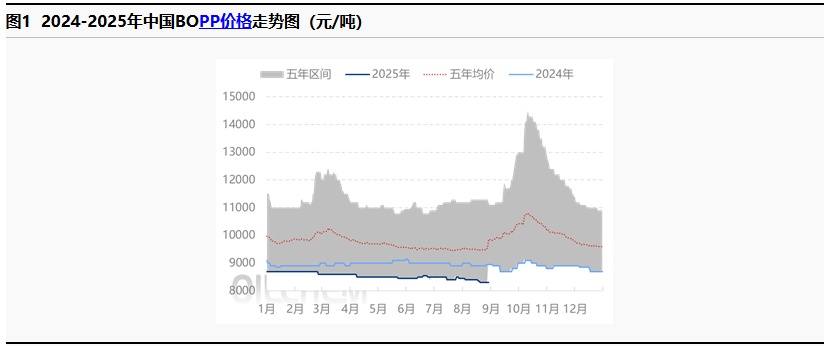

In August, the BO PP market saw a slight price correction, with the overall average price down by 1.16% compared to the previous month. As of August 29, the mainstream price for thick optical film in the East China market was between 8,100 and 8,300 RMB/ton, remaining flat month-on-month. International crude oil prices showed a downward trend, PP futures continued to decline, and the spot market followed with a correction. With insufficient cost support, film manufacturers slightly reduced their ex-factory prices by 150 RMB/ton. Market mainstream prices remained basically stable, with some regions seeing a slight drop of 50 RMB/ton. According to traders, overall market inquiries were not strong, downstream buyers continued to place orders at low prices, and sales undercutting was able to maintain thin profits through increased volume. When prices were slightly higher, downstream bargaining power obviously weakened.

BOPP Monthly Fluctuation Table of Industrial Chain Products (Unit: Yuan/Ton)

|

Product |

Region |

2025 August, 20XX |

2025 July, Year |

2024 August, 20xx |

Month-on-Month % |

Year-on-year % |

|

PP:T30S |

Zhejiang |

6970.97 |

7070.65 |

7554.52 |

-1.41% |

-7.72% |

|

BOPP |

East China |

8362.9 |

8461.29 |

8961.29 |

-1.16% |

-6.68% |

|

Tape master roll |

East China |

8236 |

8509 |

9355 |

-3.21% |

-11.96% |

Data source: Longzhong Information

8 In [Month], the prices of raw materials in the BOPP industry chain, BOPP prices, and downstream tape master roll prices all showed a downward trend.

Crude oil prices declined, leading to insufficient cost guidance for the industrial chain. The focus of PP futures and spot prices fell within the month, with the cost trend showing a stepwise decline. In August, the average price of raffia in East China was 6,970.97 yuan/ton, down 1.41% month-on-month and 7.72% year-on-year.

The downstream product, tape jumbo roll, shows little movement in raw material trends, with downstream demand mainly driven by small orders. The monthly average price decreased by 3.21% compared to the previous month and by 11.96% compared to the same period last year.

BOPP Table of Correlation Coefficients of Related Product Prices

|

Relationship |

Variety Name |

2025 Since [that] year |

2025 August |

|

Upstream |

PP |

0.95 |

0.95 |

|

Downstream |

Tape master roll |

0.97 |

0.79 |

Source of data: Longzhong Information

From January to August 2025, overall, BOPP showed a high correlation with upstream PP. Main factors in August: As the raw material for BOPP, PP directly affects BOPP prices. In August, the price adjustment range of BOPP was basically consistent with that of PP, and the correlation between BOPP and its raw material increased significantly. The correlation between BOPP and tape jumbo rolls dropped to 0.79 in August, which was lower than the correlation coefficient between BOPP and its raw material. In September, the cost side of BOPP may provide some support, driving film prices upward and giving downstream industries a certain level of confidence to restock.

In August, the average order duration for BOPP companies was 8.82 days, representing a month-on-month increase of 0.80% and a year-on-year increase of 28.01%. As both raw material and film prices have declined, and there is an expectation of increased demand in the future, some downstream enterprises and traders anticipate that although there is a possibility of a further drop in film prices, the scope for such a decrease is limited. As a result, they are making moderate follow-up orders to replenish stocks. In mid-August, some film companies received satisfactory orders, but overall downstream demand remained limited, and there was no significant replenishment activity observed in the market.

In September, the international oil prices are expected to have room for decline. The United States is promoting peace talks between Russia and Ukraine, leading to a relaxation of geopolitical tensions. Additionally, the U.S. Labor Day in early September marks the end of the summer travel peak, indicating a seasonal decline in demand, which will gradually weaken support for oil prices. For polypropylene (PP), there are expected maintenance shutdowns in September, while some previously shut down facilities will gradually resume operations. Coupled with the expected capacity expansion of CNOOC's Daxie Petrochemical Phase II Line 1 with a capacity of 450,000 tons per year, there is a potential increase in market supply resources. Most downstream industries are gradually entering the peak consumption season, providing favorable support for PP downstream demand. Therefore, there is some guidance on the cost side for BOPP. On the supply side, many recently shut down facilities have resumed production, and new capacities are being released in North China, Southwest China, and East China, indicating a potential gradual increase in market supply. In terms of demand, September marks the traditional peak demand season for BOPP, and there are additional consumption benefits from traditional holidays expected later.Holidays such as Mid-Autumn Festival and National Day, including visiting relatives and traveling, both drive consumption in the packaging industry.Additionally, there is a possibility of increased overseas demand, and membrane companies may see a slight rise in orders.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics