Golden hair technology leads in peek material! revenue exceeds 60 billion, net profit up 160%

The future of AI lies in humanoid robots, and the future of humanoid robots may be hidden in a material called PEEK!

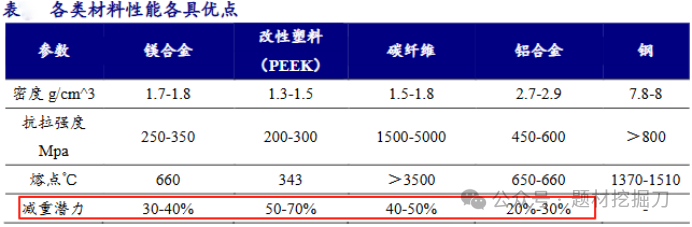

AI technology has indeed accelerated the iteration of robots, but endurance and flexibility remain obstacles to their large-scale commercialization. Generally, the lighter the robot, the longer the endurance, which is why lightweight materials such as aluminum alloy, carbon fiber, and PEEK have become highly sought after.

PEEK material is particularly impressive: its density is only 1.3g/cm³, approximately 1/5 that of aluminum alloy, yet its tensile strength can reach 200-300MPa, almost comparable to metals. It has a weight reduction potential of up to 70%, making it the best solution for lightweight robots.

(Data source: wind and other public information)

The Optimus-Gen2 from Tesla uses a significant amount of PEEK material, making it about 10kg lighter than the first generation, with greatly improved endurance and flexibility.

At the point where humanoid robots are about to be mass-produced, PEEK materials have become highly sought after, with the global market size expected to exceed 1.4 billion USD by 2030.

PEEK material is difficult to handle, with foreign giants monopolizing 80% of the market.

However, not everyone can produce this material. Currently, 80% of the global market is dominated by three companies: Victrex from the UK, Solvay from Belgium, and Evonik from Germany. Why? Because there are two high barriers blocking entry:

The production process is too difficult: The purification of PEEK requires five steps: "dissolution → precipitation → filtration → distillation → drying," and it must be conducted in a sealed environment at a high temperature of 120-200°C and above 4 atmospheres, making it extremely challenging.

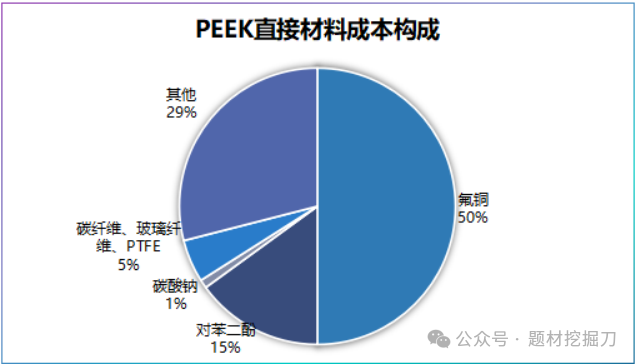

The cost cannot be reduced: Raw materials account for 75% of the production cost of PEEK, with fluorine ketone accounting for 50% of the material cost. It takes 3-5 years to expand the production of fluorine ketone, so the price of PEEK is easily affected by fluctuations in raw material costs.

What makes it even more challenging is that foreign manufacturers strictly control the technology, formulas, and equipment. Coupled with the rapidly changing demands of downstream markets such as automotive, aviation, and robotics, companies must continuously engage in research and development to keep up. Therefore, under the circumstances of surging demand and technical blockades, the domestic substitution of PEEK materials is particularly urgent.

(Data source: wind and other public information)

In this substitution battle, Kingfa Sci. & Tech. Co., Ltd. has already taken a step ahead.

Why is Kingfa Sci. & Tech. taking the lead? Early Deployment + Technical Accumulation

The core business of Kingfa Sci & Tech is modified plastics, which contributed 103.41% of the profits in 2024, making it an absolute pillar. The second largest source of profit is new materials, including fully biodegradable plastics, specialty engineering plastics, and high-performance carbon fibers.

PEEK is essentially a special engineering plastic. Kingfa Sci & Tech started its layout in 2013 and has now developed the ability to independently research and develop PEEK polymerization technology, with an annual production capacity of 500 tons. Leveraging its production capacity and first-mover advantage, its PEEK materials have already been used in batches for structural components in drones and humanoid robots.

Why can it run so fast? The answer lies in technical accumulation.

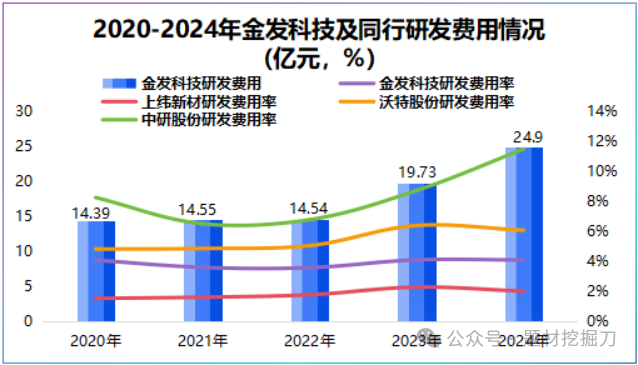

From 2020 to 2024, the average R&D expenditure rate of Kingfa Technology is about 4%. Although slightly lower than that of Water Shares and Zhongyan Shares, the total investment is substantial — the cumulative R&D expenditure over five years amounts to 8.811 billion yuan.

(Data source: wind and other public information)

In February 2025, it launched the next-generation bio-based low-carbon LCP material icryst®LCPCER-B, making it the first in the country and the second globally to pass the international sustainability and carbon certification for LCP material suppliers. This technological breakthrough in high-temperature pyrolysis, purification, and catalytic conversion capabilities has laid the foundation for subsequent PEEK research and development.

In addition, it has developed a low-deformation special reinforced polyolefin material, filling the gap in high-end materials for long-term energy storage in China; the flame-retardant reinforced modified plastic PC has also broken the monopoly of overseas manufacturers in the security industry.

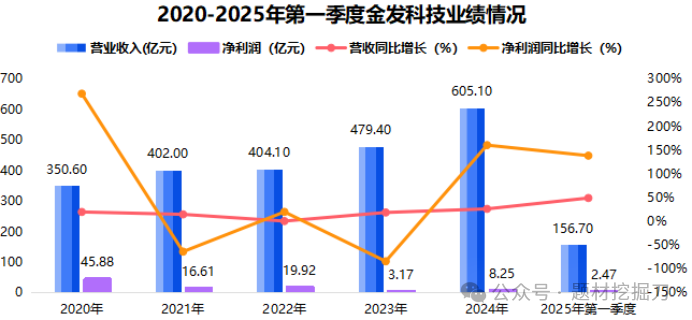

These investments have already started to translate into performance: In 2024, the revenue exceeded 60 billion yuan for the first time, marking a year-on-year increase of 26.23%; net profit reached 820 million yuan, representing a year-on-year growth of 160.36%.

(Data source: Wind and other public sources)

The performance forecast for the first half of 2025 is even more impressive, with an expected net profit of 550-650 million yuan, representing a year-on-year growth of 44.82% to 71.15%. High research and development is transforming into high growth.

High revenue, low profit? Here's where the problem lies.

However, there is a contradiction: while Kingfa Sci.& Tech. Co., Ltd. has high revenue, its profit is not particularly outstanding. Why is that?

The healthcare business became a drag: In 2020, it made significant profits from medical products such as gloves and masks, with this segment contributing 22.81% of the profits and a gross margin as high as 76.06%. However, as the demand boom receded and product prices declined, the gross margin for the healthcare business fell to -18.8% in 2024, dragging down overall profits.

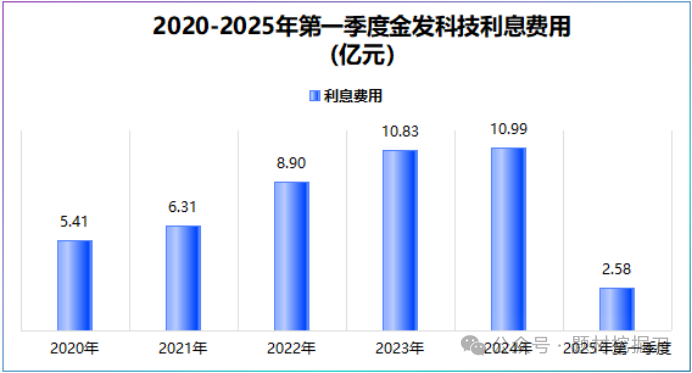

High interest expenses: In recent years, Kingfa Sci. & Tech. Co., Ltd. has borrowed a significant amount of money, with interest-bearing liabilities nearing 30 billion yuan in the first quarter of 2025, which is three times that of 2020. The interest expenses have also increased from 541 million yuan in 2020 to 1.099 billion yuan in 2024, squeezing the net profit margin.

(Data source: wind and other public information)

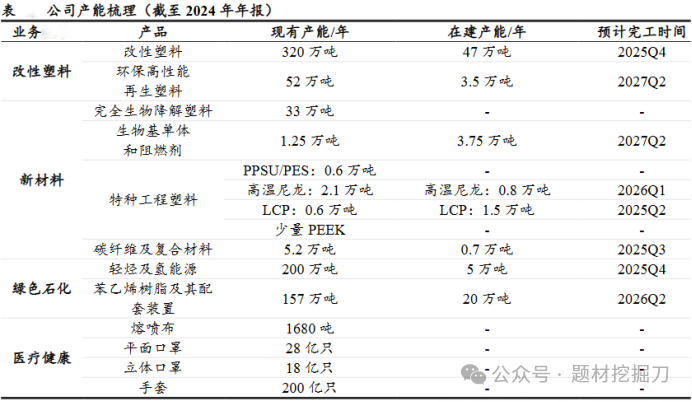

Where did the borrowed money go? Expansion. By 2024, the production capacity under construction includes 470,000 tons per year of modified plastics, 60,500 tons per year of new materials, and 200,000 tons per year of styrene resin and supporting facilities. The scale of the expansion is quite extensive.

(Data source: Wind and other public information)

Can the production capacity be absorbed? Betting on the "lightweight runway"

Some people are concerned about whether such a large production capacity can be sold, but Kingfa Sci. & Tech. Co., Ltd. is betting on the "lightweight track" supported by robotics, new energy vehicles, and the low-altitude economy. The demand for modified plastics and new materials in these fields is surging.

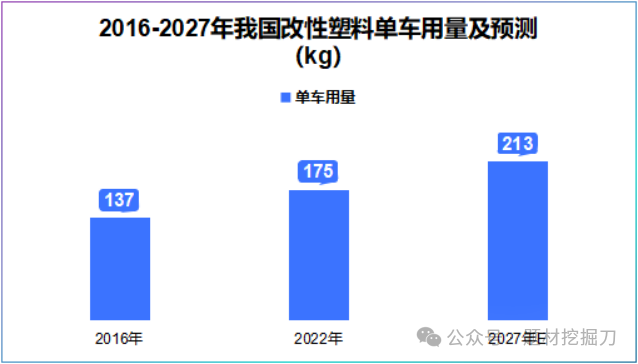

New Energy Vehicles: Automobiles are the mid-to-high-end market for modified plastics. In July 2025, the domestic sales of new energy passenger vehicles are approximately 1.18 million units, a year-on-year increase of 25%, showing strong momentum. Moreover, for every 10% reduction in vehicle weight, fuel consumption can be reduced by 6%-8%. It is expected that by 2027, the domestic usage of modified plastics per vehicle will reach 213 kg.

(Data source: Wind and other public information)

Golden Hair Technology's automotive modified polymer materials hold the highest domestic market share. Its new halogen-free flame-retardant composite materials can replace traditional metal components, increasing the amount of modified plastics used in each new energy vehicle.

Aerospace and low-altitude economy: The carbon fiber in the company's new materials is primarily used in aerospace. In eVTOL (electric vertical take-off and landing aircraft), seats, fuselage, battery boxes, etc., almost all require carbon fiber. In 2024, Kingfa Technology's carbon fiber sales increased by 135.07% year-on-year, already indicating how strong the demand is. Additionally, new materials such as LCP, PPSU, and high-temperature nylon are widely used in aerospace and low-altitude economy due to their high-temperature resistance.

Therefore, Jinhair Technology is not merely betting on "production capacity," but on a "lightweight track" constructed by robots, new energy vehicles, and the low-altitude economy. Next, it remains to be seen whether they can bring the production capacity to fruition as scheduled and truly convert the technology into performance.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track