Global Chemical Industry Reshaped: Opportunities Amid China’s Rise and Overseas Decline

The global chemical industry is currently undergoing profound structural changes, with the continuous withdrawal of production capacity from traditional European chemical powerhouses contrasting sharply with the rapid rise of China's chemical industry. The core logic of this industrial transformation lies in the fact that China's chemical industry has gradually evolved from import substitution of basic raw materials to forcing the withdrawal of overseas capacity upstream, and further extending into the field of fine chemicals. In this process, China's large-scale refining strategy and...The transformation of "reducing oil and increasing chemicals" has played a key role, driving the industry towards high-quality development.

I. The Deep-rooted Causes of the Decline of the European Chemical Industry

The predicament of the European chemical industry stems from multiple overlapping factors. The surge in energy prices caused by the Russo-Ukrainian conflict has led to European natural gas prices remaining high for an extended period.Above 30 USD/MMBtu, far higher than China's level of 10-15 USD. Meanwhile, the EU carbon allowance price has long been above 80 euros per ton, more than ten times higher than China's carbon market price of 40-50 RMB. According to BASF statistics, the utilization rate of chemical production capacity in Europe has dropped to below 70% in 2023, a decrease of about 15 percentage points compared to before the conflict.

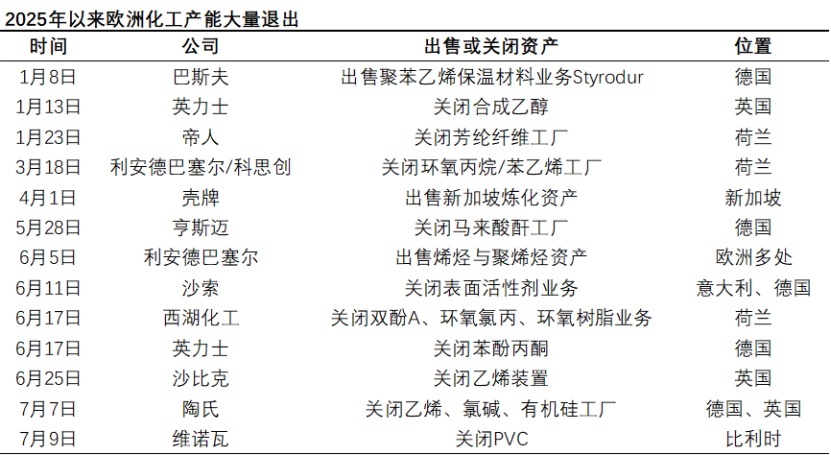

This cost pressure is directly reflected in corporate decision-making.From 2023 to 2025, over 11 million tons of chemical production capacity in Europe have been announced for closure, involving a wide range of products such as olefins, aromatics, and fine chemicals. Notable events include INEOS shutting down Europe's largest phenol facility and Dow closing a chlorine-alkali plant in Germany. It is noteworthy that 90% of these closed capacities have opted for permanent closure rather than sale, indicating that their asset restructuring value has essentially been lost.

II. The Rise Path of Chinese Chemical Industry

In recent years, China's chemical industry has achieved leapfrog development, with its share in the global market continuing to rise.In 2023, China's chemical product sales accounted for 43% of the global market, while Europe's share dropped to 13%. This shift is reflected not only in the field of basic chemical raw materials but is also gradually emerging in fine chemicals and high value-added products.

In the benzene industry chain, China has fundamentally changed the global supply and demand pattern through the continuous commissioning of refining and chemical integration projects. The completion of projects such as Zhejiang Petrochemical and Shenghong Refining and Chemical has significantly increased domestic supply capacity.Between 2021 and 2024, China's net import volume of bisphenol A decreased by 555,000 tons. Meanwhile, the production capacity of pure benzene in Europe, Japan, and South Korea is accelerating its exit due to cost disadvantages, and international giants like ExxonMobil are shutting down facilities.

The development of the olefin industry chain is equally remarkable. China, leveraging breakthroughs in coal chemical and light hydrocarbon cracking technologies, has accounted for a significant share of global ethylene production capacity.More than 20%. In the next three years, over 20 million tons of new production capacity will be put into operation. It is worth noting that although the production capacity of general materials like PE and PP has shown signs of surplus, in the high-end polyolefin sector, Chinese companies are gradually achieving import substitution through technological upgrades.

The breakthrough in the PC industry chain holds more significant meaning. Companies like Wanhua Chemical and Zhejiang Petroleum & Chemical have achieved technological breakthroughs, rapidly increasing China's PC production capacity to 44% of the global share, achieving a fundamental shift from net imports to net exports. The market share of traditional giants like Covestro and Teijin is being rapidly replaced by Chinese manufacturers.

3. Large-scale Refining and Chemical Integration"The strategic value of reducing oil and increasing chemical production"

The rapid development of China's chemical industry has benefited from the continuous advancement of the large-scale refining and chemical strategy.In 2023, China already had 33 refineries with a capacity of over 10 million tons each, bringing the total refining capacity to 980 million tons—the highest in the world. More importantly, these refineries generally adopt a flexible configuration of "producing olefins when suitable and aromatics when suitable," with the proportion of light feedstock for ethylene exceeding 35%, significantly reducing production costs.

The implementation of the "reduce oil, increase chemicals" strategy has shown remarkable results. Taking Zhejiang Petrochemical as an example, its 40 million tons per year refining and chemical integration project has achieved a chemical product yield of 70%, far exceeding the traditional refinery level of 40%. By 2025, with the commissioning of new projects such as Jilin Petrochemical and Zhenhai Refining and Chemical, China's production capacities for ethylene, propylene, and aromatics will be further enhanced.

Author: ZHUANSUOJIE Market Research ExpertZhao Hongyan

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track