From “Making Money While Lying Down” to “Selling Cars at a Loss,” the “Business Formula” of Luxury Car Dealers Has Changed

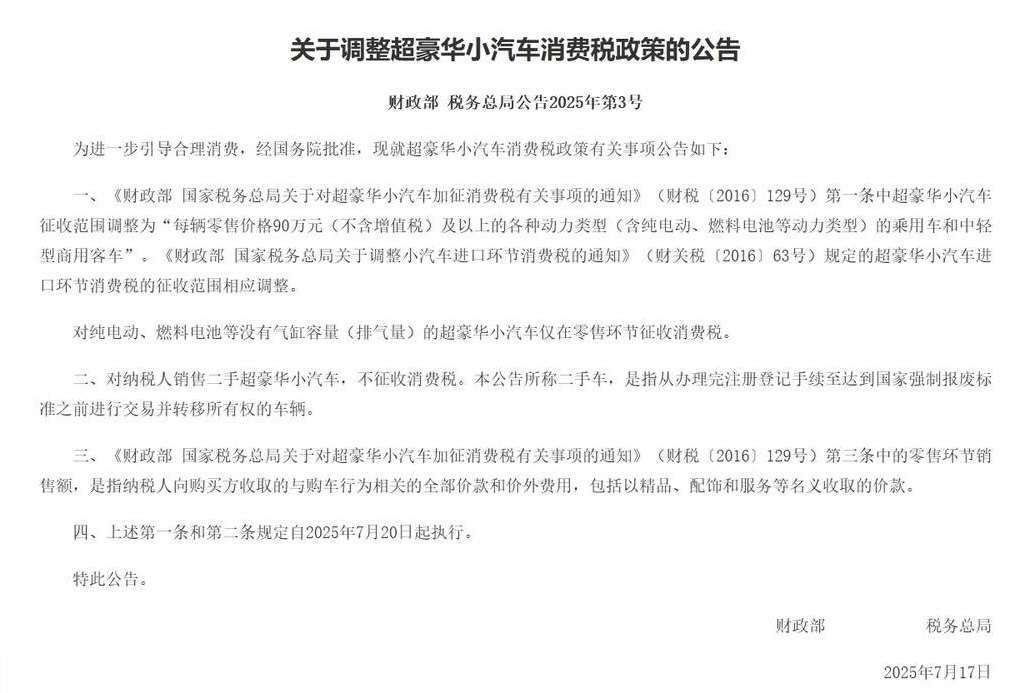

In July 2025, a fiscal policy caused a stir in the luxury car market. According to a joint announcement by the Ministry of Finance and the State Taxation Administration, the consumption tax threshold for ultra-luxury passenger vehicles will be lowered from 1.3 million yuan to 900,000 yuan (excluding value-added tax) starting July 20. The new regulation significantly expands the range of taxed models and, for the first time, includes new energy vehicles such as pure electric and fuel cell cars.

Source of the image: Screenshot of the "Announcement on Adjusting the Consumption Tax Policy for Ultra-Luxury Automobiles"

On the eve of policy implementation, the market was abuzz with activity. Some Porsche and BMW dealers extended their business hours late into the night to complete transactions before the window of opportunity closed. After the policy took effect, luxury brands reacted quickly: Jaguar Land Rover announced that for purchases made between July 20 and July 31 of specified models like the Range Rover Westminster Edition and Defender V8 series, the brand would fully cover the additional taxes. Consequently, some stores saw a rebound in customer traffic. Mercedes-Benz dealers launched a "Tax Reform, Price Unchanged" campaign, promising to cover the consumption tax for customers purchasing specified models like the Maybach S-Class and GLS SUV before August 31. Such seemingly proactive responses appear to be temporary measures by brands to address the tax adjustment. In reality, they reflect a deeper anxiety across the luxury segment amid ongoing pressure on sales.

In recent years, the market landscape has undergone significant changes, affecting both ultra-luxury brands such as Porsche and Maserati, as well as luxury brands dominated by BBA. Data shows that in the first half of 2025, traditional luxury brands experienced a year-on-year sales decline of 10% to 20% in China, with net profits shrinking substantially. Among them, Mercedes-Benz's net profit fell sharply by 55.8% year-on-year.

The ultra-luxury sector is also feeling the chill: Porsche's imported sales in China have dropped by 26.1% year-on-year, Jaguar Land Rover's imported sales have decreased by 17.1%, and brands such as Bentley, Rolls-Royce, and Maserati are generally facing a decline of over 20% in sales in China. Once immensely popular, luxury brands are now collectively facing severe challenges.

Sales Collapse and Model Failure

The wave of electrification is reshaping the industry landscape with an unstoppable momentum. The market foundation of traditional luxury brands is being fiercely challenged. This structural transformation has inevitably permeated every link of the distribution channel, with the dealer network at the market front line bearing the brunt of the pain caused by a sharp decline in sales, rising costs, and the failure of traditional profit models.

To salvage market share, luxury brands have launched an unprecedented price war, with the terminal market seeing phenomena such as "50% off for BMW, 60% off for Jaguar, and 70% off for Tiger." Specifically, some BMW 5 Series models have discounts exceeding 150,000 yuan, with on-road prices dropping to the 300,000 yuan range; Mercedes-Benz C-Class terminal price reductions have surpassed 40%. Porsche models like the Cayenne and Panamera have seen maximum discounts reaching as high as 30% off. However, despite substantial concessions, the loss of market share has not been halted—traditional luxury brands' share in the luxury car market has sharply declined from over 90% in 2020 to 44% in 2024.

Sales continue to shrink, directly leading to a drastic contraction of channels. In recent years, luxury brand dealerships have frequently closed stores and withdrawn from networks. Last year, BMW's first global 5S store announced its closure, and Tianjin's largest Audi 4S store suddenly shut down. At the beginning of this year, Porsche stated that it is streamlining its sales network in China, closing stores with insufficient operational capacity, and plans to reduce the number of dealerships to around 100 by 2027. Mercedes-Benz also plans to close more than 100 inefficient traditional 4S stores by 2025 and is experimenting with a direct sales model for new energy vehicles.

The wave of store closures is not limited to a single brand, as large dealership groups of luxury brands are also scaling back. Yongda Auto closed 18 4S stores and 4 showrooms last year, most of which involved mid-to-high-end fuel vehicle brands. LSH Auto closed several Mercedes-Benz 4S stores in regions such as Beijing, Shanghai, and Hangzhou in March. As of July this year, Guanghui Automotive had 287 stores de-authorized by manufacturers, accounting for about 39% of the total 735 outlets at the beginning of 2024.

The operational difficulties of dealers are closely related to their high channel cost structure. Generally, the costs of luxury brand 4S dealerships are mainly composed of four parts: huge funds occupied by massive vehicle inventory worth tens of millions or even over a hundred million, high investment in building the dealership, daily operational expenses, and customer acquisition and marketing costs. Among these, vehicle inventory, as the most direct cost item, often becomes the "last straw" that breaks the dealer.

On the revenue side, the traditional 4S dealership profit model includes four main pillars: new car sales, maintenance and repair, financial rebates, and manufacturer incentives. However, in the current environment, these four pillars are facing challenges.

Firstly, the decline in luxury brand sales has directly led to a significant decrease in dealer revenue. The difficulty in achieving sales targets has made manufacturer rebates elusive, and there is a widespread phenomenon of price inversion in new car sales. It is reported that in 2024, over 80% of luxury brand dealers will face the issue of new car price inversion.

Furthermore, the accelerated replacement of fuel vehicles by new energy vehicles has led to a significant reduction in after-sales business for luxury brand dealers. According to relevant industry reports, the profitability of after-sales services provided by 4S shops can account for up to 50%. However, the after-sales maintenance services for new energy vehicles are relatively straightforward, and their maintenance requirements are not as demanding as those of traditional luxury fuel vehicles, thus limiting the revenue generation potential for dealers in this area.

An even more severe issue is the cash flow crisis. Dealers typically purchase vehicles through a tripartite financing agreement among the OEM, the bank, and the dealer. The bank provides advance payment financing, the OEM ships the vehicles and pledges the certificates of conformity to the bank, and after the vehicles are sold, the dealer repays the loan to redeem the certificates. However, in a persistently sluggish market, the turnover rate of vehicles slows down, forcing some dealers to resort to private lending to repay bank loans. This leads to a surge in financing costs and may ultimately trigger a cash flow break crisis.

Additionally, the capital market's valuation of traditional distribution channels has also become pessimistic. With the luxury brands lagging in their electrification transition and the impact of new forces' direct sales models, investors have begun to question the long-term profitability of the asset-heavy 4S dealership networks.

Under multiple pressures, the traditional dealership profit model is losing sustainability. The financial reports of publicly-listed dealership groups have clearly demonstrated the industry's predicament: among the 10 major publicly-listed auto dealers, 8 experienced a decline in performance in 2024, 9 saw a drop in gross profit margin, and 5 turned from profit to loss. "Inverted sales margins and selling at a loss" have become common phenomena, especially for luxury brands.

In the era where electrification and intelligence are reshaping the automotive industry, luxury car dealers find themselves at a crossroads of transformation. Channel reform and model restructuring have become unavoidable propositions for them.

Luxury car dealers collectively lean towards new forces.

Four years ago, traditional luxury fuel vehicles still held a 90% market share, but now they have been surpassed by the new energy sector. In 2024, sales of new energy luxury cars soared to 2.88 million units, increasing more than 12 times in four years, occupying half of the market for the first time. This transformation is reflected not only in sales figures but also in the evolution of sales channels. Luxury car dealers, who once relied on luxury brands like BBA to "make money effortlessly," are now launching a collective transformation wave, terminating dealership authorizations for some traditional luxury brands like BBA and shifting their focus to domestic new energy brands such as AITO, NIO, XPeng, and Li Auto. Zhongsheng Group, Yongda Auto, and other large dealership groups are typical representatives of this trend.

Image source: AITO Auto

According to reports, Zhongsheng Group obtained authorization related to nearly 50 Huawei Smart Selection Car businesses last year. Additionally, Zhongsheng plans to convert 48 of its luxury car brand 4S stores into 40 AITO User Centers and 8 HarmonyOS Smart Mobility User Centers in two phases. Yongda Group stated that by 2025, the number of Huawei HarmonyOS Smart Mobility stores will increase to approximately 40 to 50. Similar scenarios are spreading across the country: the world's first BMW 5S store was taken over by BYD dealer Northern Huapeng Group, transforming to operate Denza and Fangcheng Leopard; Hengxin Auto, Xiamen C&D Corporation, and others are also accelerating the layout of Denza showrooms. According to incomplete statistics, by the end of 2024, more than 40 dealers that once operated luxury brands such as BBA, Porsche, and Maserati have switched to the NIO camp.

Behind this shift is an increasingly severe financial crisis. A dealership operating the Mercedes-Benz brand revealed that its 2,000-square-meter showroom is facing significant annual losses, with an average loss of about 20,000 yuan for each Mercedes-Benz car sold. The initial investment of 200 million yuan is at risk of sinking, stating that "without transformation, we can only wait for death." In contrast, switching to a new energy brand has brought a turnaround in profitability. For example, a Mercedes-Benz 4S store in Changsha, which spans over 2,000 square meters, did not achieve profitability for an entire year while operating the Mercedes-Benz brand, losing an average of 20,000 yuan per car sold. After switching to the AITO brand, the comprehensive gross profit per car increased to about 13,000 yuan.

The core value of the transformation of luxury brand dealerships lies in the fundamental change of business logic. Unlike the traditional era of fuel vehicles, new power brands adopt a model of "light asset operation at the pre-sale end and authorized heavy operation at the after-sale end." In this model, dealers no longer need to bear inventory pressure. In simple terms, companies handle online marketing, while dealers are responsible for offline maintenance, with each performing their own duties. This breaks the problem of companies pushing inventory onto dealers that existed in the era of fuel vehicles. Taking the cooperation between AITO and Zhongsheng Group as an example, dealers can receive a fixed commission of about 4.5% for each vehicle sold, with a single vehicle profit of approximately 1,000 yuan.

This model disrupts the financial predicament of traditional 4S dealerships. In the past, dealers had to advance tens of millions or even over a hundred million yuan to purchase inventory vehicles, utilizing tripartite financing agreements to rotate funds. If sales encountered obstacles, it could easily trigger a financial crisis, especially for luxury brand dealers with higher-priced vehicles, whose financial pressure is understandably significant. Under the new model of domestic new luxury brands, companies can control front-end sales through digital direct sales, while dealers focus on delivery and after-sales services, forming a more sustainable division of labor.

The transformation of luxury brand dealerships is far from a simple brand switch; it is a structural adjustment of the entire automotive sales system. Amid the wave of electrification, the once unbreakable manufacturer-dealer relationship is being reshaped.

Channel "Slimming" of Luxury Dealers

Faced with the continuous decline in sales and profits, as well as the challenge of dealer partners collectively switching to new luxury brands, traditional luxury brands are actively adjusting their channel strategies, attempting to create a better survival environment for their remaining dealer networks. The core of these adjustments is to promote the transformation of the sales system towards a lighter and more service-oriented direction.

Last year, luxury brands such as BBA collectively adjusted their evaluation mechanisms for dealers. They not only lowered annual sales targets but also significantly increased subsidies and relaxed assessment standards. To alleviate the continuous losses faced by dealers due to price inversions, BMW was the first to announce its withdrawal from the price war in July of that year, with Mercedes-Benz and Audi following suit. Luxury brand manufacturers are no longer solely pursuing sales volumes but are shifting towards maintaining channel health. Traditional luxury brands have begun to engage in substantial transformations of channel forms, turning to more flexible and cost-effective channel types such as smaller showrooms and satellite stores.

Image Source: Lincoln Motor Company

In early 2025, Mercedes-Benz announced its latest channel strategy in China. The dealer network will transition from a "scale expansion phase" to a "quality and efficiency improvement phase," primarily to streamline scale and alleviate the burden on dealers.Lincoln Motors has launched the "Sparks Ignition" plan, reducing the single-store area by 80% to approximately 800 square meters, lowering the investment threshold to 1.5 million yuan, and streamlining the operating team to around 10 people. Under this model, the total investment for a single Lincoln store can be controlled within the range of 1 to 2 million yuan, which is only one-tenth of the investment required for a traditional 4S dealership.

The lightweight model is accompanied by innovations in operational mechanisms. Lincoln offers franchisees a "zero inventory pressure for the first six months" policy, builds a digital marketing platform, and provides specialized training and regional exclusive protection rights. According to Mao Jingdi, President of Lincoln China, this plan has helped the Lincoln dealer network recover to 105 stores, with 80% achieving profitability. These practices demonstrate that by reasonably controlling scale and cost structure, traditional luxury channels still possess resilience for survival.

Another dimension of channel transformation is the shift in business focus. Through the "Spark" plan, Lincoln is expanding into lower-tier markets by extending its "small and refined" stores to third- and fourth-tier cities such as Fuyang, Shaoxing, and Ordos, further enlarging its coverage map.

The transformation towards service-oriented models is also reflected in the upgrading of experiences, with multiple brands introducing transparent workshop systems, allowing customers to watch the vehicle maintenance process in real-time by scanning a code. This visualization of services not only enhances trust but also reinforces the positioning of after-sales services as a pillar of profitability. In response to the decline in after-sales maintenance business among traditional luxury brands due to the wave of electrification, luxury brands are reshaping their competitiveness by deepening the connotation of services.

The essence of this channel transformation is essentially the redistribution of the value chain of luxury cars. When new car sales can no longer support the vast channel system, manufacturers and dealers jointly explore more flexible and lightweight operations, as well as channel models that focus more on the essence of service. In an era where electrification is disrupting industry rules, this may become the fulcrum for traditional luxury brands to re-establish themselves.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track