Foreign Chemical Companies' Q2 Performance Comparison: Intensifying Divergence, High-Value-Added Business Becomes Key to Breakthrough

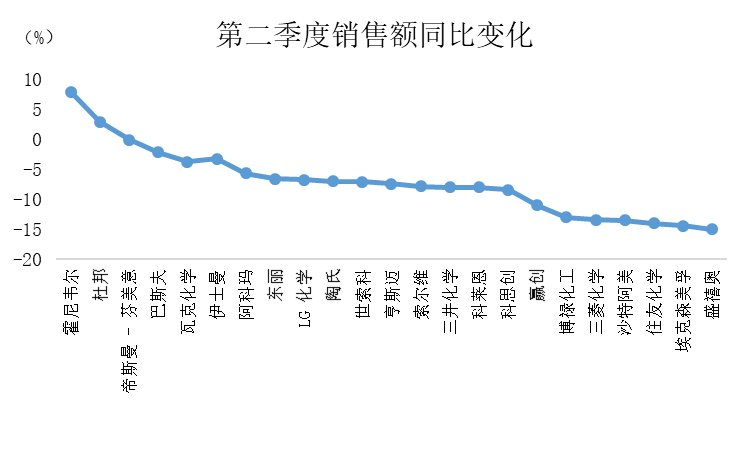

In the second quarter of 2025, the global chemical industry showed clear polarization under the combined pressures of weak demand, macroeconomic fluctuations, and geopolitical uncertainties. As of now, the latest financial results disclosed by 28 foreign chemical companies, including BASF, Dow, and Honeywell, indicate that although most companies saw a decline in performance due to falling product prices and high energy costs, some, such as Honeywell and DuPont, achieved growth against the trend by relying on high value-added businesses. Notably, DSM-Firmenich reported an impressive year-on-year increase of 982% in net profit for the first half of the year. European chemical companies, burdened by high energy costs and falling product prices, faced pressure throughout the supply chain and became the “hardest-hit area” of the industry.

High-value-added business efforts, leading companies break through against the trend.

Against the backdrop of overall industry pressure, companies focusing on high value-added businesses have demonstrated strong resilience. In the second quarter, Honeywell’s sales reached $10.4 billion, an increase of 8% year-on-year, with organic sales growing by 5%. Segment profit rose 8% year-on-year to $2.4 billion. Although the profit margin narrowed slightly, it remained at a high level above 20%, underscoring the counter-cyclical strength of its high value-added segments such as aerospace and performance materials.

DuPont also achieved growth through technological barriers, with net sales in the second quarter reaching $3.26 billion, a year-on-year increase of 3%. Significant contributions came from its electronics materials and industrial biotechnology businesses. Continuing operations' net profit surged by 35% year-on-year to $238 million. Notably, its plan to spin off its electronics business (Qnity) will be completed in November, and post-spin-off, the focus of the industrial sector is expected to further strengthen the proportion of high value-added businesses.

DSM-Firmenich has become a performance "dark horse," with net profit soaring 982% year-on-year to €541 million in the first half of the year, and adjusted EBITDA in the second quarter increasing by 19% year-on-year, with a profit margin rising to 18.9%. This performance is closely related to its strategic focus—having completed the divestment of the feed enzymes business in June, it has not only shed low value-added assets but also strengthened high-margin segments such as nutrition and health, and material sciences, driving the overall optimization of its profitability structure.

Additionally, Saudi Basic Industries Corporation (SABIC) reported an adjusted net income of 500 million riyals for the second quarter, a significant improvement from a net loss of 100 million riyals in the first quarter, benefiting from relatively stable energy costs in the Middle East and a rebound in demand for downstream specialty chemicals.

Weak demand combined with cost pressures has led to significant overall industry strain.

In contrast to a few breakthrough companies, the majority of chemical enterprises experienced a decline in performance in the second quarter, with European companies being particularly prominent. Shengxiao's second-quarter sales fell by 15% year-on-year to $784 million, net loss widened to $106 million, and adjusted EBITDA decreased by $25 million year-on-year, mainly due to weak downstream demand in plastic building materials and consumer electronics, coupled with fluctuations in raw material prices.

Sumitomo Chemical's performance is more representative, with a net loss attributable to the parent company of 4.5 billion yen in the second quarter, a significant year-on-year decline of 118.4% (compared to a profit of 24.4 billion yen in the same period last year). Although operating profit increased by 121.3% year-on-year due to cost control, the decline in prices in the agrochemical and basic chemicals segments still dragged down overall performance.

The “chain collapse” of European chemical companies is particularly notable. BASF’s sales in the second quarter fell by 2.1% year-on-year to €15.77 billion, EBITDA dropped by 9.7% year-on-year, and net income was only €80 million, a sharp year-on-year decline of 81.4%. The main reasons are soaring energy costs and sluggish demand in Europe’s automotive and construction industries. Covestro’s EBITDA in the second quarter decreased by 15.6% year-on-year, with a net profit loss of €59 million; Arkema’s EBITDA fell by 19.3% year-on-year, and adjusted net income dropped by 44.9%. Energy prices in Europe are 30% to 50% higher than in other regions, directly squeezing the profit margins of basic chemicals.

The chemical segments of global energy giants are also under pressure. ExxonMobil's total revenue in the second quarter declined by 14.4% year-on-year, with profits decreasing by 8% quarter-on-quarter; Saudi Aramco's total revenue in the second quarter fell by 13.5% year-on-year and net profit dropped by 22% due to lower prices of crude oil and refining products, reflecting the downward pressure linked to the energy and chemical industry chain.

Industry differentiation intensifies, structural opportunities emerge.

From the second quarter data, the differentiation in the global chemical industry is evident not only among companies but also across business segments and regional markets. High value-added businesses (such as electronic chemicals, specialty materials, and nutrition technology) have become the core drivers that transcend economic cycles, while companies reliant on basic chemicals and sensitive to energy costs continue to face pressure.

Regional disparities are further widening: Middle Eastern companies remain relatively stable due to their low-cost energy advantage, North American companies maintain resilience through industrial upgrading and downstream integration, while European companies are caught in an "upstream and downstream chain contraction" due to dual pressures of energy and geopolitics. In the future, divesting low-margin assets, focusing on core technologies, and establishing low-cost energy bases may become mainstream strategies for chemical companies.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track