EVA Price Rises Continuously Amid Overseas Production Capacity Withdrawal, China Set to Take Global "Discourse Power"

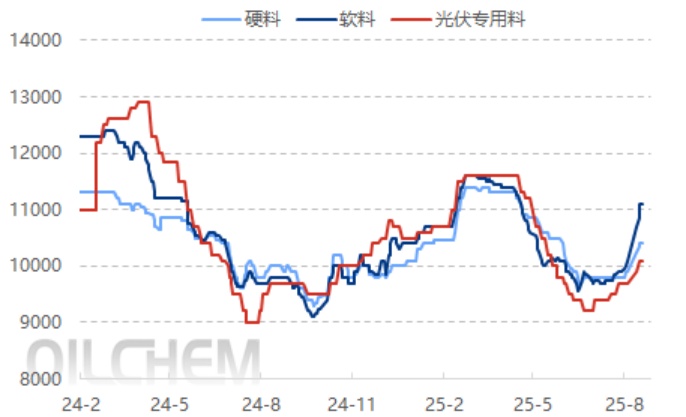

Recently in ChinaThe EVA market has entered a "surge mode," as of August 2.7On that day, the prices of mainstream products all saw significant increases: the settlement price of photovoltaic materials reached...The price range for rigid materials is 9,900-10,200 RMB/ton, up 2% from last week; soft material prices have climbed to 11,000-11,300 RMB/ton, with an increase of 4.76%; rigid material prices are also strong, reported at 10,250-11,000 RMB/ton, with a weekly increase of 3.53%. In just a few weeks, the overall EVA market has shown a hot trend of "reduced volume and increased prices."

EVA Market Price Trend Chart

The surge in EVA prices is by no means driven by a single factor, but is the result of simultaneous tightening on both domestic and international supply sides. Domestically, planned shutdowns and maintenance at Sinopec Zhongke and Gulei Petrochemical, along with an unexpected shutdown at Sinochem Quanzhou and a short-term stoppage at Jiangsu Hongjing for cleaning, have directly caused domestic weekly EVA production to drop to 53,500 tons, a decrease of 9,300 tons from last week, or 14.81%. In response, holders have begun to withhold goods and are reluctant to sell, making spot supply in the market increasingly tight.

The more critical issue is the overseas supply side.“Double impact”: Not only are Korea’s Total and companies from Taiwan conducting major overhauls lasting more than 20 days during July and August, resulting in a tight supply of overseas EVA, but major overseas producers are also undergoing strategic capacity adjustments. Korea plans to cut 2.7–3.7 million tons of naphtha cracking capacity, a move that will not only affect the supply of EVA feedstock but also impact PTA and other related chemicals. One of Lotte Chemical’s cracking units in Korea, with an annual capacity of 640,000 tons, has been forced to reduce its operating rate to 75% due to continued pressure on olefin product margins. The market has suffered a significant impact as a result.The combination of "routine maintenance + strategic production cuts" has further exacerbated the supply gap of global EVA and related chemical products.

However,The upward momentum of EVA prices has shown signs of "concern." Although current market quotations continue to rise, downstream acceptance of high-priced raw materials is gradually decreasing: the foam shoe material industry, affected by weak overseas orders and the postponement of new product ordering events, only follows up with small orders based on actual demand after a phase of replenishment, exhibiting strong resistance to high-priced supplies; even the relatively robust photovoltaic encapsulation film sector has started to control its purchasing pace due to the narrowing price gap between EVA and downstream products. This means that even if there is no obvious supply shortage in the future, the space for further price increases of EVA will be limited.

Behind the weak price increase is the global...The production capacity pattern of EVA is accelerating its transformation. Overseas companies are continuously reducing capacity due to profit pressures and strategic adjustments, while the domestic market is witnessing a supply rebound—next week, domestic EVA production is expected to increase to 61,100 tons, a year-on-year rise of 9.25%. Facilities such as Sinochem Quanzhou and Gulei Petrochemical will also ramp up the production of soft materials to alleviate the shortage of soft materials. In the long term, with overseas capacity continuously under pressure and domestic capacity steadily increasing, the global EVA capacity concentration "shifting towards China" will further deepen, and China's influence in the global EVA market will correspondingly strengthen.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track