European Chemical Industry Faces Upstream and Downstream Chain “Collapse”!

The European chemical industry holds an important position globally.The area is currently experiencing unprecedented cascading collapses.

The chemical production capacity in Europe is highly concentrated in the Northwestern European industrial corridor, with Germany forming the main industrial axis centered around the Rhine River region. In the lower reaches of the Rhine River, within the "chemical golden triangle" formed by Ludwigshafen, Leverkusen, and Frankfurt, there is a concentration ofBASF(The world's largest chemical company)

The giants contribute 78% of Germany's chemical production capacity and dominate the production of specialty chemicals, pharmaceutical intermediates, and high-performance materials.

Extending northwest to the Benelux Union, the Port of Antwerp (Belgium) and the Port of Rotterdam (Netherlands) are jointly constructed.The largest petrochemical hub in EuropeAntwerp, with an annual crude oil processing capacity of 180 million tons, has become the second-largest petrochemical cluster in Europe, while Rotterdam, leveraging its deep-water port advantage, has become an important base for companies such as LyondellBasell, focusing on the production of polyolefins and basic chemicals.

However, years of losses, high production costs, and aging equipment have gradually caused European companies to lose their competitiveness, making them increasingly dependent on imports for basic chemical raw materials such as ethylene and propylene. Taking cracking units as an example, several major players have shut down facilities one after another, toppling the entire industrial chain like dominoes. According to incomplete statistics and the current plans of major companies, the region may permanently withdraw about [amount missing] by the end of 2027.4.6 million tons/year of ethylene, 2.28 million tons/year of propylene, and 430,000 tons/year of butadiene production capacity.

Moreover, the crisis in the European chemical industry has gone beyond the shutdown of production capacity and is eroding its core competitiveness—the fine chemical service system. For example, after evaluation,HuntsmanIt has been found that the number of customers with demand for products and formulas provided by system vendors has decreased, and customers' willingness to pay has declined. This situation is particularly evident inEspecially common in EuropeAs a result, Huntsman made the decision to shut down two polyurethane plants.

In response to the current situation, the European Commission officially launched the "Action Plan for the Chemical Industry" on July 8, 2025, aiming to...Establish a European Key Chemicals Alliance, implement affordable energy actions, set up innovation-driven mechanisms, and reform regulatory systems.Address the threefold challenges of high energy costs, intensified global competition, and weak demand, while promoting industrial modernization and upgrading.

However, just one week after the policy was implemented, industry giant INEOS publicly voiced its concerns on July 15, pointing out fundamental flaws in the plan: "This belated scheme neither addresses the urgency of the industry's crisis nor offers any substantive solutions. For Europe's chemical industry, which is on the verge of collapse, these measures are nothing more than a drop in the ocean." Such sharp criticism reflects widespread skepticism within the industry regarding the effectiveness of the policy. Additionally, it is worth noting that a recent EU measure to impose retaliatory tariffs on US products totaling 93 billion euros may have a certain impact on local industrial development in the future. Taking Germany as an example, the US and Germany are mutually dependent in certain high-end manufacturing sectors. In the chemical products sector, including imported products such as diagnostic reagents, 15% come from the United States, with a total value of 2.9 billion euros. In the energy sector, Germany mainly imports crude oil and hard coal from the US, totaling 14.8 billion euros, accounting for 13.6%.

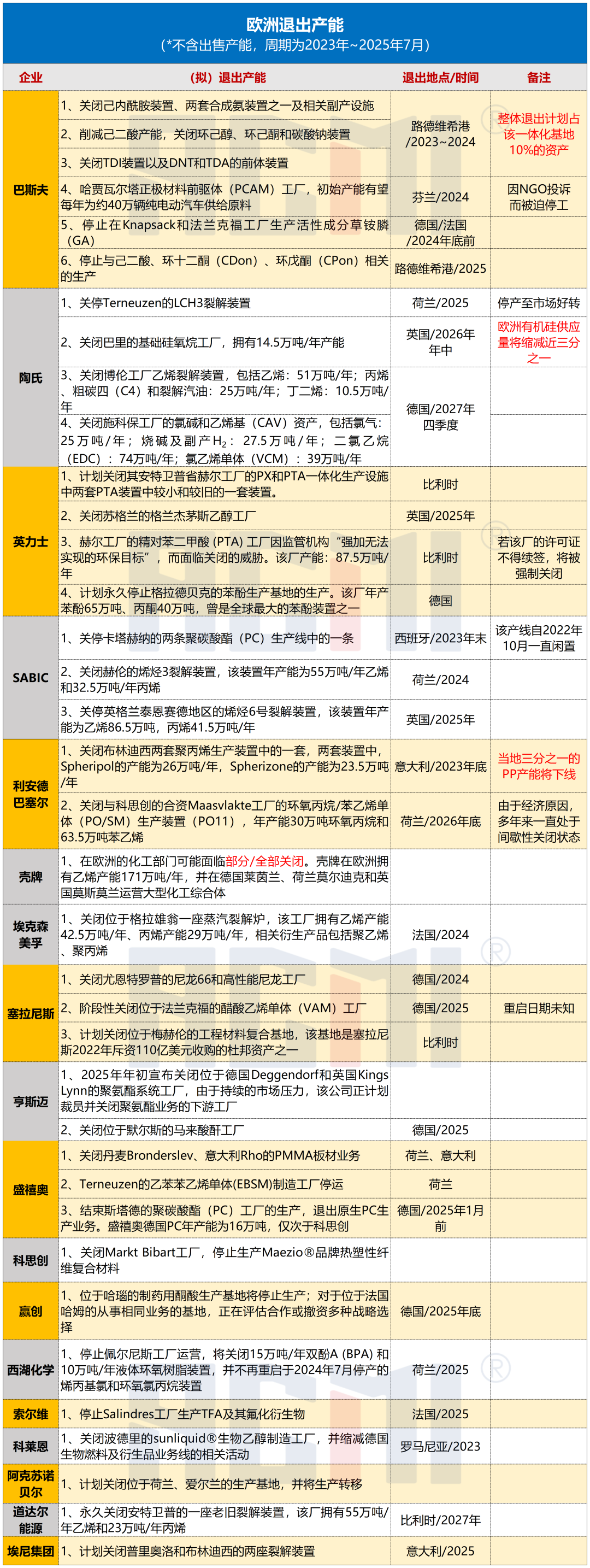

According to incomplete statistics,Since 2023, giants including BASF, Dow, Evonik, Huntsman, Celanese, INEOS, Covestro, SABIC, LyondellBasell, ExxonMobil, AkzoNobel, Shell, and TotalEnergies have been gradually "withdrawing" from Europe.:

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track