Europe reluctant to let go of fuel cars

BBA is surprisingly unanimous in opposing the complete ban on the sale of fuel cars in Europe by 2035.

Recently, Mercedes-Benz has taken over the baton from BMW and Audi, with its CEO Ola Källenius also expressing dissatisfaction with the aforementioned policies during a media interview. Compared to his predecessors, Källenius's statements are bolder and more threatening. He links fuel vehicles to the European automotive industry, bluntly stating that without fuel vehicles, the European automotive industry will face a "collapse."

Opponents spoke with one voice, while supporters were equally clear in their stance. Last September, Volvo Cars and dozens of industrial manufacturers backed the EU, urging the implementation of the policy to ban the sale of internal combustion engine vehicles by 2023.

Their testimonies were equally upright and awe-inspiring. Volvo CEO Jim Rowan stated, "The 2035 target is crucial for aligning all stakeholders and ensuring Europe's competitiveness."

Caught between supporters and opponents, the EU's stance remains indecisive. On one hand, the EU is making various efforts to implement policies, and the policies have not been canceled yet; on the other hand, under the lobbying from the opposition, the EU has frequently made concessions, not only granting exemptions for synthetic fuels but also postponing fines for failing to meet emission reduction standards in March.

The repeated backtracking and indecisive attitude of the EU reflects the unsmooth progress and hidden crisis of electric vehicles in Europe.

From the current situation in Europe, the adoption rate of electric vehicles remains low, and the public's attitude towards electric cars is lukewarm. Car manufacturers find themselves in an especially awkward position, as their transition to electrification falls short of expectations. According to semi-annual reports, under the dual pressures of sales and tariffs, the profitability of European car companies has already been affected, and their profit sources rely heavily on fuel-powered vehicles. If Europe continues to aggressively push for the 2035 ban on internal combustion engine vehicles, it is highly likely, as Conlinson mentioned, that it will lead to the "collapse" of the European automotive industry.

Amidst intertwined interests, Europe still finds it hard to let go of fuel-powered vehicles.

01The electrification soil has not yet formed.

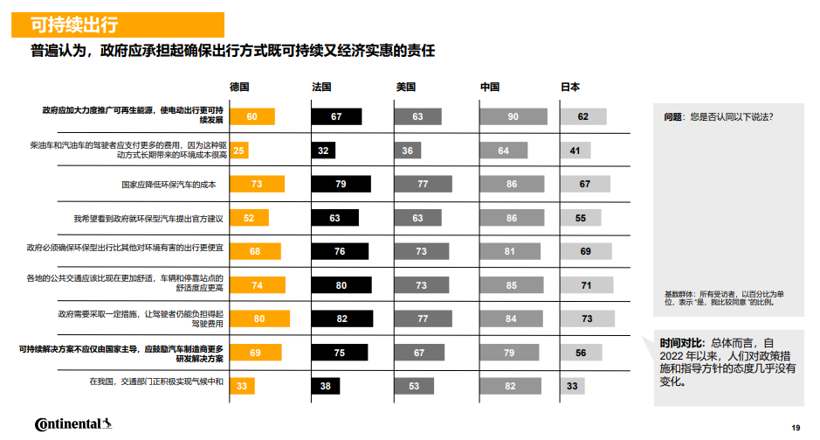

Even compared to China, where the acceptance of new energy vehicles is highest, the EU's ban on internal combustion engines seems somewhat aggressive. The "2024 Future Mobility Trends Survey Report" shows that in terms of sustainable mobility, the approval rate among Chinese consumers is 90%, while only 60% of users from the EU countries such as Germany and France agree that the government must vigorously promote sustainable mobility.

According to the report "Research on the Timetable for Phasing Out Traditional Fuel Vehicles in China," China will prioritize hybrid technology to significantly reduce fuel consumption. It is expected that by 2050, pure electric vehicles will account for about 85% of the private car sector. This means that China not only allows but also encourages hybrid models as a transition for phasing out fuel vehicles. Furthermore, by the middle of this century, the share of pure electric vehicles will not have reached 100%.

In contrast, the EU's policy somewhat reveals a one-size-fits-all radical approach. According to the plan, the EU aims to reduce net greenhouse gas emissions by 55% from 1990 levels by 2030 and ultimately achieve carbon neutrality by 2050. The decarbonization of the transportation sector is seen as key to achieving this goal. Consequently, in 2023, the EU issued an internal combustion engine ban, stipulating that from 2035 onwards, the sale of new cars emitting carbon dioxide will be prohibited within the EU.

This means that neither cars using synthetic fuels nor hybrid vehicles are eligible for sale, only pure electric models are exempt.

For Europe at present, this is almost an unattainable "fantasy." Data shows that in the first half of this year, hybrid vehicles accounted for 34.8% of total sales in the EU market, an increase of 5.6% in market share compared to the same period last year; gasoline and diesel vehicles accounted for 37.8% of the total, a decrease of 10.4% in market share compared to the same period last year; purely electric vehicles accounted for 15.6% of the total, an increase of 2.7% in market share compared to the same period last year.

Despite a year-on-year decline in the market share of fuel vehicles in the EU market, consumers still prefer hybrid models over purely electric vehicles, and the penetration rate of electrification remains relatively low. In contrast, in the first half of this year, the cumulative sales of new energy vehicles in China reached 6.937 million units, of which 4.415 million were purely electric models.

The low electrification penetration rate in the EU market is due to a variety of reasons, including low public willingness, insufficient efforts by car manufacturers to electrify, inadequate government subsidies, and insufficient infrastructure support.

The complex reasons behind the low electrification adoption rate in the EU market include not only the low willingness of the public to accept it, but also the lackluster advancement of electrification by car companies. Additionally, there are supporting deficiencies such as insufficient government subsidies and lagging infrastructure development.

Ceylan Shevket, Senior Director for European Corporate Ratings at Fitch Ratings, stated that range anxiety regarding electric vehicles and the limited charging infrastructure are dampening consumer enthusiasm for purchasing electric vehicles. Additionally, issues of price affordability and the pace of technological change further limit the popularity of electric vehicles.

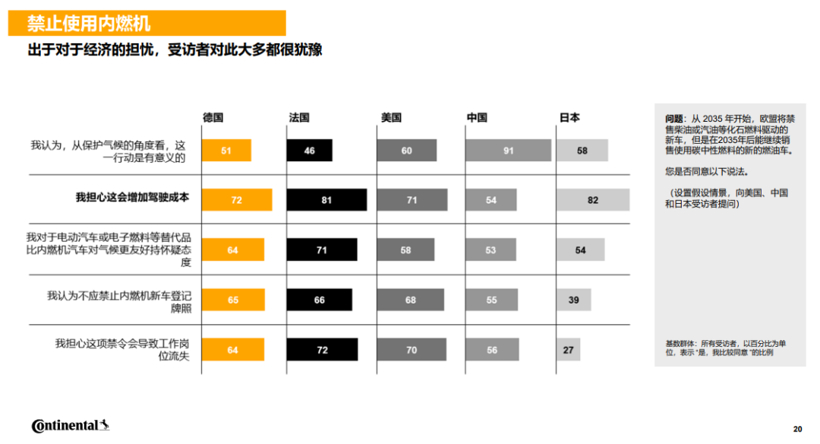

Price is also an important reason why European consumers oppose banning internal combustion engines. Data shows that more than half of German and French users are skeptical of the view that "electric vehicles are more environmentally friendly than internal combustion engines." On the contrary, they worry that banning internal combustion engines will increase driving costs and lead to job losses.

Their concerns are not unfounded. As one of Europe's key pillar industries, the automotive sector provides nearly one million jobs in Germany alone. A conventional internal combustion engine car typically consists of 20,000 to 30,000 parts, whereas an electric car has only over 10,000 parts. Many small German companies rely on supplying parts for internal combustion engines for their livelihood. Once the demand for internal combustion engines declines, the employees of these companies will undoubtedly face the risk of unemployment.

The root of public concern stems from government inadequacy. On one hand, with the reduction of subsidies, European consumers' willingness to purchase electric vehicles has somewhat declined. Several countries, including the UK, France, and Germany, have terminated their subsidy programs for electric vehicles.

In the case of Germany, it previously stipulated that pure electric and plug-in hybrid vehicles below 40,000 euros would receive subsidies of 6,000 euros and 4,500 euros, respectively; pure electric and plug-in hybrid vehicles priced between 40,000 and 65,000 euros would receive subsidies of 5,000 euros and 4,000 euros, respectively. However, starting from September 2023, Germany has canceled subsidies for pure electric vehicles for individuals. It originally planned to retain subsidies for businesses until the end of 2024, but adjusted the subsidy standard to provide a subsidy of 4,500 euros only for pure electric models priced below 45,000 euros, with no subsidies for other models.

As a result, the registration of pure electric vehicles in Germany from January to May this year was 140,000 units, a decrease of 15.9% compared to the same period last year, and it has been lower than the previous year for four consecutive months.

Apart from the cooling of subsidies, the EU's charging station deployment also faces significant challenges. According to data from energy technology company GridX, there are approximately 882,000 charging stations in the EU, which is far from the EU Commission's goal of installing 3.5 million charging stations by 2030. Achieving the EU's 2030 target means that 410,000 new public charging points need to be installed annually, which is almost three times the current annual installation rate.

However, even if the EU achieves its goal of deploying 3.5 million charging stations by 2030, it may still be insufficient to support a full transition to electric vehicles. The European Automobile Manufacturers Association (ACEA) believes that by 2030, the number of charging points needed to meet decarbonization targets may rise to 8.8 million.

A more severe challenge comes from within the automotive companies themselves. As brands that rose in the era of fuel vehicles, many European car companies are not transitioning smoothly to new energy. From the recently released semi-annual financial reports, it is apparent that the proportion of pure electric models is low, and the majority of these companies' revenue and profits still heavily rely on fuel vehicles. Recklessly cutting off this profit cow of fuel vehicles would be nothing short of a disaster for traditional brands.

Taking Mercedes-Benz, which strongly opposes the ban on the sale of internal combustion engines, as an example, in the first half of this year, pure electric vehicles accounted for only 8.4% of its global sales, even lower than 9.7% in the same period last year. Even including plug-in hybrids, new energy vehicles only accounted for 20.1%. Against this backdrop, Mercedes-Benz's financial report for the first half of the year was not promising, with net profit affected, and the setback in electrification transition is undoubtedly one of the important reasons for the decline in Mercedes-Benz's performance.

02At critical moments, frequently making concessions.

The current reliance on gasoline vehicles and the EU's urgent desire to achieve electrification transformation have led to a conflict centered around the policy of banning the sale of combustion engine vehicles by 2035. This has resulted in the EU being determined to implement the policy, yet struggling to withstand the lobbying and even criticism from member states and car manufacturers, frequently making concessions at critical moments.

The conflict between car manufacturers' reliance on internal combustion engine vehicles and the EU's urgent push for electrification ultimately culminates in the 2035 ban on the sale of fuel-powered cars. As a result, despite the EU's firm stance on wanting to implement the policy, it has consistently struggled to withstand the lobbying and even "bombardment" pressure from member states and car manufacturers, causing the EU to repeatedly make concessions at critical moments of policy implementation.

Previously, while setting the policy to ban the sale of fuel vehicles within the EU by 2035, the EU also established an interim target to reduce carbon emissions from fuel vehicles by 15% by 2025 compared to 2021 levels. Industry agencies predict that if automakers fail to meet the reduction targets by 2025 and are fined, the total loss could reach 16 billion euros.

For instance, Volkswagen, a major automotive giant, has warned that if the company is to meet its emission reduction targets, it will incur a loss of 1.5 billion euros this year. To comply with the EU's emission reduction requirements, some European car manufacturers have even had to purchase "carbon credits" from overseas new energy companies, such as competitors Tesla and BYD, to offset their carbon footprint.

At the critical juncture when the penalties were about to be implemented, the European Union ultimately made concessions. In March this year, European Commission President Ursula von der Leyen stated that car manufacturers failing to meet emission reduction targets this year would temporarily not be required to pay fines. The timeframe for car manufacturers to meet carbon emission targets has been extended from one year to three years, and companies that do not meet the targets are allowed to exceed them in the coming years to avoid penalties. In other words, the fines have been postponed to 2027. This can perhaps be seen as a phase of setback in the EU's push to ban internal combustion engines.

Despite the European Union having made concessions on fines, some car manufacturers are still not satisfied.

Previously, Klaus von Mauch, Senior Vice President of Engine Production at BMW Group, stated that "the internal combustion engine is our foundation." Audi's global CEO, Markus Duesmann, also indicated that Audi will no longer set a specific timeline for ending the development and sales of internal combustion engine vehicles. Following this, as mentioned above, Mercedes-Benz CEO Ola Källenius expressed even stronger opposition to this policy, stating that it would not only hinder Mercedes-Benz's development but also lead to the collapse of the entire European automotive market.

For car manufacturers, there is still a faint glimmer of hope regarding the 2035 ban on internal combustion engines. In a meeting held in 2023, under strong recommendations led by Germany, the policy made some concessions: if internal combustion engine cars only use carbon-neutral fuels, they can continue to be sold after 2035.

Despite the concessions being limited and synthetic fuels only substantially benefiting small-scale sports car brands, the actions of the EU indicate that although its stance is tough, it remains somewhat wavering. If this policy flexibility persists, the situation in 2035 may witness new changes.

In the tug-of-war between environmental vision and real-world challenges, Europe's farewell to fuel-powered cars is destined to be a long goodbye.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track