EU Carbon Tariff Takes Effect, Raising "Green Threshold" for Petrochemical Exports

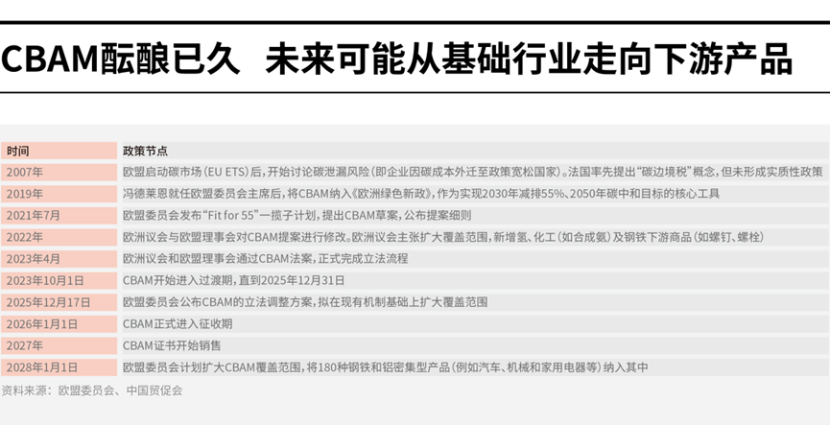

On January 1, 2026, the European Union's Carbon Border Adjustment Mechanism (CBAM) officially came into effect, marking the transition of the world's first "carbon tariff" from policy text to practical implementation. Although its current scope is limited to six basic industries—iron and steel, aluminum, cement, fertilizers, electricity, and hydrogen—and does not yet directly include plastic products like polyolefins in the taxation list, Chinese petrochemical export enterprises are already feeling the spreading pressure.

This pressure doesn't stem from immediate tax bills, but rather from the transmission of supply chain impacts and the early penetration of customer compliance requirements. Starting from the end of 2025, a number of Chinese enterprises exporting plastic products to the European Union have successively received "carbon data inquiry letters" from European customers, requesting information on product carbon footprints, raw material origins, and energy consumption emissions during production. Although these data do not currently constitute mandatory reporting obligations, they foreshadow that companies lacking carbon management capabilities will face market access barriers once CBAM is extended to downstream products – such as automotive parts, appliance casings, and packaging materials made of steel and aluminum-intensive plastics.

In fact, the EU has clearly planned to extend the CBAM coverage to approximately 180 downstream products by 2028, a significant portion of which involves engineering plastics, modified polyolefins, and composite materials. Taking automobiles as an example, a complete vehicle contains over 100 kilograms of plastic components. If its PP, ABS, or PC/ABS alloys cannot demonstrate low-carbon attributes, the export cost of the entire vehicle may be indirectly increased. More crucially, even if the end product is not taxed, EU importers, in order to avoid their own compliance risks, may proactively screen for "low-carbon suppliers," effectively creating a de facto green trade barrier.

For the polyolefin industry, the real challenge lies in the carbon intensity transparency of upstream raw materials. Most domestic PE and PP plants still rely on naphtha or coal as feedstock, resulting in significantly higher carbon emissions per unit product compared to ethane cracking routes in Europe and the United States. If CBAM requires disclosure of emissions data from the polymerization stage in the future, and companies cannot provide internationally recognized verification reports, they may be subject to the EU's "default value" – a figure that is often much higher than actual levels, leading to a surge in hidden costs. Drawing from the experience of the steel industry, using the default value could increase the carbon cost per ton of product by several hundred yuan, enough to weaken price competitiveness.

Estimation of CBAM Costs for Steel Exports from Major Global Countries to the EU

|

|

Estimate CBAM cost (EUR/

|

|

|

22.0 |

|

|

60.2 |

|

|

62.6 |

|

Turkey |

77.5 |

|

|

80.8 |

|

|

144.0 |

|

|

230.4 |

|

Indonesia |

541.0 |

It is worth noting that CBAM is not only an environmental policy, but also a strategic tool for the EU to reshape global industrial rules. By internalizing carbon costs into trade conditions, it forces companies in third countries to accelerate decarbonization. In the short term, CBAM has a limited direct impact on plastics and chemicals exports; but in the medium and long term, it is quietly raising the green threshold for "going global".

Author: Zhou Yongle, Senior Market Analyst

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories