End of an Era! DuPont Sells Business for $12.8 Billion, Teijin Exits

DuPont recently announced that the company has entered into a definitive agreement with TJC portfolio company Arclin to acquire DuPont's aramid business (Kevlar® and Nomex®), with the transaction valued at approximately $1.8 billion (approximately 12.8 billion RMB). The transaction is expected to be completed in the first quarter of 2026, subject to customary closing conditions and regulatory approvals.

After the transaction is completed, DuPont will receive approximately $1.2 billion in pre-tax cash proceeds, $300 million in receivable notes, and a future non-controlling common equity interest in Arclin, currently valued at $325 million, which is expected to represent approximately 17.5% of the shares upon completion of the transaction.

Arclin is headquartered in Georgia, USA, and is a leading materials science company with 18 manufacturing facilities in Canada, the United Kingdom, and the United States. It provides products for industries including construction, agriculture, transportation, meteorology and fire protection, pharmaceuticals, nutrition, and electronics, including urea, melamine, and phenolic polymer systems. TJC is an investment company that, as of June 30, 2025, manages assets totaling $33.2 billion (approximately 236.74 billion RMB) and has invested in more than 85 projects over more than 23 years.

Through this transaction, DuPont further optimizes its new product portfolio, acquires substantial cash for reinvestment, and retains equity participation, achieving multiple benefits. This is also a firm step by DuPont to focus on high-growth areas such as semiconductors, healthcare, and water treatment. It is reported that the spin-off of the electronic business is expected to be completed by November 1. After the spin-off, the remaining industrial sector will be integrated into DuPont.

On the same day, August 29, based on the decision to divest DuPont's aramid business, the global giant Teijin of Japan simultaneously announced that it has decided to transfer its shares in DuPont Teijin Advanced Papers (Japan) Limited (“DTPJ”) and DuPont Teijin Advanced Papers (Asia) Limited (“DTPA”) to DuPont or its designated affiliates. The transaction is expected to close in February 2026 (tentative), with specific financial details undisclosed.

It is reported that DuPont Teijin (Japan) was established in 1994 with an investment of 1 billion yen, with each company holding 50% of the shares. It is engaged in the manufacturing, processing, and sales of synthetic paper containing aramid materials, as well as the sales of cardboard. DuPont Teijin (Asia) was also established in 1994, with each company holding 50% of the shares and an investment of 8 million Hong Kong dollars, engaged in the import and sales of synthetic paper containing aramid materials.

In addition to reasons related to DuPont, Teijin's streamlining of its business portfolio aligns with the company's strategy and represents an important initiative to reallocate resources and focus on key areas for future development. It is reported that Teijin Aramid announced in January this year that due to competitive pressure in Asia, it plans to close its aramid fiber production facility in Arnhem, Netherlands. This is part of a series of cost-cutting measures and is deemed necessary.

As of now, with approximately 1,900 employees and 5 production facilities, the "DuPont era" (from the 1960s to the present) of the world's largest and most renowned aramid business (para-aramid Kevlar® and meta-aramid Nomex®), with a net sales of $1.3 billion (approximately 9.27 billion RMB) in 2024, has come to an end, and the global leader in aramid has changed hands.

In contrast to the "cold treatment" of aramid fiber business by foreign giants, a large number of domestic enterprises are steadily entering the market. In January this year, Sinochem International’s subsidiary Sinochem High Fiber successfully launched its aramid fiber expansion project with an annual capacity of 2,500 tons in one go, bringing the total capacity to 8,000 tons per year, which has been applied to battery box products. In February, Sinopec Yizheng Chemical Fiber New Materials (Ningxia) Co., Ltd. was established, planning an annual production of 4,000 tons of para-aramid fiber. In May, Shenghong Holding Group’s subsidiary Jiangsu Shengbang New Materials successfully launched its para-aramid fiber project with an annual capacity of 5,000 tons in one go. In June, Inner Mongolia Fengshengtai New Materials’ annual production project of 6,000 tons of meta-aramid fiber (Phase I) was put into operation.

In addition to the above, major domestic aramid-related enterprises include: Taier New Materials (16,000 tons each of para-aramid and meta-aramid), Chaomeisi (acquired by Tongyizhong), Zhongfang Special Fiber, Yizheng Chemical Fiber, Jufang New Materials, Hebei Silicon Valley Chemical, and Pingmei Shenma, among others.

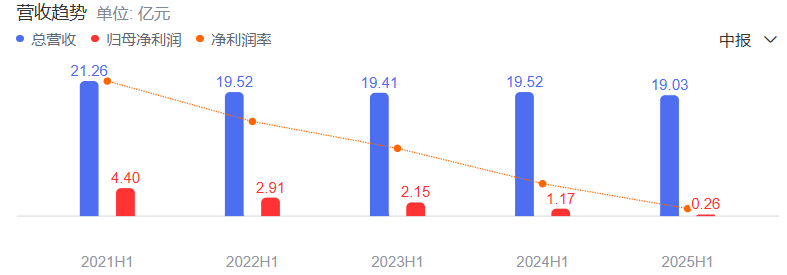

At present, there is an overall oversupply in the domestic mid- to low-end market, while there is a shortage in the high-end segment (especially for para-aramid), leading to extremely fierce competition. Taking the industry leader, Taihe New Materials, as an example, after reaching a periodic peak in 2021, its profits have declined year by year. In addition to losses from its spandex business, another reason is that the prices of the two types of aramid fibers have continued to fall since 2023.

By the first half of this year, the company's meta-aramid finally achieved growth in sales volume, revenue, and profit, with prices basically stabilizing at the stage bottom. Prices in the low-end industrial filtration sector also saw a slight increase; however, para-aramid still experienced a decline.

Facing competition, Taihe New Material is currently gaining an edge by leveraging its production capacity and technological advantages, while also fully embracing six major growth areas: new energy vehicles, smart wearables, green manufacturing, bio-based materials, information communication, and green chemicals. Its main downstream aramid products are aramid coated membranes and aramid paper. In addition, technologies such as bio-based aramid fiber development and composite membranes for electrolytic hydrogen production are under research and development.

In the first half of this year, the gross profit margin of Tahe New Material's aramid series for security, information, and new energy industry products was 32.63%, with a revenue growth of 5.36%.

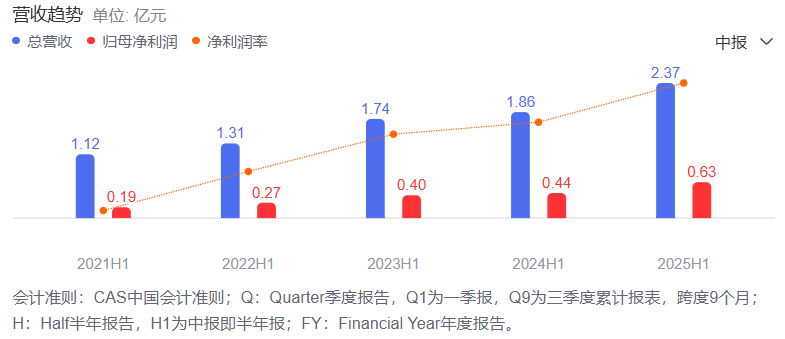

Among them, Minstar, a leading aramid paper company under its umbrella, is the best example of outstanding performance. In the first half of 2025, the company achieved an operating revenue of 237 million yuan, a year-on-year increase of 27.91%, and a net profit attributable to shareholders of the listed company of 63.0278 million yuan, a year-on-year increase of 42.28%. Its products are used in multiple rapidly developing fields such as new energy vehicles, wind power, photovoltaics, energy storage, and AI smart data centers. Moreover, the company has maintained high growth for nearly five consecutive years.

Therefore, in addition to combating "involution," fully embracing emerging industries is the true path. The rise of emerging industries in China will lead the next decade in new materials!

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track