Dongfeng Motor Corporation Delisted, "Passing the Baton" to Lantu

After an 11-day trading suspension, Dongfeng Motor Group Co., Ltd. released an announcement late at night on August 22 that sent shockwaves through the automotive industry. The announcement stated that "Lantu Motors will be listed on the Hong Kong Stock Exchange via a secondary listing, and Dongfeng Motor Group Co., Ltd. will simultaneously complete a privatization delisting." This marks the transfer of the group's market value and development responsibilities from Dongfeng Motor Group and its parent company Dongfeng Motor Corporation to Lantu Motors.

After the announcement was released, the capital market responded quickly. Dongfeng Motor Group’s ADR price once surged to $62.22, with an increase of over 91% within an hour, and finally closed at $61, representing a single-day increase of 87.69%. This reflects that Dongfeng Motor Group “making way” for Voyah Auto is in line with market expectations.

Image source: Internet

"Retreat and advance" dual operations

The core of this transaction is the simultaneous advancement of Dongfeng Motor Group’s delisting and the listing of Voyah Auto. According to the announcement, the transaction adopts a combination model of “equity distribution + merger by absorption,” with the two major steps being interdependent and carried out in coordination.

First, Dongfeng Motor Group will distribute its 79.67% stake in Voyah Automotive to all shareholders according to their shareholding ratio. Subsequently, Voyah Automotive will be listed on the Hong Kong Stock Exchange through an introduction.

The second step involves Dongfeng Motor Group (Wuhan) Investment Co., Ltd., a wholly-owned subsidiary of Dongfeng Motor, acting as the entity for the absorption merger. It will pay equity consideration to the controlling shareholder of Dongfeng Motor Group Co., Ltd., and cash consideration to other minority shareholders, thereby achieving 100% control of Dongfeng Motor Group Co., Ltd.

Image source: Dongfeng Motor

Once the relevant conditions are met, Dongfeng Motor Group Co., Ltd. will apply for the delisting of H shares. The distribution, listing, and merger are expected to be completed in a similar timeframe.

Based on the relevant valuation, the theoretical total value per H-share is approximately HKD 10.85, which shows a significant premium compared to the previous stock price but still a certain discount relative to the net asset value. In addition to the shares directly held by Dongfeng Motor, each H-share can also receive a cancellation price of HKD 6.68, with the theoretical value of Lantu H-share being approximately HKD 4.17 per share.

According to the information, introduction listing is a method for applying for the listing of issued securities. Its core characteristic is that during the listing process, no new shares are issued and no financing is conducted. Instead, the securities held by existing shareholders are directly listed for trading on the exchange.

Expectation of restructuring market value

After the suspension of Dongfeng Motor Group's stock, there have been continuous speculations about its "privatization and delisting," "dual A+H listing," and "Voyah's spin-off IPO."

There are speculations that if privatization fails, Dongfeng Motor Group will find it difficult to proceed with its A-share listing, causing the 21 billion yuan financing plan to fall through, directly restricting the development of its new energy business. Affected by the low valuation and insufficient liquidity in the Hong Kong stock market, its financing capability is limited. Although it can attempt to raise funds through the spin-off of Voyah for listing, issuing bonds, and bank loans, the scale is limited and the cost is high, making it difficult to fill the significant funding gap.

Insufficient funds will limit Dongfeng Motor Group Co., Ltd.'s investment in research and development and capacity expansion, further widening the gap with leading car manufacturers. The viewpoint suggests that if Dongfeng Motor Group cannot overcome the financing bottleneck by 2026, it may miss the opportunity for transformation and fall out of the leading ranks in the new energy vehicle sector.

Industry insiders suggest that Dongfeng Motor should adopt a "three-step" strategy: in the short term, accelerate the spin-off and listing of Voyah; in the medium term, optimize the capital structure through debt-to-equity swaps; and in the long term, deepen equity cooperation with technology companies to enhance overall competitiveness.

The image source: Dongfeng Motor Corporation

Dongfeng Motor Group Co., Ltd. also stated in the announcement that since its listing, the company has not conducted any equity refinancing, and the financing function of the H-share platform has basically been lost. As of July 31, 2025, its total market value was only HKD 39.12 billion, far below that of its competitors such as Geely Automobile and Great Wall Motor, whose Hong Kong stock market values were HKD 201.5 billion and HKD 155.2 billion, respectively.

The Hong Kong stock market generally undervalues traditional fuel vehicle companies and favors new energy vehicle companies or traditional vehicle companies with well-developed new energy businesses.

In the US stock market, Tesla's market capitalization has surpassed one trillion dollars, ranking it as the highest among global automakers. In the Hong Kong stock market, "NIO, Xpeng, and Li Auto" have all entered the ranks of billion-dollar market capitalizations, with Li Auto reaching a market value of 187 billion HKD. However, in terms of sales volume, new forces like Tesla are far below traditional car manufacturers such as Toyota and Dongfeng Motor Corporation.

Dongfeng Motor Group Co., Ltd. stated that this transaction aims to integrate resources to focus on emerging industries, achieve valuation reconstruction, and assist in its transition to the new energy vehicle industry. After the listing of Voyah, it will broaden financing channels, enhance brand image, and bring new growth opportunities for shareholders.

"Transitioning" to the future

Dongfeng Motor Group's delisting to make way for Voyah also signifies a strategic "handover" for the entire group.

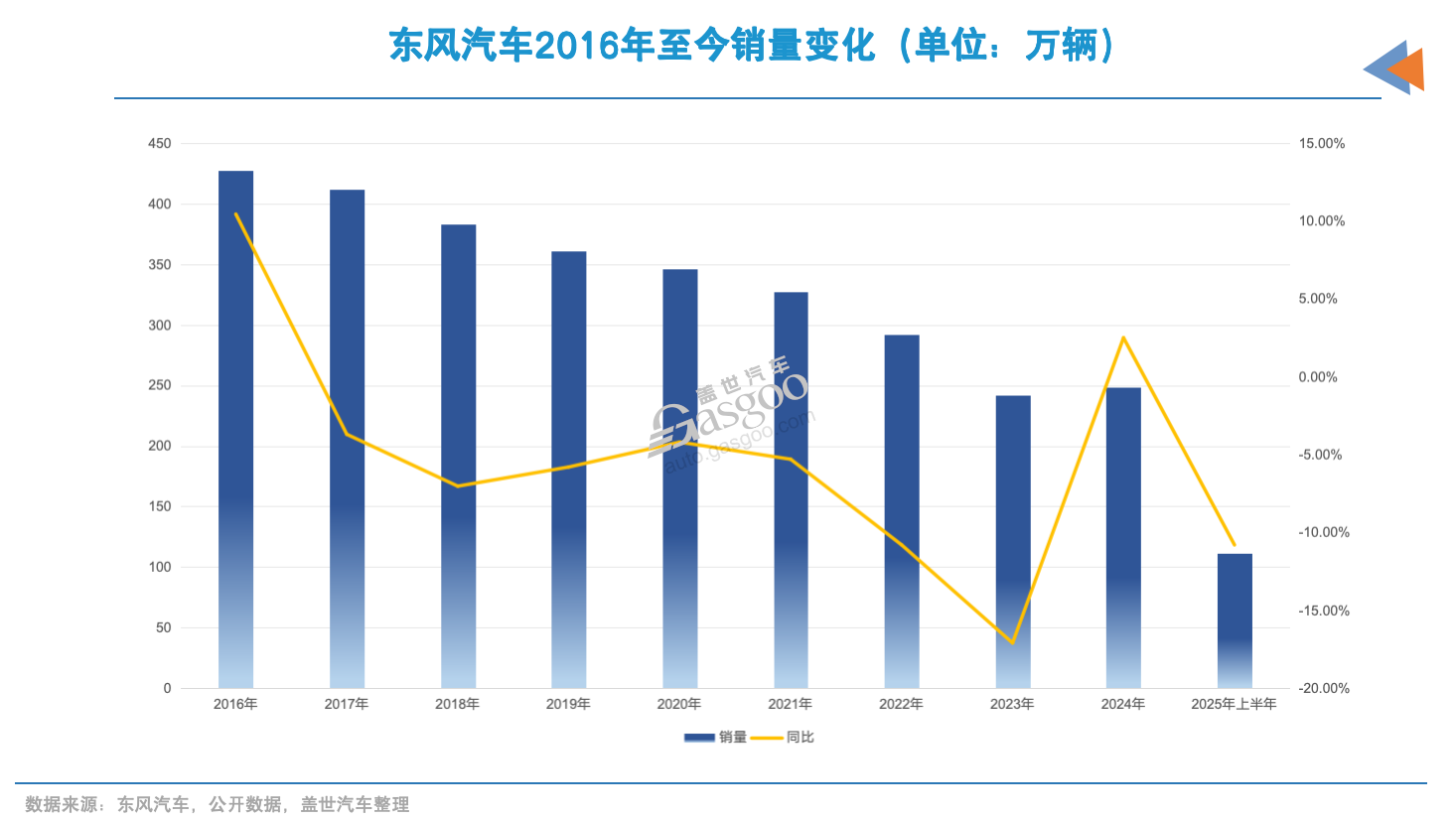

In recent years, Dongfeng Motor has been constrained by the pressures of industry transformation, with sales declining for several consecutive years. Sales have shrunk from a peak of 4.27 million vehicles in 2016 to 2.48 million vehicles in 2024, a decrease of nearly 1.8 million vehicles. In the first half of 2025, Dongfeng Motor's terminal sales reached 1.116 million vehicles, a year-on-year decrease of 10.8%, and its market share dropped from approximately 14% to 7%.

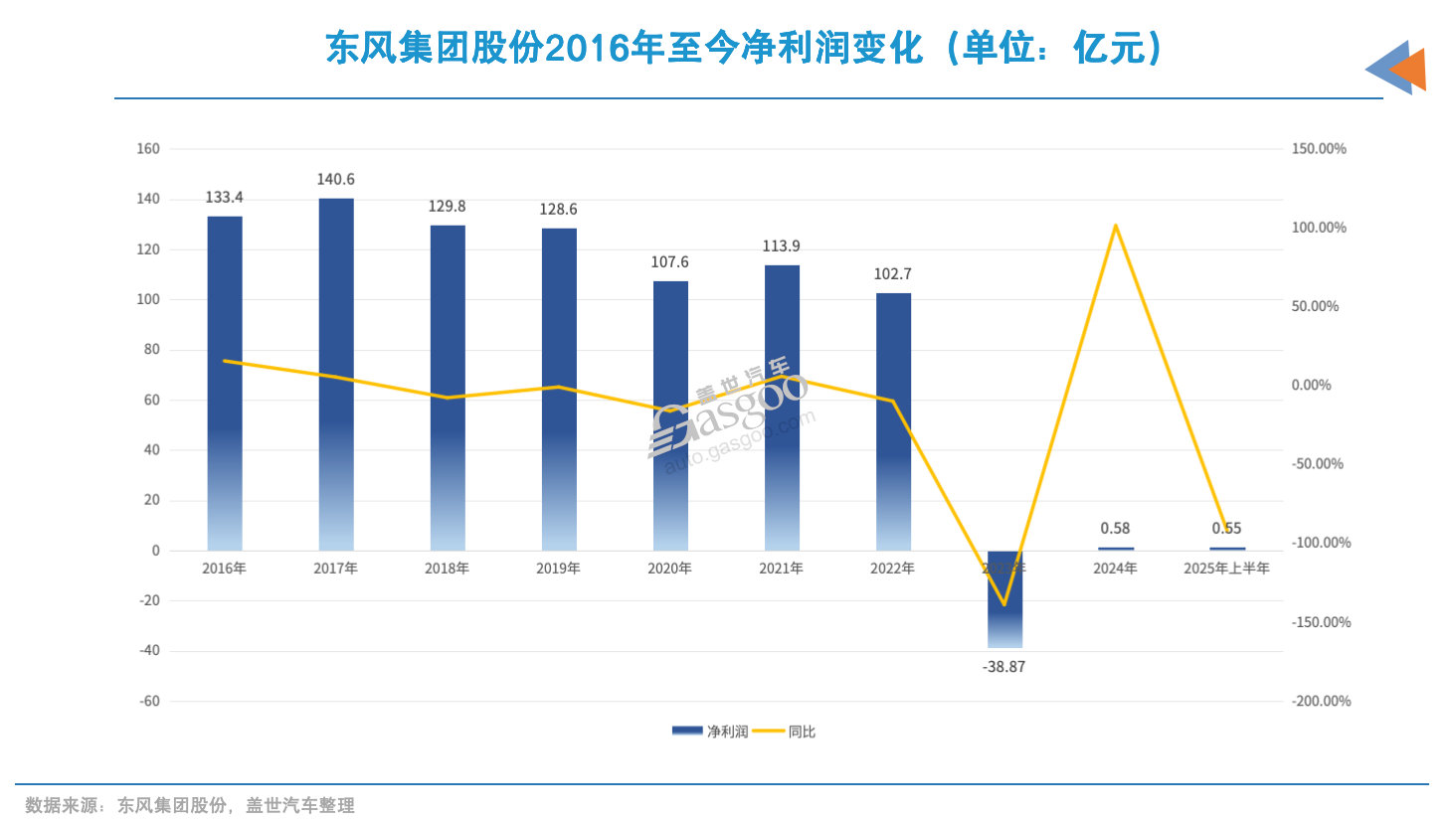

The independent brand has yet to form a profitable scale effect, coupled with the dual pressure on sales and profitability of the joint venture segment, resulting in the continuous shrinkage of profits for Dongfeng Motor Group Co., the passenger car listed entity. Since 2022, its net profit has experienced a steep decline, plummeting from 10.2 billion yuan to 58 million yuan in 2024, with a loss of 3.89 billion yuan in 2023.

In the first half of this year, Dongfeng Motor Group Co., Ltd. continued to experience a situation of "increased revenue but not increased profit": revenue reached 54.53 billion yuan, a slight increase compared to 51.15 billion yuan in the same period last year; net profit was only 55 million yuan, a year-on-year decrease of 92%.

In terms of sales, Dongfeng Motor Group sold approximately 823,900 vehicles in the first half of the year, a year-on-year decrease of 14.7%. In 2024, Dongfeng Motor Group's sales are 1.896 million vehicles, a year-on-year decline of 9.2%.

On the other hand, Voyah Auto is demonstrating strong growth momentum, with its fundamentals continuously improving. In 2024, it delivered 86,000 vehicles, a year-on-year increase of 70%. In the first seven months of 2025, cumulative sales reached 68,000 vehicles, with monthly sales exceeding 10,000 for five consecutive months. The average price per Voyah vehicle is 280,000 yuan, effectively boosting the overall gross profit level of the group.

In terms of market performance, Voyah (========) has demonstrated competitiveness in multiple segments. Since 2023, the Voyah Dreamer has repeatedly won the monthly sales championship in the new energy MPV category. The Voyah FREE+ ranks among the top three in sales for hybrid SUVs priced between 200,000 and 300,000 RMB.

In terms of profitability, CEO of Voyah Auto, Lu Fang, once revealed, "We adhere to the path of high-quality development, expecting to achieve quarterly profitability starting in 2024, and profitability in the first half of this year is more stable, which is the fastest in the industry." This means that Voyah Auto is approaching the break-even point.

In terms of long-term development, an IPO is a crucial step for the growth of new energy vehicle companies. As early as 2021, Voyah Auto proposed the "extensive use of capital markets" and is considering an independent listing in the future. This introduction to Hong Kong is seen as an important milestone in the development of Voyah Auto and carries the transformation hopes of the entire Dongfeng Motor. However, according to a relevant official from Voyah Auto, the listing date for Voyah is uncertain, with the typical cycle being around 3-6 months.

Currently, the competition in the new energy vehicle industry has evolved from manufacturing capabilities to the ecological synergy of "automobile + technology." Companies like Avatr and Seres have achieved deep integration of capital and technology by strategically securing investments from Huawei.

For Dongfeng Motor, relying solely on the group's own funds is no longer sufficient to support core technology research and development, making the expansion of financing channels a necessary choice. Whether it is new forces like "Wei Xiaoli" or traditional car companies like Changan and Seres, they have all conducted multiple rounds of financing to advance electrification and intelligentization layouts.

In May this year, BAIC BluePark, a subsidiary of BAIC Group, announced a private placement to raise no more than 6 billion yuan, which will be used for the development of new energy models (5 billion yuan) and an AI intelligent platform (1 billion yuan). NIO also announced in March that it would issue up to 119 million Class A ordinary shares to raise funds for technology research and development and to strengthen its financial position.

If Voyah Auto successfully lists on the Hong Kong Stock Exchange, it will have the opportunity to leverage the capital market to strengthen its financing capabilities and increase investment in key areas of intelligence and electrification, thereby enhancing its long-term competitiveness in the new energy market.

Dongfeng Motor Group's recent capital operation of "one exit, one entry" is not only a switch of business entities but also a re-decision of its future strategic direction. The listing of Voyah Auto in Hong Kong provides Dongfeng Motor with a new financing channel and offers more possibilities for its transformation and upgrading.

By shifting the group's focus to Voyah, Dongfeng Motor hopes to achieve a revaluation and strengthen its new energy business layout. However, whether it can continuously obtain financing through the Hong Kong stock market platform and maintain competitiveness in research and development, production capacity, and market expansion remains crucial for Voyah and Dongfeng Motor to establish a foothold in the fierce industry competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

At Least 44 Dead in Century-Old Fire! Questioning Hong Kong's Hong Fu Garden: Why Has the Path to Fire Resistance Taken 15 Years Without Progress?

-

Satellite chemical's profits surge! can the 26.6 billion yuan high-end new materials project meet expectations? a review of progress on four major projects

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Estun Turns Profitable in 2025 Half-Year Report, Industrial Robot Shipments Rank First Among Domestic Brands

-

Avatr Files for IPO on HKEX, Plans to Complete Listing in Q2 2026