Dongfeng General Manager in Position: A "Financial Expert" to Break the Deadlock

In July of this year, the State-owned Assets Supervision and Administration Commission forwarded an article mentioning that automotive central enterprises, as the "mainstay" of China's automotive industry, must focus on three main lines: stabilizing operations, strengthening innovation, and promoting reform, in the concluding year of the 14th Five-Year Plan and the deepening action of state-owned enterprise reform.

Meanwhile, faced with intense domestic competition, a complex and volatile international environment, and various risks and challenges in the industry, automotive central enterprises must plan ahead and adopt multiple measures.

There is an old Chinese saying: "Man proposes, God disposes." This saying emphasizes the importance of human initiative and effort, especially in business and management, where the majority of outcomes are influenced by human factors.

As is well known, the three major state-owned enterprises, FAW, Dongfeng, and Changan, have all experienced vacancies in the position of general manager (president). The position of general manager at FAW Group was vacant for seven months starting from August 2023 before a candidate was finally appointed. The position of president at Changan Automobile has been vacant since April this year and remains unfilled to date.

On October 11th, after being vacant for nearly eight months, the position of General Manager of Dongfeng Motor Corporation welcomed its latest appointee: Comrade Feng Changjun has been appointed as the Director, General Manager, and Deputy Secretary of the Party Committee of Dongfeng Motor Corporation, and his position as Chief Accountant of Dongfeng Motor Corporation has been revoked. Finally, Chairman Yang Qing of Dongfeng Motor Corporation has welcomed his assistant.

As industry insiders have stated, Dongfeng Motor Corporation is facing a dual challenge of external transformation and internal profitability. In this critical counterattack, the group will play the role of a "central command." Now, Feng Changjun is coordinating not only a financial "self-rescue" led by Chairman Yang Qing, but also a strategic breakthrough that concerns the future survival and development of Dongfeng.

01What problems is Dongfeng facing?

Frankly speaking, looking at the Chinese automobile market in 2025, Dongfeng Motor Corporation is at a very critical crossroads.

The joint venture sector, once the "cash cow" of the group, is no longer thriving, while the new energy business, which carries future hopes, has yet to stand on its own. This situation of "a gap between the old and the new" constitutes the deepest source of pressure for Dongfeng at present, subjecting it to severe tests on multiple levels, including finance, strategy, and internal management.

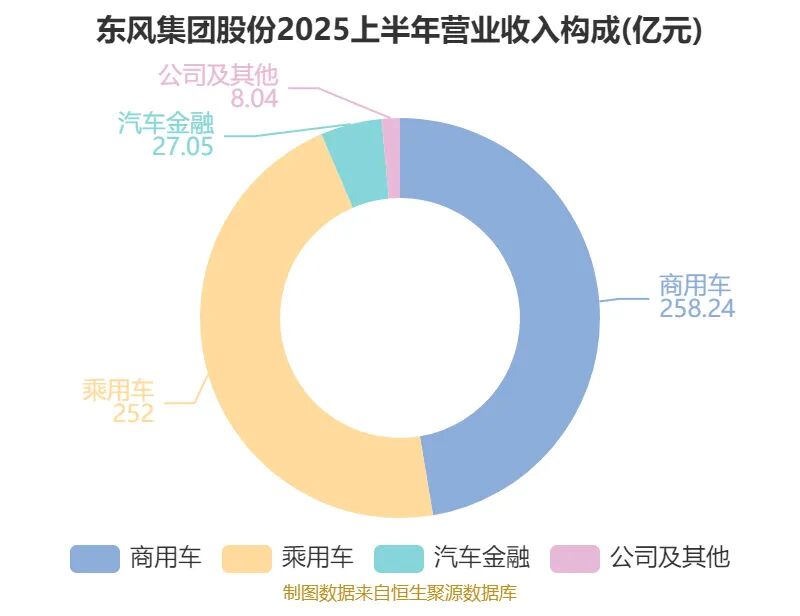

The most direct pressure is reflected in the financial data. The announcement indicates that in the first half of 2025, Dongfeng Motor Group's net profit attributable to the parent company is expected to be between 30 million and 70 million yuan, a year-on-year decline of 90% to 95%, a staggering figure.

One of the reasons behind this is the steep decline in sales of its traditional joint venture pillars. Meanwhile, to cope with intense market competition, it has invested all its valuable cash resources into research and development, brand building, channel development, and marketing in the realm of independent business.

As the traditional business, including joint venture brands, is shrinking, Dongfeng's transition to new energy, although showing growth, is not strong enough. Its high-end new energy brand, Voyah, has maintained a high year-on-year growth rate, and vehicles like M-Hero and Aeolus are also striving to establish a presence. However, when considering Dongfeng's new energy sales within the overall group framework, their proportion remains relatively low.

This means that the growth brought about by the new energy business is still not enough to fill the huge gap left by the collapse of joint venture brands. On a larger scale, although Dongfeng Motor Corporation has a strong technical reserve in the new energy field, there is still a gap in brand recognition, market responsiveness, and scalability compared to leading new forces and giants like BYD.

In addition, amid the booming wave of Chinese car exports, Dongfeng faces a significant risk of lagging behind. Compared to SAIC, Chery, Changan, and other car companies that have established considerable scale and brand recognition in overseas markets, Dongfeng's overseas business scale is relatively small. Its overseas channel network and depth of local operations still lag behind those of leading car companies.

In addition to external challenges, Dongfeng's internal strategic execution is also being tested. In June 2025, its restructuring plan with Changan Automobile was announced to have stalled, which is undoubtedly a setback at the strategic level. Although Dongfeng has taken actions, such as establishing Yipai Technology to integrate the resources of the three major independent passenger car brands with the aim of improving operational efficiency, it is still in the initial stages.

Some analyses indicate that while Yipai Technology integrates the three major mainstream brands (Fengshen, Yipai, and Nano), the high-end positioning of the Lantu brand still requires the group's continuous investment in high-end technology platforms. This may lead to internal resource competition in areas such as R&D budget and supply chain prioritization, or issues of insufficient integration of R&D resources and redundant investment by subsidiaries.

In fact, this issue is not limited to Dongfeng Motor Corporation. Companies like FAW Group and Changan Automobile, which are both focusing on high-end market positioning and aiming for breakthroughs with mainstream brands, are also facing challenges with R&D integration and resource allocation. Fortunately, after the former Chief Accountant Feng Changjun was promoted to General Manager, Dongfeng Motor Corporation seems to have found a solution first.

02The chief accountant is the best choice at the moment.

Considering the severe challenges currently faced by Dongfeng Motor Corporation, combined with Feng Changjun's professional background, a clear conclusion can be drawn: Feng Changjun's appointment is a highly targeted key personnel arrangement, and he is likely the most suitable candidate to solve the complex issues the company is facing.

Currently, Dongfeng Motor Corporation's most pressing crises are concentrated in two areas: a significant decline in profits and tight cash flow. On one hand, the traditional joint venture business is experiencing severe losses, while on the other hand, the transition to new energy requires substantial funding. Feng Changjun, as a seasoned financial expert and former chief accountant, possesses a unique advantage in addressing this core issue.

On one hand, he possesses a deep understanding and strategic continuity assurance. Since serving as the chief accountant of Dongfeng in 2020, Feng Changjun has been well aware of the company's financial situation, cost structure, as well as issues such as resource misallocation and waste. With his promotion to general manager this time, he does not need to go through a lengthy adaptation period, ensuring both the continuity of strategic execution and the immediate efficiency of decision-making.

On the other hand, he possesses outstanding capital operation capabilities. Public records indicate that Feng Changjun once led the Hong Kong stock listing of Dongfeng's subsidiary, Voyah Auto. This experience proves that he is not a traditional, conservative financial officer, but rather a strategic manager adept at leveraging capital markets to fuel the transformation of enterprises.

In the context of overall tight funding within the group, his core competency lies in how to raise funds for new energy research and development through methods such as business spin-offs and the introduction of strategic investments. Moreover, Lantu is just a part of Dongfeng Motor Corporation's passenger vehicle business, and there may be potential capital operations in the commercial vehicle sector in the future.

According to the press release from Dongfeng Motor Corporation, the automotive industry has now entered a development stage characterized by the deep integration of "technology + management + capital." Feng Changjun is a versatile leader who aligns with this trend and can provide the critical capability support needed for Dongfeng Motor Corporation to break through.

In the fierce industry competition, relying solely on technological advantages is no longer sufficient. More importantly, it is about how to accurately allocate limited resources to the most promising technological routes. Feng Changjun's experience can help him go beyond a singular technological perspective and optimize R&D resource allocation. Additionally, it is about how to balance the R&D investments of subsidiaries such as Lantu, Yipai, and Mengshi to avoid redundant construction.

This is precisely the challenge of integrating R&D resources faced by Dongfeng Motor Corporation as previously analyzed. As a manager proficient in finance and group control, Feng Changjun is able to promote the integration and optimization of the R&D system from the perspective of investment return and group strategic synergy, thereby addressing the issue of resource dispersion.

Furthermore, Feng Changjun possesses a composite ability in large enterprise group management and control, directly addressing Dongfeng Company's longstanding issues by strengthening group management and enhancing strategic execution. In the future, he is expected to drive the establishment of a more efficient financial and operational control system, streamline decision-making processes, ensure the powerful execution of group strategies in each subsidiary, and break the previous situation of each acting independently.

More importantly, in the current context that emphasizes the youthfulness of cadres, 47-year-old post-70s Feng Changjun is working alongside chairman Yang Qing, who is from the post-60s generation. This not only brings valuable youthful vitality to the leadership team of Dongfeng Motor Corporation but also helps to promote deeper reforms, allowing for a more agile response to the rapidly changing market environment.

03What kind of "Eastern Wind" does the future need?

In fact, a bigger question within the industry is why Feng Changjun, who comes from a financial background, was appointed as the general manager. In reality, in the global automotive industry landscape, it is not uncommon for individuals to grow from the financial sector into core executive roles within car companies. For example, Carlos Tavares of the Stellantis Group and Adrian Mardell of Jaguar Land Rover.

Carlos Tavares is renowned in the industry for his exceptional cost control capabilities and is known as the "cost killer." He led the merger and integration of PSA and FCA, significantly enhancing the group's profitability through efficient business synergies. During his tenure, Adrian Mardell successfully guided Jaguar Land Rover to a financial turnaround, recovering from losses and massive debts, achieving the "best profit in a decade."

These managers typically have a deep understanding of the company's capital structure, mergers and acquisitions, and investments. They are often skilled at cost reduction and efficiency enhancement, and can quickly improve the company's financial situation by streamlining operations and optimizing processes.

Certainly, some people would argue that the core challenge for managers with a financial background lies in avoiding an excessive focus on short-term financial performance that may constrain long-term development. Meanwhile, the strategic contraction adopted to cut costs could also cause the company to miss out on long-term growth opportunities. In this regard, Carlos Tavares is a typical example.

However, according to a speech by Feng Changjun at the TEDA Forum this September, Dongfeng Motor is actively promoting its "One Core, Two Foundations, Two Elements" intelligent strategy. This involves using the Taiji large model as the intelligent engine, the Tianyuan electronic and electrical architecture and Tianyuan OS operating system as the fundamental technologies for intelligence, and Tianyuan Smart Drive and Tianyuan Cabin to create a highly personalized intelligent "third living space" for users. The company aims to build an intelligent system that covers the entire chain of research and development, manufacturing, and services, continuously enhancing Dongfeng Motor's exploration and innovation in the field of automotive intelligence.

It is not difficult to see that he has a clear and profound understanding of the current situation and future goals of Dongfeng Motor Corporation, as well as the challenges faced by the automotive industry. If he can combine meticulous financial management with long-term strategic planning, ensuring the company's short-term viability while steadfastly investing in future core technologies and markets, this is exactly what Dongfeng Motor Corporation needs.

"We must have key core technologies firmly in our own hands. We should set this aspiration and elevate our national automobile brands."

At the end of the article, let's review the new requirements set by the State-owned Assets Supervision and Administration Commission (SASAC) during last year's Two Sessions for the three central automobile enterprises (FAW, Dongfeng, and Changan): separate assessment of the new energy vehicle business for these three central enterprises, with assessment criteria including technology, market share, and the future development of the enterprises.

Industry insiders believe that this series of policy relaxations addresses the concerns of these three central enterprises regarding hesitancy and reluctance to invest, and will lead to changes in various aspects such as strategy, layout, innovation, products, and corporate governance.

Since then, as everyone has seen, the three major central enterprises, including Dongfeng Motor Corporation, have begun to act more freely, both internally and externally, with frequent actions such as organizational restructuring and partnering with cross-industry companies. Perhaps this is the new image of the automotive central enterprises that the State-owned Assets Supervision and Administration Commission requires and wants to see.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track