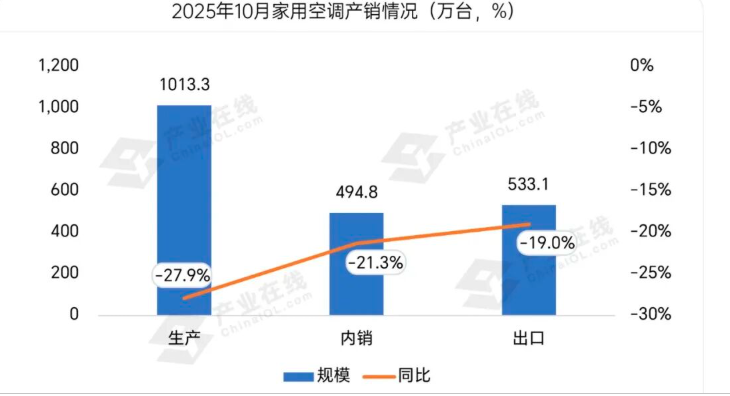

Demand Overdraft and Rising Costs Continue to Weigh on Household Air Conditioners in October

ChinaIOL

In the domestic market, the terminal sales of household air conditioners did not achieve good market results during the Double Eleven promotional season. During the event, both online and offline retail sales of air conditioners experienced a significant decline, and price wars failed to stimulate effective demand. This year's Double Eleven had the support of the fourth batch of 69 billion yuan in national subsidies, and platforms like JD.com and Suning launched joint government-enterprise subsidies and tiered subsidies. Brands such as Midea and TCL also added their own discounts, but...The prices of most popular air conditioners are higher than during the 618 shopping festival.The promotional effects did not meet expectations. Additionally, the previous national subsidies have exhausted a significant amount of demand, leading consumers to become fatigued with promotions. As a result, companies have scaled back production and adopted a more conservative strategy.

In October, the export market for household air conditioners continued to be constrained by multiple external pressures.Although markets such as Europe and Africa still have structural growth, it is difficult to offset the weakness in traditional major markets.The North American market, affected by high tariffs and transshipment trade, has continued its downward trend since the cold spell, becoming the main factor affecting the export landscape. Meanwhile, the Southeast Asian market has seen a significant downturn due to a cool and rainy summer and high inventory levels. Additionally, the instability of international trade policies has further suppressed export momentum.

ChinaIOL

In October, the production and sales of household air conditioners declined not only due to the sluggish demand in both domestic and foreign markets but also due to structural increases in costs that further exacerbated the pressure. The average price of electrolytic copper rose by over 4% during the month, with spot market prices rising in tandem. The prices of core refrigerants for air conditioners have also been continuously climbing, with the long-term price of R32 significantly increasing compared to the third quarter. As copper and refrigerants are key raw materials in air conditioner production, their price increases directly drive up manufacturing costs.

The stark contrast between high costs and terminal price wars is continuously squeezing the profit margins of the home air conditioning industry, forcing some small and medium-sized enterprises into a dilemma of "losing money whether they produce or not."

In summary, the combined effects of demand overextension, rising cost pressures, and weak domestic and foreign sales markets have led to a decline in both production and sales data for household air conditioners in October. Looking ahead, as the effects of policies gradually take hold and cost pressures ease, the industry is expected to gradually stabilize by early 2026. However, in the short term, it still needs to face the dual challenges of inventory digestion and demand restart.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories