Dawn 2025 Half-Year Financial Report Released, Masterbatch Revenue Soars Consecutively

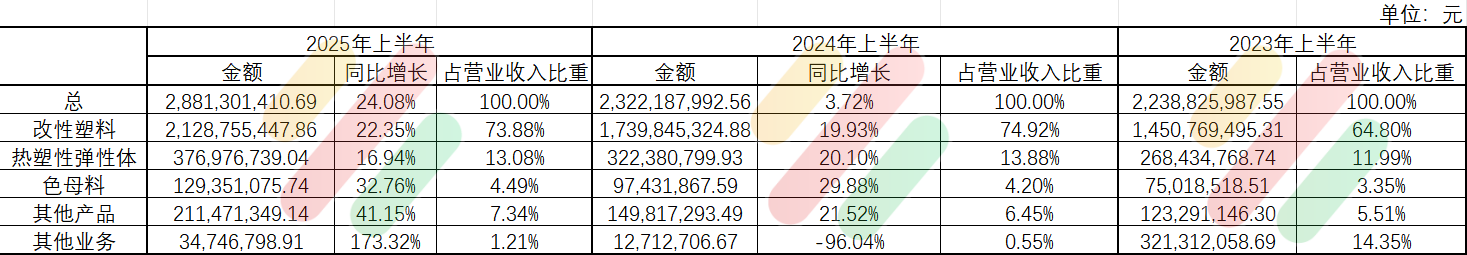

On the evening of August 25, 2025, Dawn Holdings released its 2025 semi-annual report. The data shows that the group’s total revenue for the first half of the year reached 2,881.3014 million yuan, representing a year-on-year increase of approximately 24.08%. Operating profit increased by 38.93% year-on-year, total profit rose by 33.67% year-on-year, and net profit grew by 26.14% year-on-year. Net profit attributable to shareholders of the listed company, excluding non-recurring gains and losses, increased by 41.69% year-on-year.

1. The masterbatch business continues to boom, showing strong growth momentum.

Dawn color masterbatch business has been steadily increasing in recent years. In the first half of 2024, revenue reached 97.43 million yuan, a year-on-year increase of 29.88%; in the first half of 2025, it reached 129.35 million yuan, a year-on-year increase of approximately 32.76%, with both the growth rate and magnitude improving.

This achievement is inseparable from the industrial chain layout and related party cooperation. In 2025, Dawn plans to adjust the connected transaction limits by increasing the purchase limit with Dawn Chemical by 46.7 million yuan, Daehan Dawn Shanghai Company by 30 million yuan, and Qingdao Haier Environmental Materials by 40 million yuan to ensure the stable supply of masterbatch raw materials and product sales.

In 2025, Dawn's capital operations also supported the masterbatch business. The company acquired 100% equity of Anhui Boste New Materials for 33 million yuan, enabling business expansion in fields such as masterbatch; it also plans to acquire 100% equity of Dawn Titanium and raise funds. Although focusing on the titanium industry, the group's enhanced strength and improved industrial chain can provide more resources for the masterbatch business.

2. Continuous Actions in 2025 Inject New Momentum for Development

In 2025, Dawn has been active in business expansion, technological research and development, and cooperation arrangements.

In terms of business expansion, in addition to acquiring Anhui Bost and planning to acquire Dawn Titanium, Anhui Bost is focusing on silane cross-linked polyolefin insulated cable materials. In the future, it will develop products in multiple fields such as power cables and automotive cables, forming synergy with the masterbatch business.

In terms of technological research and development, Dawn focuses on "industrial chain collaborative innovation, breakthroughs in high-end materials, and green intelligent manufacturing," organizing three major sectors of common foundations to form a technology roadmap. As of the end of the semi-annual report period, it holds 273 valid patents. It has also engaged in joint research and development with universities such as Beijing University of Chemical Technology and South China University of Technology, and has established an overseas joint laboratory with a Japanese research institute to enhance technological capabilities and improve the competitiveness of products like color masterbatches.

In terms of cooperation and layout, Daon focuses on advancing overseas expansion in regions such as Southeast Asia and Central Asia to broaden the international market for color masterbatches; it has also established an environmental materials company with Haier, participating in the revision of PCR technology standards, driving the development of color masterbatches towards environmental sustainability.

3. Outstanding Performance in Other Businesses and Significant Achievements in Coordinated Development

Apart from color masterbatches, Dawn's other businesses have also performed remarkably well.

The polymer materials business is core, with revenue of 5.446 billion yuan and net profit attributable to shareholders of 354 million yuan in the first half of 2025, representing a year-on-year increase of 17%-35%, benefiting from the growth in demand for new energy vehicles and home appliances. The company has made breakthroughs in robot simulation skin elastomer materials, with DVA material finished products meeting the standards in tire road test data. The packaging segment has also developed two core products.

In the military industry sector, the 2024 military cable materials have been supplied, and HNBR materials are used in military equipment; the acquisition of Dawn Titanium (130,000 tons/year titanium dioxide capacity) has created a synergy of "polymers + titanium dioxide." In the 5G field, the subsidiary Haier New Materials' long glass fiber reinforced PP materials are used in 5G base stations, modified plastics have entered the supply chains of CATL and BYD, and high-temperature polyester materials are suitable for 5G devices.

In digital transformation, Dawn has advanced multiple digital projects and received provincial and municipal honors in the first half of the year; in green transformation, it continues to practice environmental protection concepts; in international transformation, it focuses on multi-regional layouts to enhance international competitiveness.

Overall, Dawn Group experienced a good development trajectory in the first half of 2025. Each business segment progressed at its own pace, showing corresponding development trends. In the future, there is the potential for continued growth across multiple fields, providing a reference for the industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track