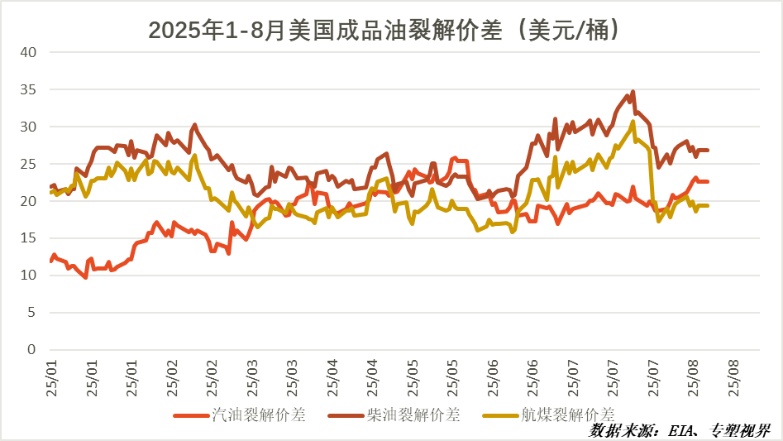

Crack spread peaks and retreats, pressure on crude oil to decline intensifies

The first half of 2025,The cracking spread in North America (represented by the United States) showsOverall fluctuating upwardThe trend reflects that the profit margin of refineries is gradually expanding.

1-7 Three main refined oil products(Gasoline, Diesel, Jet Fuel)The crack spreads have shown a significant increase, indicating continuous improvement in refining margins.I'm sorry, but you didn't provide an image or any content to translate. Please provide the text you would like translated into English.。

Among them,Diesel crack spread (dark red line) The greatest fluctuation indicates that diesel profits are the most sensitive to changes in market supply and demand.

Gasoline crack spread (red line) Steady upward movement,The trend is relatively stable, fully in line with the North American market.Seasonal patterns From the winter to the summer driving peak seasonSummerDrivingSeason) Demand analysisGradually increaseGasoline consumption increased, driving refining profits to reach the highest point of the year.

Jet fuel crack spread (yellow line) The trend is neutral.The above content translates to English as ",".The price level and volatility are between gasoline and diesel, reflecting the continued recovery and growth in demand for air travel.

North America's summer travel peakThe overall strengthening of the crack spreadMain driving force,Economic activity has also driven industrial and logistics sectors.Industry PairDemand for diesel and jet fuel.

Additionally,Refinery enters seasonal maintenance.At the time, May cause refined oil Stage appearanceNervous, lower refined oil This will exacerbate market concerns and drive up refined oil prices.,To expand the cracking spread.

Due to the change in crack spread being a leading indicator of crude oil demand, based on the recent significant decline from high levels in the crack spread, we expect...In the third and fourth quarters, international crude oil prices will face downward pressure, and the trend may be weak or fluctuate downward.

The transmission logic of crack spread (refining margin) contraction is as follows:

Faced with narrowing profits, the most direct response for refineries is to reduce processing volumes or undertake maintenance ahead of schedule. This means they will decrease crude oil purchases, directly weakening the demand for crude oil. If refinery processing volumes decline while crude oil supply remains stable, it may lead to an increase in crude oil inventories, thereby putting downward pressure on oil prices from a fundamental perspective.

The current crack spread of the three main refined oil products isAfter peaking in the early third quarter of 2025 (around July), there has been a significant decline, indicating that the momentum on the refined oil consumption side may be weakening, and the profit margins of refineries are being rapidly compressed.

Despite the bearish signal from crack spreads, crude oil prices are still influenced by the following key factors, which may alter the forecast path:

1. OPEC+ Policy: This is the biggest variable. If OPEC+ (especially Saudi Arabia and Russia) takes measures to extend or deepen production cuts, it will provide strong support for oil prices on the supply side, potentially offsetting the impact of weak demand.

2. Geopolitical Risks: Any geopolitical turmoil or supply disruptions in major global oil-producing regions (such as the Middle East, Russia) can lead to a short-term surge in oil prices.

Extreme Weather: If a North Atlantic hurricane hits the Gulf of Mexico, causing offshore oil platforms and coastal refineries to shut down, it will simultaneously affect crude oil supply and refined oil demand in the short term, resulting in complex price fluctuations.

Therefore, the judgment on the future trend of oil prices is as follows:

Baseline scenario (higher probability): In the absence of significant external interventions (such asIn the context of significant production cuts by OPEC+, given the refining margins indicating weaker refining profits and demand, it is difficult for international crude oil prices to maintain their strength in the third and fourth quarters. It is more likely that they will experience a volatile downward trend or a weak consolidation within a range.

Risk Scenario: IfOPEC+ has introduced stronger-than-expected production cuts, or significant geopolitical events may occur, which could support oil prices and keep them at high levels, or even push them higher again. However, even so, the weakness of the crack spread will limit the upside potential and sustainability of the oil price increase.

Author: Gao Xing, Senior Market Analyst

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track