Countdown to "universal social security": Which of the 400,000 Repair Shops Benefit? Who Suffers the Most?

The implementation date of the "new social security regulations" is approaching.

Strictly speaking, this is not an entirely new policy. Legally, social security contributions have always been mandatory, and there is no room for "not paying."

Starting from September 1st, for more than 400,000 auto repair shops nationwide, it will become a mandatory requirement to fully pay social insurance for employees according to the law. Any form of "negotiated waiver" or "voluntary non-payment" agreement will be considered invalid.

The strict implementation of the "pay all dues" principle means that the labor costs for auto repair shops will inevitably increase significantly, and the actual income received by employees will correspondingly decrease. It may even exacerbate the existing phenomena of pay cuts or layoffs within the industry.

From a more macro perspective, the implementation of universal social security may indirectly affect the disposable income of car owners, thereby somewhat inhibiting the consumption vitality of the automotive aftermarket.

However, in the long run, the trend towards standardization and compliance in the auto repair industry is irreversible. So, in this period of industry pain caused by the sharp increase in compliance costs, who will ultimately benefit? Who will bear the greatest impact? How should the industry respond?

01. Is there a way to avoid it?

In the past, repair shops aimed to reduce labor costs, while employees tended to prefer higher immediate cash income. The "tacit agreement" of "not paying social security" is being broken.

After the implementation of the new regulations, the following common evasion methods will be explicitly defined as illegal:

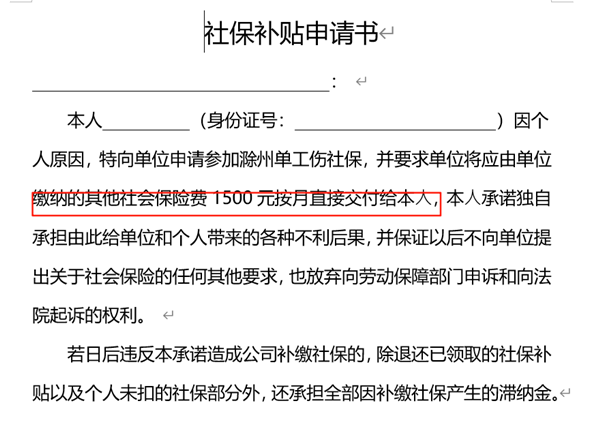

No matter whether employees "voluntarily" sign a commitment to waive social security, it is considered invalid.

Second, attempting to pay social security through a third party by fabricating an employment relationship is also illegal.

Thirdly, it is also non-compliant to pay social insurance based on the local minimum base rather than the actual salary of the employees.

Facing cost pressures, many repair shops are naturally exploring ways to circumvent them, such as signing "part-time agreements," outsourcing labor, or implementing an employee "partnership" model.

However, these paths actually hide risks: if the so-called "part-time" employee's actual working hours exceed the legal standard (such as more than 4 hours per day), even with an agreement in hand, it may still be recognized as a de facto employment relationship.

If the outsourcing company itself lacks the necessary qualifications or fails to fulfill its social security payment obligations, the repair shop, as the "actual employer," may be held jointly liable and responsible for paying wages or even compensating for work-related injuries.

Regarding the plan to make employees "partners"—for example, the repair shop invests 99.999% to bear the risk, while employees contribute labor as a 0.001% "stake," receiving a fixed "base profit" and a share of the remaining profits each month.

Past precedents indicate that if an employee is still subject to attendance management and receives a fixed salary, the court may ultimately determine that an employment relationship exists, making it difficult for the agreement to circumvent the obligation of social security contributions.

Furthermore, some repair shops are attempting to adapt by splitting employee wages into "basic salary" and "social security subsidy" components. The idea is that if an employee later sues the company for not paying social security, the company could countersue to demand the return of the accumulated social security subsidies, effectively achieving an "offset."

In a certain region, a chain once implemented this method: employees had a monthly salary of 7,000 yuan, with an actual payment of 8,200 yuan (including a 1,200 yuan social security subsidy). After working for four months, the employees initiated labor arbitration, and the court ruled that the company must pay the social security contributions. The company subsequently sued to recover the monthly 1,200 yuan subsidy and was also supported by the court.

"Of course, this is a time-consuming task," the person in charge admitted, acknowledging that not only is the process complicated, but it essentially fails to truly resolve the issue of compliance payment, merely shifting the focus of the conflict.

Who benefits? Who gets hurt the most?

For the industry as a whole, standardizing employment is undoubtedly a good thing. However, for many current auto service shop operators, this means a sudden increase in operating costs.

Rent, labor, and environmental compliance have become the "three mountains" weighing on us. In recent years, the scarcity of traffic has led to high online marketing costs, further eroding the already thin profit margins. The additional expense of full social security for all employees could very well become "the last straw that breaks the camel's back" for some stores.

Many industry insiders believe that the impact of mandatory social security will present a "spindle-shaped" distribution.

Enterprises at both ends are relatively advantageous: one end consists of companies that have long adhered to compliant operations and have a good foundation in social security contributions; the other end consists of "mom-and-pop shops" with flexible cost structures primarily run by family members.

The repair shops caught in the middle, which account for the highest proportion, are the most difficult. According to the "80/20 rule," these businesses mostly hover around the breakeven point, and they also have the highest proportion of unpaid or underpaid social security contributions. They may be forced to face the tough decision of whether to "close down" or "tough it out."

As the head of a regional chain in the West revealed to AC Auto: "In the past few years, we have gradually promoted social security compliance, and currently 71% of our employees are covered by social security, making the pressure relatively manageable."

Notably, a participation rate of 70% is considered a mid-to-high level in the industry. According to data from the "China Corporate Social Security White Paper 2024," only 28.4% of enterprises are fully compliant with the social security payment base in 2024. The situation is similarly severe in the automotive repair industry, with approximately 70% of repair shops either not paying or underpaying.

Even for large chain brands, the social insurance contribution rate of their franchisees is generally low. However, for directly operated chains, especially those operating across regions, the risk becomes even greater when faced with collective employee rights actions.

Of course, there are also opinions suggesting that the industry need not be overly anxious. Some legal experts point out that the current social security payment inspections are still primarily based on a complaint-driven approach, and proactive inspections by collection agencies are relatively rare.

Theoretically, if a company continues to not pay social security after September 1st, the risk mainly comes from whether employees file a complaint. Once an employee complains, the law will inevitably favor the protection of the worker.

Therefore, rather than passively waiting or hoping for the best, it is better to proactively communicate honestly with employees to discuss a salary adjustment plan after social security compliance and seek internal balance together.

03. Finding a Way Out Within the Regulatory Framework

An indisputable fact is that full compliance with social security is an irreversible trend, and the overall compliance costs in the automotive repair industry will continue to rise in the future. Regardless of changes in the enforcement intensity, repair enterprises must plan ahead and proactively adapt.

There are already painful lessons warning us that the fixed monthly expenditure on social security payments is, in the long run, far less than the risks brought by non-payment. For example, in Changsha, a former employee of a repair shop who returned to work for 11 months suddenly resigned and claimed double wages of over 80,000 yuan on the grounds of not having signed a labor contract. Such "professional blackmail" is not uncommon in the industry, and bosses often have no choice but to "spend money to avoid disaster."

More critically, employees lack social security protection, and in the event of a workplace injury, accidents while commuting, or incidents within dormitories, the company may face substantial medical expenses, compensation payments, and litigation risks. These potential financial burdens far exceed the costs of social security contributions themselves.

Moreover, social security compliance is just one of the many compliance challenges currently faced by auto repair companies. Compliance requirements in areas such as safety and finance are also becoming increasingly stringent, and the trend of rising operational costs is already set.

In the case of taxation, it is common in the industry for private car customers not to request invoices, for income not to be recorded, and even for payments to be received in personal accounts.

Some practitioners admit: "Currently, about 20% of customers request invoices (mostly to retain evidence), and we usually issue invoices with a 1% tax rate, which is in itself non-compliant. If the tax authorities conduct a strict investigation, the problem can easily be exposed."

In addition, irregular operations such as distributing wages through separate ledgers, discrepancies between wages and social security bases, and inflated accident repair costs may be magnified under strict regulatory environments, becoming fatal risks.

Therefore, for more automotive service companies, instead of racking their brains to evade social security obligations under the new regulations and the broader compliance trend, it would be better to proactively adjust their business strategies to cope with the inevitably rising costs.

AC Auto has previously summarized feasible directions, including: optimizing business structure, increasing the proportion of working hours, and reducing low-margin businesses; focusing on high value-added areas such as new energy vehicle maintenance, high-end vehicle specialized repair, and refined maintenance; meanwhile, striving to enhance customer trust and loyalty, and improving the professional capabilities and fighting strength of the team.

Ultimately, compliance for auto repair companies should not be seen as merely a burden. When there is a widespread tendency in the industry to evade responsibility, those companies that are the first to embrace compliance and fulfill their legal obligations are more likely to gain the trust of car owners and foster a team of more loyal employees, thereby positioning themselves more advantageously in future market competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics