Cost Supply Jointly Pushes PC Prices Up, Can "Silver Ten" Continue After the Holiday?

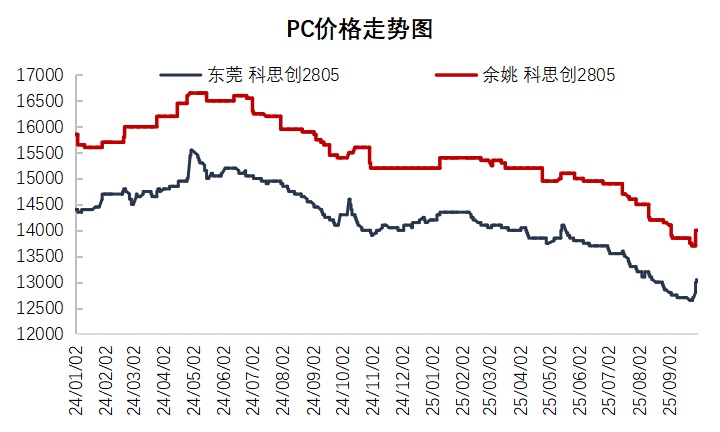

Recently, domestic polycarbonate (PC)The PC market, which had been in a prolonged slump, began a wave of volatile upward movement starting from mid to late September. The shift in the market's focus is not driven by strong demand, but rather...Cost pressures continue to increase. Maintenance expectations are concentrated on the supply side.The result of joint action. AsAs the traditional peak season of "Golden September and Silver October" enters its later stage, whether the PC market can continue its upward trend after the holiday has become a focal point of industry attention.

Cost provides strong support, supply shrinkage expectations, jointly promote.PC price increase

The core driving force behind the price increase of PC comes from strong support on the cost side and expected contraction on the supply side. As a key raw material for PC production, bisphenol A accounts for a significant proportion of production costs; approximately 0.9-0.95 tons of bisphenol A are required to produce 1 ton of ordinary PC via the phosgene method. Since late August, due to the impact of industry profit losses, some bisphenol A facilities have undergone early maintenance or reduced operating rates, leading to a tightening supply that has rapidly pushed prices up. Although the initial price increase for PC lagged, the price gap between upstream and downstream narrowed to 2400 yuan/ton, the lowest level of the year, which has significantly increased cost pressure on the industry, forcing the market to stabilize and support prices.

The shift in supply-side expectations has become another key driver of rising prices.In late September, after the announcement of the maintenance plans by enterprises such as Lihuayi Weiyuan, the market realized that the supply contraction for the fourth quarter was a foregone conclusion. According to statistics, in October, a total of 45 PC units in China will undergo maintenance, involving a production capacity of 467,000 tons. Among them, Lihuayi Weiyuan's 130,000-ton unit will undergo 45 days of maintenance, and Jiaxing Teijin's 150,000-ton unit will undergo one month of maintenance. Combined with maintenance of foreign units such as LG Chem and Thailand Mitsubishi, both domestic and foreign supplies are showing a reduction trend. Under the expectation of supply contraction, holders are reluctant to sell and are firm on prices, while traders are increasing their operations to fill the gaps, collectively pushing the market focus upward.

PC Market Outlook: Fluctuating Upward Amidst Mixed Factors

After the National Day holiday,The PC market is about to enter a critical period in October. Its trend will be the result of a three-way game between cost, supply, and demand, and it is expected to show an overall pattern.Fluctuating with a strong bias.The pattern is established, but the upward space may be limited.

1. Raw material Bisphenol A: Support remains, but upward momentum is lacking.

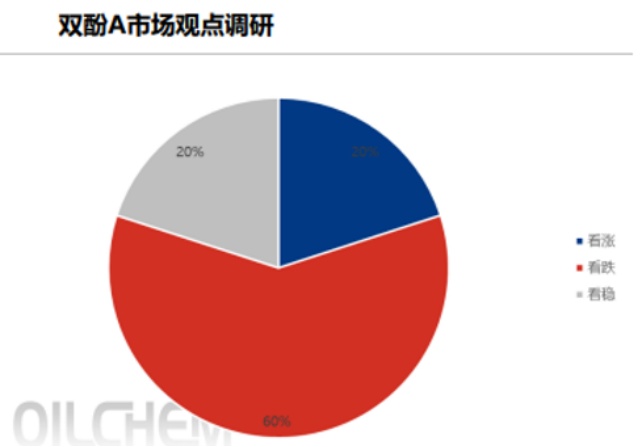

Raw material bisphenol The bisphenol A sector faces difficulties in providing sustained positive support. Although there are plans for maintenance involving three bisphenol A units, including Changchun Chemical, in October, with a total annual capacity of 770,000 tons, the overall supply in the industry remains relaxed. 60% of market participants are bearish on the October bisphenol A market, primarily due to the expected commissioning of new units combined with weak downstream demand. It is anticipated that the bisphenol A market will predominantly experience weak fluctuations in October. While the low operation level of bisphenol A may weaken the cost transmission momentum for PC (polycarbonate), the current PC price is at a historical low, which can still provide bottom support from the cost side.

2. PC Self-Supply: Certain Reduction is the Biggest Advantage

The core benefit for the PC market in October undoubtedly comes from the supply side. As mentioned earlier, the concentrated maintenance at the beginning of the fourth quarter will lead to a significant tightening of supply. In addition, inventory levels at both factories and traders are currently low, with most factories relying on pending orders for support. This "low supply, low inventory" situation gives sellers strong confidence to maintain prices, and it is expected that market quotes will still have room for increase after the holiday.

3. Downstream and terminal demand: Mild improvement, but difficult to become a strong engine.

The performance on the demand side will be the key to determining the extent and duration of the price increase.

- Downstream industry differentiation:Starting from mid to late September, orders in downstream modified industries have shown a significant improvement, leading to an increase in procurement of phosgene-based PC, which has been the main driving force behind recent market activity. However, demand from other application areas remains sluggish, with overall basic demand providing support but lacking momentum for price increases.

- Terminal Consumer OutlookIn the fourth quarter, traditional consumer electronics and home appliances enter a seasonal peak, and orders are expected to increase sequentially. The automotive industry may also accelerate production to achieve annual targets.PC demand provides certain support. However, overall, the recovery of terminal consumption is limited, making it difficult to serve as a strong driver for a significant increase in the PC market.

In summary, after the holiday.The PC market is expected to experience a volatile upward trend amid the "strong supply benefits" and the "weak demand reality."

Short term (In October, under the dual effects of cost support and reduced supply, the price level of PC will continue to rise, making the market more inclined to increase than to decrease. Pay close attention to the pricing dynamics of various factories and the actual implementation of their maintenance plans.

Medium to long term (From November to December: The market may show a "rise first, then fall" pattern. In November, due to ongoing maintenance, the tight supply situation will be maintained, and prices may continue to rise. After December, as maintenance facilities gradually restart, supply pressure will increase. If demand does not keep pace, there is a risk of price correction.

Risk Warning: Two points need close attention. One is whetherPC prices continue to rise, but cost transmission remains sluggish. The possibility of production cuts at some non-integrated PC factories may increase, which could further strengthen benefits from the supply side. Secondly, there is the downstream acceptance of price increases and the sustainability of procurement. If the demand for restocking after the holiday is quickly released and then falls into a wait-and-see situation, the market's upward momentum will significantly slow down.

Author: Zhuan Suo Shi Jie Market Research ExpertZhao Hongyan

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics