China's Invisible Car Film Market: From Import Dependence to Independent Innovation

In recent years, with the rapid increase in the number of cars owned in China and the growing consumer demand for automotive beauty, the market for Paint Protection Film (PPF), commonly known as invisible car wrap, has experienced significant growth. This transparent film applied to the car paint surface, with its excellent physical protective properties (such as scratch resistance, UV protection, and acid rain corrosion resistance), is rapidly transitioning from a high-end niche product to a mass consumer market.

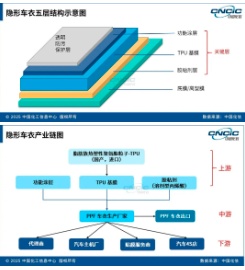

Currently, the invisible car films on the market are mainly composed of five layers, with the core functional layers consisting of the middle three layers (functional coating - TPU base film - adhesive layer) being the most important. These directly determine the protective performance, durability, and construction reliability. Studies show that vehicles equipped with high-quality three-layer structured invisible car films can reduce paint repair costs by approximately 70% compared to unprotected vehicles.

Localization process of core materials

TPU includes two types: aliphatic and aromatic. Aliphatic TPU is widely used in the production of car protective films due to its excellent yellowing resistance and weather resistance. The TPU base film is the primary cost component of the protective film. Through technological upgrades and large-scale production, leading companies have achieved significant optimization in the production costs of key materials (such as TPU base film and functional coatings).

TPU Particles: From Highly Dependent on Imports to Domestically Dominated

The current market exhibits a distinct gradient pattern: Lubrizol, Huntsman, and BASF occupy the high-end segment, Covestro holds the mid-to-high-end segment, while domestic companies are mainly concentrated in the mid-range and mass markets. According to research by China Chemical Information, although domestic TPU pellets have made breakthroughs in mass production capacity, there remains a certain gap compared to top international products in key indicators such as long-term weather resistance and batch stability. This technological gap forces domestic companies to rely on price competition to gain market share, while imported brands adjust their pricing strategies to respond to the competition, resulting in continuous pressure on industry profit margins.

Vertical Integration: Restructuring Industry Chain Competitiveness

Faced with intense market competition, some companies choose to break through industry bottlenecks with a closed-loop model. A typical example isNylonchem has established a full-chain production capability from "resin to base film to car wrap," enabling precise control over cost, quality, and delivery cycles.Although this model requires heavy asset investment, it significantly improves product consistency and supply chain stability, enabling successful entry into the North American high-end market, with exports accounting for 40% and achieving brand premium.

From 2022 to 2024, the number of TPU base film manufacturers doubled, with 20 new entrants. Notably, nearly 80% of base film manufacturers chose to extend downstream by directly entering the production of car wrap finished products. Companies such as Shanxi Dingxin, Shichuang Optics, and Jizhi Technology have compressed intermediate costs through integrated operations. In contrast, a few companies like Hanlong Technology, Kaiyang New Materials, and Boruisi adhere to a specialized base film production model, focusing on technological barriers in niche segments.

Adhesives: Domestic substitution accelerates, with a clear cost advantage.

In the production process of paint protection film (PPF), adhesive is a key auxiliary material that affects product performance, and is currently still mainly sourced externally. Industry data shows that solvent-based acrylic adhesives are the first choice for PPF manufacturers due to their excellent bonding stability, low cost advantages, and suitability for high-speed coating processes.

Currently, the adhesive segment in China's paint protection film market is highly concentrated, with four major manufacturers—Foshan Linggu, Jiangsu Guojiao, Aslan, and Henkel—accounting for approximately 80% of the market share. Notably, domestic adhesives, leveraging significant cost advantages, are accelerating the reconstruction of the local supply chain.

Self-healing coating: The technical moat of PPF products

In the core technology matrix of paint protection film, the self-healing coating directly determines the product’s market competitiveness.The current industry mainly adopts two technical paths: the PU thermosetting system, which dominates the mainstream market due to its mature process, stable performance, and mass production yield exceeding 95%; and the higher-performance UV curing technology, which is mainly used in high-end customized fields due to its stringent substrate compatibility requirements and high overall costs.As leading companies accelerate their shift toward technology-driven transformation, this niche sector is undergoing profound restructuring.

The self-healing coating market is relatively small, with around 20 manufacturing companies and a relatively fragmented and disordered production capacity. Major brands include Cashew WanHui, Tohui, Hanfei, Lihua, etc. There is little differentiation among products from various companies; price, distribution channels, brand, and after-sales service are the key competitive factors in the industry. Currently, major mainstream domestic paint protection film (PPF) brands have developed, produced, and used functional coatings in-house, while a large number of small PPF manufacturers have weak R&D capabilities. The self-healing coating industry thus has high entry barriers for small PPF companies.

With the advancement of functional coating technology upgrades, leading coating companies are increasing their investment in independent research and development, driving the industry’s transformation from production-driven to technology-driven. Currently, leading enterprises are reshaping competitive rules through vertical integration, with companies such as Nar Industrial and Nacoda establishing an integrated "R&D-production-application" system to achieve cost reduction and efficiency improvement.

Industry Chain Integration and Production Pattern

Domestic brands of paint protection films are rapidly reshaping the market landscape.Its market share surged from less than 30% in 2018 to over 60% in 2024, marking the first historic overtaking of international brands.The underlying momentum of this disruptive transformation stems from the dual competitive barriers built by local enterprises: on one hand, they continuously amplify the cost-performance advantage of their products through large-scale production; on the other hand, they compress the overall solution price of "car film products + professional installation" to 50%-70% of foreign brands by utilizing a nationwide refined construction service system. This innovative model, which deeply integrates product strength with service value in scenarios, not only significantly lowers the decision-making threshold for consumers but also marks a strategic leap in industry competition from a pure price war to a systematic value war. Amid the narrowing average industry profit margins, large-scale enterprises are still advancing capacity expansion against the trend. This seemingly contradictory layout actually implies a survival logic: consolidating market share through supply chain integration (such as the pre-cutting mode for OEMs that can shorten construction cycles) and channel bundling (with the distribution system accounting for 70%). Meanwhile, the OEM model is becoming a buffer for small and medium-sized manufacturers to absorb excess capacity.

Market Applications and Drivers

The application scenarios for paint protection film (PPF) are undergoing structural expansion, shifting from being an exclusive feature for luxury vehicles to rapidly penetrating the mainstream consumer market. In 2024, the installation rate for vehicles priced between 200,000 and 400,000 RMB has exceeded 16%, an increase of 10 percentage points compared to 2018, marking the product's transformation from a high-end luxury item to an essential automotive care product. This dual-engine market penetration is driven by the luxury car segment, which continues to maintain an average annual installation rate growth of 8%, and new energy vehicles, which, with annual sales of 12 million units (a 40% market share) and a consumer base highly receptive to new technologies, have achieved an industry-leading penetration rate of 30% to 40%.The underlying logic driving transformation lies in three major breakthroughs: the rational restructuring of product price ranges, the upgrading of consumer concepts regarding paint surface maintenance, and the establishment of a closed-loop reach enabled by a 70% year-on-year growth in online channels. Together, these factors are propelling the industry into a new era of mass consumer adoption.

Export: Seeking Incremental Growth and High Profits

Under the highly competitive domestic PPF industry, most companies choose to develop export businesses to obtain higher profits. Chinese invisible car film enterprises mainly export to Southeast Asia, North America, Europe, and Russia, further enhancing profit margins through exports.

Huaxin's Viewpoint

In the future, the paint protection film (PPF) industry will continue to maintain a rapid development trend. With ongoing technological breakthroughs and further release of production capacity, industry competition will gradually shift from price wars to contests of technology and service capabilities. Enterprises with core material development capabilities and comprehensive service systems will gain greater development space. Meanwhile, with the rapid expansion of the new energy vehicle market, the development of PPF products tailored to the specific needs of electric vehicles will also become a new direction for technological breakthroughs in the industry.Overall, China's paint protection film industry has entered a stage of high-quality development and is transitioning from following and imitating to innovation-driven leadership.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track