China's Fifth Round Collective Price Increase for Titanium Dioxide Falls Short of Consumer Market Expectations

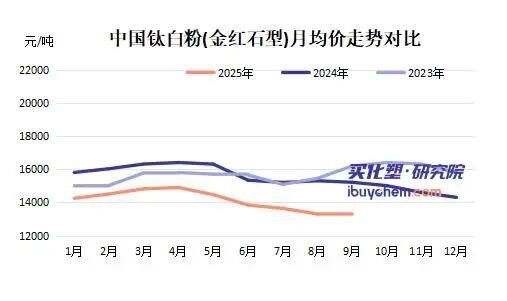

According to Huizheng Information andBuy Chemicals and PlasticsAccording to the research institute's data, from mid-September to early October 2025, Chinese titanium dioxide suppliers implemented the fifth round of price increases, raising domestic trade prices by 300 RMB/ton and export prices by 40-50 USD/ton. As a result, the cumulative increase over the five rounds reached 1900-2400 RMB/ton. However, the actual market prices compared to the same period last year and the beginning of the year have declined (the market price of rutile titanium dioxide dropped by 12.55% year-on-year and by 6.63% since the beginning of the year). This reflects the complex market contradictions behind the price increases.

Titanium dioxide is facing weak demand on the consumer end, and the price transmission mechanism is failing.The main downstream application of titanium dioxide is in architectural coatings; however, the current real estate industry is sluggish, leading to insufficient demand for architectural coatings. The competition in the terminal market is fierce, making it difficult for coating companies to pass the rising costs of titanium dioxide onto consumers, resulting in price increase notices being challenging to implement. Research from the Buy Chemical Plastics Research Institute indicates that despite multiple price hikes by companies, actual market prices have not risen but rather fallen due to weak downstream demand. This shows that the support from the domestic market is weak, and price increases are more of a "passive response" from suppliers rather than being driven by demand.

As the world's largest producer of titanium dioxide, China's export volume of titanium dioxide has declined year-on-year, with international trade barriers intensifying.From January to August 2025, China's total titanium dioxide exports amounted to 1.1901 million tons, marking a year-on-year decrease of 7.95% (a reduction of approximately 102,800 tons). Among these, the export of chloride process titanium dioxide fell by 3.38%, while the export of sulfate process titanium dioxide dropped by 8.96%. This decline partly stems from anti-dumping investigations and tariff barriers imposed by various countries on Chinese titanium dioxide (such as anti-dumping measures by India and the EU), which have obstructed exports. Meanwhile, import data also shows weakness, with total imports at 50,500 tons, a year-on-year decrease of 20.16%, indicating a deteriorating global trade environment and insufficient outward growth momentum for China's titanium dioxide.

While foreign and domestic trade are facing difficulties, the cost pressures for titanium dioxide enterprises continue to increase.The main raw materials for the production of titanium dioxide are titanium ore and sulfuric acid. In recent years, due to environmental policies, rising energy prices, and other factors, upstream costs have continued to climb. For example, titanium ore prices have remained high, and energy and environmental costs in the sulfuric acid production process have increased. Suppliers have attempted to transfer the cost pressure through five rounds of price increases, but insufficient downstream demand and market competition have led to an actual decline in market prices. This reflects that cost-driven price increases are being hindered on the demand side, compressing the profit margins of enterprises.

On September 13, Venator Asia announced the suspension of production, while some factories in Europe were closed due to the energy crisis and environmental pressures, reducing the global supply of titanium dioxide.Theoretically, this is beneficial for China's titanium dioxide exports and price increases, but the actual decline in export data indicates that weak global demand and trade barriers have offset the positive effects of reduced supply. Chinese titanium dioxide companies are trying to seize the market by raising prices, but constrained by weak domestic and export demand, global changes have not brought significant benefits.

Currently, the five rounds of price increases reflect the struggles of suppliers under pressure from costs, global supply, and internal factors. However, insufficient market demand and obstacles to exports have significantly diminished the effectiveness of these price hikes, resulting in an overall weak market. In the short term, the titanium dioxide market is likely to continue in a state of "high prices but low sales," making it difficult for price increases to be sustained. Companies need to optimize their product structure (such as developing high-end products using the chloride process) and explore emerging markets to address these challenges.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track