Celanese Shuts Down Plants While Raking In Profits? Plastic Industry Upheaval Can No Longer Be Hidden

Recently, a series of actions by the specialty materials manufacturer Celanese Corp. has drawn widespread attention in the plastics industry.

Source of image: Celanese Official Website

On one hand, in the second-quarter financial report released on August 11, Celanese reported significant net profit growth. On the other hand, the company announced the closure of its plant in Sarnia, Ontario, Canada. This plant primarily produces Vamac brand ethylene acrylic elastomers (AEM), known for their high temperature, oil, and chemical resistance. These products are widely used in plastic-related fields such as automotive seals and electronic insulation materials.

Celanese Plant Closure: A Reflection of Industry Capacity Layout Adjustment

Celanese's closure of the Canadian plant is not an isolated incident.

At the end of 2022, Celanese acquired the Vamac elastomer product line from DuPont Co., and now the company is closing the production plant for this product, reflecting its determination in business integration and strategic adjustment. The company stated that the closure of this plant, as well as a plant in Switzerland that produces redispersible polymer powders, will save the company $5 million to $10 million in costs by 2026. The related production capacity will be "integrated into existing production facilities."

From an industry perspective, similar capacity consolidations are not uncommon. In recent years, with changes in the global economic situation and intensified market competition, the capacity structure of the plastics industry has been in a state of dynamic adjustment. Some high-cost, low-efficiency capacities have gradually been phased out or consolidated, while production facilities with cost and technological advantages have been continuously expanding capacity or undergoing technological upgrades. Celanese's closure of its Canadian plant is partly aimed at reducing costs to cope with the current weak demand in the end market; on the other hand, it is also reassessing its competitive position in the global plastics market. By optimizing its capacity layout, Celanese aims to concentrate resources on developing its core business and improving overall operational efficiency.

The adjustment of this capacity layout will also have a profound impact on the supply chain of the plastics industry. For downstream companies relying on Vamac elastomers, there may be short-term challenges regarding changes in supply channels and the stability of raw material supply. These companies may need to reassess their suppliers and adjust procurement strategies to ensure production continuity. From a long-term perspective, capacity integration within the industry is expected to promote the optimization and upgrading of the supply chain, fostering closer and more efficient cooperation among enterprises, thereby enhancing the resilience and competitiveness of the entire plastics industry supply chain.

Celanese Performance Analysis: Mixed Conditions in the Plastics Industry

In the second quarter financial report, Celanese showed a significant increase in net profit. Data indicates that Celanese's net profit for the second quarter was $202 million, a notable improvement from the first quarter's $17 million loss, and a 32% increase from $153 million in the same period last year. Total revenue was $2.532 billion, a 5% increase from the previous quarter, but a 4% decrease compared to the same period last year. Adjusted earnings per share were $1.44, a 153% increase from $0.57 in the previous quarter, and a 39% decrease from $2.38 in the same period last year, but still exceeding the S&P Capital IQ analysts' expectation of $1.40.

Celanese attributed the quarter-on-quarter growth to self-help measures, including the previous divestiture of non-core assets (such as the electronic materials business Micromax) and multiple pricing strategies. However, despite these positive factors, there are still concerns about the performance of the plastics-related business segment.

The demand for the Engineering Materials (EM) and Acetyl Chain business segments, as important parts of the plastics industry, remains weak.

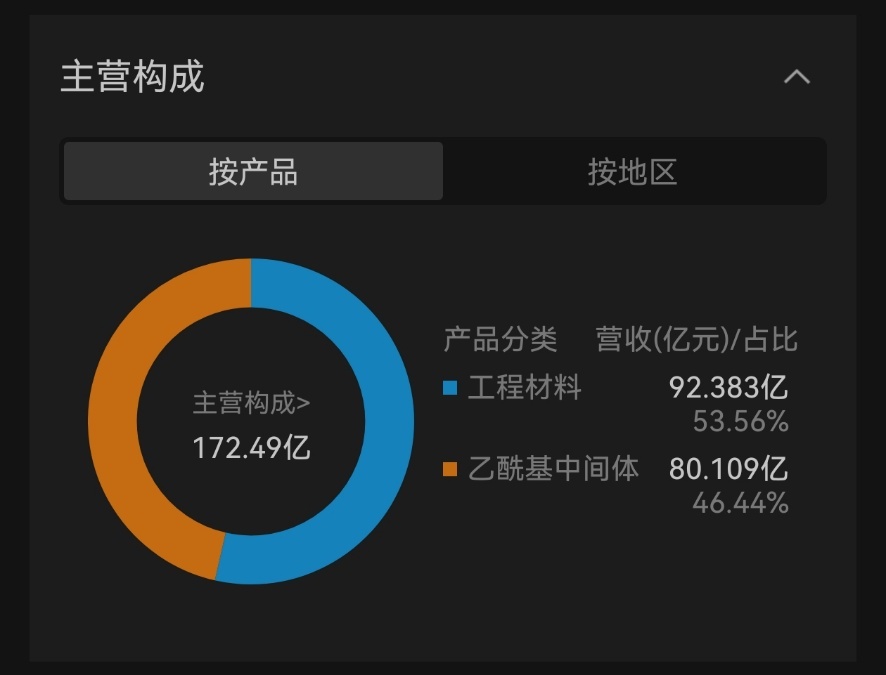

Image source: wind

Scott Richardson, President and CEO, pointed out, "The development of key engineering materials end markets such as automotive, industrial, and electronics is generally in line with expectations, with demand remaining below normal levels. The acetyl chain's main end markets have faced greater resistance due to continued weakness in areas such as paints, coatings, and construction. Additionally, the rebalancing of customer inventories for acetate tow did not ease as expected this quarter, and we anticipate that demand will remain weak for the rest of the year."

From the perspective of specific business segments, the Acetyl Chain segment reported adjusted EBIT of $196 million, up 17% from $168 million in the previous quarter. Total sales amounted to $1.1 billion, remaining flat compared to the previous quarter, as declines in volume and price were offset by currency effects. This business segment is facing weak demand in major end markets, particularly in Asia, where oversupply in the Chinese market has exacerbated the issue.

The adjusted EBIT for the engineering materials business segment was $214 million, a 70% increase from $126 million in the previous quarter, with sales of $1.4 billion, representing a 12% growth. Although the sales volume slightly improved compared to the previous quarter due to the alleviation of destocking pressure in the European automotive sector, order volumes began to weaken in June, particularly in Europe and China, and this trend continued into the early third quarter.

Celanese's performance reflects the current complex situation faced by the plastics industry. On one hand, companies have somewhat improved their financial status through proactive self-rescue measures, demonstrating the industry's resilience. On the other hand, the continued weakness in end-market demand, especially in key areas such as automotive, construction, and electronics, still exerts significant pressure on the development of the plastics industry. This indicates that there are no clear signs of recovery in demand yet, and companies still need to focus on cost control, market expansion, and product innovation.

Future Outlook of the Plastic Industry: Challenges and Opportunities Coexist

Looking ahead, Celanese expects demand in most major end markets to slow down in the second half of 2025.

"Taking these dynamics into account, and our intention to release cash by reducing inventory, we expect adjusted earnings per share for the third quarter to be between $1.10 and $1.40," Richardson stated. This forecast also reflects the challenges facing the entire plastics industry in the future.

From the demand side, the uncertainty of global economic growth and the complexity of the trade environment will continue to impact the end-user demand in the plastics industry.

Automobile industryDespite the new opportunities for plastic applications brought by the development of new energy vehicles, the overall growth rate of the automotive market has slowed down. This is especially true in some traditional automotive powerhouses, where there is limited growth in demand for plastics used in auto parts.

Construction industryThe adjustment of the real estate market and the strengthening of environmental protection policies have put some pressure on the demand for construction plastics.Electronics industryWith the rapid pace of updates and iterations in electronic products, there is a demand for high-performance, lightweight plastic materials. However, the market competition is also extremely fierce.

However, within challenges lie opportunities. With the concept of sustainable development gaining traction, the pace of innovation in the plastics industry regarding green and environmentally friendly practices is accelerating. More and more companies are investing in the research and development of eco-friendly products such as biodegradable plastics and recycled plastics to meet the market demand for environmentally friendly materials. For example, some companies have improved the efficiency and quality of plastic recycling through technological innovation, reduced production costs, and paved new paths for the sustainable development of the plastics industry. At the same time, the development of emerging technologies has also brought new application scenarios to the plastics industry. The rise of technologies such as artificial intelligence and the Internet of Things has driven the development of smart appliances and smart homes, which demand higher performance and appearance standards for plastic materials, providing opportunities for product upgrades and innovation for plastic enterprises.

Moreover, from the perspective of regional markets, emerging economies have enormous market potential. With the rapid economic development and improvement in living standards in these economies, the demand for plastic products is showing a rapid growth trend. Infrastructure construction and consumption upgrades in these regions provide a broad market space for the plastic industry. Plastic companies can enhance their presence in emerging markets, expand sales channels, reduce dependence on traditional markets, and improve their risk resistance capabilities.

Celanese's decision to close factories and its performance vividly reflect the current state of development in the plastics industry. Against the backdrop of a complex and ever-changing global economic landscape, the plastics industry is undergoing deep adjustments and transformations. The optimization of capacity structure, adjustment of demand structure, and transition to green and environmentally friendly practices will be key directions for future development.

Edited by: Lily

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track