Ceasefire Agreement Between Israel and Palestine Leads to Drop in International Oil Prices; Plastic Futures Main Contract Experiences Volatile Adjustment

1. Overnight Crude Oil Market Dynamics

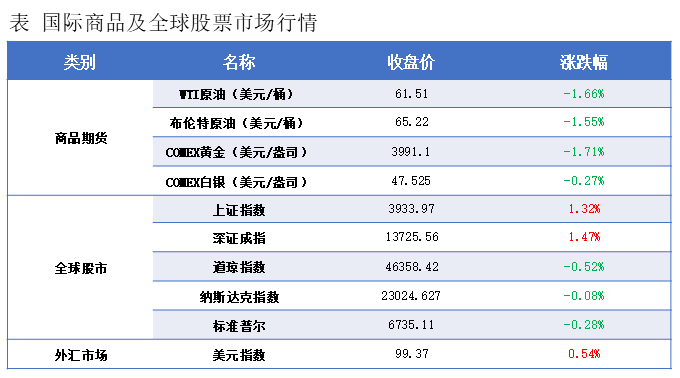

The Israeli-Palestinian sides have reached a ceasefire agreement, which has eased the instability of the geopolitical situation, leading to a decline in international oil prices.Crude oil futuresFor the November contract, it was $61.51, down $1.04 per barrel, a month-on-month decrease of 1.66%; for the ICE Brent crude futures December contract, it was $65.22, down $1.03 per barrel, a month-on-month decrease of 1.55%.

Future Market Forecast

On Thursday, oil prices plummeted, and on the first trading day after the holiday in the Asian session, the domestic crude oil sector experienced a slight correction. Although the absolute drop in oil prices during the National Day holiday was not significant, crude oil still led the energy and chemical sectors to become one of the weakest performing sectors among commodities. During the night session, oil prices continued to decline sharply, and other risk assets such as gold, silver, copper, and cryptocurrencies also fell significantly from their highs. With the conflict in Gaza cooling down as Hamas and Israel reached a first-phase ceasefire agreement, geopolitical tensions eased, and the US dollar rebounded from its low, prompting some funds to take profits and exit from risk assets.

The new batch of sanctions announced by the U.S. Department of the Treasury includes Rizhao Seahua Terminal Co. and Shandong Jincheng Petrochemical Group. Since the beginning of the year, the U.S. has sanctioned several ports and local refineries involved in Iranian crude oil. However, the actual effect of its attempts to cut off Iranian crude oil exports has been very limited. Iranian oil exports have not seen the significant reduction feared at the beginning of the year. Reports after September indicate that the decline in China's imports of Iranian crude oil is more due to the tight annual quotas for local refineries. Currently, the market has a consensus expectation that the crude oil market will face surplus pressure in the fourth quarter. However, there is a significant difference of millions of barrels per day between optimists and pessimists regarding the degree of oversupply. We have noticed that although land-based inventory pressure in the crude oil market has not been significant since September, offshore oil has accumulated significantly, exceeding 130 million barrels and reaching a new high for the year. It is expected that the crude oil market will face considerable surplus pressure in the fourth quarter.

In the context of an oversupply, investors will also face geopolitical disturbances and macroeconomic influences, leading to unstable market sentiment. This means that the rhythm of oil prices is variable. The surge in risk assets during the National Day holiday and the sudden sharp decline from high levels during last night's session are typical manifestations of this. Such uncertainty increases trading difficulty. From a technical perspective, after a brief rebound correction, oil prices show signs of continued weakness. When participating in the market, it is important to remain patient and strengthen rhythm control. Until factors that can reverse the oversupply situation emerge, it is still recommended to maintain a strategy of selling on highs for the remaining period of the year.

Section 2: Macroeconomic Trends

1. Federal Reserve - ① Williams:Support further interest rate cuts1. The labor market may further slow down. 2. Bullard: We should be cautious about rate cuts; the current rates are moderately restrictive. 3. Kashkari: I essentially agree with everything Bullard said.

2. U.S. media: The Bureau of Labor Statistics recalls some employees for staffing.CPI report expected to be released during government shutdown.。

3、The first phase of the Gaza ceasefire agreement has officially come into effect.Trump said he would go to Egypt to attend the signing ceremony of the Gaza ceasefire agreement.

Central Bank of Congo (DRC) Governor: The central bank will take action as gold prices soar.Establish gold reserves。

5. Sanae Takaichi, President of Japan's Liberal Democratic Party:No intention of causing excessive depreciation of the yen.。

The Shanghai Composite Index has surpassed the 3900-point mark for the first time in a decade.

The Ministry of Foreign Affairs: China and India will resume direct flights by the end of October this year.

During the National Day and Mid-Autumn Festival holiday, there were 888 million domestic trips, with total spending exceeding 809 billion yuan.

The Ministry of Commerce: Foreign entities such as counter-drone technology companies will be placed on the unreliable entity list.

The National Development and Reform Commission issued an announcement on managing disorderly price competition and maintaining a good market price order.

The Ministry of Industry and Information Technology and two other departments have adjusted the technical requirements for new energy vehicle products eligible for vehicle purchase tax reductions for the years 2026-2027.

The Ministry of Commerce announced the decision to implement export controls on technologies related to rare earths and on rare earth items abroad.

The Ministry of Commerce and the General Administration of Customs have implemented export controls on certain items related to medium and heavy rare earths, lithium batteries, and artificial graphite anode materials, which have obvious dual-use military and civilian attributes.

3. Early Morning Trends in the Plastics Market

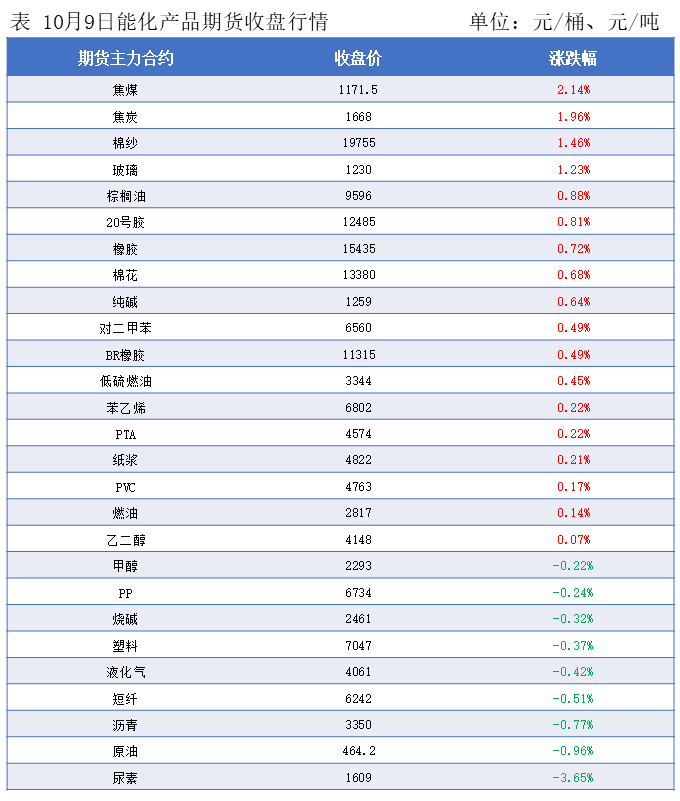

Oil prices have significantly declined! Overnight, the main contracts of domestic plastic futures fluctuated and adjusted.

The plastic 2601 contract is priced at 7047 yuan/ton, down 0.37% from the previous trading day.

The PP2601 contract is quoted at 6,734 yuan/ton, down 0.24% from the previous trading day.

The PVC2601 contract is quoted at 4,763 yuan/ton, up 0.17% compared to the previous trading day.

The styrene 2510 contract is reported at 6802 yuan/ton, up 0.22% from the previous trading day.

Section 4: Market Forecast

PE: From the supply side, the stability of PE plant operations is good, with no dynamics of plant shutdowns or production resumption, maintaining a stable supply scale. However, due to the inventory accumulation during the previous holiday, the overall market inventory pressure has increased, so suppliers mainly focus on "actively reducing inventory" as their core operation, proactively expressing their willingness to release shipments. From the demand side, downstream factories are holding a wait-and-see attitude toward the current market, with limited willingness to receive goods, only engaging in "buying at low prices," without any extra restocking beyond essential needs. The lackluster performance on both supply and demand sides, combined with the absence of clear favorable factors to boost the market, collectively restricts market activity. Overall, there are no substantial signs of recovery in downstream demand, and essential procurement is insufficient to support market rebound. In the absence of new favorable stimuli, the market is unlikely to show significant improvement, and it is expected that the polyethylene market may continue a "weakly fluctuating" trend in the short term.

From the perspective of supply and demand, the PP (Polypropylene) facility at Yangzi Petrochemical is expected to resume production today with a capacity of 200,000 tons. Coupled with the de-stocking pressure that exists after the holiday, the current market is primarily adopting a strategy of price reduction for de-stocking. Although it is peak season, the market has not shown typical peak season trends, with a lack of significant increase in downstream orders. Enterprises are not highly motivated to restock, and the procurement side is mainly adopting a "buy at low prices, fulfill immediate needs" strategy. In summary, the release of new production capacity combined with the need for de-stocking, while the downstream demand has yet to show substantial recovery, means the market lacks upward momentum. Price reduction for de-stocking will continue to be the mainstream operation in the market, with prices unlikely to have significant rebound space. It is expected that the polypropylene market may continue a weak and volatile trend in the short term.

PVC: Currently, there is no significant support for PVC in terms of supply and demand. PVC production facilities are operating at high capacity, ensuring stable supply and abundant availability of goods. However, demand has not shown any improvement, and transactions continue to lean towards low-end pricing. Although both the futures and spot markets saw a decline in prices on Thursday, priced goods still hold a price advantage. Downstream purchasing enthusiasm has increased, and compared to pre-holiday periods, priced transactions have clearly improved. The spot market overall is exhibiting a trend of buying on dips rather than on rises. As of now, there is no significant shift in domestic policy news. On the international front, oil prices have risen to a one-week high, as traders expect that the lack of progress in the Ukraine peace agreement will maintain sanctions on Russia. Additionally, a weekly report indicates growth in U.S. oil consumption. Overall, in the short term, the PVC spot market might continue to struggle at low levels.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track