Can a "Bare-Bones" Model 3 Priced at 100,000-Plus Yuan Help Tesla Make a Comeback in China?

2025 will undoubtedly be a somewhat "disappointing" year for Tesla.

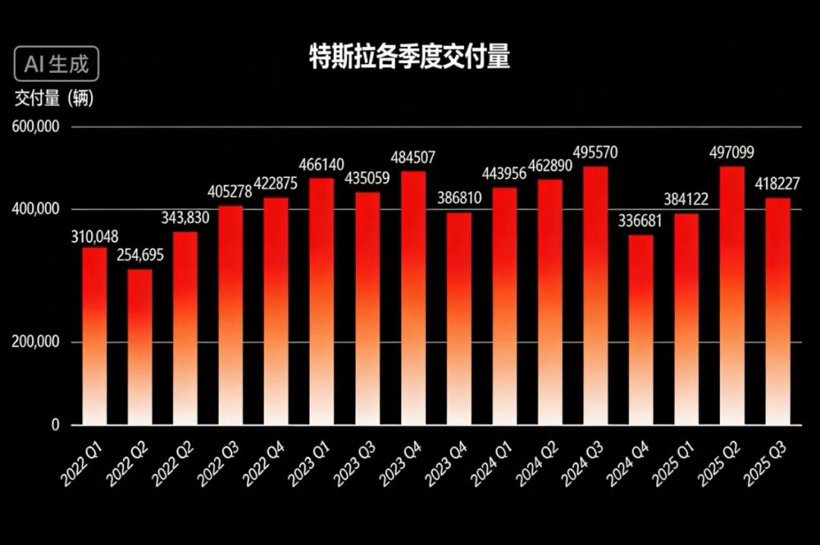

The most fundamental reason is the global delivery performance of 1.636 million vehicles, which again showed a year-on-year negative growth after 2024, with a decline exceeding 8%. This is a significant drop from the peak of 1.808 million vehicles in 2023.

Looking deeper, the successive "loss of ground" across the three major battlefields of China, North America, and Europe has sounded a definitive alarm for this American NEV manufacturer.

Taking the first sector as an example, since localizing production in China by establishing a factory, Tesla has enjoyed smooth sailing in the world's largest auto market, reaping ample domestic demand and relying on this stable production base for continuous external supply.

Alas, the high-speed growth of the past 365 days has been put on hold.

According to statistics from the China Passenger Car Association (CPCA), Tesla's retail sales in the Chinese market were only 625,000 vehicles, a year-on-year decrease of 4.78%. Including exports, wholesale sales were 851,000 vehicles, a year-on-year decrease of 7.08%.

Obviously, the aggressive moves of many independent brands have led to increasing product-level competition, making it very uncomfortable for it due to its slower pace of self-iteration. To put it more bluntly, the days of buying nothing but Model 3 and Model Y are over. Whether it's mid-size pure electric sedans or mid-size pure electric SUVs, there are more and more new options emerging.

From Tesla's perspective, this situation is undoubtedly tricky and urgent. Because, if it continues to fall into an increasingly large decline in China and loses the strategic support of this critical territory, the resulting chain reaction will inevitably be devastating.

Perhaps precisely because of this background, it's noticeable that Tesla is "getting anxious" entering 2026. In other words, it's trying to achieve a "strong start" through various incentive policies.

The first major move, on January 6th, Beijing time, was to introduce a "five-year interest-free" plan for the six-seater Model Y L. Simultaneously, for the first time, a "seven-year ultra-low interest" plan was launched for the rear-wheel drive, long-range rear-wheel drive, and long-range all-wheel drive versions of the Model 3 and Model Y, as well as the six-seater Model Y L.

The latter in particular quickly sparked a heated discussion among everyone.

Because, taking the Model 3 rear-wheel-drive version as an example, the current official website price is 235,500 yuan. Without adding any optional extras, the down payment is 79,900 yuan, the loan is 155,600 yuan, and the monthly payment is 1,918 yuan. The loan is divided into 84 installments with an annualized fee rate of 0.5%, which translates to an annualized interest rate of 0.98%. The annual principal and interest only cost around 800 yuan, and the total interest for 7 years is only over 5,000 yuan.

Undoubtedly, Tesla's "7-year ultra-low interest" scheme has once again significantly lowered the barrier to entry. It is highly suitable for consumers with tight initial budgets who seek low monthly payments and plan for long-term ownership, as well as users who have better investment opportunities for their capital, given that the 0.98% annual percentage rate is far lower than the 4%-8% typically found in the market for auto loans.

Meanwhile, as of now, many domestic brands have followed suit with policies, but in terms of annualized rate alone, Tesla remains the most sincere. This also indirectly reflects the determination of this American new energy vehicle company to emerge from its current difficulties in China as soon as possible.

And just recently, Tesla wielded its second axe.

Beijing time January 24th, it was officially announced that from now until February 28th, a limited-time insurance subsidy of 8,000 yuan is available for the purchase of certain Model 3 models.

On January 24, Tesla officially announced that from now until February 28, customers purchasing select Model 3 variants can enjoy a limited-time insurance subsidy of 8,000 yuan.

In fact, this American EV maker has a penchant for this type of promotion and it has even become a regular weapon to boost sales.

The underlying logic is quite simple: if Tesla were to opt for direct price cuts, it would inevitably trigger dissatisfaction and protests from existing owners. In contrast, by offering insurance subsidies and low-interest financing, the company provides tangible benefits to new customers while mitigating the impact on its brand image and pricing structure.

Of course, the cost is sacrificing some of the gross profit margin. But at this crucial juncture where the involution is intensifying, for Tesla, maintaining its existing market share in China and striving to expand it is more important than anything else. A temporary decline in profitability is completely acceptable.

In 2026, its most crucial ace in the hole in the Chinese market will fundamentally be – the "budget version" Model 3 and Model Y, and what kind of performance report card it can achieve.

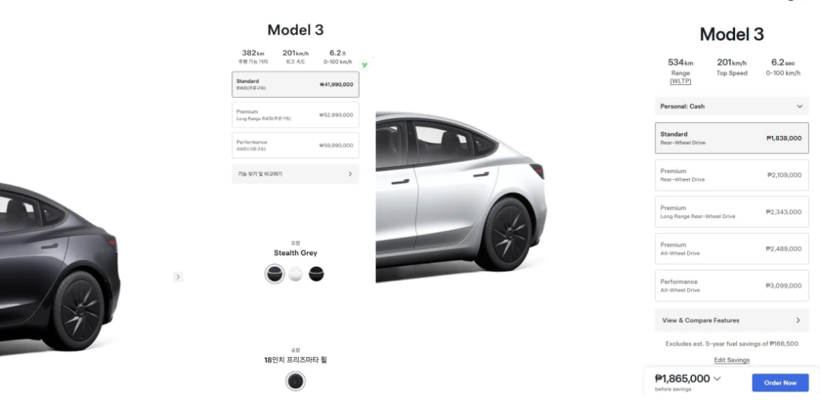

As early as the end of 2025, the two "precisely targeted" new cars mentioned above had already sparked considerable anticipation. Little did people know that just yesterday, the "budget-friendly" Model 3, tasked with spearheading the charge, made a surprise launch in several Asian countries including South Korea, Thailand, and the Philippines.

It is reported that this contestant, produced in the Shanghai factory, has undergone significant simplification in terms of configuration: reduced range, downsized battery, lower power, and deletion of comfort features such as audio, electric seat adjustment, and ambient lighting, with only core safety features retained.

In the eyes of many, the standard Model 3 is already a "blank canvas," so the "cheaper" Model 3 is like the "most basic of the basic." However, the simple and easy-to-understand principle remains: "Thanks to the strong appeal of the brand, as long as the final pricing is right, there will still be many people willing to pay for a Tesla."

Looking at the results, the "cheaper" Model 3 is currently priced at only 41.99 million Korean won in South Korea, equivalent to approximately 198,000 RMB. After local subsidies, the actual purchase price drops to 174,000 RMB. In contrast, the price in the Thai market is equivalent to 254,800 RMB, and in the Philippine market, it is equivalent to 217,000 RMB.

In addition to the aforementioned three countries, the "cheaper" version of the Model 3 has also been launched in the United States, the United Kingdom, and the Middle East. This leads to another question of great interest: "When will it be officially launched in China?"

The answer is clear, the arrow is on the string.

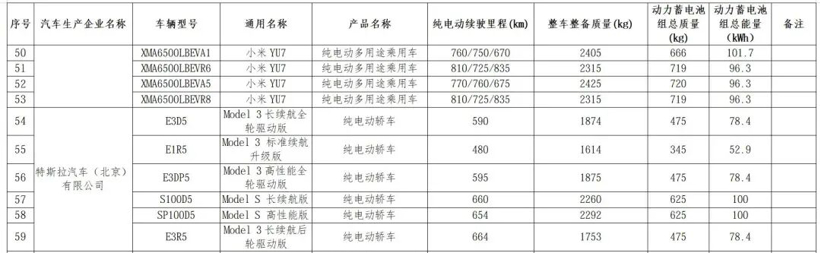

This is because, based on recent leaks this month, a "budget version" of the Model Y briefly appeared on the home charging page of Tesla China’s official website; meanwhile, a "budget version" of the Model 3 quietly surfaced in the latest batch of the Ministry of Industry and Information Technology's tax-exemption catalog under the name "Standard Range Plus."

Based on my understanding of this American new energy vehicle company, the former is likely still some time away from being released, while the latter has already entered the final countdown. I boldly predict that the "affordable" Model 3 will most likely meet Chinese consumers before or after the Spring Festival holiday.

So, how would it be priced?

Based on the current Model 3 rear-wheel-drive version priced at 233,500 yuan, it is expected that the "cheaper version" could break into the sub-200,000 yuan price range. As another benchmark, the price difference between the two in the North American market translates to over 38,000 yuan in Chinese currency.

Moreover, China has long been the market segment with the lowest average transaction price for Tesla’s global products. Whether considering internal or external factors, sentiment or logic, the mission-critical "budget version" Model 3 should demonstrate sufficient competitive edge in its pricing.

Only in this way can there be hope for this American NEV company to turn things around in China in 2026.

Additionally, it is worth noting that at the recently concluded Davos Forum, Elon Musk dropped a bombshell: "We hope to get approval for supervised FSD (Full Self-Driving) in Europe, ideally next month, and China might be around the same time."

The implication is that, in addition to the "cheaper" Model 3, we will soon welcome the release of the "full-featured" FSD. Whether Tesla can re-establish product appeal and freshness with a leading intelligent driving experience by 2026 is crucial to its success.

Whether admitted or not, the car-making business remains the driving force propelling other new ventures forward. Over the past two years, sluggish global sales have made it difficult for Tesla to enter the virtuous cycle it originally anticipated, even creating an outside perception of "losing sight of one thing while attending to another."

2026, it's time to reclaim what was lost...

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers