Byd's revenue surpasses tesla, but chinese automakers' total profit may be less than half of toyota's?

The comfortable days of traditional state-owned enterprises relying on joint venture "cash cows" are gone forever.

Recently, several Chinese car companies released their financial report data for the first half of 2025. Whether traditional car manufacturers or new forces, the overall trend shows increased polarization and concentration at the top. Particularly in terms of net profit attributable to the parent company, only three listed car companies, BYD, Seres, and Li Auto, maintained year-on-year growth.

In the price war, "increased revenue without increased profit" has become an industry pain point. If losses are accounted for, the combined profits of Chinese listed car companies are not even half of Toyota's.

This also indirectly reflects the "false prosperity" of the domestic automobile industry.

BYD's revenue surpasses Tesla.

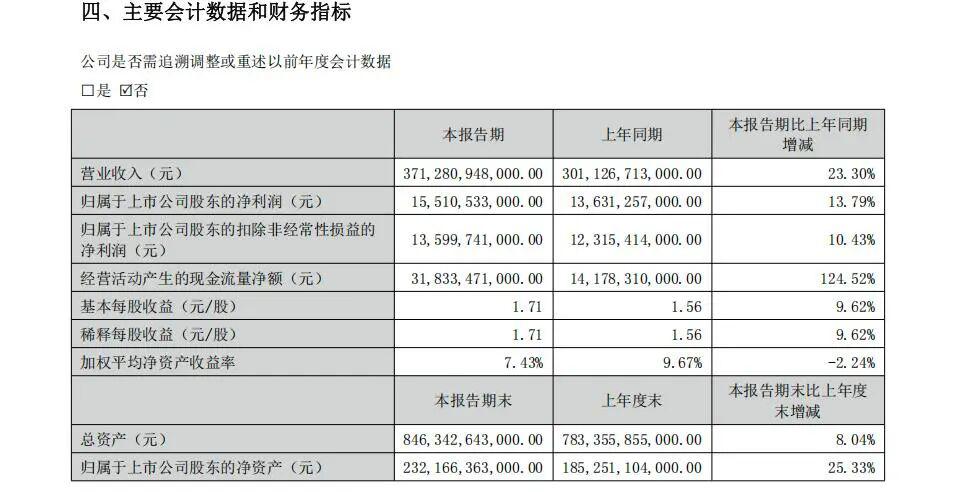

On August 29, BYD disclosed its financial report for the first half of 2025. The report shows that in the first half of the year, the company achieved an operating revenue of 371.281 billion yuan, a year-on-year increase of 23.3%; the net profit attributable to shareholders was 15.511 billion yuan, a year-on-year increase of 13.79%. The company's profitability maintained steady growth, making it the only car company with a net profit exceeding 10 billion yuan in the half-year period.

It must be said that BYD is undoubtedly the leader among domestic car companies in terms of financial performance. In addition to high profits, BYD's net cash flow from operating activities reached 31.8 billion yuan, and its cash reserves soared to 156.1 billion yuan. In the first half of the year alone, it paid taxes amounting to 21.7 billion yuan.

Notably, in the first half of this year, BYD surpassed Tesla in revenue for the first time. Tesla's total revenue for the first half of 2025 was $41.8 billion, approximately RMB 299.5 billion, a year-on-year decrease of 11% compared to $46.8 billion in the same period last year. In terms of net profit attributable to shareholders, BYD's net profit attributable to shareholders was RMB 15.511 billion, a year-on-year increase of 13.79%, while Tesla's net profit for the same period dropped by 30%, with net profit attributable to shareholders being $2.327 billion, approximately RMB 16.7 billion, which is still slightly higher.

In terms of revenue composition, overseas markets have become an important source of growth for BYD. According to the financial report, overseas business revenue reached 135.358 billion yuan, marking a year-on-year increase of 50.5%, accounting for 36.5% of the group's total revenue, and becoming a significant growth driver.

According to reports, in the first seven months of this year, BYD's global cumulative sales reached 2.49 million vehicles, a year-on-year increase of 27.4%. Among them, overseas sales of passenger cars and pickup trucks exceeded 550,000 units, a significant year-on-year increase of 130%, surpassing last year's total overseas sales. This year, it is expected to reach the milestone of one million vehicles sold overseas.

After BYD, Geely, as another private enterprise, is also remarkable.

In the first half of the year, Geely Automobile's total revenue reached 150.28 billion yuan, up 27% year-on-year; core net profit attributable to shareholders rose to 6.66 billion yuan, a significant increase of 102% year-on-year (in contrast to net profit attributable to shareholders of 9.29 billion yuan, which decreased by 12.3% year-on-year). The net cash flow from operating activities was 15.03 billion yuan, and the cash reserve at the end of the period reached 58.8 billion yuan, an increase of 26% compared to the beginning of the year.

Geely's financial report emphasizes stability. They are also the only domestic car company whose fuel vehicle segment continues to grow.

In the first half of this year, as China's fuel vehicle market share declined by 3.9%, Geely Automobile's fuel vehicle sales reached 684,000 units, marking a year-on-year increase of 21%. Its market share reached 8.8%, solidifying its position as the leading independent brand.

On the other hand, the long-stagnant new energy sector finally experienced a breakthrough this year, akin to crossing a river by feeling the stones like BYD did. The Xingyuan model currently has an average monthly sales volume of 40,000 units, surpassing BYD's Dolphin and Seagull models, firmly securing the top position in China's passenger vehicle segment. The Galaxy Xingyao 8, upon its launch, immediately became the best-selling B-class plug-in hybrid sedan.

In the first half of the year, Geely Galaxy sold 548,000 vehicles, a year-on-year increase of 232%. This single brand accounted for 39% of Geely's total sales, with a market share of 8.4%, up 4.8 percentage points year-on-year. It firmly remains in the top tier of new energy vehicle sales in China and has become a key driving force in Geely's transition to new energy.

Geely aims to secure the core market of fuel vehicles while seeing clear prospects in the transition to new energy. Based on strong performance in the first half of the year, Geely has raised its annual sales target to 3 million vehicles, having achieved 54.9% of this target from January to July.

In the second half of the year, Geely will launch several significant models, including the Galaxy M9, a flagship plug-in hybrid SUV that has already started pre-sales; the Zeekr 9X, positioned as a luxury pure electric SUV, also began pre-sales at the Chengdu Auto Show; and the Lynk & Co 10 EM-P, which will officially be launched in September.

These high-end models will further enhance the profit margin of Geely's main business.

Compared to Geely, Great Wall seems to have not yet found a suitable path for its transition to pure electric vehicles.

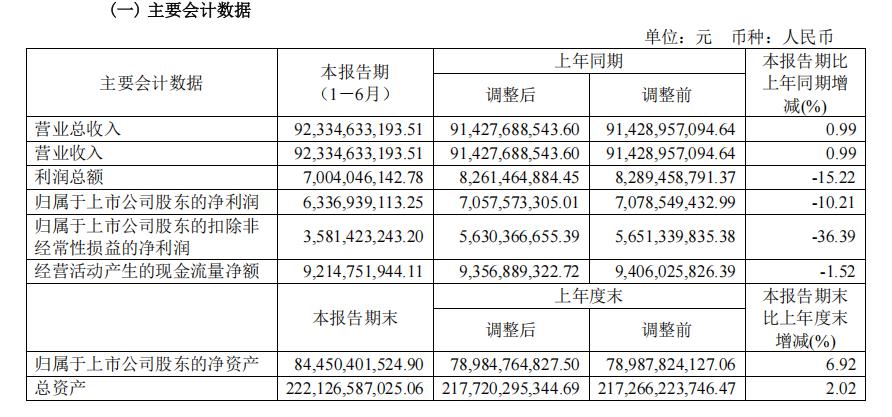

At the Chengdu Auto Show, Great Wall Motors showcased a collective exhibition of its brands including Haval, Wey New Energy, Tank SUV, Ora, Great Wall Cannon, and Great Wall Soul Motorcycles, displaying over 30 models. On the same evening, Great Wall Motors released its mid-2025 financial report. In the first half of this year, Great Wall Motors achieved a revenue of 92.335 billion yuan, a slight increase of 0.99% year-on-year; the net profit attributable to shareholders of the listed company was 6.337 billion yuan, a year-on-year decrease of 10.21%.

From January to June this year, Great Wall Motors sold a total of 568,900 new vehicles, an increase of 2.52% year-on-year. In June alone, Great Wall Motors sold 110,700 new vehicles, a significant year-on-year increase of 12.86%. In the first half of this year, Great Wall Motors sold a total of 160,400 new energy vehicles and 197,700 vehicles in overseas markets.

Haval and the pickup truck brand remain important pillars for Great Wall Motors.

In addition, the financial report disclosed that in Great Wall Motors' new energy strategic layout, the pure electric brand ORA will become one of the core elements. This brand will not only be a key focus for Great Wall Motors in expanding the new energy market in the second half of the year, but will also drive continuous increases in investment in research and development and marketing.

Lü Wenbin, the general manager of the Euler brand, revealed: "In the second half of the year, we will launch two major new products for the global market. These two products took 3 years and cost 1 billion yuan."

To some extent, Euler may also represent the new hope for Great Wall Motor's transition to pure electric vehicles.

Traditional state-owned enterprises are mired in losses.

In stark contrast to the strong growth of private car companies, some traditional large automotive groups are facing profitability challenges.

Some say that at this year's Chengdu Auto Show, SAIC quietly came out on top. Not only did Buick and Cadillac make a grand appearance, but they also launched a series of new products, including the SUV Envision, which middle-aged men can't ignore, the MPV GL8, and the all-new XT5.

Additionally, the Shangjie jointly launched by SAIC and Huawei also made a high-profile appearance at the Chengdu Auto Show, making the passenger car segment particularly lively.

Despite the intensive product launches, SAIC Motor Corporation is still unable to hide its awkward situation during the transition period.

The day before the Chengdu Auto Show, SAIC Motor Corporation released its mid-year report for 2025. The report shows that the company's revenue for the first half of the year was 294.336 billion yuan, an increase of 6.23% year-on-year; net profit attributable to shareholders was 6.018 billion yuan, a decrease of 9.21% year-on-year.

With nearly 300 billion yuan in revenue and a net profit of only 6.018 billion yuan, it must be said that SAIC is indeed a representative of the image of state-owned enterprises.

If the "increased revenue without increased profit" of SAIC can be tolerated, the severe losses of GAC Group only highlight another serious issue: the comfortable days of traditional state-owned enterprises relying on joint venture cash cows are gone for good.

The financial report shows that the total consolidated operating income of GAC Group was 42.611 billion yuan, a year-on-year decrease of approximately 7.88%. The net profit attributable to shareholders of the parent company recorded a loss of 2.538 billion yuan, a significant year-on-year decline of 267.39%, compared to a profit of 1.516 billion yuan in the same period last year, marking a shift from profit to loss.

Revenue, net profit, and sales have all declined, causing a "red alert" for GAC Group's core financial data.

In terms of automobile production and sales, GAC Group produced 801,700 vehicles in the first half of this year, a year-on-year decrease of 6.73%; sales reached 755,300 vehicles, a year-on-year decline of 12.48%. The decline in both production and sales further confirms the weakness in market demand. Among the different car models, new energy vehicles performed particularly poorly, with sales of 154,100 vehicles, a year-on-year decrease of 6.08%. Additionally, key new energy models are still in the "ramping-up period" and have not yet reached their planned targets.

On one hand, the profits brought by GAC Honda and GAC Toyota have significantly shrunk; on the other hand, the independent business is also unable to shoulder the heavy responsibility. The "Panyu Action" proposed by GAC Group has yet to show results.

In the second half of the year, GAC is preparing to win the "three major battles" of user demand, product value, and service experience. The company will advance two key tasks: expanding its overseas market layout and building a competitive cost control system, in order to fully reverse the situation and achieve stable performance recovery.

Unlike GAC, Dongfeng has taken a different path.

After an 11-day suspension, Dongfeng Motor Group Co., Ltd. released an announcement late at night on August 22 that stirred the automotive industry. The announcement stated, "Voyah Automobile will be listed on the Hong Kong stock market by way of introduction, and Dongfeng Motor Group Co., Ltd. will simultaneously complete privatization and delisting." This signifies that Dongfeng Motor Group Co., Ltd. and its parent company, Dongfeng Motor Corporation, have entrusted the task of restructuring the group's market value and development to Voyah Automobile.

In recent years, Dongfeng Motor has been constrained by the pressure of industry transition pains, with sales declining for several consecutive years. From a peak of 4.27 million vehicles in 2016, it shrank to 2.48 million vehicles in 2024, a reduction of nearly 1.8 million vehicles. In the first half of 2025, Dongfeng Motor's terminal sales were 1.116 million vehicles, a year-on-year decrease of 10.8%, and its market share also dropped from about 14% to 7%.

In the first half of this year, Dongfeng Motor Group Co., Ltd. continued to experience "increased revenue without increased profit." The group's revenue was only 54.53 billion yuan, a slight increase compared to 51.15 billion yuan in the same period last year; net profit was only 55 million yuan, a decline of 92% year-on-year.

In terms of sales, Dongfeng Motor Group sold approximately 823,900 vehicles in the first half of the year, a year-on-year decline of 14.7%, with the decline further expanding. For Dongfeng, they are also facing the awkward situation of shrinking joint venture sectors, and perhaps taking over the independent segment could be a good way out.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track