Byd revenue surpasses tesla for the first time! q2 r&d investment of 30.9 billion: First in A-shares

After 3 years of rapid growth, few people could have imagined.BYD"What 'slowing down' would look like:"

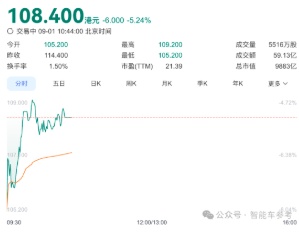

"Number One"Q2 performance report submitted, experiencing unprecedented doubts.The Hong Kong stock market opened today with a decline of 5.2%, and the A-shares fell by 3.8%, corresponding to a market value evaporation of 71.2 billion Hong Kong dollars and 40 billion RMB, respectively.

In the past three months, BYD's domestic sales have continuously declined both year-on-year and month-on-month.

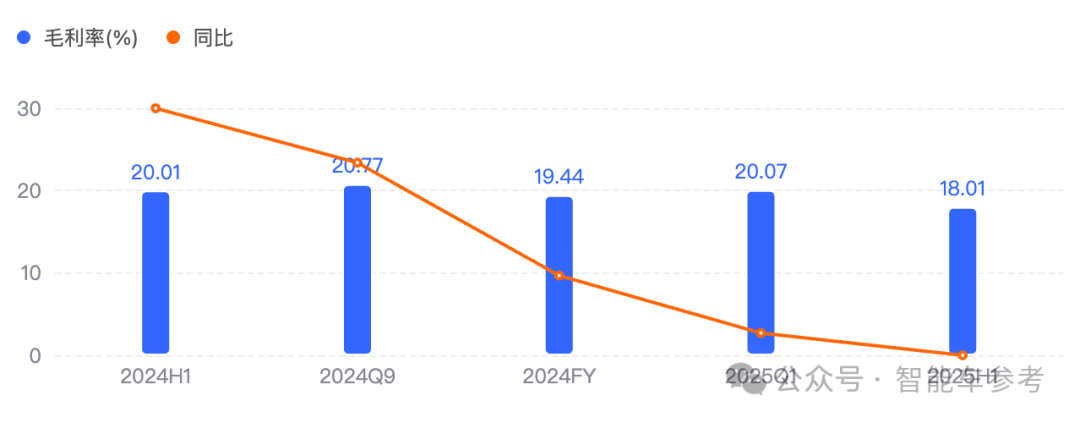

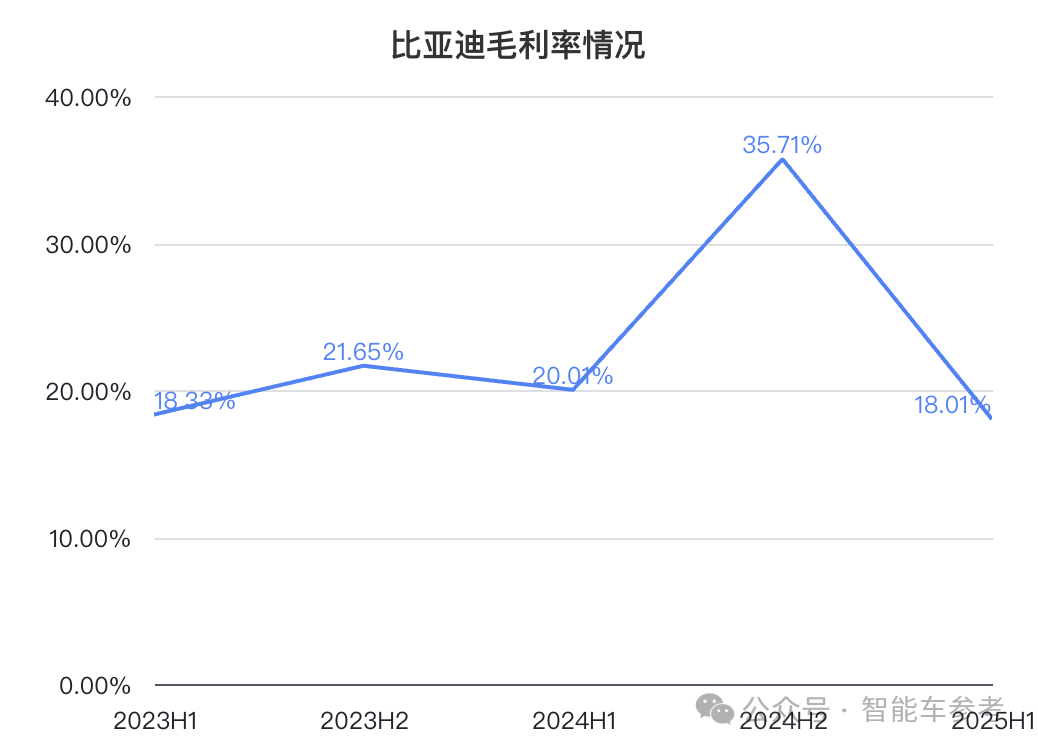

The gross profit margin in the second quarter decreased by nearly 4% quarter-on-quarter.

The net profit attributable to shareholders decreased by 2.7 billion yuan year-on-year and 2.8 billion yuan quarter-on-quarter.

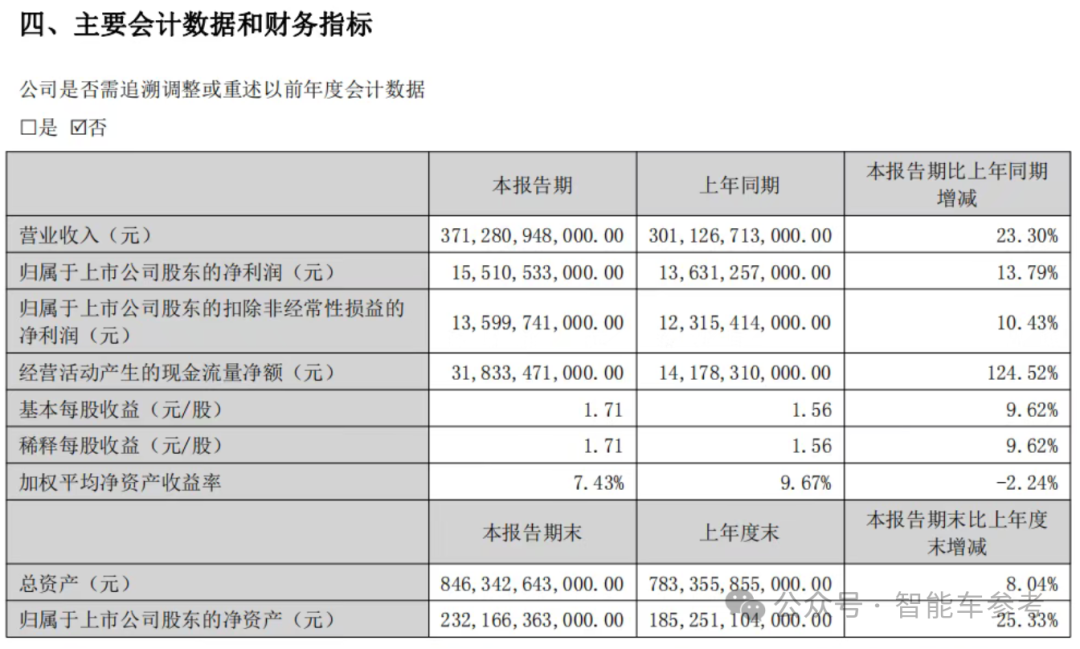

If you just look at this table, many people might think that BYD fell short of expectations. For instance, the net profit of 15.51 billion is much lower than the widely anticipated 18 billion, and some even cry "thunderstorm."

On the other hand, BYD still achieved some milestones in the first half of 2025:

Revenue reached 371.28 billion yuan, surpassing Tesla for the first time.;

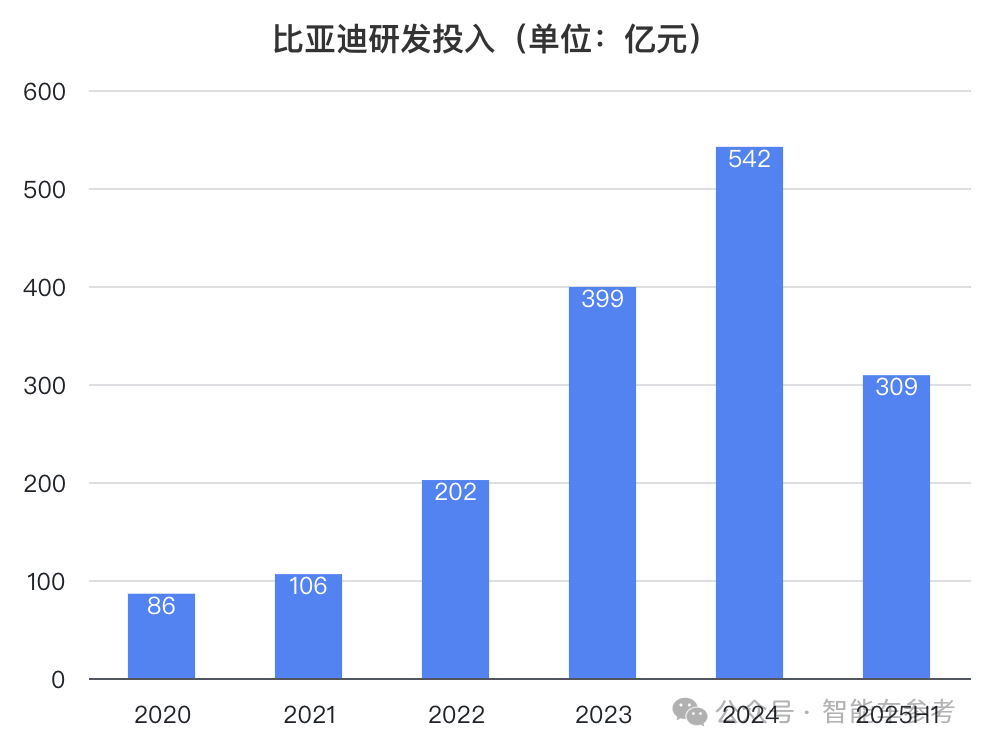

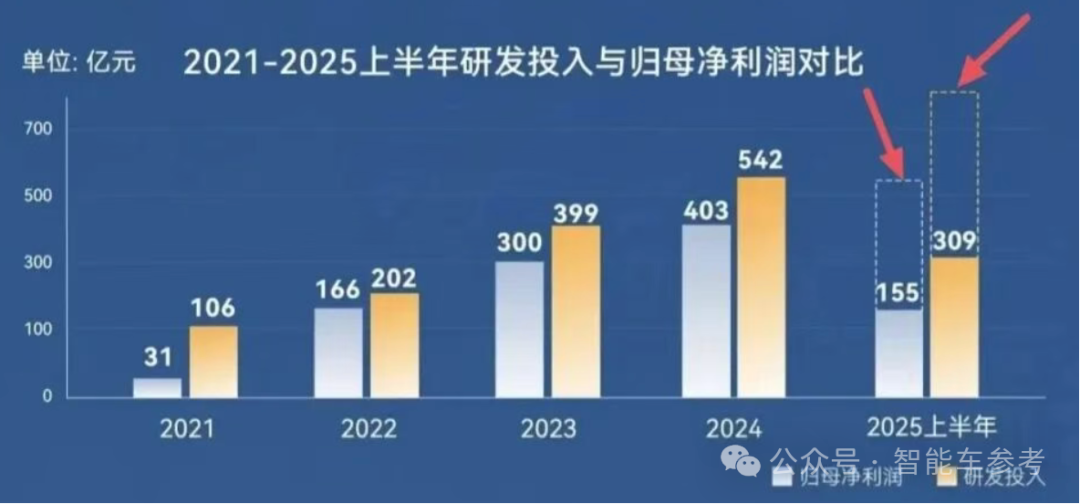

Research and Development Investment¥30.9 billion, a year-on-year increase of 53%, ranked first in the A-shares.

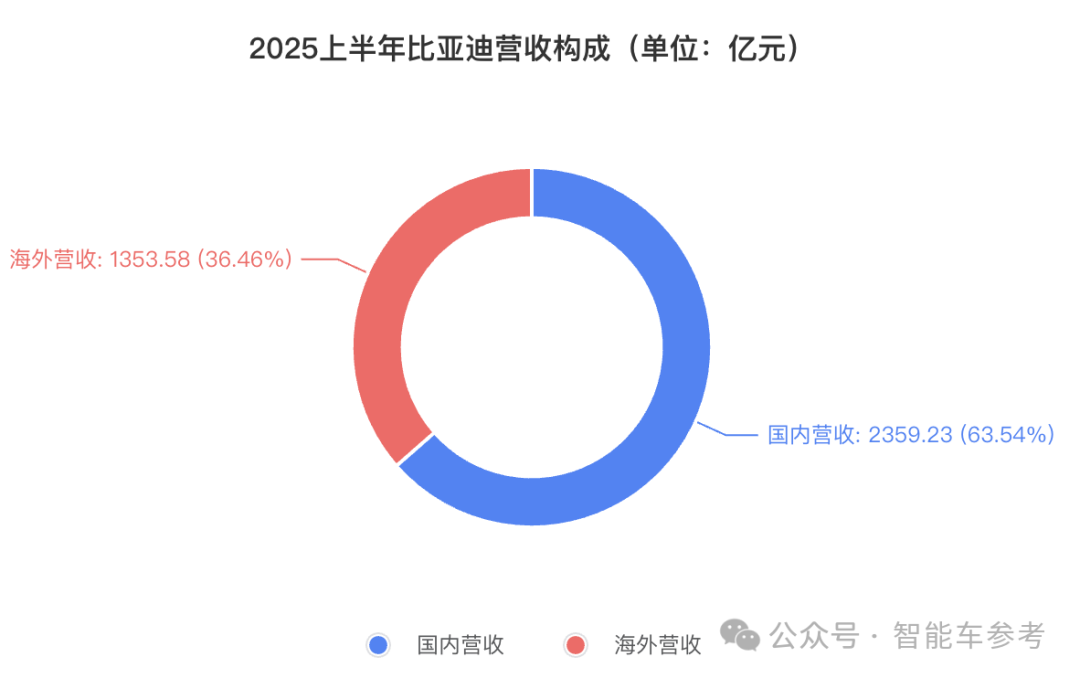

Overseas business reached 135.358 billion yuan, a year-on-year increase of 50.5%, accounting for 36.5% of the total revenue.

What exactly is BYD like? Intelligent Car Reference breaks down and extracts the essence of the financial report for you, presenting a more complete picture of the fundamentals.

How was BYD's performance in the first half of the year?

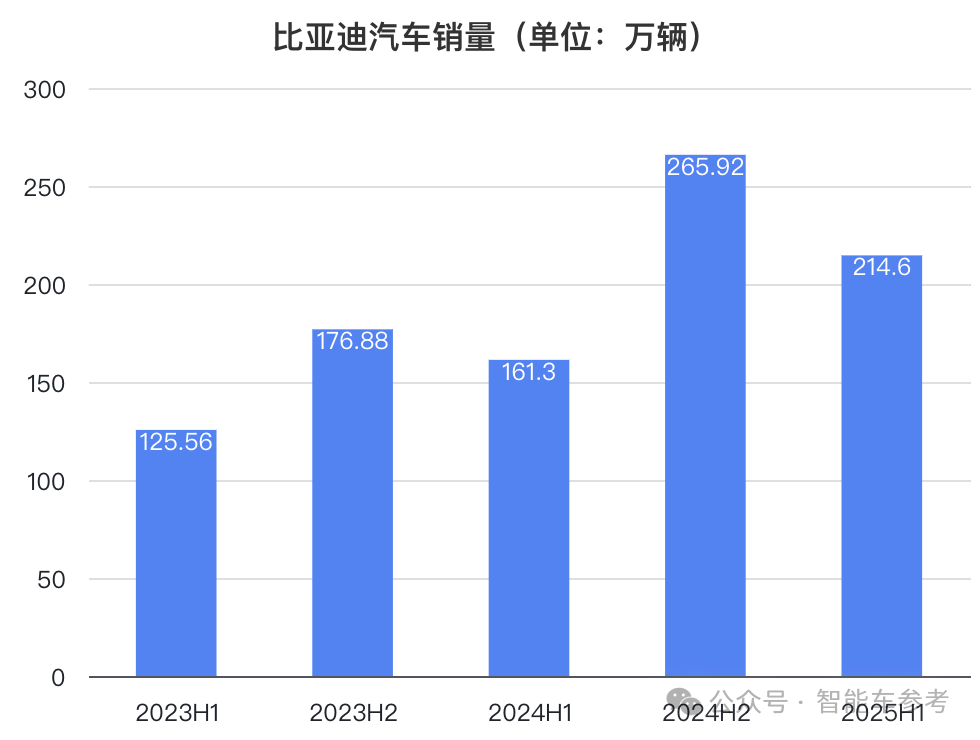

In the second quarter, BYD sold 2.146 million new cars, an increase of 33.04% year-on-year.

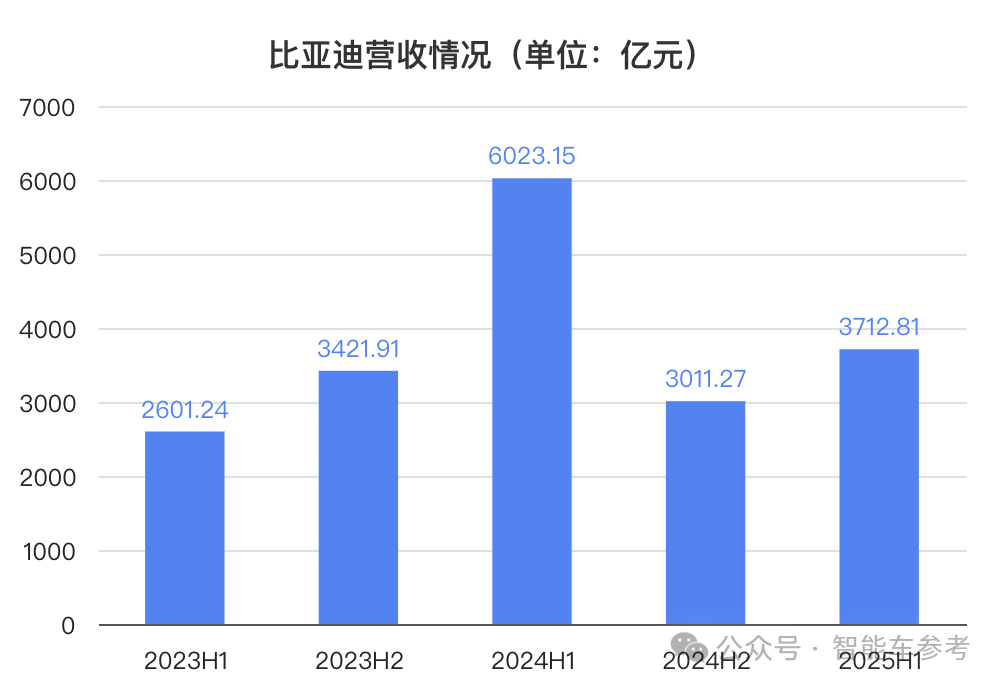

Revenue: 200.92 billion yuanYear-on-year growth of 14% and month-on-month growth of 17.9%; the entireThe first half of 2025BYD achievesRevenue reached 371.28 billion yuan, a year-on-year increase of 23.30%.:

Half-year revenue,BYD surpasses Tesla for the first time.The latter is $41.8 billion (approximately RMB 299.5 billion).

Of course, BYD's total revenue sources not only include automobiles but also electronics, energy storage, semiconductors, rail transit, etc. However, automobiles have always been the absolute mainstay.

In the total revenue for the first half of 2025, the automotive business income was 302.5 billion yuan, accounting for more than 80%, with a year-on-year growth of 32.5%.

The money spent by BYD includes the following aspects:

In the first half of 2025, the R&D expenses reached 30.9 billion yuan, marking a year-on-year increase of 53%. This growth rate is more than twice the revenue growth rate and also ranks first in R&D investment among A-share listed companies.

Another point is that the proportion of R&D investment to revenue has continued to reach new highs in the past three years, with the proportion reaching 8.3% in the first half of this year.

The selling expenses, administrative expenses, financial expenses, etc., total approximately 25 billion yuan. Among them, the growth rate of administrative expenses is 35%, significantly higher than the revenue growth rate. This could indicate that BYD is facing challenges in personnel management due to its expansion in scale, suggesting that there is considerable potential for improving management efficiency in the future.

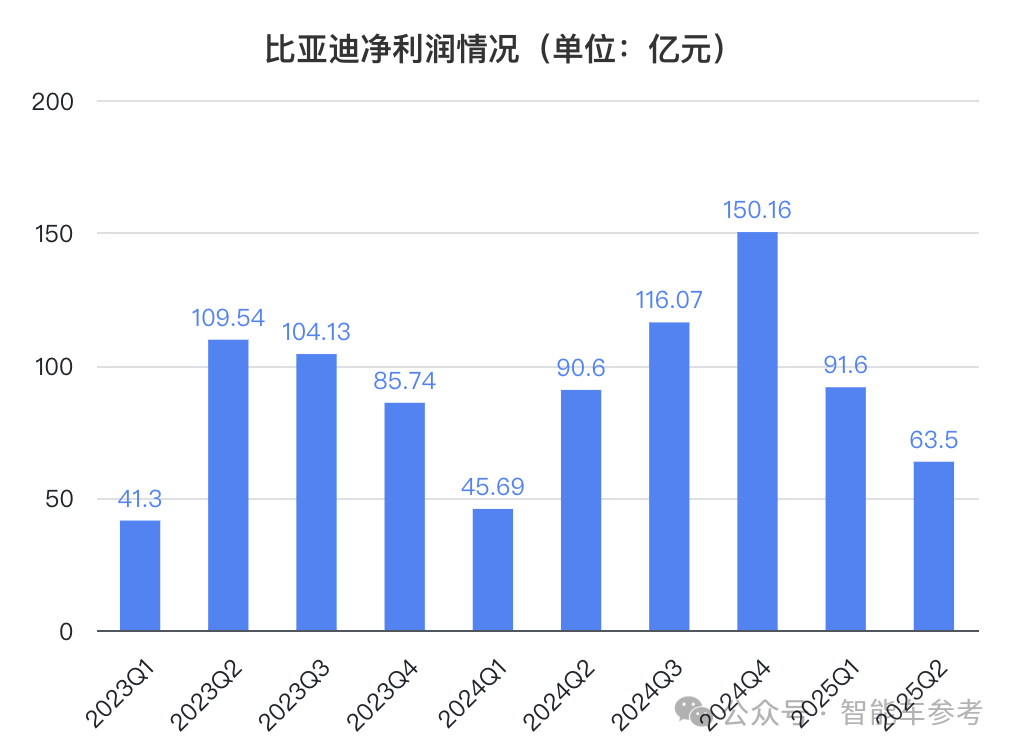

The net profit for the first half of the year was 15.51 billion yuan, an increase of 13.79% year-on-year.

In the first quarter, BYD's net profit was 9.16 billion yuan, more than doubling, while in the second quarter, the net profit was 6.35 billion yuan, a decrease of about 30%.

This is alsoBYD's net profit declined year-on-year for the first time in 14 quarters.。

The gross profit margin in the second quarter was 18%, down 2% year-on-year.

Net profit (Generally believed to be over 18 billion)The main factors for BYD's stock price decline after the opening are lower than expected performance and a decrease in gross margin.

The growth is there, but it's not as fast; the revenue and profit growth are disproportionate, in other words, the ability to make money has declined.

The general background of the first half of the year is:

BYD has been engaged in a price war for half a year, but it is actually "twice the effort for half the result," as the growth in volume and profit is not proportional.

Fortunately, there is a new growth engine found by BYD in the financial report.

Fundamental data analysis: what stage is BYD at?

BYD's potential and growth are actually apparent.

First, break down the composition of sales:

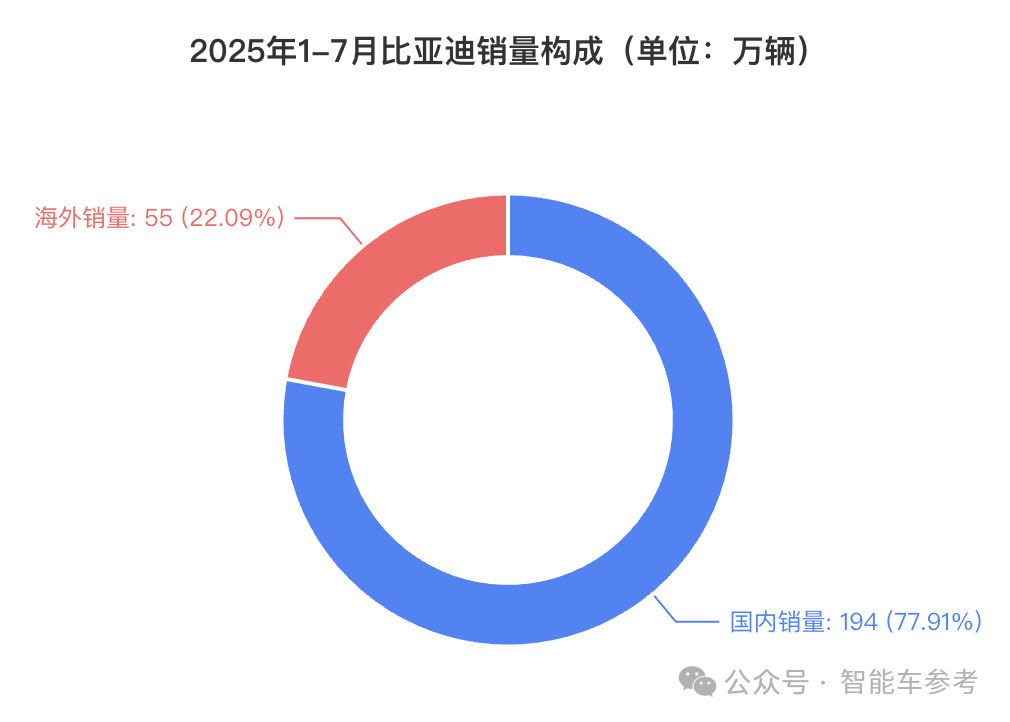

BYD's overseas sales exceeded 550,000 units from January to July, with a year-on-year growth rate of over 130%.The proportion of total sales exceeds 22%.

According to BYD's goal, the minimum target for this year is 5 million vehicles, with overseas sales expected to exceed 1 million, and there may be even higher expectations.

Corresponding to revenue,Overseas business reached 135.358 billion yuan, a year-on-year increase of 50.5%, accounting for 36.5% of the total revenue.。

There is no doubt that going overseas is BYD's most promising growth engine for the next phase.

There is more direct evidence in the financial report.

The first half of 2025, BYDCapital expenditure is 80.5 billion yuan.Compared to the same period last year, it increased by 71%.

This means: In fact, BYD is racing against the entire industry.

Several overseas vehicle and battery manufacturing bases have been put into operation, with several others under construction.

This is the foundation for BYD to challenge Volkswagen and Toyota, and the layout for achieving 10 million global sales in the coming years has basically been established.

The "race" is also reflected in R&D investment. In addition to being the first in A-shares with 30.9 billion, the first half of 2025, like most years for BYD,The R&D investment is higher than the net profit.。

This also explains the issue of gross profit falling short of expectations.

BYD's R&D investment in recent years has rarely been capitalized.Most of the expenses are expensed, which means that R&D investment will not be converted into intangible assets and will not be amortized over time, thus affecting the current profit.

For example, the capitalization rate of R&D expenses has been over 95% in the past three years.Even assuming an average capitalization rate of around 50% from 2012 to 2018, it could release over 10 billion in profits in the first half of 2025.。

The decline in gross margin is not something BYD can really complain about, after all, it was BYD that fired the first shot in the price war.Now, it's inevitable to be plagued by aftereffects.

It seems that BYD's strategy is to maintain profits in the first quarter and then relax profit requirements in the second quarter to boost sales volume, resulting in a noticeable decline in profits.

The objective factor is that the price war is really too damaging.

Deep-seated factors include the gradual strengthening of domestic growth, with accelerated overseas capacity building on one hand, and the use of technology to exchange for time and space on the other. Both expenditures have increased significantly.

Despite proceeding with composure and intentionally "hiding" profits, BYD's resilience and potential continue to make it the number one among independent brands.

What other noteworthy data is there?

BYD's "underperformance" is actually due to not intending to use financial means to artificially boost profits amid an intense price war.

Because they do have the confidence and are not in a hurry to prove themselves through short-term profits.

This is the "privilege" and reward for BYD's years of continuous high-intensity investment and climbing the technological peak.

By the end of June 2025, BYD's cash reserve stands at 156.1 billion yuan, slightly higher than the end of 2024 (154.9 billion yuan), ensuring the company's stable operations.

In the first half of 2025, the net operating cash flow was 31.8 billion yuan, representing a year-on-year growth of 125%, indicating that BYD's overall business scale is still expanding rapidly.

The frequently mentioned "liabilities" show that BYD's asset-liability ratio was 71.8% by the end of June 2025, with total debt exceeding 600 billion. However, compared to 77.9% at the end of June 2023, BYD has already decreased it by 6.1 percentage points.

At first glance, it looks intimidating, but BYD's scale is unmatched by other independent car manufacturers. Moreover, this debt ratio is just an average level among global car companies.

In a rapidly developing industry, liabilities symbolize massive investments and R&D expenditures. The larger the company and the higher its revenue, the higher its total liabilities.

Since the beginning of the year, BYD's "========" initiative has resulted in over 1.2 million vehicles equipped with the "========" system. This provides a vast amount of data to support the future development of intelligent driver assistance systems, which also implies a significant investment in computing power and talent.

Therefore, maintaining a high level of debt within a controllable range is direct evidence of business expansion and the climb to the technological peak. The seemingly astonishing debt figures are actually an accelerator for the reshaping of the Chinese automotive industry.

In the century-long transformation of the automotive industry, players who do not dare or are unable to take on a debt of hundreds of billions may not even qualify to participate.

In the first half of 2025, BYD's performance data, in terms of profit and gross margin, does indeed seem somewhat below expectations at first glance.

However, the closing situation is hard to say.

BYD's growth potential, R&D investment, and business layout are all well-known. When someone sells, there will be others who buy, which is the so-called "decline" point. In fact, it's precisely the time for investors who truly understand and are optimistic about BYD to acquire shares.

Moreover, in the context of anti-involution, BYD itself has suffered setbacks and is unlikely to engage in a price war in the second half of the year.

What should be the reasonable expectations for BYD?

It's hard to say, but here's an internal image from BYD that leaked last November about a "ten trillion market value":

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track