Byd, geely, and great wall's h1 net profit ≈ catl's: Selling Cars Not as Profitable as Selling Batteries?

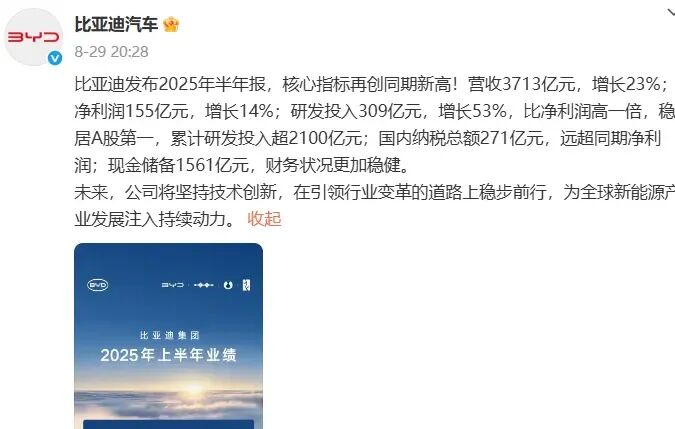

In the first half of 2025, financial reports of Chinese passenger car manufacturers went public one after another.

From the financial data of listed automakers that have released their financial reports for the first half of 2025, it can be observed that...Sales of new energy vehiclesUnder the backdrop of continuous growth, the industry exhibits a unique phenomenon.

On one hand, the explosive growth in new energy vehicle sales has become a highlight in car manufacturers' financial reports, driving a surge in performance for upstream power battery companies.

On the other hand, intense "price wars" and "internal competition" have led car companies to face the dilemma of "increased volume without increased revenue," with profit margins being significantly compressed.

The 2025 semi-annual financial report data shows that with the development of new energy vehicles, domestic brands have eroded a significant portion of the market share from joint venture companies.

As the tide of joint venture "profit cows" recedes, the profitability of large state-owned automobile groups has significantly declined, and the overall profit of the automotive industry is sharply shrinking. The profitability of leading private enterprises appears more prominent. Among the listed passenger car companies in China, in the first half of the year...Net profitThe highest isBYD(002594.SZ)、 (0175.HK) andGreat Wall MotorsThe three leading private enterprises (601633.SH).

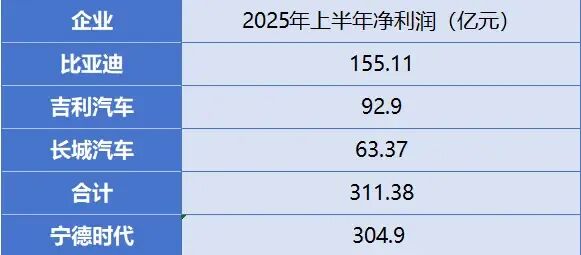

However, the combined profits of the three most profitable private car companies in the first half of the year—BYD (15.51 billion yuan), Geely Automobile (9.29 billion yuan), and Great Wall Motor (6.34 billion yuan)—total approximately 31.14 billion yuan, which is almost just...Contemporary Amperex Technology Co., Limited (CATL)The net profit (30.49 billion yuan) of this battery company, which has risen to prominence thanks to new energy vehicles, is considerable.

The semi-annual reports of car manufacturers generally reflect the profound impact of price wars and internal competition on profitability. There are no winners in a price war, and this pressure may continue.

"Intense market competition," "price pressure," and "intensifying industry involution" frequently appear in semi-annual performance reports, reflecting the challenge enterprises face in balancing cost pressures with sales growth.

Dissecting the Joys and Woes in the Financial Reports of the Three Major Private Car Enterprises

Based on the disclosed financial report data, the first half of 2025RevenueAmong the top four automobile manufacturers, BYD firmly holds the top position with a revenue of 371.281 billion yuan.SAIC Motor Corporation LimitedFollowing closely behind with 294.326 billion yuan; the third is Geely Automobile, with a revenue of 150.285 billion yuan; Great Wall Motors ranks fourth with a revenue of 92.335 billion yuan in the first half of the year. Among them, except for SAIC Motor Corporation Limited, the other three are all private car companies. However, although...SAIC Motor Corporation Limited Higher revenue, but net profit is not as good as Geely Auto and Great Wall Motors.

Analyzing the financial reports of three leading private car companies reveals that their performance in the first half of the year has distinct characteristics.

In terms of revenue, all three car manufacturers achieved positive revenue growth.

BYD's revenue in the first half of the year was 371.281 billion yuan, a year-on-year increase of 23.30%, the highest among the three companies, and significantly ahead.

Geely Automobile's revenue reached 150.285 billion yuan, a year-on-year increase of 26.51%, with the fastest growth rate.

Great Wall Motor's revenue was 92.335 billion yuan, a year-on-year increase of 0.99%. Although the growth rate is slow, its second-quarter revenue was 52.348 billion yuan, a year-on-year increase of 7.78%, which is a significant acceleration compared to the first-quarter revenue's year-on-year decline of 6.63%.

In terms of profit performance, there was a significant divergence. Among the three, only BYD achieved a "double success" in revenue and net profit, while Geely Automobile and Great Wall Motor experienced a "revenue increase without profit increase" phenomenon.

BYD's net profit was 15.511 billion yuan, up 13.79% year-on-year; Geely Automobile's net profit was 9.290 billion yuan, down 14% year-on-year; Great Wall Motor's net profit was 6.337 billion yuan, down 10.22% year-on-year.

The reasons for the decline in net profit of Geely Automobile and Great Wall Motor are not the same.

Geely Automobile's core net profit attributable to shareholders for the period was 6.66 billion yuan. After excluding the foreign exchange gains and losses of 2.64 billion yuan during the period, the net profit attributable to shareholders, compared to the core net profit attributable to shareholders of 3.3 billion yuan last year—after excluding the one-time gain of 7.73 billion yuan from the sale of a subsidiary and an asset impairment loss of 250 million yuan—represents a year-on-year increase of 102%.

After deducting 2.84 billion yuan in government subsidies and other non-recurring gains and losses, Great Wall Motor's performance in the first half of the year...Non-net profit attributable to recurring activitiesThe amount was only 3.581 billion yuan, a significant year-on-year decrease of 36.39%. This means that the primary reason for Great Wall Motor's profit decline is the drop in its core automotive business.

In terms of sales, the growth in sales for the three car companies can be described as "booming". Data shows that the three leading private car companies achieved double-digit sales growth in the first half of the year.

In the first half of the year, BYD's cumulative sales reached 2.1459 million vehicles, a year-on-year increase of 33.04%. Among them, new energy vehicle sales were 2.1132 million, a year-on-year increase of 30.94%, with the market share continuing to lead.

In the first half of the year, Geely Automobile's cumulative sales reached 1.409 million vehicles, representing a year-on-year increase of 47.40%. New energy vehicle sales amounted to 725,000 units, marking a year-on-year increase of 126.00%, with a significant improvement in new energy penetration rate.

In the first half of the year, Great Wall Motor's cumulative sales reached 569,000 vehicles, a year-on-year increase of 10.40%. New energy vehicle sales reached 160,000 vehicles, a year-on-year increase of 22.64%, accelerating the pace of its transition to new energy.

A common characteristic is that the growth rate of sales volume is greater than the growth rate of revenue, which in turn is greater than the growth rate of profit. This means that the price per new car is decreasing, and the profit margin is being further compressed.

The direct cause of this result is the price war.

Share VS Profit

The automotive industry is a business that highly prioritizes scale and efficiency. Amid price wars and profound changes in supply and demand, automakers need to find a balance between scale and efficiency.

The price war is impacting all participants in the industry.

In the cutthroat price war where "every cut draws blood," car companies involved find it difficult to stay unaffected, falling into the dilemma of choosing between "market share" or "profit."

In order to survive, car companies have no choice but to engage in close combat over pricing.

In the first half of this year, BYD's revenue surpassed for the first time.TeslaThe gross profit margin decreased from 18.78% in the same period last year to 18.01%. Among them, BYD sold 144,000 more new cars in the second quarter compared to the first quarter, with revenue increasing by more than 30% year-on-year, but in the second quarter.Gross profit marginThe profit margin shrank to 16.3%, down 3.8 percentage points from the previous quarter, directly causing a decline in the profitability per vehicle. Morgan Stanley stated in its latest research report that BYD's second-quarter profit per vehicle had decreased from 8,800 yuan in the first quarter to 4,800 yuan.

BYD stated in its financial report that competition in the Chinese automotive industry has entered a white-hot stage, with industry irregularities such as "fixed pricing" and "excessive marketing" emerging, which greatly disrupt normal business order and hinder the high-quality development of the automotive industry.

BYD, once relying on the advantages of vertical integration and economies of scale, has shown particularly impressive financial figures. However, it currently faces significant growth pressure. In the first half of this year, BYD's cumulative sales reached 2.1459 million vehicles, a year-on-year increase of 33.04%. However, starting from May, its sales have declined both year-on-year and month-on-month, with monthly sales of 294,000 vehicles, 293,000 vehicles, and 263,000 vehicles from May to July, respectively, marking a consecutive three-month decline in month-on-month sales.

Specifically, it appears that BYD's sales are concentrated in its popular models, the Dynasty and Ocean series, which are priced below 200,000 yuan. In the first half of the year, their combined sales reached 1.95 million units, accounting for over 90% of the total sales. Furthermore, the substantial investment in smart technology R&D has yet to translate into actual sales; the breakthrough in high-end brands is still awaited. The combined sales of Denza, Fangchengbao, and Yangwang in the first half of the year amounted to 142,000 units, accounting for only 6.6% of the total sales.

During the same period, Geely Auto, an old rival, is accelerating its catch-up, with sales in the second quarter reaching 235,000, 236,000, and 237,000 units respectively, showing a quarter-on-quarter increase. According to data from the China Passenger Car Association, BYD's market share fell to 15% in July this year, compared to 18% in the same period last year, while Geely's market share rose from 6.8% to 11.1%.

Geely Auto's gross profit has also been affected by the price war.

According to Geely Automobile's financial report, in the first half of this year, Geely Automobile's average revenue per vehicle decreased by 14,000 yuan year-on-year to 96,000 yuan; the gross profit margin was 16.4%, down 0.3 percentage points year-on-year; the gross profit margin in the second quarter was slightly higher than in the first quarter, at 17.1%, a slight year-on-year decrease of 0.7%. Dongwu Automobile estimates that its net profit attributable to shareholders per vehicle is 5,000 yuan.

The new energy business has become the biggest highlight for Geely Auto in the first half of the year. Geely Auto's CEO and Executive Director Gui Shengyue frankly stated that the truly "valuable" aspect of Geely Auto's sales in the first half of the year lies in the fact that the market share gap between Geely Auto's full range of models and new energy vehicles in China and the first place (namely BYD) is continuously narrowing.

In the first half of the year, Geely Automobile had an 11.44% market share in the new energy vehicle market, ranking second. There is still an 18 percentage point gap from the first place, BYD, which holds a 29.48% market share. However, compared to a 27 percentage point gap last year, the difference has significantly narrowed.

Under the fierce competition between BYD and Geely Automobile, Great Wall Motor seems to have fallen behind.

In the first half of this year, Great Wall Motors Revenue increased by 0.99%, net profit declined by 10.22%, and net profit excluding non-recurring items was only 3.581 billion yuan, a significant year-on-year decrease of 36.39% during the same period.Gross profit marginDecreased by 7.83% year-on-year to 18.38%.Net profit marginCompared to the same period last year, it decreased by 11.1% to 6.86%, indicating that the profitability of the main business is rapidly deteriorating.

“ Even if the sales drop out of the top ten, it's not a concern, because for healthy development, we would rather do less and have a smaller market share than pursue meaningless sales volumes," said Wei Jianjun, Chairman of Great Wall Motors, who has repeatedly publicly questioned the "sales-first theory." However, it is an undeniable fact that Great Wall Motors' new energy vehicle sales are lagging behind.

In the first half of this year, the cumulative sales of its new energy vehicles reached 160,400 units, accounting for only 2.31% of the national market. Moreover, the proportion of new energy vehicles in its total sales was only 28.2%, far below the industry's penetration rate of 44.3% for the first half of the year. The sales figure of over a hundred thousand units is far from BYD's more than 2 million units and Geely's new energy vehicle sales exceeding 700,000 units during the same period.

In the context of the accelerated transition of the automotive industry towards intelligence and electrification, R&D investment has become a core element of competition for car companies.

The research and development expenses of the three companies reflect the determination and intensity of automakers' transformation: In the first half of this year, BYD invested 29.6 billion yuan in R&D, nearly 10 billion yuan more than the same period last year; Geely Automobile's R&D expenses were 7.328 billion yuan, accounting for 4.9% of its revenue; while Great Wall Motor had the lowest among the three, with 4.239 billion yuan, a slight year-on-year increase of 1.21%. In the first quarter, its R&D expenses of 1.906 billion yuan were even surpassed by sales expenses of 2.296 billion yuan, indicating a hidden risk of "heavy marketing, light R&D."

The Profit Dilemma of Automobile Companies

Selling batteries is better than selling cars?

Sales of new energy vehiclesWhile the booming market is "lifting" the performance of car companies, it has not brought equally booming profit results to them.

Compared to upstream battery companies, vehicle manufacturers are at a disadvantage in the profit distribution pattern of the industry chain, leading to the phenomenon that "selling cars is not as profitable as selling batteries."

Even the combined profits of the top three most profitable car companies—BYD, Geely Automobile, and Great Wall Motors—during the first half of the year only equate to the profits of a single company, the battery manufacturer CATL.

In the first half of 2025, CATL recorded a net profit of 30.49 billion yuan, with a daily profit of 168 million yuan. This profit scale is close to that of China's top three listed vehicle manufacturers: BYD (15.511 billion yuan), Geely Automobile (9.29 billion yuan), and Great Wall Motor (6.34 billion yuan).Net profitThe total is 31.13 billion yuan.

Ningde Times' 27 billionAdjusted net profitIt even far exceeds the combined total of BYD (13.6 billion yuan), Geely Automobile (core net profit attributable to the parent company, 6.66 billion yuan), and Great Wall Motor (3.581 billion yuan).

Contemporary Amperex Technology Co., Limited (CATL)The market value of nearly 1.4 trillion yuan is also approximately equal toBYDApproximately 1 trillion yuan + Great Wall Motor 225 billion yuan + Geely Auto 190 billion yuan.

In fact, as "involution" intensifies in the automotive industry and price wars escalate, car companies are adopting the strategy of "exchanging price for volume," leading to pressure on the overall profit margins of the industry. Selling cars at a loss to expand market share and attempting to "outlast competitors" has become a tactic deeply detested by the industry but one that cannot be avoided.

Cui Dongshu, Secretary-General of the China Passenger Car Association, released the "Analysis of Price Cuts in the Passenger Car Market in June 2025" on July 7. It states that from January to June 2025, the arithmetic average price reduction for new energy vehicle models that experienced price cuts was 23,000 yuan, with a reduction rate of 12%.

According to the data from the China Association of Automobile Manufacturers, in the first seven months of this year, automobile sales in China reached 18.269 million units, representing a year-on-year increase of 12%. This appears to be a good growth trend, but from...National Bureau of StatisticsAccording to the data, in the first half of the year, the profit margin of China's automobile manufacturing industry was only 4.8%, lower than the 5.15% profit margin of industrial enterprises above a designated size.

In the financial reports for the first half of 2025, most car manufacturers mentioned the impact of "price competition" and "involution" on profits.

The above table only displays part of the data, which has been compiled by Phoenix Auto.

In response to the escalating price war, policy measures have been taken multiple times to regulate competitive order. The China Association of Automobile Manufacturers issued a "Proposal to Maintain Fair Competition Order" at the end of May, directly pointing out the impact of the "disorderly price war" on industry efficiency. The proposal states that leading enterprises should not monopolize the market, squeeze the living space of other entities, or harm the legitimate rights and interests of other operators. Apart from legally reducing prices to handle products, enterprises should not dump products at prices below cost.

National Development and Reform CommissionRelevant departments also emphasize "regulating industry competition order" to halt price wars, in order to promote the long-term healthy development of the industry.

At the corporate level,Geely AutomobileExpress opposition to "involution-style" vicious competition, uphold open and healthy competition, avoid price wars, and focus on value wars, technology wars, quality wars, service wars, brand wars, and corporate ethics wars.Great Wall MotorChairman Wei Jianjun bluntly stated that "involution-style competition is a form of slow suicide" and called on the entire industry to respect the rules and return to rational development.XPeng MotorsCEO He Xiaopeng proposed "focusing on technological competition and international markets," indicating that industry competition is shifting from price wars to a multidimensional contest involving technology, brand, and channels.

Under policy guidance, the price war has eased recently. According to statistics from the China Passenger Car Association (CPCA), the number of new cars with price cuts from January to July was 106 models, significantly fewer than the 147 models in the same period in 2024. In June, the overall profit margin of the automotive industry rebounded to 6.9%, indicating that promotional activities are stabilizing and economies of scale are gradually emerging.

In the future, as the penetration rate of new energy vehicles continues to increase, industry competition is likely to become more intense. However, mere price wars are no longer sustainable, and companies need to shift from "price competition" to "value competition" through technological upgrades, product innovation, and global expansion.

With the strengthening of policy regulation and the establishment of technological barriers, the industry is expected to gradually break away from the vicious cycle of price wars and shift towards a competition model centered on technology, branding, and globalization.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track