Breaking the Bottleneck of Domestic Automotive-Grade Light-Guiding Polycarbonate: Insights into Wanhua Chemical's High-End Materials R&D Strategy

China's automotive industry chain has reached a milestone in the localization of high-end materials. On August 27, Wanhua Chemical and Geely Auto jointly announced the successful domestication of automotive-grade optical polycarbonate (PC) materials, marking a substantial advancement for Chinese companies in the high-end automotive materials sector, which has long been monopolized by foreign giants.

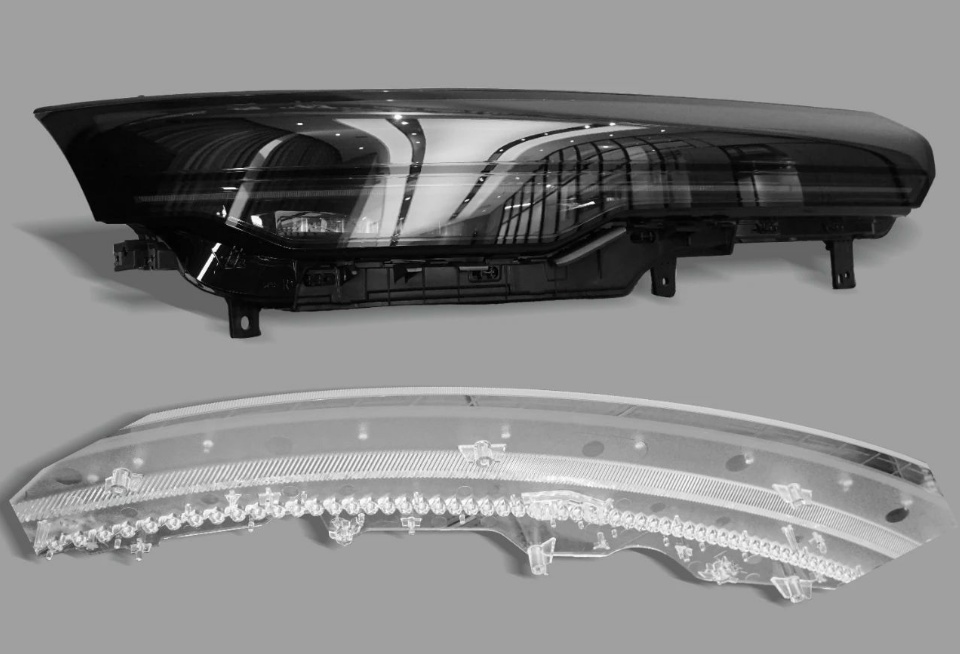

Image source: Wanhua Chemical

This collaboration not only fills the gap in domestically produced automotive-grade optical polycarbonate in China but also provides a replicable successful model for collaborative innovation across the local industry chain.

High-end materials"Stranglehold"Dilemma: The International Competitive Landscape of a Niche Market

Although optical materials for automotive lighting may seem like just a small part of automotive components, their performance directly determines the safety and reliability of intelligent automotive lighting systems. As the optical material for the core components of automotive lamps, light-guiding polycarbonate must meet multiple stringent requirements—it needs to...High transmittance, low haze, low birefringence, yellowing resistanceOptical "hard indicators" as mentioned above are also required.High liquidity, high impact resistance, high temperature resistanceThe "hard requirements" of physics.

Image source: Wanhua Chemical

For a long time, this niche market has been dominated by international giants such as Covestro, Mitsubishi Chemical, Sumitomo, and Idemitsu, with domestic companies mostly in a follower position. According to industry data, China's overall polycarbonate market relies on imports for high-end products, and the optical-grade polycarbonate segment is even more passively dependent on imports both in terms of equipment and products.

The key distinction between automotive-grade light-guiding polycarbonate and ordinary products lies in its requirement to meet the stringent standards of the automotive industry: a light transmittance of over 90%, passing UV aging tests, and withstanding high and low temperature cycles (-40°C to 135°C) without optical performance degradation or yellowing. These performance requirements pose extremely high barriers to the industrial-scale production of the material.

Technical Breakthrough: From Interface Aggregation Method to Full-Process Independent Innovation

The industrial preparation of automotive-grade optical polycarbonate currently relies mainly on the interfacial polycondensation method, which is significantly more complex than the process for ordinary polycarbonate. This method involves the reaction of bisphenol A (carbon footprint: 4.93 kg CO₂e/kg) with sodium hydroxide, followed by a liquid-liquid interfacial polycondensation reaction with highly toxic phosgene (COCl₂, carbon footprint: 1.39 kg CO₂e/kg). This technological route not only requires strict control of residual small-molecule impurities and extremely high standards of equipment cleanliness, but also necessitates the use of phosgene—a highly toxic and corrosive essential raw material—which demands comprehensive safety measures and exhaust treatment systems. Consequently, both the initial equipment investment and subsequent maintenance costs remain extremely high.

Wanhua Chemical, through its independently developed interfacial polycondensation phosgene process, has made breakthroughs in raw material ratio, additive optimization, and production processes, and has launched the automotive-grade light-guiding PC material Clarnate® LED1355. This material addresses the industry challenge of PC's susceptibility to yellowing by optimizing the polymerization process, significantly enhancing the product's purity and anti-aging performance. Test data shows that its core indicators such as weather resistance, light transmittance, and impact strength all reach the level of imported competing products, with some parameters, such as light transmittance (exceeding 90%), even surpassing international counterparts.

Geely Automotive's technical team simultaneously overcame the challenges of material forming processes. Through precise injection molding and optical calibration technologies, they successfully applied this material to the lighting designs of multiple models including Zeekr and Geely, creating a unique visual effect that blends a sense of technology with Eastern aesthetics. This deeply integrated upstream and downstream collaboration model from the R&D stage significantly improves innovation efficiency and shortens product time-to-market.

Industrial Chain Collaboration: A Demonstrative Case of Building a Local Innovation Ecosystem

The collaboration between Wanhua Chemical and Geely is far more than a simple supplier-customer relationship; it establishes a new paradigm of local industrial chain upstream and downstream collaborative innovation. The success of this model is reflected on three levels:

Technical collaborationWanhua focuses on breakthroughs in the performance of materials themselves, while Geely specializes in the development of application processes. From the early stages of material research and development, the technical teams of both parties have engaged in deep interaction to ensure that material characteristics and processing requirements are perfectly aligned. This integrated "design-material-process" development model avoids the common issue of disconnection between materials and applications in traditional supply chains.

Market Coordination AspectThis collaboration has made Wanhua Chemical the first Chinese company to enter the core supply chain of light guide grade materials for Geely Automobile's headlights. It also marks another breakthrough following the certification of headlamp lens materials by Hyundai Kia Group, the world's third-largest automaker, in March this year. By adopting high-end domestic materials, Geely has enhanced supply chain security and cost competitiveness.

Ecological CollaborationWanhua Chemical is accelerating the construction of a full industrial chain layout for automotive materials. On August 21, the company officially signed a strategic agreement with Changzhou Xingyu Co., a leading enterprise in the automotive lighting industry. Both parties will focus on the innovative research and development and application of key materials such as high-performance PC and PMMA, aiming to develop next-generation automotive lighting solutions that meet cutting-edge demands. As a leader in China's automotive lighting industry, Xingyu Co. has an annual production capacity of 80 million various automotive lights, with customers including mainstream automakers such as Hongmeng Zhixing, Chery, Geely, Volkswagen, Li Auto, BMW, NIO, XPeng, Mercedes-Benz, and BYD.

Image source: Wanhua Chemical

Material Matrix: Wanhua Chemical's Automotive Optical Materials Landscape

It is worth noting that Wanhua Chemical is building a complete product matrix of automotive optical materials. Besides PC, commonly used materials for automotive lighting include PMMA, COC/COP, transparent ABS, transparent PP, and transparent PA. Each material has its own advantages: PC is often chosen for headlights (impact resistance), turn signals (high temperature resistance), and dashboards; PMMA is preferred for tail lights (brightness) and ambient lights; ABS is selected for buttons; transparent PP is a cost-reduction option; and COC, as a new material, is considered the future standard for automobiles.

Wanhua Chemical currently has product lines for PC, PMMA, and COC/COP.

In the field of COP/COC, the company launched the WANCOP™ branded product last year. Recently, Wanhua Chemical disclosed a patent titled "A Cyclic Olefin Polymer and Its Preparation Method and Application," which introduces elastomer units with cyclohexyl side groups into the norbornene main chain and adds flexible aliphatic alkyl units onto the side chain polycyclic structures. This endows the COP polymer with excellent mechanical properties while maintaining the superior optical properties and thermal stability of cyclic olefin polymers. In June this year, Wanhua also filed a patent for a "Dual Active Center Metallocene Complex," which can efficiently catalyze the copolymerization of ethylene/α-olefins with cyclic olefins.

Industry Insights: From Breakthrough in a Single Point to Systematic Innovation

The collaboration between Wanhua Chemical and Geely Automobile provides important insights into independent innovation within China’s automotive industry chain.

The technical breakthrough needs to focus on core pain points. The biggest technical challenge of automotive-grade light-guiding PC is the yellowing problem after long-term use. Wanhua Chemical has specifically addressed this common industry issue by optimizing the polymerization process, endowing the product with market competitiveness.

Industry chain collaboration is the key to breakthroughs. The industrialization of high-end materials requires not only breakthroughs in the materials themselves but also the synchronous development of downstream application technologies. Wanhua, Geely, and Xingyu have formed a complete innovation chain of "materials - components - complete vehicles" through deep cooperation.

Independent innovation requires long-term investment. Wanhua Chemical's technological accumulation in the field of polycarbonate is not achieved overnight but through years of continuous investment. From ordinary PC to optical-grade PC, and then to COC materials, it reflects the company's step-by-step path of technological breakthroughs.

Standard guidance is of paramount importance. The key distinction between automotive-grade materials and ordinary industrial materials lies in their necessity to meet the stringent standards of the automotive industry. Wanhua Chemical benchmarks international automotive standards throughout its product development process, which is a prerequisite for gaining recognition from OEMs.

With the acceleration of automotive intelligence and electrification, the innovation of automotive materials will embrace a broader space. New applications such as smart car lights and autonomous driving sensors demand higher requirements for materials, which presents both a challenge for Chinese companies and an opportunity to overtake in curves.

Edit: Lily

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track