BOPP Film Industry Enters Structural Adjustment Phase! Delays in Two Major Fundraising Projects of Deguan New Materials Reveal What Signals?

Recently, Guangdong Decro Film New Materials Co., Ltd. (stock code: 001378) announced the postponement of the dates when certain projects funded by raised capital will reach their intended usable state, attracting attention within the industry. As a leading enterprise in the field of functional BOPP films, Decro’s adjustment of its capacity expansion plan reflects certain development trends in the packaging industry. This article will interpret the event from an industry perspective, combining the company’s announcement and the 2025 semi-annual report.

Source of the image: Dukang New Material Announcement

The postponement of two major fundraising projects by Dekuang New Materials has attracted attention.

Guangdong Decro Film New Materials Co., Ltd., founded in 1999, has three wholly-owned subsidiaries, including Guangdong Decro Packaging Materials Co., Ltd. It has three technology parks located in Shunde District, Foshan City, covering an area of 246,000 square meters. The company is equipped with seven internationally advanced biaxially oriented film production lines imported from Germany and Japan, 14 functional masterbatch production lines, two functional coating production lines, and seven research laboratories for functional films and materials. After 20 years of development, Decro New Materials has become a leader in China's functional BOPP film industry. Currently, Decro’s pearl film accounts for more than 90% of the market for wrap-around labels on carbonated beverages like Coca-Cola and Pepsi in China, while its laser film series holds a 60% market share of China's laser anti-counterfeiting base film. Products such as crystal film, anti-fog film, antibacterial film, paper-like film, pearlized film, heat-seal film, and matte film all meet international advanced standards and are widely used in fields such as printing and lamination, laser anti-counterfeiting, food packaging, high-end beverage packaging, trademark printing, and UV varnishing.

Source: DG New Materials official website

On August 16, 2025, Deguan New Materials issued the "Announcement on the Extension of Certain Fundraising Investment Projects," announcing that the expected completion date for the "Functional Film and Functional Masterbatch Reconstruction and Expansion Project" would be postponed from the original October 30, 2025, to June 30, 2026. Simultaneously, the expected completion date for the "Experimental and Testing Upgrade Technical Transformation Project" would also be postponed from October 30, 2025, to December 31, 2026. This adjustment has been reviewed and approved by the company's fifth Board of Directors at its ninth meeting and complies with relevant regulatory requirements.

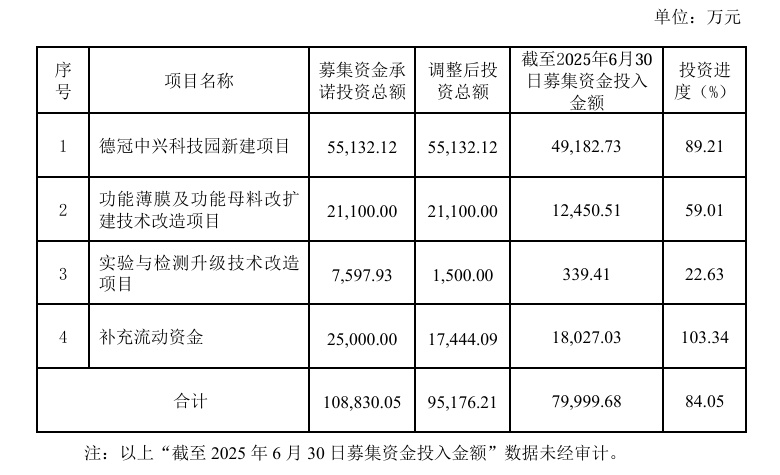

It is noteworthy that, according to the announcement, as of June 30, 2025, the "Functional Film and Functional Masterbatch Expansion and Technical Renovation Project" had an investment of 124.5051 million yuan, with a progress rate of 59.01%. The "Experimental and Testing Upgrade and Technical Renovation Project" had an investment of only 3.3941 million yuan, with a progress rate of 22.63%.

As of June 30, 2025, the company's use of raised funds is as follows:

Overseas equipment delivery delay

Prudent advancement of the technical pathCause delay

The delay in the delivery of overseas equipment is the direct cause of the postponement of the "Functional Films and Functional Masterbatch Expansion and Renovation Project." Deguan New Materials clearly stated in its announcement that the main equipment used in the project was all procured from overseas suppliers. Due to the longer delivery times from these overseas suppliers, the project could not be completed as originally planned. This situation reflects the reality that the global supply chain has not fully recovered in the post-pandemic era, especially the international procurement of high-end equipment faces significant uncertainties. As the packaging industry is highly globalized, its equipment and technology upgrades often rely on international supply chains. The situation encountered by Deguan New Materials is not an isolated case within the industry.

The cautious advancement of the technological path is the main reason for the delay in the "Experiment and Testing Upgrade Technology Transformation Project." The company stated that during the project's implementation, in order to adapt to the development trends of the new materials industry, the company's technological development stage, and the project construction cycle, it decided to gradually invest the raised funds and advance the integration of "material, film, coating" technology path through prudent allocation of experimental testing equipment. This cautious attitude reflects Dekun New Material's rigorous approach to technology research and development—not blindly pursuing speed, but ensuring that each stage of investment can generate actual benefits.

From an industry background perspective, the decision to postpone these two projects actually reflects De Crown New Materials' strategic adjustment in response to the transformation period in the packaging industry. Currently, the packaging industry is undergoing a transition from traditional single-function to high-performance and sustainable directions, with market demand showing diversified and multi-layered characteristics. According to the announcement, De Crown New Materials clearly recognizes that "with the increasing diversification of product packaging in recent years, BOPP film, as a widely used packaging material, is showing diversified, multi-layered, and multi-faceted market demand." This market change requires companies to enhance their R&D capabilities and product testing levels. De Crown New Materials' choice to advance projects at a more steady pace is precisely to better adapt to this industry trend.

BOPPEntering the film industryStructural adjustment

The delay in the fundraising project of De Crown New Materials is behind it.The entire packaging materials industry is undergoing profound changes. As an important category of plastic packaging, BOPP film, with its high transparency, high gloss, and high tensile strength, is widely used in the packaging of food, daily chemicals, pharmaceuticals, and electronic products. However, with the tightening of environmental regulations and the enhancement of consumer environmental awareness, traditional plastic packaging faces significant challenges. Functionality, recyclability, and biodegradability have become key words for the development of the industry.

It is worth noting that Deguan New Materials emphasized the importance of experimental and testing capabilities in its announcement, stating that "the company requires advanced testing equipment to conduct more targeted testing on product quality, functionality, technical parameters, etc., promoting the overall development of products towards high quality." This statement reveals the current development trend in the packaging industry.Quality and FunctionalityIt is replacing simple price competition and becoming the core competitiveness of enterprises. As downstream industries increasingly demand packaging materials with special features such as barrier properties, temperature resistance, and printability, the R&D and testing capabilities of film production enterprises have become particularly important.

From the perspective of market structure, China's BOPP film industry has entered a phase of structural adjustment. On one hand, there is an overcapacity in ordinary BOPP film and fierce market competition; on the other hand, there is still a supply gap in high-end functional BOPP films, which rely on imports. Deguan New Materials insists on advancing (rather than canceling) its fundraising projects, indicating its optimism about the prospects of functional films, albeit with a more prudent implementation pace. The semi-annual report for 2025 shows that the company invested 28.0984 million yuan in R&D, accounting for 3.81% of the total, and holds 164 patents, having won the China Patent Award four times. These technological reserves provide a solid foundation for its transformation.

Deguan New Material's net profit falls by 28%,6A billion in funding secures project delay.

On August 16th, Decrown New Materials released its semi-annual report for 2025.

The report shows that the company's operating income for the first half of 2025 was 736 million yuan, a year-on-year decrease of 2.54%. The net profit attributable to shareholders was 37.203 million yuan, a year-on-year decrease of 28.27%. The net profit attributable to shareholders excluding non-recurring items was 31.6816 million yuan, a year-on-year decrease of 39.64%.

As of June 30, 2025, DeGuan New Materials had a cash balance of 140 million yuan, trading financial assets of 10 million yuan, and large certificates of deposit and fixed income certificates in other current assets totaling 463 million yuan, indicating relatively ample liquidity. Meanwhile, the balance of construction in progress increased from 59.0583 million yuan at the beginning of the period to 212 million yuan, showing that the company is still actively advancing various project constructions. This financial situation provides a buffer for the delay of fund-raising projects, allowing the company to avoid hastily advancing projects due to financial pressure.

In terms of market layout, Dekuan New Materials adheres to a dual strategy of both domestic and international sales. The semi-annual report shows that the company's domestic sales revenue is 695 million yuan, while international sales revenue is 41.2694 million yuan. Although the domestic market is highly competitive, the company has maintained a relatively stable market position through product differentiation. After the completion of the projects funded by the capital raised, the company's product structure and market competitiveness are expected to further improve.

Strategic Outlook: Balancing Short-term Adjustments and Long-term Value

The case of Deguan New Materials highlights the typical challenges faced by the packaging industry during a period of transformation: finding the optimal balance between technological innovation and market realities. In the short term, project delays may affect the pace of market expansion; however, in the long run, this cautious approach helps avoid the risks of hasty investments and enables a more precise grasp of opportunities in the high-end market.

The 2025 semi-annual report shows that Deguan New Material maintains a stable foundation, which provides confidence for the company's strategic adjustments. Amid the industry's trend of "advancing towards high-end," if Deguan New Material can fully utilize the time window brought by project delays to further optimize its technical roadmap and product structure, it is expected to consolidate its leading position during the industry's reshuffle.

Editor: Lily

Material: Deguan New Materials official website, official announcements, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track