Behind the New Chemical Industry Tycoon: The Rise of the Coal-to-Olefin Sector?

On June 24, 2025, the New Fortune 500 Wealth Creation List was announced, and Dang Yanbao, the founder of Ningxia Baofeng Energy, surpassed the Li Shuirong family with an asset of 87 billion yuan, becoming the new billionaire in the chemical industry.

Image source: Internet

The wealth shift reflects the vigorous development of China's coal chemical industry, especially in the coal-to-olefin sector. At the same time, the escalating tension in the Strait of Hormuz is posing a threat to global energy transportation channels, which brings great challenges to traditional olefin producers that rely on the imported oil route, but provides historical opportunities for Chinese coal-to-olefin enterprises that have formed a complete industrial chain.

Specialized Plastic World will conduct an in-depth analysis of the profit structure and technological advantages of coal-to-olefins, as well as its development prospects amidst geopolitical turbulence.

The New Chemical Tycoon's Coal-to-Olefin Empire

The rise of Dang Yanbao's wealth is quite legendary. This entrepreneur, born in Yanchi, Ningxia, started as a small business owner and ventured into various fields including refined oil sales, building materials, logistics, and real estate, ultimately finding his true wealth growth point in the coal chemical industry. In 2005, he founded Ningxia Baofeng Energy Group Co., Ltd., which initially focused on coking business but gradually expanded into coal-based methanol, olefins, and other product fields, building a vast empire of coal-based new materials.

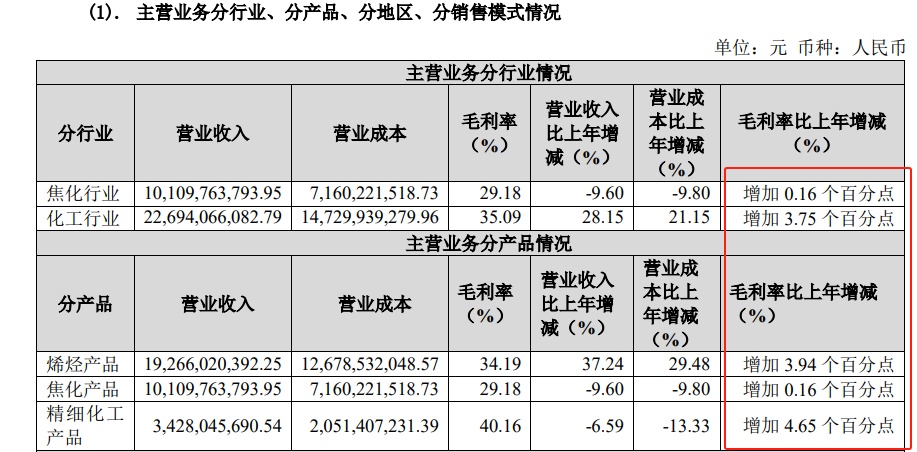

Baofeng Energy's core business model is to produce high-end chemical products by substituting coal for oil, primarily comprising three sectors: First is coal-to-olefin, which involves using coal and coke oven gas as raw materials to produce methanol, and then utilizing this methanol to produce polyethylene and polypropylene; second is coking operations, where raw coal is refined into clean coal, which is then used in coking to produce coke; third is fine chemical processing, where byproducts from the coal-to-olefin and coking operations are utilized to produce fine chemical products such as MTBE and pure benzene. Among these, coal-to-olefin has become the company’s primary and most profitable sector.

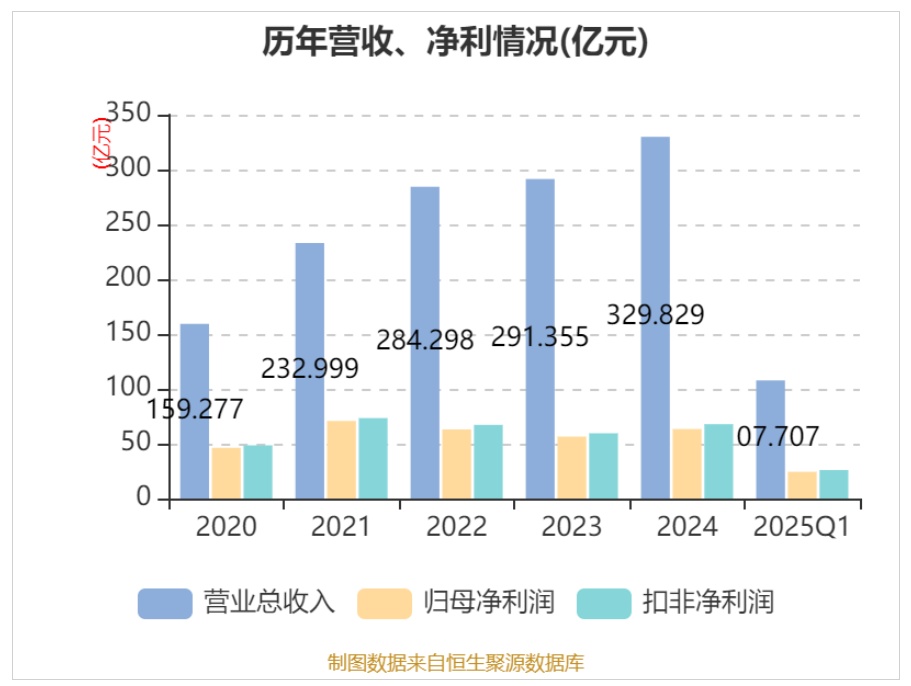

In 2024, Baofeng Energy achieved a revenue of 32.983 billion yuan, a year-on-year increase of 13.21%; net profit reached 6.338 billion yuan, a year-on-year increase of 12.16%, with a sales gross margin of 33.15%. In the first quarter of 2025, the company's performance growth accelerated further, achieving a total operating income of 10.771 billion yuan, a year-on-year increase of 30.92%; attributable net profit was 2.437 billion yuan, a substantial year-on-year increase of 71.49%. This outstanding performance became the strongest support for Dang Yanbao to top the list of chemical industry tycoons.

The Profit Advantage and Cost Structure of Coal-to-Olefins Production

The reason why coal-to-olefins has become Baofeng Energy's "cash cow" is closely related to China's unique resource endowment and the trend of energy prices in recent years. In terms of capacity structure, oil-based olefins remain the main production route for domestic polyolefins: in polyethylene, oil-based capacity accounts for 62%, light hydrocarbon-based accounts for 19%, and coal or methanol-based accounts for 19%; in polypropylene, oil-based capacity accounts for 53%, propane-based accounts for 24%, and coal or methanol-based accounts for 23%.

However, in terms of profitability, the coal-based route has already demonstrated a clear advantage. In 2024, the overall profit of the domestic polyolefin industry improved year-on-year due to the favorable decline in the prices of raw materials such as coal and crude oil, and the profitability advantage of coal-to-olefins further expanded. Data shows that the average profit of coal-based polyethylene reached 1,967 yuan per ton in 2024, an increase of 626 yuan per ton compared to 2023, representing a year-on-year growth of 46.7%. In contrast, the oil-based polyethylene industry has been in a loss for most periods over the past three years. Although it turned from negative to positive in 2024, the average profit was only 106 yuan per ton. This means that the profit of coal-based polyethylene is on average 1,861 yuan per ton higher than that of oil-based polyethylene.

Let's take a look at the situation in the polypropylene sector. In 2024, except for coal-based production which remained profitable, all other production routes in the polypropylene industry were still in a loss-making state. The average profit for coal-based polypropylene was 1,066 yuan/ton, increasing by 351 yuan/ton compared to 2023; while the average profit for oil-based polypropylene in 2024 was -897 yuan/ton, and for PDH-based polypropylene, the average profit was -779 yuan/ton. Coal-based polypropylene had an average profit that was 1,963 yuan/ton higher than oil-based polypropylene and 1,845 yuan/ton higher than PDH-based polypropylene.

The key reason why Baofeng Energy can achieve excess profits in the coal-to-olefins sector lies in its highly integrated cost control system. The company owns its own coal mine resources, and 2023 data shows that its coal mine equity production capacity reaches 11.02 million tons, with an annual output of 8.2 million tons from operating mines. This "coal-chemical" integrated business model enables Baofeng to effectively weaken industry cycle attributes and maintain relatively stable production costs during fluctuations in coal prices.

Capacity Expansion and Technological Upgrades: Baofeng's Growth Engines

The performance growth of Baofeng Energy is not accidental but is based on continuous capacity expansion and technological upgrades. In 2024, several key projects of the company have made breakthrough progress: the 100,000-ton/year vinyl acetate project has been completed on schedule, providing a stable and low-cost raw material guarantee for the EVA project; the 100,000-ton/year needle coke project has been completed on time, processing self-produced asphalt into high-end needle coke products, extending the coal tar processing industry chain; the Power Island project has achieved centralized steam supply, saving investment and reducing production costs.

2024225/EVA projectEVA Corrected and translated version: Notably, in February 2024, the Baofeng Ningdong 250,000 tons/year EVA project was completed, successfully producing photovoltaic-grade EVA products, entering the high-value-added new materials field.

On February 14, 2025, the 3 million tons/year olefin project of Inner Mongolia Baofeng Coal-Based New Materials Co., Ltd. officially commenced operation, marking the beginning of commercial operation for the world's largest coal-to-olefin project in a single factory. This massive project, with a total investment of 48.4 billion yuan, uses coal instead of oil to produce polyethylene and polypropylene, with an annual output of 3 million tons of polyolefins, accounting for 23.4% of the national total production. The project adopts the most advanced DMTO-III technology in the industry, increasing the annual olefin production capacity of a single unit to 1 million tons. The economies of scale have reduced the investment cost and depreciation cost per ton of olefin. Meanwhile, this technology achieves a higher olefin yield, reducing the methanol consumption per ton of olefin to 2.66 tons, further strengthening the cost advantage.

On April 27, 2025, the construction of the Baofeng Energy Storage Cathode, Anode, and Electrolyte Plant, as well as the Baofeng Energy Phase IV Olefin New Materials Project, commenced simultaneously. Among them, the Baofeng New Energy Storage and other projects involve an investment of 10.5 billion yuan, aiming to build an annual production capacity of 250,000 tons of lithium iron phosphate cathode materials, 150,000 tons of artificial graphite anode materials, and 170,000 tons of electrolyte materials, along with a 100GWh lithium battery and energy storage system and energy storage power station. The Baofeng Energy Phase IV Olefin New Materials Project involves an investment of 20.5 billion yuan, adopting the most advanced industry technology to achieve domestic substitution and lead the coal-based new materials industry towards a direction of high-end, low-carbon, and intelligent development.

Strait of Hormuz Crisis: Strategic Opportunities for Coal-to-Olefin Production

As companies like Baofeng Energy in the coal chemical industry surge forward, the global energy transportation choke point—the Strait of Hormuz—is facing an unprecedented crisis.

Image source: Internet

Since June 2024, with the escalation of US-Israeli military strikes against Iran, the situation in the Persian Gulf has continued to deteriorate. Many cargo ships have been forced to alter their routes or suspend navigation as they approach the Strait of Hormuz. According to Reuters, the number of empty oil tankers entering the Strait of Hormuz dropped by 32% within a week, while loaded oil tankers decreased by 27%, highlighting the direct impact of the conflict on shipping activities.

On June 22, the Iranian parliament approved a proposal to close the Strait of Hormuz and handed the final decision to the Supreme National Security Council. Le Figaro reported that blocking the Strait of Hormuz is "Tehran's last ace." Data from the U.S. Energy Information Administration shows that approximately 20 million barrels of oil are transported through the strait per day in 2024, accounting for 20% of global total consumption.

The Strait of Hormuz is not only a chokepoint for global energy transportation but also a crucial hub for the bulk chemical trade. The crude oil and natural gas transported through this strait provide key raw materials for the global chemical industry, such as ethylene, propylene, methanol, and liquefied natural gas (LNG). As the largest exporter of methanol and urea globally, the Middle East relies on this strait to maintain the stability of its supply chain. If the strait were to be blocked, the imbalance in supply and demand in the global chemical market would trigger significant price volatility.

For the Chinese chemical industry, the impact of the Hormuz Strait crisis is particularly profound. China is the world's largest importer of methanol, most of which comes from the Middle East. Restrictions on the import of petrochemical raw materials such as ethylene and propylene may further affect the stable operation of domestic plastics, rubber, and textile industries. According to industry analysis, the increase in transportation time and costs will squeeze profit margins, especially for high transportation cost categories such as liquefied natural gas, methanol, and polystyrene, which will be severely impacted.

However, opportunities are also brewing amidst the crisis. The potential blockade of the Strait of Hormuz provides a strategic development window for China's coal-to-olefins industry. Unlike traditional petrochemical enterprises that rely on imported oil routes, coal-to-olefins companies are based on the abundant domestic coal resources and are not constrained by international crude oil transportation channels. Against the backdrop of increasing emphasis on energy security, the advantage of raw material self-control in coal-to-olefins will receive more policy support and market recognition.

The Future Prospects and Challenges of Coal-to-Olefins

Against the backdrop of geopolitical turbulence and energy transition, the coal-to-olefins industry is faced with a development environment characterized by coexisting opportunities and challenges. From the perspective of favorable factors:

Firstly, the cost advantage of coal-to-olefins is expected to continue. In 2024, coal prices are significantly expected to decline, while international oil prices are increasingly volatile due to geopolitical influences, and this trend is unlikely to change in the short term. Companies like Baofeng Energy are continuously reducing the production costs of coal-to-olefins through technological upgrades and economies of scale. The DMTO-Ⅲ technology has reduced the methanol consumption per ton of olefins to 2.66 tons, and there is still room for optimization in the future.

Secondly, the national energy security strategy provides policy support for coal-to-olefin. Under the goals of "carbon peak and carbon neutrality", the path of simply expanding coal consumption is no longer feasible, but as an alternative to oil, modern coal chemical industry, especially the production of high-end chemicals such as coal-to-olefin, is still regarded as an important means to ensure national energy and chemical raw material security. The "Innovative Development Layout Plan for Modern Coal Chemical Industry" issued by the National Development and Reform Commission clearly proposes to promote the complementary and coordinated development of coal chemical industry and petrochemical industry.

Third, high-end and differentiated development opens up growth space. Baofeng Energy has laid out high value-added products such as photovoltaic-grade EVA and needle coke, and entered the field of energy storage materials. This strategy of extending to high-end new materials can effectively avoid the risk of price fluctuations in bulk chemicals and improve overall profitability.

However, the industry also faces challenges that cannot be ignored. First, carbon emission constraints are a major limiting factor for the development of coal-to-olefins. The carbon emission intensity of coal chemical processes is significantly higher than that of the petroleum route. Under the dual carbon goals, companies need to invest more costs in the application of technologies such as carbon capture and storage (CCS). Baofeng Energy has begun to explore the low-carbon path of coupling green hydrogen with coal chemicals, but large-scale commercialization still needs time.

Secondly, water resource stress cannot be overlooked. Coal chemical industry is a typical high-water-consuming sector, and the main coal-rich areas in China often lack water resources. In the future, project approvals and water resource management will become stricter, and enterprises need to continuously improve their water efficiency levels.

Technical iteration risks also exist. With the volatility of crude oil prices and the increased supply of light hydrocarbon feedstocks (such as ethane and propane), as well as advancements in bio-based routes, the cost advantage of coal-to-olefins may face challenges. Companies need to continuously invest in R&D to maintain technological leadership.

Dang Yanbao's rise to the top of the chemical industry is not only a success story of an entrepreneur but also a reflection of the rise of China's coal chemical industry. In today's global geopolitical landscape marked by turbulence and heightened attention to supply chain security, the development model represented by coal-to-olefin companies like Baofeng Energy, which emphasizes autonomous control over raw materials, is seeing its strategic value being re-evaluated by the market.

The crisis in the Strait of Hormuz reminds us of the immense risks associated with excessive reliance on a single energy transportation route. China's resource endowment of "rich coal, poor oil, and little gas" determines that coal-to-olefins will play an important role in the medium to long term. However, the sustainable development of the industry must be based on technological innovation and green transformation, achieving a balance between economic viability and environmental friendliness by improving resource utilization efficiency, reducing carbon emission intensity, and developing high-end products.

Editor: Lily

The data in this article is sourced from publicly available information such as Chemical Industry New Materials, New Fortune Magazine, Baofeng Energy annual reports, China Securities Journal, Reuters, and the U.S. Energy Information Administration.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track