Behind the burning cash and financing of Pulpex and Paboco, what is constraining the development of the paper bottle revolution?

Introduction: By 2025, the global beverage packaging market is estimated to reach a valuation of $117 billion, with plastics still accounting for 40% of the share. However, a "de-plasticization" revolution driven by pulp molding technology is underway — companies like Pulpex and Paboco are capturing the market through innovative paper bottle technologies as an environmentally friendly alternative to traditional plastics, which has garnered significant attention in recent years.

The two companies have been continuously raising funds, but the application prospects of paper bottles involve constraints in multiple aspects such as technology, economics, policy, and consumer behavior. The following sections will provide a more detailed analysis:

I. Application Prospects of Paper Bottle Packaging

1. Market Demand Driven by Environmental Concerns

Policy Pressure: Globally, policies such as the EU's Single-Use Plastics Directive and China's Plastic Ban are accelerating the phase-out of plastic packaging. For example, the EU requires that all packaging be reusable or recyclable by 2030, making paper bottles a crucial option for companies to comply with regulations.

Policy Pressure: Globally, policies such as the EU's "Single-Use Plastics Directive" and China's "Plastic Ban" are accelerating the phase-out of plastic packaging. For example, the EU requires that all packaging be reusable or recyclable by 2030, making paper bottles an important option for companies to comply.Consumer Preferences: According to a 2022 McKinsey survey, 67% of consumers are willing to pay a premium for eco-friendly packaging, with Gen Z showing particularly high loyalty to sustainable brands. The "natural" and "recyclable" labels on paper bottles can significantly enhance brand image.

Corporate ESG Goals: Giants like Coca-Cola and L'Oréal have committed to reducing plastic use. For instance, Coca-Cola is working with Paboco to develop a paper bottle prototype, aiming to achieve 100% recyclable packaging by 2030.

2. Technological Breakthroughs and Innovations

-

Advances in Materials Science:

Advances in Materials Science:

Nano-coating Technology: By using cellulose nanofibers (CNF) or biobased barrier layers (such as PLA), the water and oil resistance of paper bottles can be enhanced. A "NanoCrystal Cellulose" coating developed by Nippon Paper Industries can withstand liquid penetration for up to 12 hours.

Composite Materials: Combining paper-based materials with biobased plastics (such as PEF) retains the recyclability of paper while providing sealing properties similar to PET.

-

Upgraded Production Processes:

Upgraded Production Processes:

3D Molding Technology: Swedish company Ecolean uses pulp molding technology to produce lightweight paper bottles, which consume 30% less energy than traditional plastic bottles.

Digital Printing: This supports personalized design, reduces the cost of small-batch production, and caters to the high-end custom market (such as luxury perfumes).

3. Potential in Niche Markets

The beverage industry: Alcoholic beverages (such as whiskey, wine) and short shelf-life drinks (such as fresh-squeezed juices) are early testing grounds for paper bottles. Carlsberg's "fiber bottle" has passed consumer tests and is planned for mass production in 2025.

Cosmetics industry: L'Oréal, in collaboration with recycling company Terracycle, launched an essence in a paper bottle, emphasizing the concept of "zero plastic," aligning with the sustainable positioning of high-end brands.

Cosmetics Industry: L'Oreal collaborates with recycling company Terracycle to launch a paper-bottled essence, emphasizing the "zero plastic" concept, which aligns with the sustainable positioning of high-end brands.Household Chemicals: Unilever pilots paper-bottled shampoo in Southeast Asia, utilizing local bamboo pulp resources to reduce costs.

Household Chemicals: Unilever pilots paper-bottled shampoo in Southeast Asia, utilizing local bamboo pulp resources to reduce costs.II. Core Challenges Constraining the Development of Paper Bottles

II. Core Challenges Constraining the Development of Paper Bottles1. Technical and Performance Bottlenecks

1. Technical and Performance BottlenecksInsufficient barrier properties:

Insufficient barrier properties:

Liquid penetration: Paper fibers tend to soften when exposed to water, requiring multiple layers of coating (such as aluminum foil, PE), but this reduces recyclability. For example, paper bottles with plastic coatings need to be separated for processing; otherwise, they contaminate the paper pulp stream.

Liquid penetration: Paper fibers tend to soften when exposed to water, requiring multiple layers of coating (such as aluminum foil, PE), but this reduces recyclability. For example, paper bottles with plastic coatings need to be separated for processing; otherwise, they contaminate the paper pulp stream.Oxygen barrier: Beverages that are sensitive to oxygen (such as beer) require additional barrier layers, and currently, the cost of bio-based materials is 2-3 times that of traditional PET.

Oxygen barrier: Beverages that are sensitive to oxygen (such as beer) require additional barrier layers, and currently, the cost of bio-based materials is 2-3 times that of traditional PET.Mechanical strength limitations: Paper bottles have weaker compression resistance compared to glass and plastic, making them prone to deformation during long-distance transportation. Solutions include increasing wall thickness (but this increases weight) or embedding reinforcing structures (such as honeycomb lining).

Mechanical strength limitations: Paper bottles have weaker compression resistance compared to glass and plastic, making them prone to deformation during long-distance transportation. Solutions include increasing wall thickness (but this increases weight) or embedding reinforcing structures (such as honeycomb lining).2. Economic Challenges

2. Economic ChallengesHigh production costs:

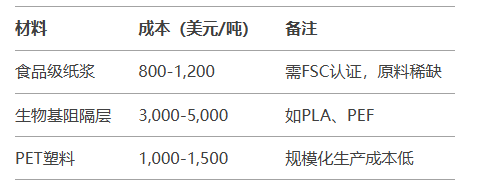

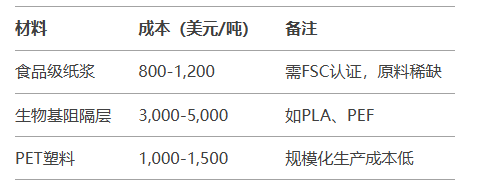

High production costs:

Recycling Costs: Paper bottles need to be sorted for recycling. If mixed with regular waste paper, they can contaminate the production line. Some European countries have established dedicated recycling facilities, but the global adoption rate is less than 10%.

3. Supply Chain and Infrastructure Gaps

Dependency on Raw Materials: High-quality pulp depends on a few production areas such as Northern Europe and Canada. Geopolitical issues or natural disasters may lead to supply chain disruptions.

Decentralized Recycling Systems: Developing countries lack paper bottle sorting facilities. For example, in India, only 35% of waste paper is recycled, and most paper bottles may end up in landfills.

4. Consumer Acceptance and Habits

Concerns about Functionality: Consumers worry that paper bottles are prone to damage, leakage, or affect taste. In 2021, a brand's paper-bottled mineral water was taken off the shelves due to complaints about "paper odor."

Misconceptions: Some consumers mistakenly believe that paper bottles are 100% biodegradable. In reality, coated paper bottles require specific conditions for processing, which may lead to "greenwashing" controversies.

III. Future Breakthrough Directions

1. Technology Integration:

-

Develop all-paper-based barrier coatings (such as mycelium coatings) to avoid plastic pollution.

-

Use AI to optimize structural design, for example, by generating lightweight and pressure-resistant bottle bodies through algorithms.

Develop all-paper-based barrier coatings (such as mycelium coatings) to avoid plastic pollution.

Develop all-paper-based barrier coatings (such as mycelium coatings) to avoid plastic pollution.

Use AI to optimize structural design, for example, by generating lightweight and pressure-resistant bottle bodies through algorithms.

Use AI to optimize structural design, for example, by generating lightweight and pressure-resistant bottle bodies through algorithms.

2. Policy and Capital Promotion:

Government subsidies for R&D (such as the U.S. Department of Energy funding bio-based material projects).

-

Establish a globally unified standard for paper bottle recycling to promote industry chain collaboration.

Establish a globally unified standard for paper bottle recycling to promote industry chain collaboration.

Establish a globally unified standard for paper bottle recycling to promote industry chain collaboration.

Establish a global unified standard for paper bottle recycling to promote collaboration across the industrial chain.

3. Business Model Innovation:

3. Business Model Innovation:-

Deposit System: Drawing inspiration from Germany's bottle deposit system, increase the recycling rate of paper bottles.

-

Shared Packaging: For example, the Loop platform offers refillable paper bottle services.

Deposit System: Drawing inspiration from Germany's bottle deposit system, increase the recycling rate of paper bottles.

Deposit System: Drawing inspiration from Germany's bottle deposit system, increase the recycling rate of paper bottles.

Deposit System: Drawing inspiration from Germany's bottle deposit system, increase the recycling rate of paper bottles.Shared Packaging: For example, the Loop platform offers refillable paper bottle services.

Shared Packaging: For example, the Loop platform offers refillable paper bottle services.

Shared Packaging: For example, the Loop platform offers refillable paper bottle services.IV. Summary

IV. SummaryThe long-term prospects of paper bottle packaging depend on the rate of decline in technology costs and the improvement of recycling infrastructure. In the short term, it is more likely to be widely adopted in high-value-added sectors (cosmetics, premium beverages), while the mass consumer market will need to wait for technological maturity and cost reduction through scale. If key bottlenecks can be overcome, paper bottles have the potential to become one of the mainstream packaging options in the "post-plastic era," but this will require the joint efforts of businesses, governments, and consumers.

The long-term prospects of paper bottle packaging depend on the rate of decline in technology costs and the improvement of recycling infrastructure. In the short term, it is more likely to be widely adopted in high-value-added sectors (cosmetics, premium beverages), while the mass consumer market will need to wait for technological maturity and cost reduction through scale. If key bottlenecks can be overcome, paper bottles have the potential to become one of the mainstream packaging options in the "post-plastic era," but this will require the joint efforts of businesses, governments, and consumers.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track