Beauty industry regulatory storm hits: How L'Oréal and Procter & Gamble "Detox" Packaging

The annual conference (CEAC) of the European Cosmetics Association (CE) was held in Brussels from June 11 to 12. CEAC is a barometer for the development of the cosmetics industry.

In the next two years, the European beauty industry will face a wave of regulatory changes. The European Commission is currently evaluating the existing framework of the EU Cosmetics Regulation and will announce the evaluation results by the end of 2026, which may lead to regulatory updates. Additionally, the revision of the Regulation on the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) is also underway and is expected to be completed by the end of this year.

At this conference, the industry described these upcoming changes as a "regulatory tsunami." The beauty industry must be prepared for regulatory changes.

A sub-forum at the annual conference was dedicated to discussing the "Challenges of Sustainable Packaging in Cosmetics," revealing the bottlenecks in the application of post-consumer recycled materials (PCR) and innovative solutions.

The packaging and recycling of cosmetics are as significant as the regulation of cosmetic ingredients. How can the industry balance innovation with sustainability while maintaining competitiveness? Let's see how the European cosmetics industry addresses this challenge.

— 1 —

Cosmetic Packaging: Not Just About Aesthetics, But Also a Guardian of Safety

The core function of cosmetic packaging goes far beyond being just a "container"; it also has to fulfill the following functions:

1. Protective functional components: prevent the oxidation and decomposition of active ingredients (e.g., vitamin C degrades when exposed to light).

Secondly, isolate pollution: prevent microbial invasion or moisture loss (such as the sealed design of face cream).

User experience: precise control of dosage (e.g., pump head design).

However, with the European Union's Packaging and Packaging Waste Regulation (PPWR) mandating that the proportion of recycled plastics in cosmetic packaging must reach 10%-50% by 2030 (depending on the type of material), the industry faces a battle to balance "sustainability" and "safety."

— 2 —

The Five Structural Bottlenecks of Recycled Materials

According to the analysis by Quantis expert Victor Frontere, the cosmetics industry faces the following challenges:

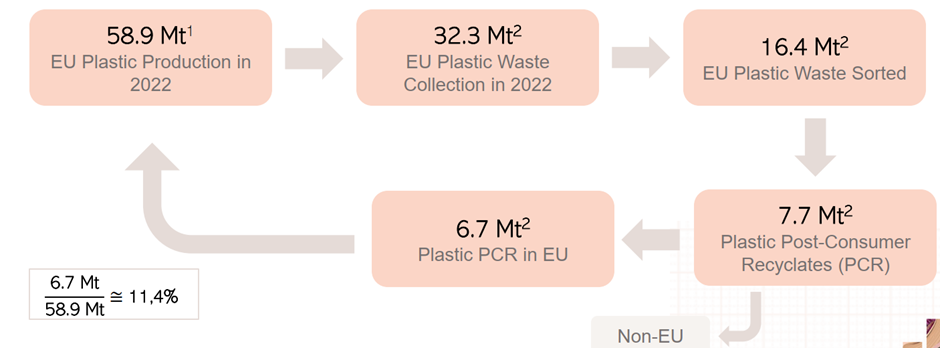

Diagram: EU Plastic Recycling Volume Diagram

Chart: Post-Consumer Recycled Material Usage in Plastic Packaging in Germany in 2023

1. Collection and sorting gap: In 2022, the EU only recycled 11.4% of plastic waste, and high-quality recycled materials are in short supply.

2. Safety and Quality Threshold: Cosmetics come into direct contact with the skin and must pass migration tests (such as heavy metals and plasticizer residues).

Cross-industry competition: The food and beverage industry seizes high-purity rPET (such as the German deposit system recycling 98% of beverage bottles).

4. Cost Disadvantage: The price of recycled plastic is highly volatile, and the cost of some categories is 30% higher than that of virgin plastic.

5. Brand aesthetic requirements: The uneven color and low transparency of recycled materials may affect consumer perception.

Moreover, the difficulty of recycling varies significantly among different materials. Data from the sub-forum shows us which recyclable materials are the most "in demand."

- Plastics (PET/PP/PE): Food-grade and cosmetic-grade rPET and rPP are extremely scarce.

High-transparency recycled glass is limited due to insufficient color sorting technology.

- Metal (Aluminum): Closed-loop recycling is relatively mature, but prices fluctuate significantly.

Biobased materials: Despite active innovation, they do not meet the PPWR quota requirements.

— 3 —

Safety Assessment: From Food Compliance to "Self-Established Standards"

As an important component of the "S" in ESG, product safety has always been a top priority for cosmetics manufacturers. It not only involves functional ingredients in cosmetics and excipients but also considers the material of the packaging and its interaction with the packaged product/cosmetics. This aspect has increasingly gained the attention of major manufacturers, consumers, and regulatory agencies, with all stakeholders making continuous efforts in this regard.

Interaction between packaging materials and the packaged products.

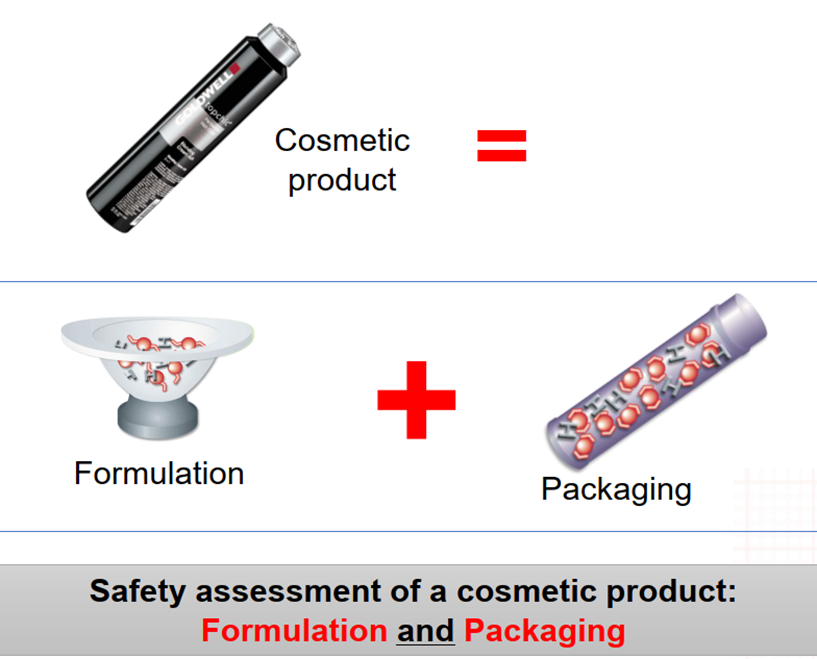

The safety of cosmetic products requires consideration of both the cosmetic formulation and the packaging.

1. Limitations of food-grade standards and the necessity for the cosmetics industry to independently develop a safety assessment system.

The safety assessment of cosmetic packaging must begin with the legal framework. According to Article 3 of the EU Cosmetics Regulation (EC 1223/2009), cosmetics must ensure human health safety under normal or reasonably foreseeable conditions of use.

Article 17 further clarifies that trace amounts of prohibited substances that are "technically unavoidable" in packaging may be allowed to migrate, but they must meet safety standards. This legal foundation sets clear requirements for the safety assessment of cosmetic packaging, while also presenting challenges for the use of recycled materials.

In safety assessment practices, the cosmetics industry has long drawn on the regulatory framework for food contact materials (FCM), based primarily on two important premises:

Firstly, cosmetics and food have similarities in physicochemical properties (such as pH value, lipophilicity, etc.).

Second, the two are also comparable in terms of the packaging-to-content contact ratio.

The EU regulations on food contact materials (EU 10/2011) provide a well-established method for safety assessment, including migration testing, a list of permitted substances, and simulation tests with specific solvents. This cross-referencing approach has proven effective in the evaluation of traditional packaging materials.

However, when it comes to post-consumer recycled (PCR) materials, the limitations of food-grade standards become particularly apparent. Anne Fuchs, a toxicology expert at Kao, pointed out in the report that currently only rPET has received relatively comprehensive EFSA (European Food Safety Authority) certification, while certification cases for rPE and rPP are few and far between. This discrepancy mainly stems from the complexity of material characteristics and recycling processes.

1. Differences in material structure: The chemical structure of PET is more stable, resulting in less degradation during mechanical recycling and making it easier to remove contaminants through processes such as high-temperature washing. In contrast, PE and PP (especially LDPE and flexible PP films) tend to retain contaminants more easily during the recycling process and lack effective purification technologies.

2. Raw material sourcing control: EFSA-certified rPE and rPP almost entirely come from "closed-loop systems" (such as industrial waste streams) or highly controlled raw materials (such as medical packaging recycling). However, the large amount of packaging materials required by the cosmetics industry mainly comes from post-consumer recycled "yellow bags" (Germany's household waste recycling system), where the complexity of raw materials and the risk of contamination are significantly higher.

3. Certification process obstacles: EFSA has stricter certification requirements for non-PET materials. For example, for rHDPE and rPP, only a few applications for rigid packaging have been approved, while flexible packaging (such as tubes and films) has not been certified at all. This limitation directly affects the range of choices for cosmetic packaging.

It is worth noting that while the compliance of food contact materials provides valuable reference for the safety assessment of cosmetic packaging, it is not a mandatory requirement. The report emphasizes: "Food compliance is very helpful, but not necessary." This understanding compels the cosmetics industry to develop specialized safety assessment systems, especially for those recycled materials that cannot obtain food-grade certification.

The necessity for this led to the establishment of the CosPaTox Alliance and the formulation of its technical guidelines. This alliance brings together the entire value chain, from raw material suppliers to brand owners, aiming to establish a set of safety assessment standards for recycled materials specifically targeting cosmetics and household product packaging. Its core innovation lies in surpassing the limitations of food-grade standards by establishing a scientific and practical safety assessment framework for various recycled materials through steps such as material characterization, toxicological evaluation, exposure simulation, and risk quantification.

2. Solutions of the CosPaTox Alliance.

In 2024, the CosPaTox Alliance (Cosmetic Packaging Toxicology), composed of over 30 organizations including L'Oréal, Procter & Gamble, and Beiersdorf, released the world's first "Guideline for Safety Assessment of Recycled Plastics in Cosmetics." The core of this guideline is to assess risk through non-targeted screening (such as GC-MS testing) and exposure simulation (assuming 100% substance migration to the product), and to set safety thresholds based on adult or child usage scenarios. For example, if a certain substance is detected in a 250ml rHDPE shower gel bottle exceeding 15.5mg/kg, further evaluation of its carcinogenicity is required.

In terms of testing, the CosPaTox alliance has developed a detailed protocol.

First is material characterization, including non-targeted testing (such as GC-MS extraction model simulants) and targeted testing (supplementary detection of specific substances like heavy metals, polycyclic aromatic hydrocarbons, etc.). All chromatographic peaks will be quantified and classified as specific substances or "unidentified" components.

Secondly, toxicological characterization is considered. Unidentified substances are assumed to have genotoxicity by default, while identified substances are evaluated based on their Cramer classification (TTC approach) or actual toxicological data (such as NOAEL, ADI).

Exposure characterization follows, assuming all substances completely migrate into the cosmetics and calculating the daily exposure amount based on the product type (such as leave-on or rinse-off). Finally, risk characterization is performed by comparing the exposure values with safety thresholds (such as TTC or MACE values) to draw conclusions.

To verify the reliability of the testing method, the CosPaTox consortium conducted a ring study involving 31 types of PCR materials (rHDPE, rPP, rLDPE), utilizing four extraction procedures and comparisons across seven laboratories. The results showed that the standard deviation of the total extraction amount was less than 10%, demonstrating the repeatability of the method.

Additionally, the coalition has developed a "worst-case scenario calculation tool" to help brand owners quickly assess the suitability of materials. For example, for leave-on cosmetics (such as lotions), the limit for specific substances in each kilogram of PCR material is 0.37mg, while for household products (such as laundry detergent), the limit is relaxed to 1923mg.

— 4 —

Industry Action: From "Passive Compliance" to "Active Breakthrough"

Propose the following strategy:

- Lock in long-term supply: Sign multi-year agreements with recyclers or jointly invest in building dedicated production lines.

Design reduction: Promote lightweight single-material packaging (such as removing the pump head from replacement packaging).

Aesthetic Innovation: Transforming the "flaws" of recycled materials into a design language (such as a frosted texture).

- Ecological co-construction: Support deposit-based recycling systems and fund small-scale packaging recycling technologies.

Collaboration cases include L'Oréal and L’Occitane partnering with Carbios to promote the commercialization of chemical recycling technology; Unilever invested in Closed Loop Partners in 2021 and launched an industry alliance in 2025, focusing on the recycling of small-sized packaging.

Despite the PPWR setting "exemption clauses" (such as assessing technical feasibility in 2028), the cosmetics industry has realized that relying on policy leniency is not as beneficial as proactive innovation. As Beiersdorf analyst Heiner Gers-Barlag stated, "The safety issue of recycled materials is not the endpoint but a catalyst for industry upgrading."

In the future, the sustainability of cosmetics packaging concerns not only environmental protection but also a comprehensive test of technology, safety, and innovation. The industry needs to continue promoting cross-sector collaboration, improve recycling systems, and ensure product safety through scientific assessment. Only in this way can it meet regulatory requirements while gaining consumer trust and market recognition.

— 5 —

China Standards

On August 1st, the State Administration for Market Regulation (National Standardization Administration) announced the issuance of 9 national standards related to plastic and recycled plastic under Announcement No. 19 of 2025, all of which will be implemented starting February 1, 2026. Among them, the "Guidelines for Recyclable and Recycled Design of Plastics Part 1: Polyethylene Terephthalate (PET) Materials" (GB/T 46020.1-2025) and "Guidelines for Recyclable and Recycled Design of Plastics Part 2: High-Density Polyethylene (PE-HD) Materials" (GB/T 46020.2-2025) hold significant guiding importance for fields such as cosmetic packaging.

Source: Global Zero Carbon

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track