BASF Suddenly Cancels

Recently, BASF and Yara International have jointly decided to terminate the project to develop a low-carbon ammonia production facility equipped with carbon capture and storage technology in the Gulf Coast region of the United States.

In June 2023, the two parties announced a collaboration and have since been selecting a site to build a plant along the U.S. Gulf Coast. BASF and Yara are long-term partners and are currently jointly operating a world-class ammonia plant at BASF's Freeport, Texas facility. Additionally, BASF produces ammonia in Ludwigshafen, Germany, and Antwerp, Belgium. Yara operates the world's largest ammonia production system, with production facilities located across Europe, the Americas, and Asia.

BASF cited “purely economic considerations” as the reason for the divestment. The company stated that it will focus its resources on projects with higher value-added potential. As part of a large-scale cost reduction plan, BASF has already significantly cut its capital budget for the coming years.

Sell/Abandon Multiple Businesses

In September 2024, BASF released its new strategy "Winning Ways," dividing its businesses into "core businesses" and "autonomous businesses." In 2024, BASF Group consists of 11 business segments. After the reorganization of the Catalysts division in January 2025, it will comprise 12 business segments, which are grouped into the following six major business areas:

Specifically, the surface treatment technology business domain has been adjusted into three major "independent businesses": the Coating Business Division remains unchanged, while two independent business divisions—Battery Materials, and Environmental Catalysts and Metal Solutions—have been established. The chemical and refining catalyst businesses, originally part of the Catalyst Business Division, have been transferred to the Specialty Chemicals Business Division under the Industrial Solutions business domain.

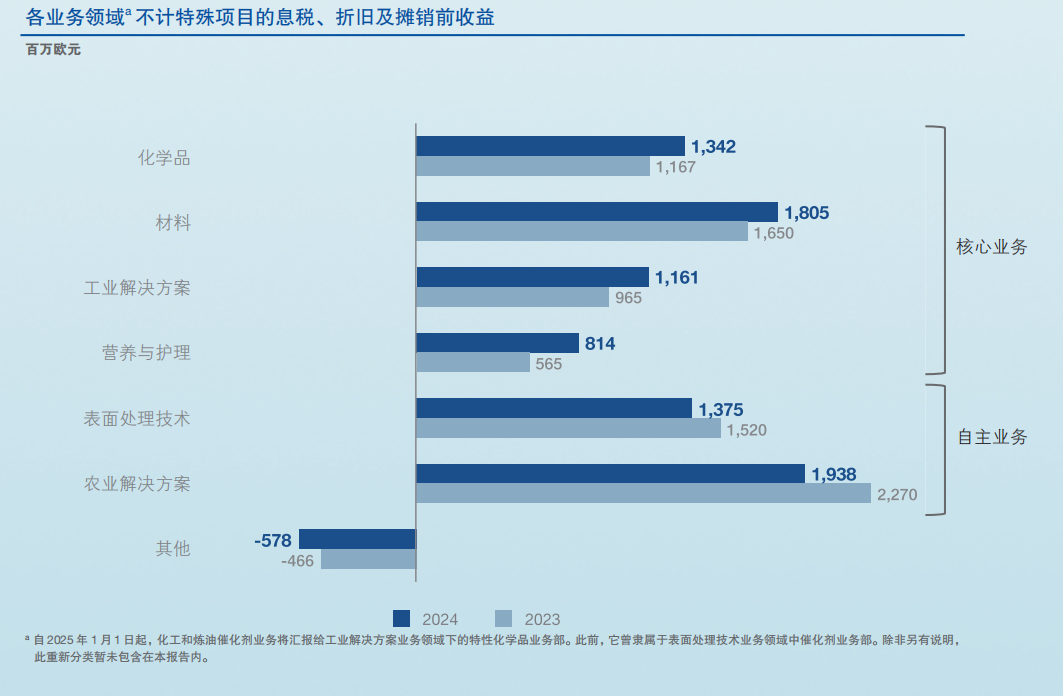

The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), excluding special items, for each business in 2024 and 2023 is as follows:

BASF's "independent business" segment has undergone several adjustment measures, specifically: the Environmental Catalysts and Metal Solutions division was spun off in 2023.

The Battery Materials Division: Operating in a rapidly growing environment characterized by high market and technological risks. To mitigate these risks, it is focusing on leveraging existing capacity and adjusting expansion plans. In 2024, BASF abandoned its initial plan to independently produce nickel and cobalt; the battery materials plant in Finland had to implement indefinite layoffs due to the revocation of a temporary permit; the plan to build a nickel-cobalt production facility in Indonesia was halted; similarly, BASF also withdrew its investment in the lithium mining business in Chile.

The Coatings Division: BASF's decorative coatings business in Brazil was sold to Sherwin-Williams for $1.15 billion in February 2025. In May, BASF Europe initiated the previously announced sale plan of its coatings business, with a potential transaction value of approximately 6 billion euros. According to related reports, the company has sent information about the business to potential bidders.

The Agricultural Solutions division plans to complete legal separation by 2027 and introduce an independent enterprise resource planning system, with an IPO planned for 2027, at which time BASF may sell its minority stake in the pesticide and seed manufacturer.

In addition to the above strategic plans for independent businesses, several other business lines have also been reduced.

In June 2024, BASF sold its bioenergy enzymes business to the Raman Group; in July, BASF sold its additive manufacturing business to the Forward AM leadership team and established Forward AM Technologies GmbH; in the same month, BASF announced the cessation of production of the active ingredient glufosinate ammonium at its Knapsack and Frankfurt plants in Germany; in August, BASF decided to stop production related to adipic acid, cyclododecanone, and cyclopentanone at its Ludwigshafen site in Germany; in September, BASF sold Wintershall Dea's exploration and production business (excluding Russian-related assets) to Harbour Energy, completing the sale in August 2025 and receiving $1.56 billion; in November, BASF completed the transfer of its mining flocculants business to Solenis; in December, BASF sold its Food and Health Performance Ingredients business (including the Illertissen production site in Germany) to the Louis Dreyfus Company (LDC). In July 2025, BASF completed the sale of its Styrodur® business to BACHL.

At the beginning of 2024, BASF announced plans to further intensify austerity measures, especially in energy-intensive sectors, by closing more production facilities and focusing on the development of core businesses. In February of the same year, BASF proposed a "cost reduction and efficiency enhancement" plan for the Ludwigshafen production site, aiming to save 1 billion euros annually by the end of 2026, which will lead to further layoffs. From the above developments, it appears that BASF's strategic focus is on profitable growth, with a priority on high-growth markets.

The report also states that it plans to expand its business in China, India, and five ASEAN countries (namely Indonesia, Malaysia, Singapore, Thailand, and Vietnam) by strengthening local organizational structures, production operations, and R&D activities. It is expected that by 2035, chemical growth in these seven countries will account for nearly 80% of global growth.

The performance in the first half of 2025 is under pressure.

In terms of performance, BASF's total sales in 2024 amounted to 65.3 billion euros, a year-on-year decrease of 5.2%. EBITDA was 6.7 billion euros, down 6.9% year-on-year. Net income reached 1.3 billion euros, significantly exceeding the 225 million euros in 2023. In the first quarter of 2025, sales were 17.4 billion euros, a year-on-year decrease of 0.9%; EBITDA was 2.18 billion euros, down 18% year-on-year. In the second quarter of 2025, sales were 15.77 billion euros, a year-on-year decrease of 2.1%; EBITDA was 1.77 billion euros, down 9.7% year-on-year; net income was 80 million euros, a year-on-year decrease of 81.4%.

In 2024, BASF's sales in the Greater China region are approximately 8.6 billion euros, compared to 9.4 billion euros in 2023. By the end of 2024, BASF's cumulative investment in the Greater China region will exceed 13 billion euros (with joint investments with partners totaling approximately 17 billion euros).

Turning to the performance of BASF Shanghai Coatings Co., Ltd., in the first half of 2025, the operating income was 2.298 billion yuan, a year-on-year increase of 3.1%; net profit was 188 million yuan, a significant decrease of 17.38% year-on-year.

From 2016 to 2024, the company’s operating revenues were 3.455 billion yuan, 3.723 billion yuan, 3.993 billion yuan, 3.871 billion yuan, 3.780 billion yuan, 3.986 billion yuan, 4.537 billion yuan, 4.868 billion yuan, and 4.826 billion yuan respectively. Net profits for the same period were 147 million yuan, 134 million yuan, 60 million yuan, 149 million yuan, 286 million yuan, 287 million yuan, 235 million yuan, 366 million yuan, and 406 million yuan. According to the data, in the past five years, the company’s operating revenue declined for the first time in 2024, while net profits have reached record highs every year.

The company in question is a joint venture between BASF Coatings Ltd. (60% share) and Shanghai Huayi Fine Chemical Co., Ltd. (40% share), established in 1995. Its main products include OEM automotive coatings, automotive parts coatings, and motorcycle coatings. It currently has two production sites: the Caojing plant located in Fengxian District, Shanghai, and the Minhang plant located in Minhang District, Shanghai.

It is worth mentioning that in the first half of 2025, BASF's Coatings division signed agreements with SAIC-GM-Wuling, Li Auto, and NIO, among others, and successfully expanded the polyester and polyurethane resin capacity at its Caojing plant in Shanghai on March 24th.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track