BASF Makes Strategic Shift with Sale of Coatings Business Valued at 7.7 Billion Euros: What's the Hidden Agenda?

BASF has agreed to sell the majority stake of its coatings business to the private equity firm Carlyle Group and Qatar Investment Authority. This business includes automotive OEM coatings, automotive refinish coatings, and surface treatment business, valued at 7.7 billion euros. BASF will retain a 40% stake in the coatings business and will receive approximately 5.8 billion euros in pre-tax cash proceeds upon completion of the transaction.

Source of the image: BASF

Source: BASF

This transaction marks the conclusion of one of the largest corporate deals in Germany this year and adds a significant chapter to BASF's recent large-scale business restructuring. What details of this transaction are worth noting? What are BASF's strategic considerations behind the sale of its coatings business? What background do the acquirers have? What impact will this move have on the global chemical industry? Today, we will analyze the key points behind this with insights from multiple sources.

01 Transaction Details Analysis

BASF's sale of its coatings business includes automotive OEM coatings, automotive refinish coatings, and surface treatment businesses, which are expected to achieve sales of approximately 3.8 billion euros in 2024. According to the agreement, BASF will retain a 40% stake and receive approximately 5.8 billion euros in pre-tax cash proceeds upon the completion of the transaction. The deal is expected to be completed in the second quarter of 2026, subject to customary regulatory approvals. Combined with the sale of its Brazilian decorative coatings business to Sherwin-Williams for 1.15 billion USD earlier this year, BASF's entire coatings division is valued at 8.7 billion euros. This valuation is roughly 13 times the adjusted EBITDA for 2024, which is above the industry average, reflecting the market's optimistic outlook on the future growth prospects of this business.

Source of the image: BASF

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF Group, stated: "We are delighted to collaborate with Carlyle, whose expertise in the industry, business separation capabilities, and collaborative approach will contribute to the long-term success of BASF Coatings." This transaction not only brings substantial cash gains to BASF but also enables the company to implement its previously announced stock repurchase program of at least 4 billion euros ahead of schedule, originally planned for 2027 to 2028.

02 Sale Background and Strategic Considerations

BASF's decision to sell its coatings business is based on a comprehensive consideration of multiple factors.

European chemical companies are generally in trouble, with overcapacity, demand falling short of expectations, and fierce competition from Chinese competitors putting the European chemical industry in a long-term slump. According to reports, groups such as ExxonMobil and Saudi Basic Industries Corporation (SABIC) are considering exiting part of their European chemical businesses, while LyondellBasell sold four European plants earlier this year.

Due to the sharp rise in energy prices, BASF is facing the most severe crisis in years. Selling the coatings business will provide BASF with new funds to help it navigate the current difficulties. From a strategic perspective, this is part of BASF's broader strategy to focus on closely integrated and physically connected business areas within its global large-scale chemical integration sites. BASF is rapidly executing its "Winning Ways" strategy released in December 2024, and this transaction marks an important step for the company in unlocking the value of "independent businesses."

Through the "focus" strategy, BASF divides its main businesses into core and independent businesses, managing them differently. Core businesses include Chemicals, Materials, Industrial Solutions, and Nutrition & Care. These are closely linked to BASF's value chain and integrated production system, creating value through efficient resource utilization, operational excellence, and cost efficiency. Independent businesses include Environmental Catalysts and Metal Solutions, Battery Materials, Coatings, and Agricultural Solutions. These serve specific industries, and BASF will provide them with more strategic and operational flexibility to meet specific market demands.

Markus Kamieth, the current CEO of BASF, stated at the recent Capital Markets Day that despite the ongoing global economic situation, BASF is committed to significantly increasing profits within three years—under "moderate to good economic conditions," its adjusted profits will increase to 10 billion to 12 billion euros.

03 The Evolution of the Global Automotive Coatings Landscape

BASF Coatings, as a global leading supplier of automotive OEM coatings and refinish coatings, holds a significant position in the global automotive coatings market.

According to the "2025 Global Top Ten Automotive Coatings Brands Ranking" released by "Coatings World," BASF ranks third with sales revenue of $2.823 billion. Its automotive OEM coatings rank second globally, and its automotive refinish coatings rank fifth globally. This business has a broad customer base worldwide, including numerous automakers such as Volkswagen, BMW, BYD, Mercedes-Benz, Li Auto, XPeng, Geely, and NIO.

Automotive coatings account for about 65% of BASF's entire coatings business and are the most important component of BASF's coatings division. Currently, the global automotive coatings market is undergoing profound changes. Material substitution trends are mainly reflected in the replacement of solvent-based coatings with water-based coatings, domestic coatings replacing imported coatings, the application of high-performance materials, and the impact of new energy vehicles on coating demand. In the past, the automotive coatings market was almost entirely dominated by large overseas coatings companies. However, the evolution of the market landscape over the past decade shows that companies like Korea's KCC and Sino-Japanese joint ventures such as Xiangjiang Kansai have stood out.

Source: BASF

With the rise of the new energy vehicle industry, the global automotive manufacturing focus is gradually shifting from overseas to domestic markets. Manufacturers that are more closely tied to OEMs are more likely to leverage regional advantages to penetrate the supply chain. In recent years, the variety of new energy vehicle models has been increasing, leading to higher demands for customization and continuous iteration of upstream materials. For coatings, this requires upstream suppliers to have faster response times and stronger research and development capabilities.

The change is precisely the underlying industry motivation for BASF's sale of its business.

04 Background and Strategic Intentions of the Acquirer

The Carlyle Group, as a leading global investment firm, is not entering the chemical industry for the first time.

The group once acquired the chemical division of the Dutch conglomerate AkzoNobel N.V. for 10.1 billion euros, which remains Carlyle's largest transaction in Europe. Additionally, Carlyle has invested in companies related to the industry such as Axalta, Atotech, and Nouryon.

As of June 30, 2025, Carlyle managed $465 billion in assets and employed more than 2,300 people across 27 offices on four continents worldwide.

Martin Sumner, Head of Global Industrial Business at Carlyle, and Tanaka Maswoswe, Partner at Carlyle, stated: "BASF Coatings is an exceptional platform with leading technology, a world-class management team, strong customer partnerships, and a truly global business footprint."

The Qatar Investment Authority, as the sovereign wealth fund of the State of Qatar, is one of the largest and most active sovereign wealth funds in the world. The Authority's CEO, Mohammed Al-Sowaidi, stated, "This investment aligns with QIA's strategy of investing in industry leaders and demonstrates our firm confidence in the long-term resilience and growth potential of German companies."

Carlyle will leverage its global industrial and carve-out experience to support the next phase of growth for BASF's coatings business by investing in its commercial capabilities, innovation channels, and organizational structure, enhancing customer focus, and supporting the future development of the business.

05 BASF's Transformation Path and Future Plans

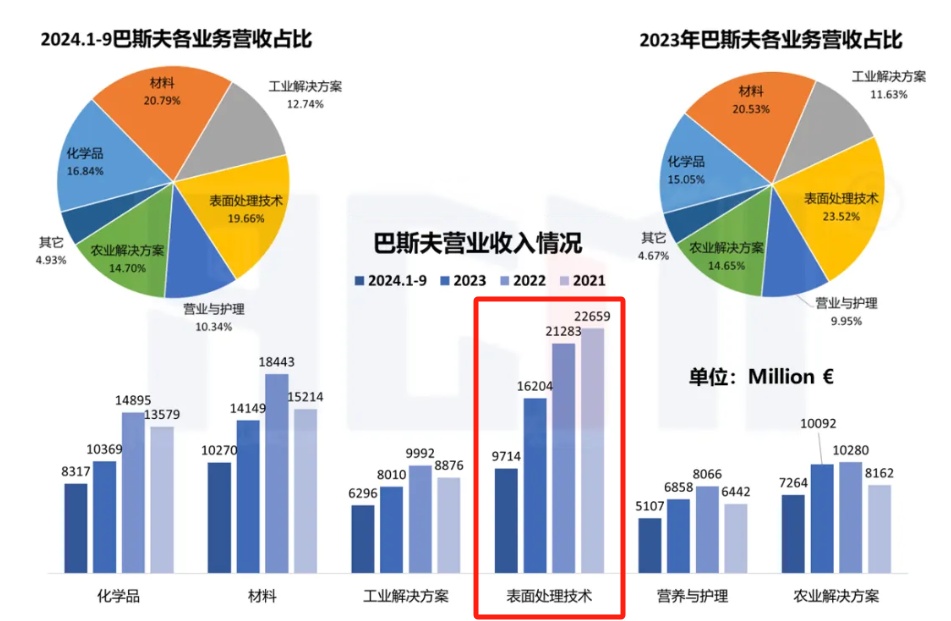

In September 2023, after Dr. Martin Brudermüller took office as the Chairman of the Board of Executive Directors of BASF Group, he released a new corporate strategy and restructured the company's business architecture. BASF's main businesses were reclassified from the six major segments during the Brudermüller era into two categories: "core" and "independent" businesses. Surface Technologies (including Coatings) and Agricultural Solutions have become independent businesses slated for divestiture under this new corporate strategy.

Since 2022, BASF has been one of the first chemical companies to initiate a major cost-saving plan from the perspective of increasing cash flow. Since the implementation of the cost reduction strategy, BASF has continuously introduced a series of specific measures aimed primarily at saving costs in Europe and adjusting the production structure of the Ludwigshafen production site.

Source: Chemical New Materials

At present, BASF's major investment projects in core value creation are globally distributed: in the chemical sector (Nanjing/Zhanjiang, China; Antwerp, Belgium; Ludwigshafen, Germany; Kuantan, Malaysia) and in the materials sector (Zhanjiang, China; France; Geismar, USA).

Particularly, BASF's large-scale integrated project in Zhanjiang will be fully operational by the end of this year. Although the current global, especially China's, overcapacity situation was unforeseen and its initial profits may not be optimistic, the adjusted profit target of 1 to 1.2 billion euros by 2030 remains unchanged.

Source: BASF

The global chemical industry may accelerate differentiation.

Under the triple pressures of competition, cost, and environmental protection, a contradiction has formed between the profitability of the coatings business and the need for sustainable investment. BASF's decision to "partially divest while retaining participation rights" cleverly balances risk avoidance and future returns, making it a rational choice grounded in reality.

Retaining a 40% equity stake allows BASF to continue benefiting from the future growth of its coatings business while receiving a much-needed cash injection. For Carlyle and Qatar Investment Authority, this acquisition is a significant part of their strategic investments in the chemical industry. With Carlyle's outstanding track record and extensive experience in successfully spinning off industrial and chemical assets, BASF's coatings business is expected to gain new momentum. From the perspective of the global coatings industry, market concentration is gradually increasing, especially in the Chinese market. Domestically, automotive coating technology was initially introduced through collaborations with overseas companies, but fully independent technology has not been achieved. With the rapid development of the new energy vehicle industry, China's position in the global automotive supply chain is continuously rising, providing opportunities for domestic coatings companies.

BASF's decision of "partial divestment + retaining equity" is not just a capital transaction, but also a paradigm shift in the chemical industry's response to structural challenges. As the transaction is set to be completed in 2026, BASF Coatings will face market changes with an independent identity, while BASF itself will streamline its operations to focus on the core competitiveness of its integrated sites. In the future, the global chemical industry may accelerate its differentiation: giants may either "cut off a limb to survive" or leverage capital restructuring to break through. This sale has already drawn a strategic dividing line for the industry—only those who adapt flexibly can navigate steadily and go far against the wind.

Edited by: Lily

Sources: BASF China, Chemical New Materials, Coatings World, European Mergers and Acquisitions, Chemical Exchange, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track