Avoiding hidden costs: What Chinese Automakers Need to Know About Overseas Site Selection

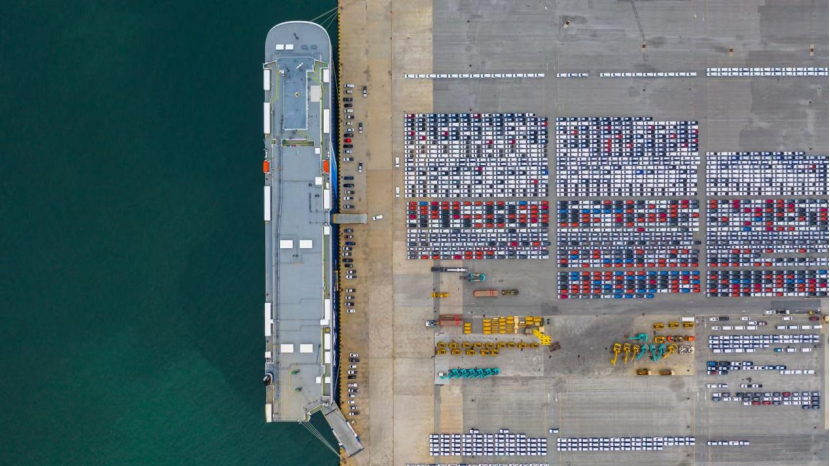

Since the beginning of this year, China's new energy vehicle exports have surged, with the scale rising significantly. According to the latest data released by the China Association of Automobile Manufacturers, in the first half of 2025, China's automobile exports reached 3.083 million units, a year-on-year increase of 10.4%. Despite the continuous impact of uncertainties such as trade barriers and geopolitical factors, China's export volume in the first half of the year still showed strong growth, exceeding 3 million units, demonstrating the global competitiveness and resilience of Chinese automotive companies.

Chinese automobile companies going global are no longer just chasing growth in sales; they are also seeking model innovation and a deeper global layout: overseas investment in building factories and localized production has become a trend. However, this path is not without obstacles. Companies venturing abroad face challenges such as site selection traps, imbalanced overseas warehouse layouts, cultural and labor conflicts, and slow production ramp-up. In the fierce competition of going global, any of these factors can be crucial for automakers, as time is of the essence for survival.

Image source: Shetu.com

The "combination punch" strategy for going abroad helps car companies navigate the waves intelligently.

With the adjustment of global industrial chains and changes in policy environment, Chinese automobile and industrial chain enterprises face challenges such as when expanding into international markets.Tariffs and Trade Barriers、Market information asymmetry, cultural differencesAnd brand building And a series of other issues.

Image source: Photo.com

Among the many challenges,Tariffs and trade barriersParticularly notable is the implementation of the Carbon Border Adjustment Mechanism by the EU in 2023, coupled with frequent anti-dumping investigations, prompting many car companies to reassess their overseas strategies. In addition, the increasingly stringent tariff policies and complex rules of origin in the United States in recent years have further driven up the operating costs for car companies.[Click here to access JLL's "one-stop" service to assist Chinese car companies in overseas expansion]

In response, JLL, a global leader in real estate services, leverages its global resources and data analysis capabilities to provide enterprises with effective strategies.

First, construction“1+N”Alternative modelAvoid reliance on a single market: When determining the preferred investment location, simultaneously evaluate multiple alternative options that encompass various dimensions such as location advantages, policy support, and cost-effectiveness. This model not only ensures the completeness of the enterprise's own information but also provides more leverage in negotiations with local governments and service providers. Additionally, it allows for the rapid activation of alternative plans in the event of sudden policy changes, effectively hedging risks.

Second, recommendation"Asset-light, fast turnover"The operational model. Unless the production operation has relatively special process or layout requirements, car companies can prioritize leasing or acquiring existing local properties and quickly start production by renovation rather than new construction. This operational model not only significantly shortens the project landing cycle but also reduces the initial investment amount, lowers early-stage risks, and reserves space for car companies to respond to market changes.

Moreover, before expanding their business in the local market, car companies need to thoroughly understand local policy trends to "get ahead of the curve" and respond and adjust in a timely manner. Bridging such "information gaps" requires leveraging professional institutions.The latter can specifically follow up on the application of newly added local subsidy projects and changes to existing subsidy projects, and assist enterprises in timely communication in the first instance, upgrading site selection negotiations from "reactive response to changes" to "proactively controlling choices."

In global operations,Information Asymmetry in the Market and Cultural DifferencesA common challenge is illustrated. For instance, in Europe, some premium properties are privately owned, and obtaining first-hand market information is crucial for car companies. However, Chinese companies new to the European market may not be able to access such information, which can directly lead to delays in overseas projects and affect delivery. In regions with diverse religions such as Southeast Asia and the Middle East, differences in work pace and customs can easily trigger labor disputes. For example, if a company disregards local customs and enforces work during religious holidays, it may lead to cultural conflicts.

In response to the aforementioned challenges, mature third-party professional organizations can fully leverage information, resources, tools, and technology to establish project management systems in different regions. This enables them to achieve "centralized coordination from headquarters" and "multi-point deployment and simultaneous advancement." During this process, third-party professional organizations can...Responsible for overall management and coordination of communication between overseas enterprises and overseas service teams to ensure that projects are delivered on schedule within a reasonable timeframe.A certain auto parts company, during its expansion into Europe, encountered issues due to insufficient preliminary research, leading to its plant design standards far exceeding the specifications of existing local properties. Later, with JLL coordinating communication between both parties and introducing multiple resources, the auto parts company effectively mitigated its losses. Additionally, in culturally sensitive regions such as Southeast Asia and the Middle East, the JLL team of think tank experts can provide practical guidance, helping companies avoid religious and customary pitfalls and prevent labor disputes.

In high-end markets such as Europe and the United States, Chinese car companies often face the issue of insufficient brand recognition, with their brand power difficult to match local giants. Brand image is a broad concept that encompasses multiple dimensions such as product strength, sales, and operations. The location of company factories, stores, and supply chain bases is also a key dimension, as it leaves a direct impression on consumers and stakeholders, influencing brand building and cultural export.

Past successful cases have shown that a reasonable real estate strategy can significantly enhance brand influence. Through strategic location selection and design optimization, it helps automotive companies improve their "impression score." The specific approach is to select prime locations to showcase the company's strength, such as setting up stores or offices in high-end urban areas. This not only enhances the company's image but also conveys the brand narrative through the space itself.

Big projects, detailed management; comprehensive consideration for the long term.

As a global leader in real estate services,Jones Lang LaSalle Corporate Real Estate Strategy Formulation、System construction Factory buildings and storesSite selection and leasing has extensive experience in these areas。In the case of the 60-hectare automotive manufacturing industrial land acquisition project by Wuling's Indonesian subsidiary, JLL successfully assisted Wuling in completing the 60-hectare industrial land transaction at its expected price, leveraging its extensive network and negotiation expertise. Throughout the project's progression, JLL set key milestones for due diligence matters on a weekly basis and strictly controlled the entire project process.

The overseas expansion of new energy vehicle-related companies is often greatly influenced by local policies, regulations, resources, etc. Land use planning and policy orientation are often key factors in determining the success of a project. If potential policy shifts and compliance-related changes are overlooked during the preliminary research and evaluation process, it is highly likely to result in subsequent investment mistakes.

Image Source: Shetu.com

A typical example is a power battery company investing in overseas factory construction: without thorough due diligence, the company quickly signed a contract to purchase a large piece of land and required supply chain companies to collectively move in. However, during the process, it was discovered that the local power grid could not support the demand for cluster production, forcing some suppliers to face a dilemma—either jointly bear the high costs of building new power facilities or passively abandon the client. Leveraging its local resource advantages, JLL assisted the power battery company in relocating to a park that better matched its needs, helping the company to minimize losses in time and quickly get its operations back on track.

The overseas expansion of the industrial chain is not only a consideration for automakers, but also a challenge faced by their upstream and downstream suppliers. Taking autonomous driving as an example, its main challenge lies in data compliance. According to the European General Data Protection Regulation (GDPR), only necessary data such as location is allowed to be collected, and it must be stored within the EU, with strict conditions for cross-border transmission. Otherwise, companies will face hefty fines. This directly increases the cost for autonomous driving solution providers to expand into Europe. For instance, a certain company built its own data center in Europe to meet GDPR requirements, resulting in a 25% increase in costs.

Practical experience has proven that it is necessary for overseas companies to categorize and consider their suppliers becauseTier 1 suppliers, battery manufacturers, and technology-oriented companies each have their own priorities when it comes to site selection.Battery manufacturers prioritize electricity supply, environmental approvals, and the attitudes of local governments and residents. Meanwhile, raw material suppliers focus more on the acquisition of core resources. For technologies such as assisted driving going overseas, it is essential to consider local technical compatibility and data compliance. Therefore, when making investment decisions, companies should not adopt a one-size-fits-all approach but instead develop differentiated strategies for different types of suppliers.

Conclusion:

As technology and production capacity ventures overseas enter a deeper phase, land and factory buildings are not only production factors but also chips in geopolitical games. More specific and detailed real estate layouts are extremely necessary for Chinese automotive companies going abroad. As JLL believes: the demand for enterprise real estate, spanning upstream, midstream, and downstream industries and involving diverse asset categories such as offices, production bases, warehouses, and retail, has risen to a strategic deployment in the grand plan of enterprises going global. Therefore, how to maturely choose investment methods and strategies, and how to efficiently manage the full lifecycle of real estate across potential markets and different business formats within the covered region, will be a mandatory question for enterprises before embarking on the journey abroad.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track